S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 24 Feb, 2022

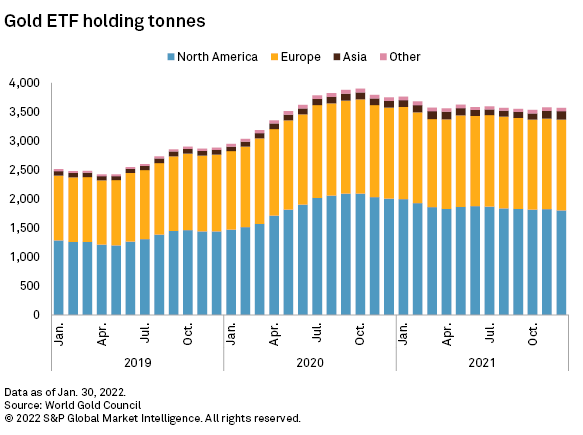

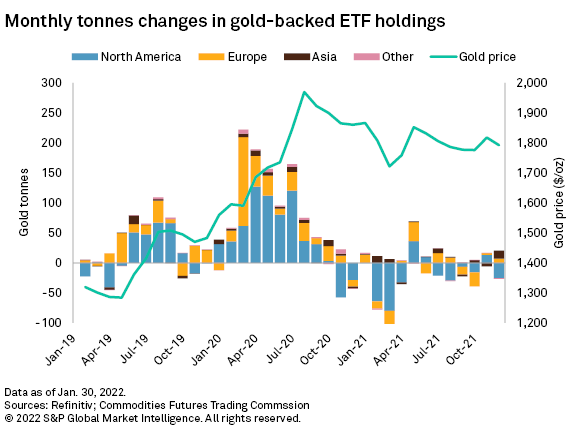

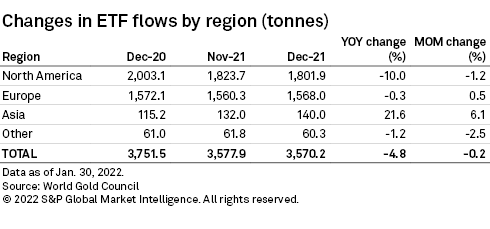

In 2021, physical gold-backed exchange-traded funds posted a year-over-year decrease of 4.8%, or 181.3 tonnes, as collective gold holdings totaled 3,570 tonnes, according to the World Gold Council, remaining above pre-pandemic levels. The popularity of gold exchange-traded funds continues to hold the interest of investors, who are more willing to leverage gold as a hedge against inflation, heightened geopolitical risks and negative real yields. Most outflows were driven by North American funds, which posted a 10.0% year-over-year decrease; the total fund flow decrease was offset, however, by smaller Asian funds, which experienced a 21.6% increase.

COMEX gold prices underperformed against other major asset classes in 2021, falling 3.7% at year-end and shedding a further 1.7% through January 2022. Gold price movements inversely mirrored the U.S. dollar, which saw the trade-weighted U.S. dollar index strengthen 6.7% over 2021 and 0.6% month over month in January. Lower gold prices in 2021 were not offset materially by spiking inflation, which reached multidecade highs in most major economies, including the U.S., where the consumer price index rose to 7.0% in December — a rate last seen in October 1990. The COMEX gold price remained above the $1,750-per-ounce mark through 2021, however, and reached $1,804.4/oz on Feb. 3, supported by investor concerns over inflation and intensifying Russia-Ukraine border tensions. A recovery of jewelry demand in key markets is also expected to provide some price support in 2022, countered by expected interest rate hikes and higher bond yields during the first half.

Following recent comments, the U.S. Federal Reserve is expected to hasten tapering of the bond purchases in 2022, with at least two, but possibly three, interest rate hikes now in the cards in order to curb the rise in inflation. Global markets are also poised as other central banks are expected to tighten monetary policy through 2022, with the Bank of England raising the interest rate 25 basis points Feb. 3, although the European Central Bank kept rates unchanged.

Historically, rising geopolitical risks have been positive for the yellow metal. The recent escalation of Russia-Ukraine border tensions has involved the U.S. and other major countries, which could lead to sanctions, disrupted trade flows and market volatility that could provide near-term support for the gold price.

