Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 28, 2022

Where are we now?

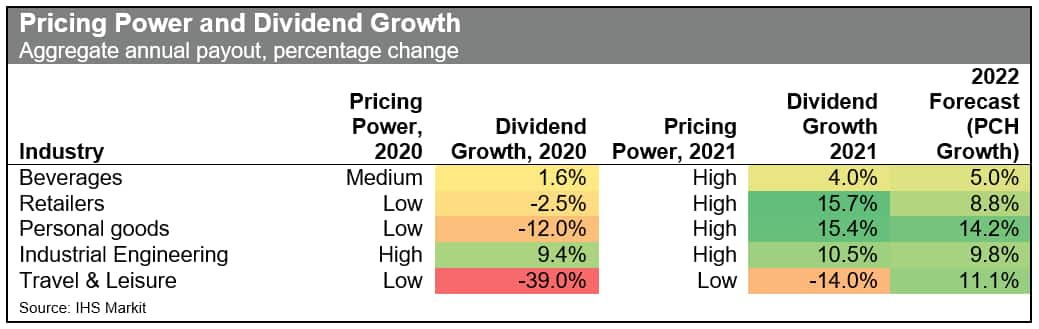

Dividend-paying stocks have historically been a successful way to protect capital against inflation. In addition to stock price appreciation that occurs during inflationary periods, companies also tend to increase their dividend distributions. This trend continued in 2021 when aggregate US dividend payments rose by 6.5% while consumer price index (CPI) came in at 4.7%.

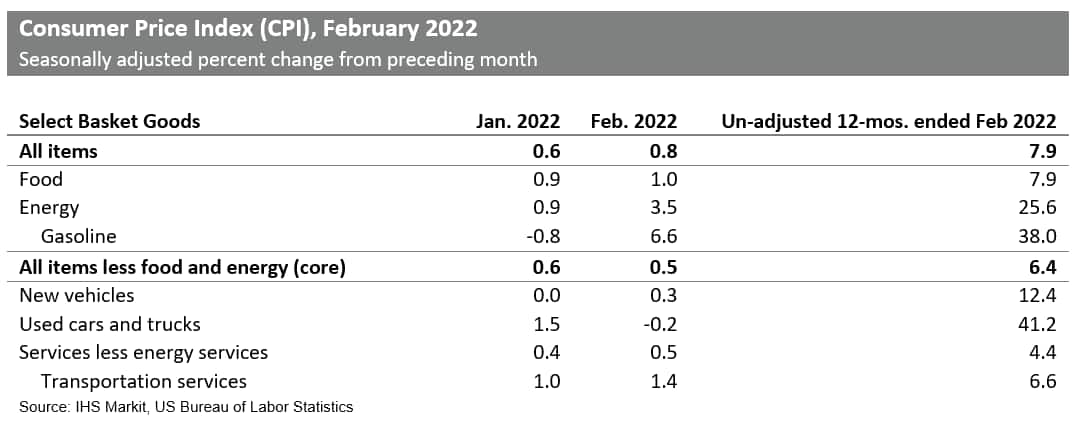

However, the inflation that has cropped up in the last three months is different than that of the past. Supply chain disruptions, energy price increases, wage inflation, and now the war in Ukraine highlight the overwhelming number of fronts from which these price pressures originate. As we saw in the latest Bureau of Labor Statistics report, CPI rose 7.9% over the prior 12 months and is now at the highest level since 1982.

Elevated CPI, coupled with the threat of war in Europe, has contributed to a stock market pullback and sent the SP500, Nasdaq, and Dow into correction territory. Higher prices are no longer a benign factor that can be taken in stride. We now look to uncover if the impact of inflation will traverse into dividend distributions.

Energy is to blame in February

The impetus for a sharp rise to inflation readings has been the increase in energy prices spurred by the Russia-Ukraine war and an embargo on Russian oil products. The gasoline portion of the CPI reading rose 6.6% in February alone (up 38% year over year) and accounted for a third of the total increase. In the futures market, Brent crude oil remains 50% above the price in December 2021.

