S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 1 Mar, 2021

By Guillaume Goton

In 2019, the global value of real estate was estimated to be US$217 trillion(opens in a new tab) – roughly 2.7 times the GDP of the entire world.[1] Global real estate consumes approximately 40% of world energy annually and accounts for more than 20% of greenhouse gas (GHG) emissions.[2] This highlights the contribution the real estate industry can make to help achieve the Paris Agreement goal of limiting global warming to well below 2°C from pre-industrial levels.

Real estate is a varied industry consisting of developers and maintenance professionals, as well as property managers and investors. Building and managing real estate provides many social benefits, but also depletes natural resources and releases pollutants into the environment. As a result, the industry has seen the emergence of a number of global and national regulatory frameworks around the integration of sustainability in business practices. Several key countries (i.e., Germany, France, and the UK) have introduced legal standards on the environmental, social, and governance (ESG) performance of existing and new real estate assets, covering both investment and development. More and more, real estate companies are compelled to demonstrate their ability to operate in line with emerging ESG benchmarks.

Recent sustainability initiatives specific to the industry are focused on building materials, energy efficiency, and waste management. Sustainable real estate companies use recyclable building materials, improve structural efficiency, and consider site aspects during the development stage. Refurbishing existing buildings with energy- and water-efficient appliances, improving energy management by using smart meters, and engaging with tenants on their impact are important measures for sustainability. Companies can validate their efforts through credible green building certification schemes, as well as by disclosing their ESG strategies and comparing their activities relative to peer groups.

Disclosing ESG Strategies

The S&P Global Corporate Sustainability Assessment (CSA), first established in 1999, is an annual evaluation of companies’ sustainability practices, focusing on criteria that are both industry specific and financially material.

The CSA uses a consistent, rules-based methodology that includes 61 different industries. There are approximately 100 questions for each industry, with each question falling under one of approximately 23 different themes or criteria. The criteria, in turn, fall under one of the three dimensions: “E”, “S”, and “G”. Some criteria are common across industries, while others are industry specific. The CSA generates a total ESG score for every company covered, as well as individual scores for the three dimensions, with 100 being the best score in each case.

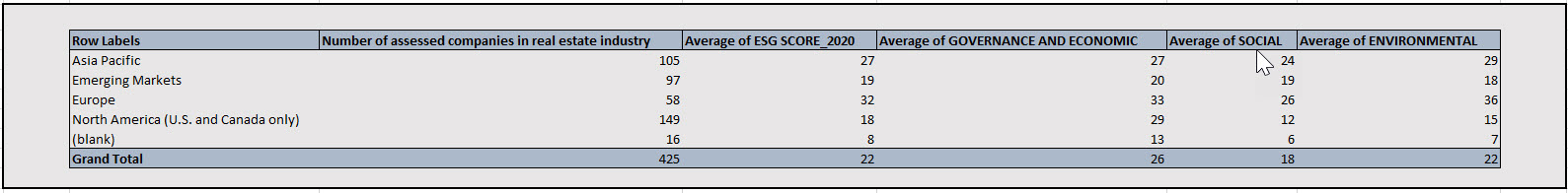

As shown in Figure 1, in 2020 real estate companies included in the CSA achieved an average ESG score of 22. Overall, real estate companies in Europe and Asia had the best performance, with average ESG scores of 32 and 27, respectively. In contrast, real estate companies in North America (U.S. and Canada only) had the poorest performance, with an average ESG score of just 18. This likely reflects the differences in maturity of sustainability and ESG reporting practices across Europe and Asia as compared to North America.

Figure 1: Scores for All Real Estate Companies Included in the CSA

Source: S&P Global, SAM CSA, Results for 2020.

The average dimension scores for real estate companies included in the CSA were: “E” 22, “S” 18, and “G” 26. In all three cases, European companies outperformed others, in particular with respect to the “E” dimension, where they posted an average score of 36 versus just 15 for North American companies. That said, much more needs to be done within all regions to improve sustainability across the industry.

Individual real estate companies do stand out from the pack, however, based on the CSA assessment. Three Australian firms led the global industry in the 2020 CSA, within a score range of just three points from one another. Dexus, which manages an Australian portfolio of properties, had an ESG score of 89. Addressing climate change is central to the firm’s sustainability approach, which includes a target of net zero by 2030 and a focus on portfolio resilience. GPT Group, with a portfolio of shopping centers across Australia, is committed to reducing its environmental impact and had an ESG score of 87. Stockland, a large diversified property group, scored 86. The company’s sustainability reporting is now in its 15th year and includes a detailed discussion of material sustainability issues, as well as in-depth data sets and select case studies.

The Pandemic Accelerates Change

Many green initiatives were already underway prior to COVID-19, but the pandemic is accelerating this trend. In the commercial sector, for example, there is a strong focus on the impact of working environments on public health. Greener real estate is gaining attention, which considers the general quality of a space and the use of building technologies that can support the well-being of occupants.

Organizations, such as the World Green Building Council (WGBC), are looking to help transform the building and construction sector to create a net zero carbon, healthy, equitable, and resilient built environment.[3] As a member of the UN Global Compact, the WGBC is working to drive the ambitions of the Paris Agreement and UN Global Goals for Sustainable Development. As consumers, investors, and regulators place increasing pressure on businesses to reduce their carbon footprint, real estate companies will likely continue to embrace green building.

To read more about corporate sustainability assessment, click here>(opens in a new tab)

[1] “Climate change: real estate worth billions could become obsolete – unless owners act now”, The Conversation, July 3, 2019.

[2]“Environmental Sustainability Principles for the Real Estate Industry”, World Economic Forum Industry Agenda Council on the Future of Real Estate & Urbanization, January 2016.

[3] World Green Building Council website, www.worldgbc.org/about-us.