Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Dec, 2022

By Joe Mantone, Gaurang Dholakia, and Gaurang Dholakia

Macroeconomic headwinds continue to plague dealmaking and thwart prospects for a sharp pickup to M&A or initial public offering activity.

With inflation remaining stubbornly high, central banks are expected to continue raising interest rates to combat the price increases. Higher interest rates have increased the cost of acquisition financing and led to depressed valuations, which reduces buyers' purchasing power and sellers' interest in pursuing deals.

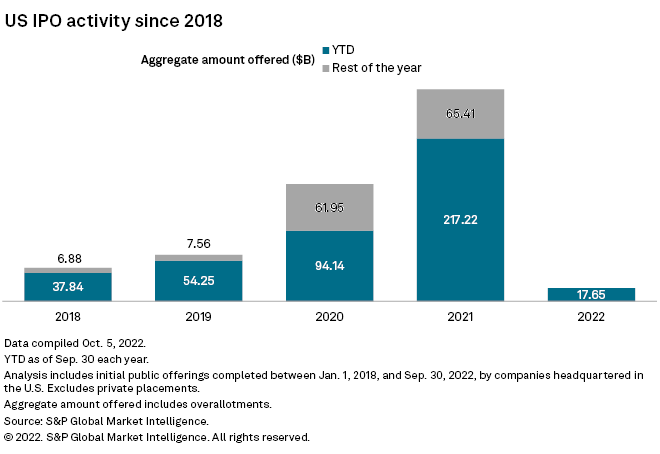

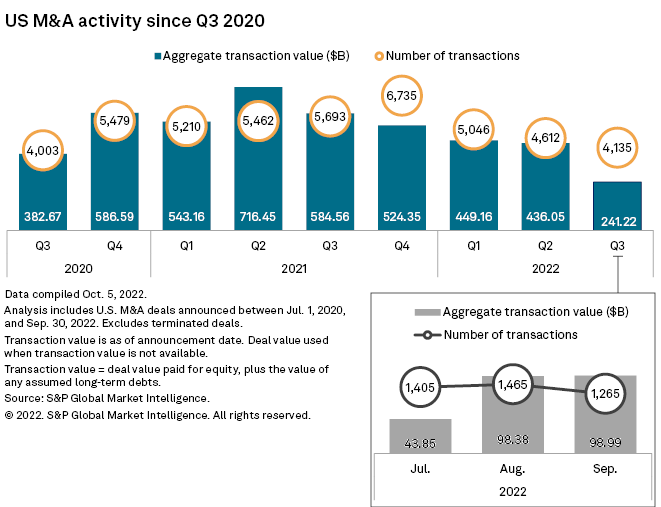

The backdrop has led to a dramatic reduction in M&A activity with the third quarter marking the fifth straight period in which the total value of U.S. M&A deals decreased. IPOs in the U.S. have fallen off the cliff. Through the third quarter, U.S. IPOs generated $17.65 billion, down from $217.22 billion through the same period in 2021, according to S&P Global Market Intelligence's latest M&A and equity offerings report.

With any luck, the third quarter will end up being a symbolic low point for M&A and equity offering dealmaking. The third quarter is traditionally a slow period for transactions as activity decelerates following the summer. Along with seasonal factors, dealmaking headwinds plagued third quarter 2022; volatile equity markets and higher interest rates remained constants as central banks moved to combat higher global inflation. The higher cost of acquisition financing makes it difficult for corporate buyers to pull the trigger on large deals and challenges financial sponsors to rationalize — or even fund — leveraged buyouts. Lower equity valuations also give sellers and issuers greater pause before testing the markets.

Overall M&A activity will remain challenged until economic uncertainty dissipates. When executives feel more confident about the economic outlook, it increases the likelihood they will pursue transactions.

However, the environment can create opportunities for M&A. Investment bankers have noted that restructuring activity has accelerated and those assignments can lead to forced sellers.

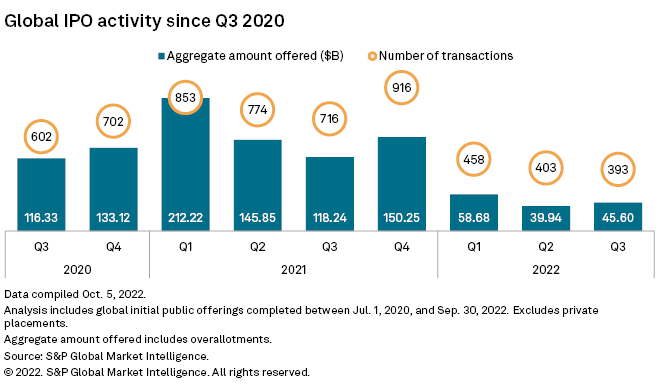

Also, companies seeking to shore up balance sheets will look to divest businesses they do not view as core. Selling off portfolio businesses helped boost IPO activity in the third quarter as spinoffs led to the two largest global IPOs of the third quarter.

Porsche AG, which was part of Volkswagen AG, executed the largest IPO of the period with a $9.06 billion deal. Corebridge Financial Inc., which was part of American International Group Inc., recorded the second-largest IPO of the period with a $1.68 billion deal. Combined, the Porsche and Corebridge transactions accounted for 23.6% of the $45.60 billion raised in the global IPO market during the third quarter.

The spinoffs helped boost IPO totals from the second-quarter level of $39.94 billion, but through the first nine months of 2022, the total value of global IPO issuance was down 69.7% year over year.

A drop in issuance from special purpose acquisition companies has contributed to the decline of IPO total values. In the first three quarters, U.S. blank-check companies raised $10.48 billion, down from $120.30 billion through the same period in 2021.

The issuance has slowed as SPACs have faced valuation pressure and have had difficulty completing M&A transactions. The drop in SPAC IPOs slows capital markets activity but also serves as a negative for M&A as it reduces the pool for potential buyers.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Download the full report

Products & Offerings