The price moderated due to OPEC increasing production and demand in China falling owing to a COVID-19 outbreak, prompting regional lockdowns, but it has since risen again. Crude oil now trades 20% below peak March highs but remains well above the average price of February. As a result, energy is expected to continue impacting inflation and the operations of global companies.

Oil and gas producers are riding the high

Inflation is top of mind for any physical goods company, but not energy producers. High oil prices are welcomed by the likes of ExxonMobil (XOM) and Chevron (CVX), whose sales are directly tied to market prices. These producers have the same fixed costs regardless of market price, so high prices increase profitability. In their most recent earnings publication, Exxon acknowledged rising input costs but expects cost savings to more than offset the impact. The company initiated a new development plan in 2018 that locked contractors and suppliers into long-term contracts, insulating some of their exposure to higher wages and materials costs. Furthermore, thanks to careful planning of assets and controlled spending, Exxon's breakeven price (the price of crude oil at which Exxon will not lose nor make a profit), is a mere $35 per barrel. This gives them plenty of cushion to absorb greater costs of machinery and drilling and ensures a continued dividend in the coming years. We expect the company to increase their dividend again in 2022 to a healthy payout ratio of 45%, the most sustainable level in the past seven years.

Transportation companies absorb costs differently

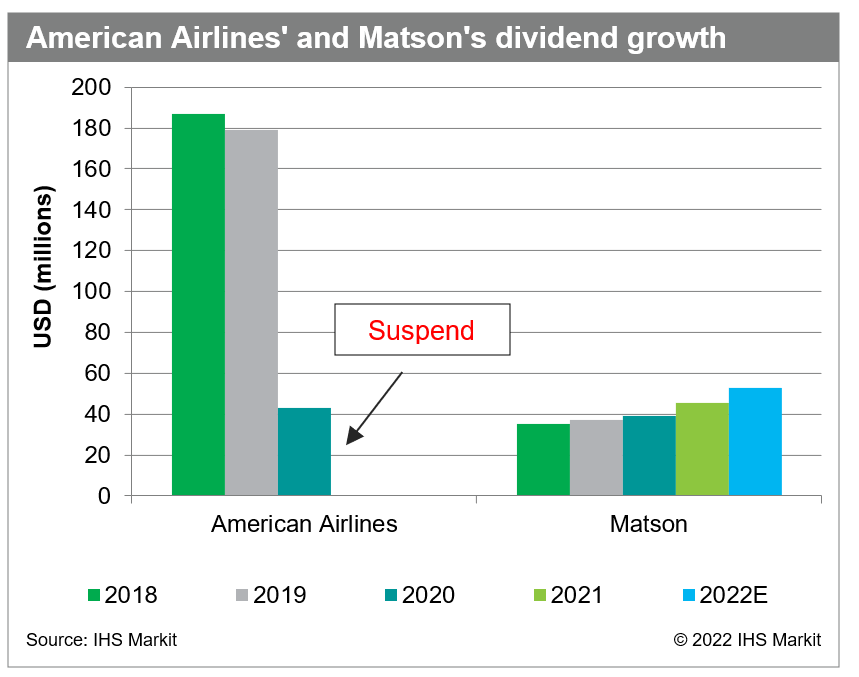

For the transportation industry, crude oil and derived products are a key input into company operations. American Airlines (AAL), the largest US airline operator, saw its fuel costs double in 2021. Company policy prohibits the use of futures contracts to hedge prices and therefore, it is fully exposed to price fluctuations in the market. The company suspended its dividend at the start of the COVID-19 outbreak and although booking sales just reached 2019 levels, it is unlikely to resume payments in the near-to-medium term. Delta and Southwest Airlines are also on hold from paying their shareholders dividends. The industry should return to profitability this year but having experienced two years of rising input costs with not enough demand to pass on these higher expenses to the customers, we do not expect a rush to distribute cash.

