Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 11 Jul, 2023

By Sarah Cottle

Today is Tuesday, July 11, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we take a close look at the latest risk scores for the eight US global systemically important banks (G-SIBs). Risk scores, which determine capital surcharges, increased sequentially in the first quarter, but not by enough to push most of the banks into a higher capital surcharge bucket, according to S&P Global Market Intelligence data. Regulators have been considering capital changes for the largest banks, and the recent failures of three regional banks have expanded the universe of banks they will target. Potential changes could require some regional banks to raise more capital and reduce banks' ability to return capital to shareholders through share buybacks and dividends.

US companies are finding it ever more difficult to cover the cost of their debt repayments. Rising interest rates have pushed up borrowing costs for companies across the board. The median interest coverage ratio of companies rated investment-grade by S&P Global Ratings sank to 6.38 in the first quarter from 7.06 in the previous quarter, S&P Global Market Intelligence data shows. The ratio — a closely watched measure of solvency calculated by dividing earnings before interest and tax by the cost of a company's debt-interest payments — has slumped sharply since a peak of 8.97 in 2022.

Default risk for the S&P 500 ticked slightly higher approaching the end of the second quarter from the first three months of the year as stock markets have rallied and first-quarter corporate earnings broadly fell year over year. The median probability of default for S&P 500 companies was 3.91% as of June 28, up from 3.84% on March 31, according to S&P Global Market Intelligence's Risk Gauge model. The scores represent the median odds of default on debt within a year, based on financial reports and the volatility of share prices for public companies in the index, accounting for country- and industry-related risks and other macroeconomic factors.

The Big Number

Trending

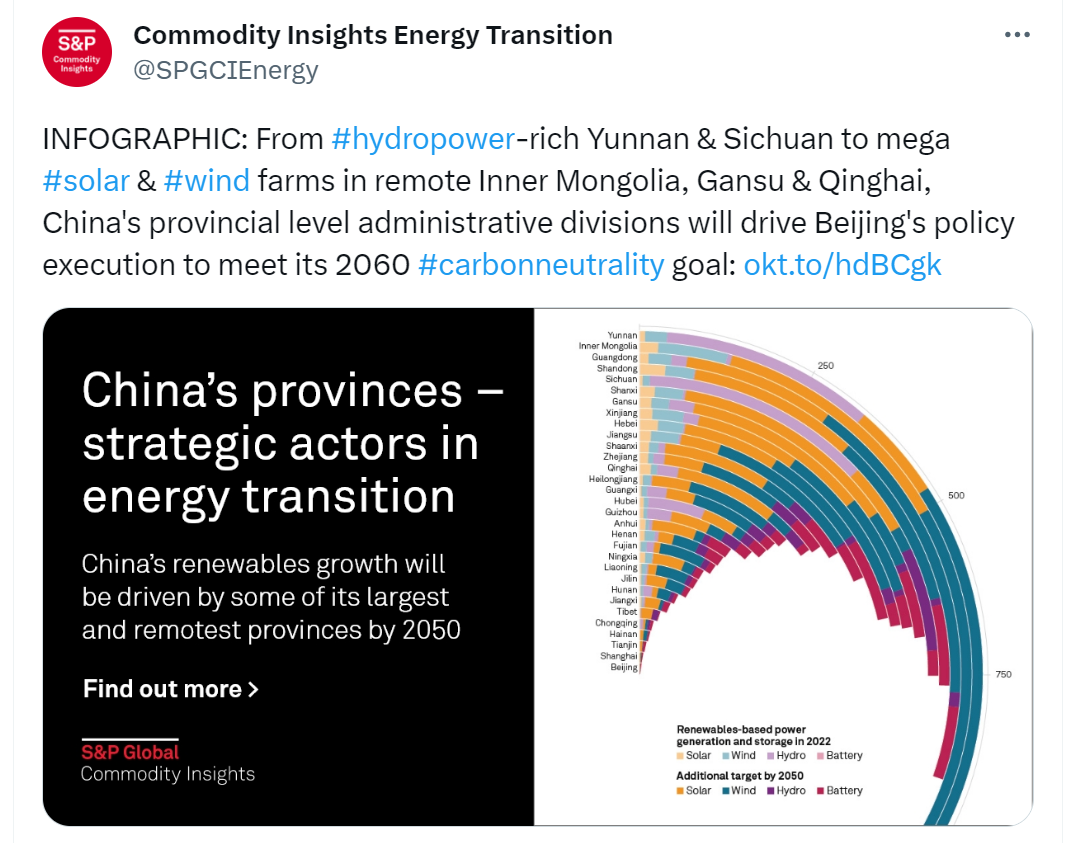

—Read more on S&P Global Market Intelligence and follow @SPGCIEnergy on Twitter.

Transform Your Tomorrow

A sustainable tomorrow starts with actionable intelligence today. Advance your sustainability journey with data, analytics and workflow solutions that help you take the next step. And the step after that.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Deavelle Sauva

Theme