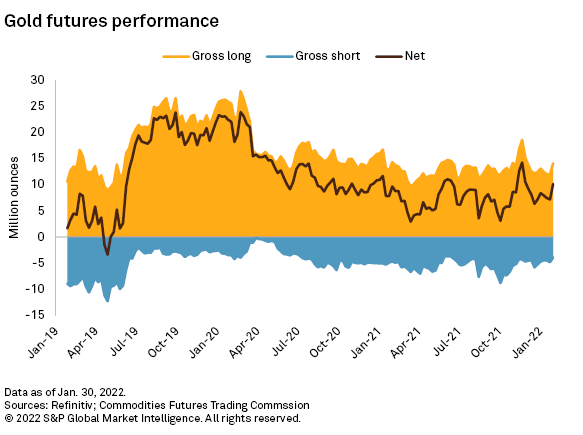

Net long positioning data for gold from the Commodity Futures Trading Commission reached a high of 14.2 million ounces in November 2021 after falling to 2.9 Moz in mid-March 2021. By the end of the year, net long positions for gold had settled to 7.2 Moz as the volume had largely followed the gold price movements.

Regional and individual gold fund flow performance, December 2020 vs. December 2021

According to the World Gold Council, global physically backed gold ETFs saw a year-over-year decrease of 181.3 tonnes in 2021 at an equivalent value of $20.5 billion. The decline was primarily led by North American gold funds, which posted a 10.0% decrease over the same period — as the U.S.-focused SPDR Gold Trust experienced a 15.0%, or 185.8-tonne, drop in gold holdings over the course of the year. December 2021 marked a particularly weak month for the funds, with holdings falling 1.2%, or 21.8 tonnes, month over month. The predominantly U.S.-focused iShares Gold Trust also displayed a similar trend, with a 6.8% year-over-year decrease at year-end and a smaller decrease of 0.6% month over month in December. Most outflows possibly stemmed from the expectations of pending interest rate hikes. Through January 2022, both SPDR and iShares increased 4.0% and 0.3%, respectively, as increased inflation drove investors to more hedging activity.

Europe-focused funds experienced mixed results, with a less pronounced fall of 0.3% year over year, closing with 1,568 tonnes — an equivalent decrease in value of $3.9 billion. The December results month over month were more positive, with inflows increasing 0.5% even though the BoE raised U.K. rates 15 basis points in December. Collectively, the WisdomTree Investments Inc. ETFs posted the largest year-over-year decrease among European funds, falling 14.4%. In contrast, Invesco Ltd. and Xetra Gold ETFs increased 5.6% and 9.7%, respectively.

Asian funds displayed an impressive growth of around 21.6% year over year, ending 2021 with approximately 140 tonnes held — an increase of 24.8 tonnes; these funds ended the year on the rise, recording an increase of 6.1%. Chinese inflows were driven by local investors taking advantage of the gold price discount.

Other gold funds based in Australia, South Africa and Turkey also saw net outflows of approximately 1.2% year over year at an equivalent value of $632.0 million, culminating in a global decrease of 181.3 tonnes.

Outlook for 2022

The gold price outlook for 2022 remains firm in the near term, amid persistent high inflation, supply-chain disruptions and Russia-Ukraine border tensions. Higher consumer demand, the likelihood of increased central bank purchases and the potential for new COVID variants could increase demand for gold as a hedge.

The Fed's hawkish stance amid multidecade-high inflation reinforces gold as a safe haven and may temper any steep drop in prices. We note that gold historically underperforms in a rising interest rate environment; however, the real yield is still negative due to rising inflation, providing further support for the price.

S&P Global Market Intelligence expects the gold price to remain range-bound in 2022, barring a geopolitical shock, a pandemic-related event or an unexpectedly aggressive rise in interest rates that could put downward pressure on prices. As reported in our monthly review of consensus metals price forecasts, equity market analysts also anticipate limited downside to the price in 2022, which is forecast to average $1,803.91/oz, up from $1,798.5/oz in 2021. S&P Global Market Intelligence expects the gold price to range largely between $1,750/oz and $1,850/oz; under these conditions, we expect a steady demand for ETFs throughout 2022, barring emergence of downside price momentum.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Segment