Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 24 Jan, 2022

By Paul Manalo

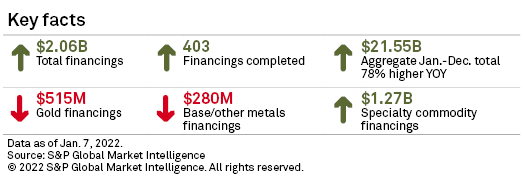

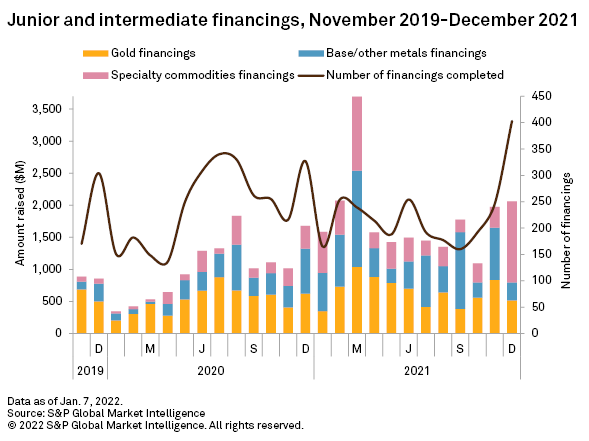

Metals and mining fundraising increased 5% month over month in December 2021 to $2.06 billion, a nine-month high. The number of financings jumped 64% to 403, the highest number in our records. With smaller financings dominating, the average offering amount declined more than one-third to $5.1 million.

December marked 19 consecutive months of financings over $1 billion and brought the funds raised year-to-date to $21.55 billion, 78% higher than the $12.13 billion raised in 2020. The number of financings declined almost 8%, however, to 2,684 from 2,904 in the year-ago period.

More than three-quarters of the funds raised came from equity offerings totaling $1.60 billion. Debt financings increased 81% to $84 million, and convertible debt posted a second monthly gain, increasing 13% to $259 million. The number of IPOs revisited its recent monthly high of 16 announcements, although they only accounted for 6% of funds raised at $122 million, down from 10% in the previous month.

Funds raised on the TSX group maintained the top spot among the major exchanges for the second consecutive month, increasing nearly one-third to $1.10 billion and accounting for more than half of funds raised for the month. Funds raised on the ASX increased 16% to $754 million, maintaining its second-place finish for a second consecutive month, while funds raised on the London Stock Exchange dropped three-quarters to $54 million. In full year 2021, the TSX/TSXV maintained its top exchange status with $8.61 billion raised, compared with $7.76 billion on the ASX, although the gap between the two narrowed considerably.

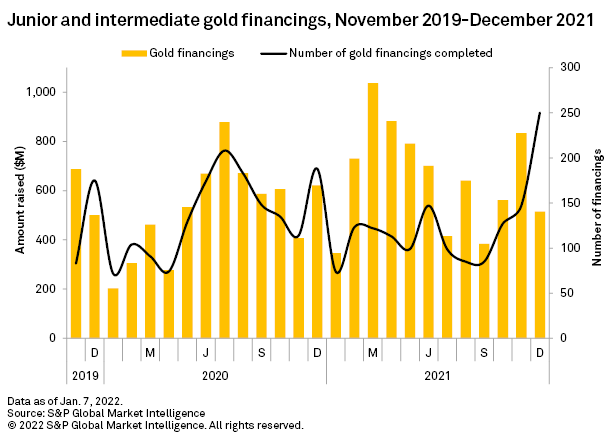

Gold funding down 38%, although number of financings at record high

Gold financings declined 38% to $515 million after two consecutive months of increases. Despite the decline, the number of financings jumped to a record high of 250, 70% higher than the previous month. Smaller gold financings and transactions with value of less than $2 million pushed the number of financings to a record high, with the total nearly doubling month over month to 181 transactions. The lack of higher-value financings, as evidenced by the lack of gold financings in December's top five, weighed down the gold total.

