Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Dec 12, 2024

By Cesar Pastrana

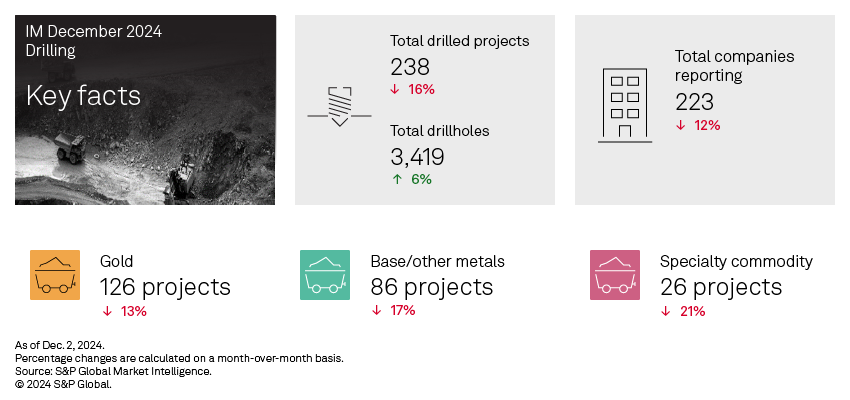

Drilling metrics went down in November, driven by the total projects drilled decreasing across all commodities. The total number of holes drilled, however, was up 6% due to increases in gold, silver and specialty metals. The total number of companies reporting also declined 12% to 223. Drilling dropped across all stages: Early-stage projects declined 8% to 90 total projects drilled, late-stage projects were down 14% to 116 and minesite projects fell 35% to 32.

Access November drill results data in the accompanying Excel spreadsheet.

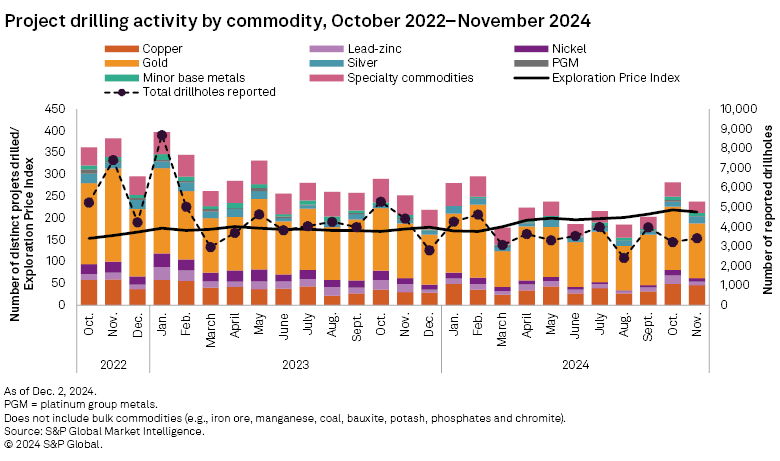

In November, drilling activity declined after two consecutive months of increases. Almost all commodities were affected, leading to an overall drop of 16% in total projects drilled, bringing the total down to 238 projects. Gold was particularly impacted, experiencing a 13% decline, with only 126 projects reported. In contrast, silver increased 33%, marking the only rise in total projects for the month. Counterintuitively, the number of reported drillholes rose by a modest 6% month over month. This uptick was driven primarily by substantial increases in silver (95%) and specialty metals (62%), along with a smaller rise in gold (4%). Meanwhile, all other commodities experienced decreases in total drillholes.

