Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 8 Nov, 2022

By Sarah Cottle

Today is Tuesday, November 08, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly

In this edition of Insight Weekly, we take another look at how this month’s midterm elections will impact energy policies in the U.S. At the federal level, the outcome of Congressional contests will help to shape likely reforms of permitting legislation for energy infrastructure projects. Gubernatorial races and elections for state utility commissions will also greatly influence local energy agendas and the ongoing transition from fossil fuels to renewable energy sources.

The energy crisis could accelerate decarbonization efforts, resulting in faster deployment of clean power around the globe. The International Energy Agency highlighted Russia's invasion of Ukraine as the main cause of the diminishing use of gas, potentially bringing an "end to the golden age of gas."

U.S. banks reported further declines in deposits during the third quarter of the year. Nine of 13 lenders with assets of between $100 billion and $1 trillion posted quarter-over-quarter falls in deposits, according to S&P Global Market Intelligence data. SVB Financial Group had the largest drop-off at 5.9%.

The Big Number

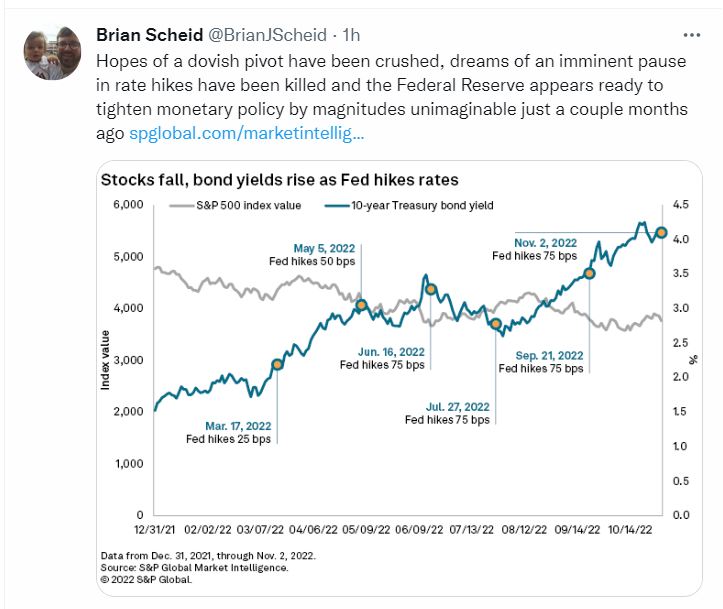

Trending

—Read more on S&P Global Market Intelligence follow @BrianJScheid on Twitter

The Big Picture

What will shape your big picture in 2023? How will disrupted supply chains, inflation, and new sustainability and M&A trends impact your sector? Our 2023 Big Picture Outlook reports can expand your perspective and enable decisions with conviction.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Waqas Azeem

Theme