S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 16 Aug, 2022

By Brian O’Rourke and Mike Paxton

Introduction

The pandemic has increased consumers' awareness of the need to monitor their health, and they are responding by buying their own dedicated health monitors, according to a recent 451 Research survey of early adopter consumers. Device-makers, healthcare providers and insurers may be able to work together to enlarge that market in the future and help supplement the market for remote patient monitoring technology. Owned devices range from blood pressure monitors to insulin delivery devices. Other owned devices include blood oximeters, vital signs monitors, sleep trackers and sleep apnea devices.

One interesting trend to watch will be whether greater percentages of early adopters buy these devices in the future, given that COVID-19 has increased emphasis on fitness and monitoring vital signs such as blood oxygen levels. Another trend to watch will be the extent to which more typical consumers follow the lead of these early adopters in purchasing healthcare devices.

According to our recent survey of early adopting consumers, who tend to have higher incomes than typical consumers, leading consumers own a significant number of health monitors. These devices range in complexity from simple vital signs monitors to blood glucose monitors and electrocardiograms, or ECGs. Over one-quarter of these more advanced consumers owned one of these devices, and more than four in five bought the device themselves rather than getting it from a healthcare provider. This might create potential for device-makers to increase market share by working with healthcare providers and insurers to provide products to consumers at no cost or reduced cost, as the healthcare system is moving to a model of increased remote patient monitoring, or RPM.

Background

451 Research conducted a leading indicator U.S.-based online survey of 1,177 consumers in June 2022. The survey queried respondents over 18 years old and from a 451 Research panel of leading indicator consumers, whom we selected for their incomes and interest in technology. Among many other topics, the survey inquired about consumer ownership of various healthcare devices, including the types of devices and brands, whether a healthcare professional provided them and whether insurers covered them.

Analysis

Our leading indicator consumer respondents tend to be higher income and more tech-savvy than the average consumer, so their ownership of devices may be of interest for a few reasons. First, it tells us what types of devices are emerging in consumer consciousness. Early adopter consumers tend to seek new technologies out of need or interest, leading to the second reason that their responses are interesting: They may tell us what average consumers will be looking for in the near future.

Leading consumers own a wide variety of dedicated health monitors

Within the survey, we asked respondents if they owned a dedicated health monitor — blood pressure cuffs, blood glucose monitors, heart rate monitors, blood oxygen monitors, insulin pumps, sleep monitors and sleep apnea/continuous positive airway pressure devices. Of our leading indicator population, 28.5% owned a dedicated health monitor.

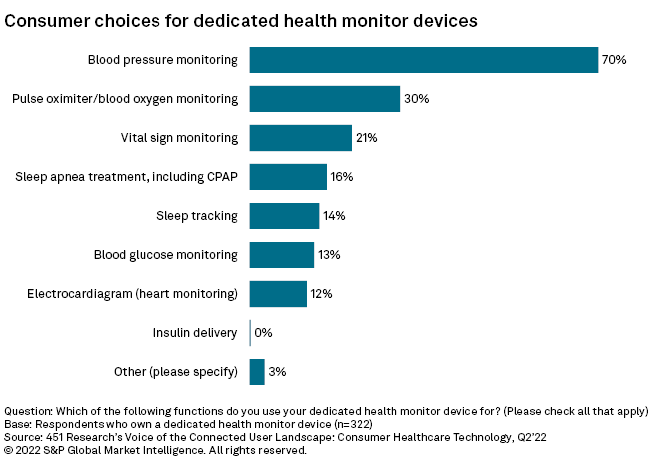

We further queried the 28.5% of respondents on the type of devices they owned. Blood pressure monitoring was the overwhelming favorite among the respondents, at nearly 70%. This is not a surprise since, in 2022, 47% of Americans have high blood pressure, according to the Centers for Disease Control and Prevention. Blood pressure monitoring even exceeded adoption of the more general vital signs monitor, which includes heart rate, respiration and temperature monitoring, and was the third most popular choice, at 20.5%. The second most popular response was pulse oximeter/blood oxygen monitoring, at just over 30%. The popularity of this device is likely tied to decreased blood oxygen levels, a symptom of COVID-19. Fingertip pulse oximeters are widely available to consumers for less than $40.

Many consumers address sleep concerns at home, including sleep apnea treatments and more general sleep tracking devices, at 15.5% and 14%, respectively. As the CDC reports, over 70 million Americans have chronic sleep problems, so the popularity of sleep devices makes sense. The availability of sleep tracking in multiple formats, including wearables, mobile phone apps and dedicated sleep monitors, has increased the ability to track sleep. Dedicated sleep monitors are widely available at retail from startup companies such as Oura, SleepOn and Kokoon Technology Limited.

Blood glucose monitoring was the response of 13% of consumers. The availability of home blood glucose monitors is expanding beyond the established home finger-stick product tests. Newer, convenient wearable technologies, utilizing a very thin filament that measures glucose in the patient's interstitial fluid just beneath the skin, are currently available from Abbott Laboratories and DexCom Inc.

Home ECG devices were the choice of 11.5% of our leading indicator respondents. Consumer ECGs have been a focus of startups over the last five years, and the devices seem to be gaining a foothold. Companies that offer these products include AliveCor Inc., Wellue, EKO International Corp. and EMAY.

Most buy their own devices

The vast majority of our leading respondents acquired their own devices, at 82% of respondents, rather than acquiring them from a healthcare provider, at 18%. This indicates that a do-it-yourself model currently permeates this market. When a respondent needs a healthcare monitor, they buy it. Still, this may indicate an opportunity for device-makers to work with insurers and healthcare providers to increase their business by bringing third parties more to the fore within the market.

The move to increased numbers of dedicated health monitors fits in well with healthcare providers' emphasis on remote patient monitoring. 451 Research's surveys of healthcare Operational Technology professionals indicate that the number of facilities focusing on RPM internet of things projects has increased since the outbreak of COVID-19. Operational Technology surveys also indicate an increasing effort from healthcare facilities to integrate RPM data into patients' electronic health records. Given that background, it seems there is an opportunity for doctors to ship devices directly to consumers at a discount if device-makers establish the necessary relationships with healthcare providers and insurers.

A complicating factor that could limit this growth, however, is the level of IoT connectivity in the devices. If the devices cannot connect to the cloud, their utility is limited since they cannot automatically transfer patients' vital signs to doctors.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.