On the seas, Matson (MATX), a US-based maritime shipping company, also saw its fuel costs double from 2020 to 2021. Thankfully, Matson implements a fuel price surcharge to pass some of the rising costs along to its clients. Its earnings were also bolstered by insatiable demand during the pandemic, which saw shipping rates on a 40-foot container increase by nearly five times. The company raised its quarterly dividend payment by 30% in the third quarter of 2021 and still only paid out 5% of its earnings that year, drastically lower than the 45% paid in 2019. While demand for shipped goods is expected to moderate from recent highs, we are forecasting Matson to increase its dividend again in the back half of 2022.

Success is in the ability to pass-through costs

The airline and maritime shipping industries are a clear example of how the ability, or inability, to pass through costs to customers can impact the dividend. In inflationary periods, companies that can increase sales prices at the same rate as their expenses will be able to maintain margins, profitability, and shareholder payments.

Consumer demand enables pricing power

If a company changes the price of its good and consumer demand is not impacted, its product is said to be demand inelastic. Food and beverage companies have shown that they fall into this category and have been utilizing their pricing power to sustain margins. Coca Cola's (KO) gross margin of 60% and operating margin of 27.6% are both at the five-year average. While its cost of goods sold and selling, general, and administrative expenses together rose USD4.5 billion during 2021, increased revenue of USD5.5 billion more than covered the difference. Demand for its product has not been impacted because its customers, the everyday consumer, have experienced higher wages, lower cost of borrowing, and increased savings. These factors allow Coca Cola to continue selling at higher prices and collecting enough revenue to pay a growing dividend, as it demonstrated with a 5% increase to its dividend in the first quarter.

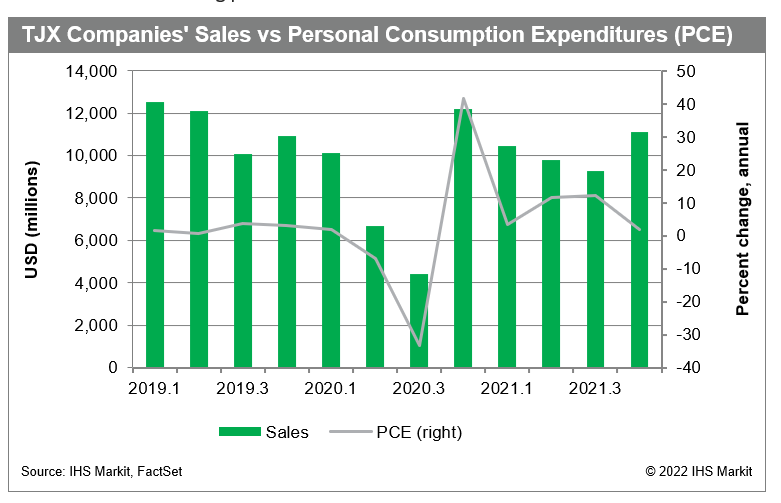

The retail industry has had a similar experience given that it serves largely the same end customer. TJX Companies (TJX) has not seen margin compression and has a gross margin of 28.5% that is on par with the five-year average, and equal to competitor Target (TGT). Real consumer spending, measured as Personal Consumption Expenditures, increased 7.9% in 2021. This buoyed demand for products and outweighed price increases that sellers pass along from their suppliers. TJX's management noted that while prices may be up on some products, it is still a value brand and can capture a higher tier of market share when luxury shoppers look to save. Additionally, the broader retail sector is experiencing the same supply chain pressures and have collectively decreased the level of competitive promotions. TJX has been able to collect full price on goods that would otherwise be subject to discounts. While the company was forced to suspend its dividend in 2020 owing to massive store closures, it has since been paying for the last four quarters. We expect the company to raise its dividend 13% next quarter to distribute excess capital that has accumulated from strong performance.

Business investment allows for industrials to raise prices too

In an industry like manufacturing, the end customer is primarily another corporation rather than a consumer. Nonetheless, the sector has been able to increase prices with the same limited impact to demand. 3M (MMM) and Caterpillar (CAT) have both acknowledged use of price increases to maintain margins. There has been almost a direct pass through of input costs that rose due to supply chain delays, freight and materials costs, and wage inflation. These companies are also investing a lot in supply chain and production efficiency to realize cost savings wherever possible. As a result, we have seen growth in both earnings and net income, increasing the cash available for shareholder distributions. 3M recently raised its dividend in February and is expected to maintain that level through the year, paying out 60% of EPS. We forecast Caterpillar to raise its in the third quarter to reach a payout ratio of close to 40%.

