Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 18 May, 2022

By Bjorn Goosen

Highlights

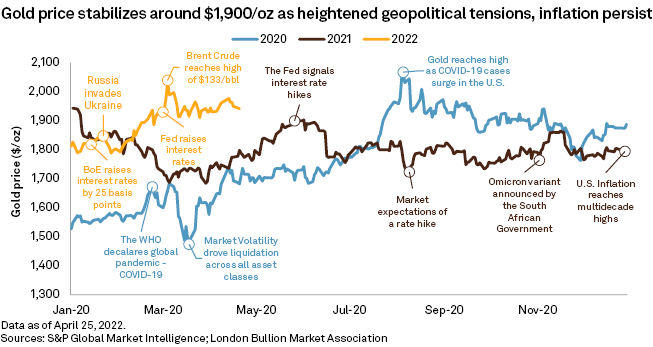

The gold price hit a 19-month high of around $2,039 per ounce in early March and has since stabilized at around $1,900/oz.

Global gold mined supply is forecast to increase approximately 4.6% year over year in 2022.

Sentiment for gold investment rose over the past two months on higher inflation and increasing geopolitical risks surrounding Russia's invasion of Ukraine. The gold price hit a 19-month high of around $2,039 per ounce in early March and has since stabilized at around $1,900/oz.

* The gold price rose 6.7% year-to-date through April 22, including a peak of $2,039/oz on March 8, its highest since August 2020, on continued geopolitical tensions related to Russia's invasion of Ukraine.

* Rising gold prices were supported by multidecade-high inflation rates in many developed countries. U.S. real yields remain in negative territory because of low nominal interest rates, supporting the case for gold investment.

* Markets expect the U.S. Federal Reserve to raise interest rates 50 basis points in May and anticipate another four rate hikes in 2022.

* Asset classes such as the U.S. Treasury 10-year note rose 57% year-to-date as inflation fears drove investors to diversify portfolios; Brent crude drove above the $100-per-barrel mark in March, gaining 37% year-to-date while the S&P 500 declined 7.0% as investors sought refuge in safer havens.

* Global gold mined supply is forecast to increase approximately 4.6% year over year in 2022.

* Our gold price outlook for the short term is to fluctuate around $1,900/oz due to the current geopolitical and macroeconomic uncertainties. As interest rates rise, we expect prices to average around $1,825/oz by late 2022 before ending our five-year forecast horizon closer to $1,700/oz.

Learn how S&P Capital IQ Pro platform can help you stay ahead of global mining activities and metals markets analysis and forecasts. Request a demo >

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.

Webinar Replay

Blog

Products & Offerings