Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 15 Nov, 2021

By Neil Barbour

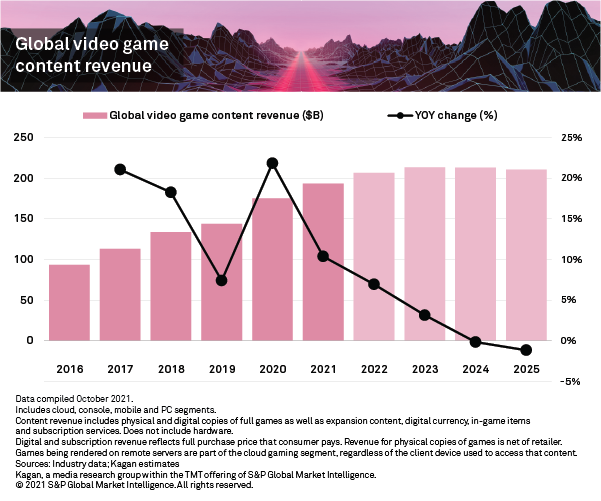

Video game content revenue had a significant bull run from 2016 through 2020, growing at a 17.0% CAGR, but a shaky handoff between hardware generations leaves the console segment susceptible to contraction over the next five years while the mobile market approaches saturation.

The free-to-play segment has been gaming's core revenue driver over the past half decade but now appears to be approaching maturity. Epic Games Inc.'s Fortnite is nearly five years old, and while other games have copied its formula to some success, no single project has come close to matching its reach.

Video game content revenue will carry its current momentum past $200 billion in 2022, but the market is forecast to decline as early as 2024 if it does not find a new growth engine. Our video game content analysis includes revenue driven by full games, add-on content, in-game purchases, digital currency and gaming-focused subscription services. This analysis does not include hardware revenue.

Mobile games make up more than half of video game content revenue, and we anticipate that the sheer size of the market will drive publishers to explore every opportunity to extend the free-to-play model's growth cycle. The PC and console segments will benefit from any resulting innovation and synergy with mobile, but are unlikely to attract as much attention, or growth, over the forecast.

Furthermore, hardware shortages effectively delayed the start of the new console generation, diminishing the segment's chances of taking a big leap over the previous generation in terms of revenue.

Cloud gaming can pull new users, and revenue, into the market, but the guarded rollouts from some of cloud gaming's biggest proponents will keep its potential in check in the near term.

MI clients can access a more complete analysis of the video game content market, including breakouts for the cloud, console, mobile and PC segments.

Products & Offerings

Segment