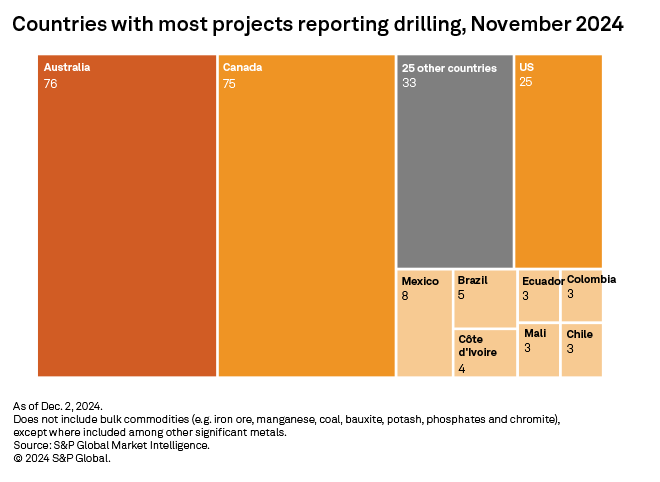

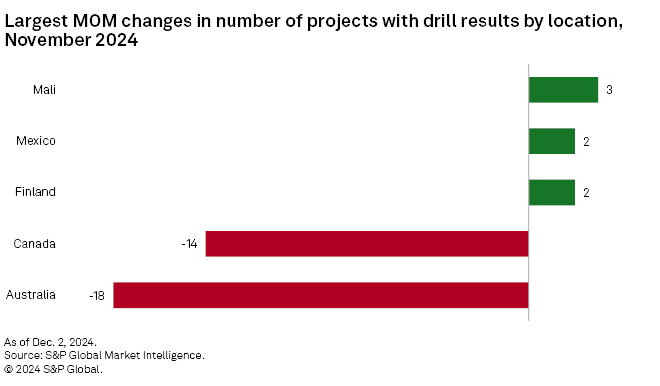

Australia, Canada and the US remained the top countries in total drilled projects reported in November despite month-over-month declines. Australia recorded the most significant drop of 19% to 76 projects, putting it nearly on par with Canada with a 16% decline, resulting in 75 projects. In the US, the number of recorded projects was also down to 25 after a five-month high in October. On the other hand, projects drilled in Mali, Mexico and Finland increased, but none reported more than three additions.

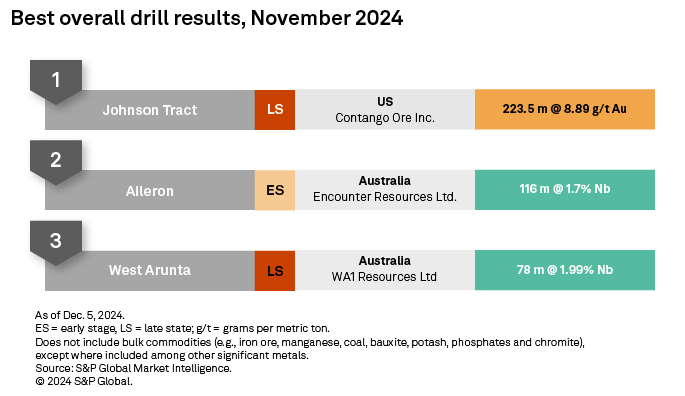

November's top result came from Australian Securities Exchange-listed Contango Ore Inc.'s Johnson Tract advanced-stage gold project in Alaska. The company reported an intersect of 223.5 meters grading at 8.89 grams of gold per metric ton, 6.06 g/t silver, 0.45% copper, 4.42% zinc and 0.88% lead. The company has announced that it is planning its programs for 2025, with a focus on advancing the project toward feasibility and mine development.

The second-best result came from ASX-listed Encounter Resources Ltd.'s Aileron project in Western Australia. The company announced an intersect of 116 meters grading at 1.7% niobium and that it has secured firm commitments for a placement to raise A$15 million. These funds will be used to support further targeted drilling aimed at assessing the scale of niobium-rare earth metals mineralized carbonatites at the Crean, Emily and Green deposits, as well as reconnaissance drilling programs to explore additional targets at the Aileron project in the West Arunta region.

TSX Venture Exchange-listed WA1 Resources Ltd.'s West Arunta project in Western Australia rounded out November's top three results, with an intersect of 78 meters grading at 1.99% niobium. An extensive drilling campaign is ongoing at the Luni deposit, a zone that is planned to support the company's early-development ambitions and will be an important part of its updated mineral resource estimate, targeted for the first half of 2025.

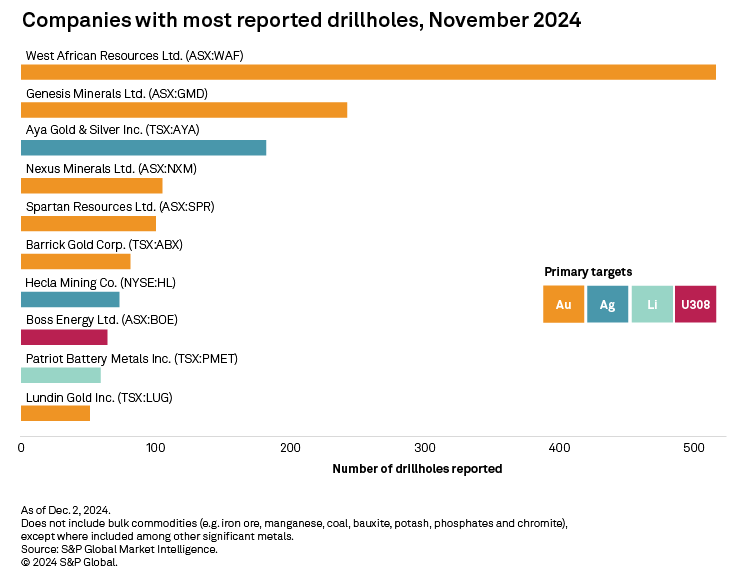

ASX-listed West African Resources Ltd. reported the most drilling holes in November, with 516 holes drilled at its Kiaka gold project in Burkina Faso. The company reported that the first owner mining-fleet has arrived on site, with the remaining fleet expected to be delivered by end-2024. Construction and operational readiness of Kiaka are on track and within budget, with the first gold production anticipated in the third quarter of 2025.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.