The year-to-date total for gold sits at $7.84 billion — the highest annual total since 2011. The December total of $515 million was 21% lower than the rolling 12-month average of $654 million. Gold fundraisings on TSX/TSXV and ASX declined to 29% and 67%, respectively. There were some jumps in the funds raised on the LSE and NYSE, but not enough to lift the total funds raised. Funds raised for gold year-to-date on the TSX/TSXV was $1.41 billion, 39% higher than on the ASX.

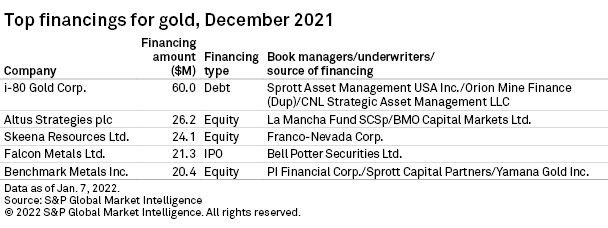

The largest gold financing in December and sixth-largest overall was $60 million in convertible bonds offered through a private placement by TSX-listed i-80 Gold Corp. The bonds, with an interest rate of 8% per annum, will mature in December 2025. The company will use the proceeds for its mining complex in Nevada.

The second-largest was completed by LSE-listed Altus Strategies PLC, which closed an institutional private placement of its common shares with gross proceeds of $26.2 million. The company intends to use the proceeds primarily as development and exploration capital for its gold assets in Western Africa.

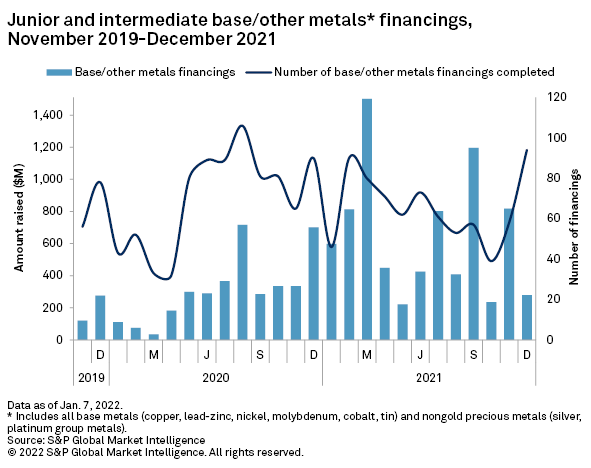

Base/other metals financings decline two-thirds

Base/other metals financings declined 66% to $280 million after a strong rebound in November that raised $817 million. Despite the dip, the number of base/other metals financings jumped to 94, a 16-month high fueled by the doubling of smaller financings.

Base/other metals financings in full year 2021 totaled $7.75 billion, more than double the year-ago period. The number of financings was 7% lower year over year at 784, which indicated generally larger individual financings in 2021.

Fundraising for copper decreased 62% to $133 million after a strong comeback in November. Funds raised for nickel trailed with $70 million, followed by zinc at $57 million. Funds raised for silver and cobalt were $11 million and $500,000, respectively.

ASX companies dominated base/other metals financings and retook the top spot among the exchanges as the amount raised increased 25% while funds raised in the TSX/TSXV dropped 79%. For full year 2021, the TSX group base/other metals total again led the ASX, but by a narrower 7% margin.

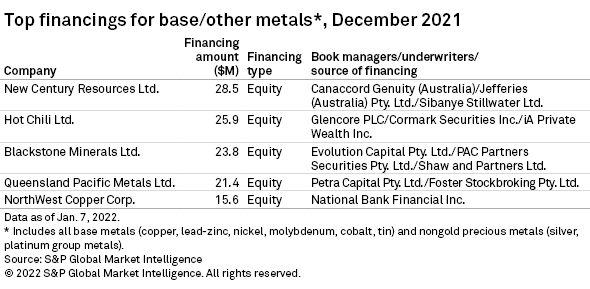

ASX-listed New Century Resources Ltd.'s follow-on equity offering through a private placement announced in October was the largest for base/other metals and the 11th largest overall for the month. South Africa-based Sibanye-Stillwater participated in the offering. New Century will use the gross proceeds of $29 million primarily for expansion of the Century zinc-lead mine in Queensland, Australia.