Navigating the supply chain

Inflation, and more specifically CPI, first rose above the Federal Reserve's target of 2% in March of 2021, a full year into the pandemic. The early cause of this inflation was supply-chain delays that were prompted by an unprecedented demand for goods, particularly ecommerce goods and automotive. While there is some optimism that supply chain pressures will ease soon, the reality is that they are not close to doing so. Therefore, companies that expect to continue paying a growing dividend will have to manage their suppliers accordingly.

Bargaining power over suppliers

Larger companies with a global supply chain are best positioned to mitigate rising costs that arise from supply chain difficulties. They purchase such large quantities from their suppliers that they often have bargaining power. For example, Walmart (WMT) has increased the price of some goods but noted that it has not needed to do so with others because of contract negotiations with those suppliers. In other words, if margins are being squeezed, it often falls on the upstream seller.

Production location also matters

Walmart boasts the fact that two-thirds of products in its stores are US made or assembled. This means less of its products need to be loaded onto shipping containers and subject to the global shipping log jam. There is simply not enough infrastructure capacity to unload containers efficiently, which is why there are still almost 100 container ships waiting for a berth off the coast of Los Angeles. A secondary benefit of local operations is that facilities are less exposed to international government COVID-19 responses, lockdowns, or mandates. Currently navigating the inflationary environment expertly, we forecast Walmart to its their dividend next quarter from $0.56/share to $0.57/share.

The automotive industry is taking the brunt

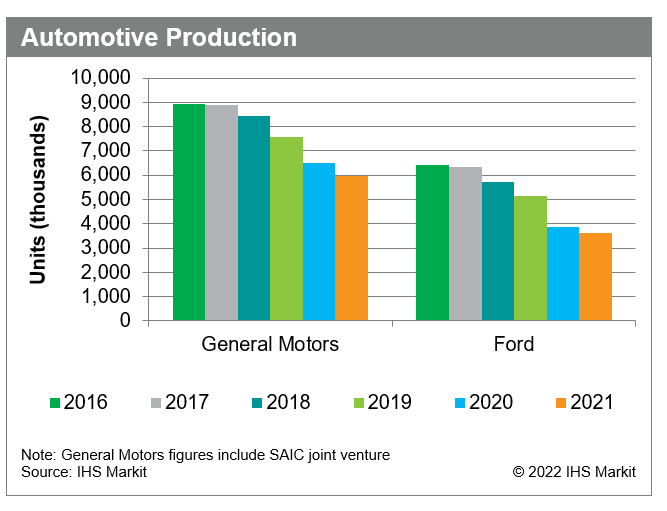

Automotive producers have been most heavily impacted by the supply chain disruptions, but it is not visible in their margins. General Motors Company (GM) noted in its 2021 year-end earnings that it achieved record EBIT adjusted margins of 11.4%. This is because the prices for autos have risen exorbitantly. The new vehicle portion of February's CPI reading was 12.4% higher year over year, while the used-car portion was up a staggering 41.2%. Auto producers are collecting higher wholesale prices owing to pent-up demand, which IHS Markit automotive analysts expect is about 10 million units higher than achievable production in 2022.

The problem is not pricing, it is that auto makers simply cannot procure the materials, particularly semiconductors, needed to build their vehicles and are forced to shut down production. General Motors has dealt with multi-week shutdowns or slowdowns across operations in North America, South America, and Asia. It has not paid a dividend since March 2020 and although the company expects to produce 25% more vehicles over 2022, we do not expect it to reinstate payments until 2023. Ford (F) has not fared much better and has also experienced multi-week shutdowns across its plants. It has, however, reinstated its dividend at 60% of the pre-COVID-19 amount. It is unlikely it will raise this dividend until it achieves normalized wholesale figures.