ASX-listed Hot Chili Ltd. was a close second with $26 million gross proceeds raised through a private placement of common shares. London-listed Glencore PLC participated in the offering along with other international institutional investors. Hot Chili will use the proceeds primarily for commissioning of its copper-gold mine in Chile.

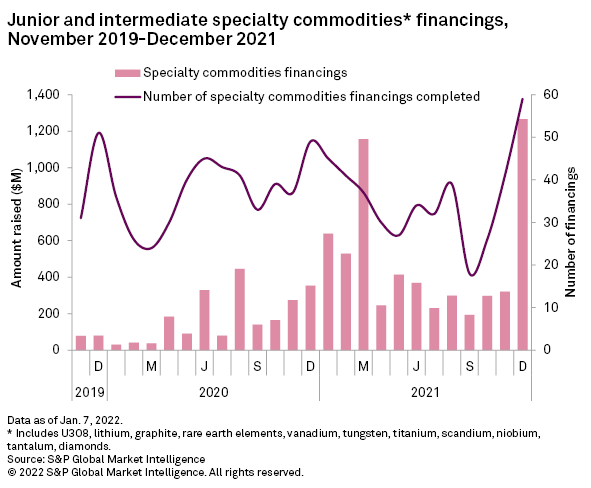

Specialty commodities increased fourfold, offsetting declines in gold and base/other metals

Specialty commodities financings surged 295% in December to $1.27 billion, the highest monthly total in our records. The number of financings was up 44% to 59, a four-year high.

Funds raised for specialty commodities in full year 2021 totaled $5.96 billion, compared with $2.17 billion in 2020. It was also by far the largest amount raised since our coverage of specialty commodities financings began in 2014, owing to strong demand for lithium and rare earth elements.

The TSX/TSXV and ASX reported record totals raised of $727 million and $474 million, respectively. In full year 2021, the ASX dominated specialty commodity financing with a total of $2.53 billion, compared with $1.74 billion raised in the TSX/TSXV group.

Lithium accounted for 84%, or $1.06 billion, of December's specialty commodities total, a record high for the commodity. Funds raised for rare earth elements were a distant second at $146 million. Graphite followed with $23 million, and nominal funds were raised for other specialty commodities.

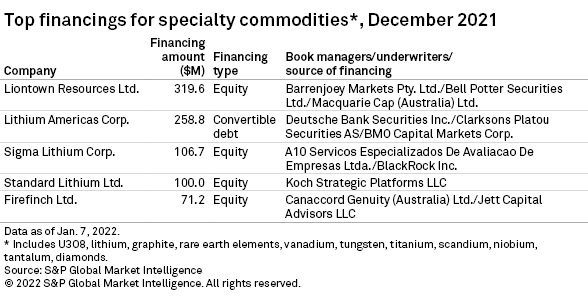

December's largest specialty commodities financing was also the largest financing overall, with $320 million raised by ASX-listed explorer Liontown Resources Ltd. from the private placement of its common shares. The company will use the proceeds for exploration and development capital, mainly for its lithium assets in Western Australia. The Kathleen Valley lithium-tantalum project, the company's flagship asset, recently completed its feasibility studies and estimated reserves and resources containing 2.1 million tonnes of lithium oxide grading 1.35%.

TSX-listed Lithium Americas Corp. was a close second with $259 million raised through an offering of convertible bonds with a coupon rate of 1.75% due in January 2027. The company's lithium assets are in Nevada and Mexico.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.