Both General Motors and Ford are forming partnerships with chip producers and other upstream producers to help smooth the supply of critical components and materials. They are also simplifying the technical requirements for their vehicles to cut down on the quantity of unique parts required. It will take time to normalize operations and lead times, which is why we do not expect the automotive industry to pay pre-COVID-19 levels of dividends until next year at the earliest.

Downside risks in the medium term

Aside from auto producers, airline operators, and a select few others, we do not expect inflation to impact broader dividend payments in the short-term of 2022. A rising tide lifts all ships and most industries have been able to stay afloat. We are forecasting aggregate dividend payments in the United States to increase 8% during 2022 to an impressive USD670 billion. With that said, inflation does not usually remediate quietly, and there are ample downside risks in the medium term.

Federal Reserve actions can go awry

The Federal Reserve recently announced a 25 basis points (bp) increase to their overnight funds rate and pencilled in six additional raises through the remainder of the year. Rate increases are implemented to increase the cost of capital and incentivize consumers to save instead of spend. The full arc is as follows: the Federal Reserve increases rates, borrowing becomes more costly, businesses invest less in growth, hiring slows, wages flatten, consumer demand for goods falls, and finally, prices come down. This method intentionally hampers business and consumer growth.

Rate increases are necessary but difficult to get right without causing a recession. There is the risk that since today's inflation is being caused by so many different factors, a sequence of cuts will slow economic growth and increase unemployment without lowering inflation, otherwise known as "stagflation." In this type of environment dividends would be impacted to the downside across all sectors.

We will be watching the Federal Reserve closely as its actions will likely steer the market as well as the ability of companies to pay dividends in the medium term.

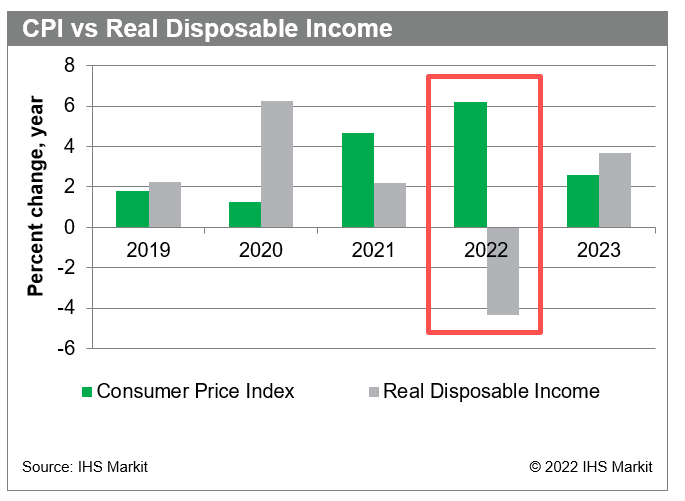

Prices will catch up to the consumer

As discussed earlier, consumer wage growth has been supporting price increases in goods and driving demand. The US Department of Labor said that average hourly wages increased by 4.7% in 2021. Since this is more than 2% less than December's CPI figure of 7%, prices are rising faster than wages and people are earning lower "real" wages.

The gap worsened in the latest CPI reading released the first week of March. The price categories that increased the most were those that impact the consumer daily, such as groceries and transportation services, which each rose 1.4% in a single month. Electricity, gasoline, and utility gas services are up 9%, 38%, and 24%, respectively, over the last 12 months. These items are growing substantially faster than incomes and ballooning household expenses. If this is not tamed soon, consumers will not be able to afford discretionary goods. The retail, food and beverage, travel, and leisure sectors could all experience a significant drop off in demand, exposing the sector to potential dividend cuts in the medium term.

It will be important to track how inflation impacts real wages in the coming months.

Heavily indebted companies will have less cash

While not mentioned earlier in this paper, significant rate hikes increase borrowing costs for companies. Companies that borrow continuously or have a lot of debt will see their payments increase meaningfully. With more cash going to interest payments there will be less available for dividend payments.

The utilities sector has recently seen a surge in share prices as investors flock to value stocks, however, they are most exposed to higher rates. Most utilities companies do not earn enough to cover debt payments and rely on additional borrowing to stay afloat. While share prices show support, we believe the sector's debt levels will inevitably expose it to downside risks in the dividend.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.