S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 22, 2023

Provisional PMI survey data for February indicate encouraging resilience of the major developed economies of the world, with reviving output growth in the US and Europe allaying fears of near-term recessions.

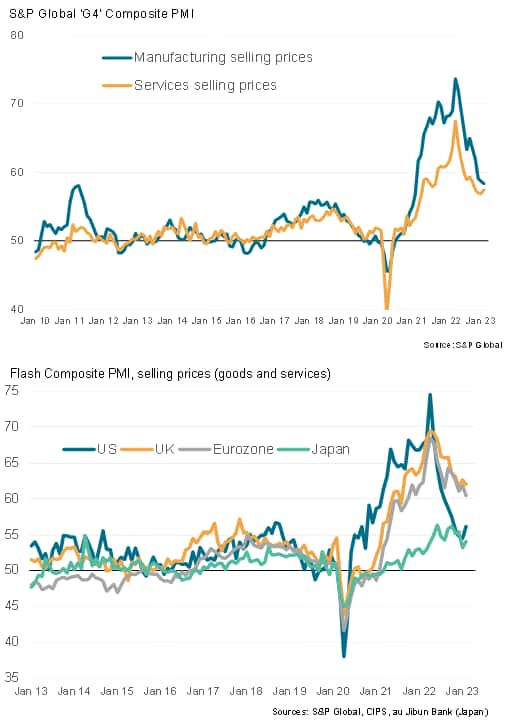

The upturn is skewed towards services, however, with manufacturing remaining in decline. The factory downturn did, however, help feed through to lower price pressures in the industrial sector, with pricing power clearly shifting from sellers to buyers amid the largest monthly improvement in suppliers' delivery times since 2009.

However, the surveys also brought news of stubbornly high inflation in the service sector, linked in part to wage growth.

The combination of elevated price pressures and economic resilience clearly adds to the case for further policy tightening at major central banks.

It nevertheless remains to be seen if February's upturn, having been aided by temporary factors such as warmer than usual weather and fewer supply shortages, can be sustained. Demand will need to rise further from current levels to ensure growth persists. In that respect, the future path of interest rates will clearly play a role.

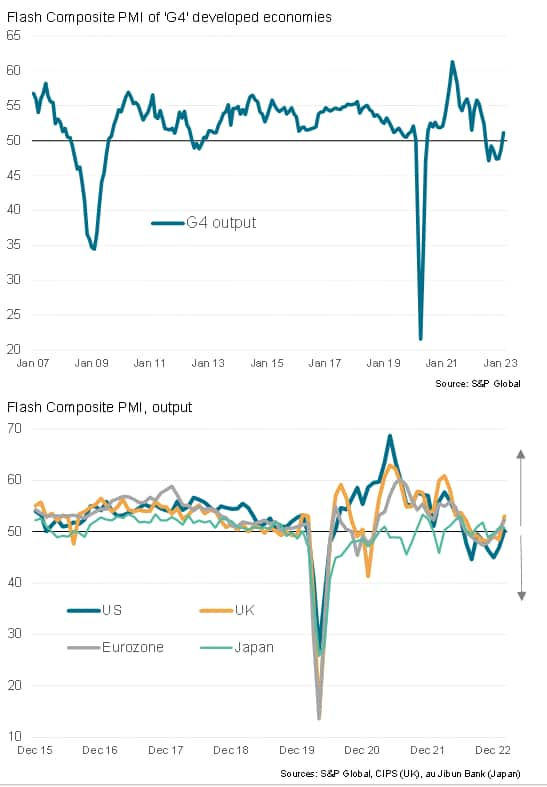

Business activity rose across the four largest developed world economies (the "G4") in February, reviving after seven months of continual decline. A weighted average of the headline composite PMI output index for the US, eurozone, Japan and the UK rose for a second month, up from 48.5 in January to break though the 50.0 no change level with a reading of 51.3 in February, according to provisional 'flash' estimates based on approximately 85% of usual survey responses. By rising above 50.0 the February survey index registered the first growth since June of last year.

Moreover, growth was recorded in all four economies for the first time since June of last year, painting an encouraging picture of a broad-based improvement.

Both the US and UK reported growth for the first times in eight and seven months respectively, while the eurozone grew for a second successive month - the rate of expansion accelerating to the highest since last May - and Japan eked out modest growth for a second month in a row.

Flash PMI output indices

The G4 expansion was driven by the service sector, where business activity rose at a rate not seen since last June, expanding for the first time in eight months. Robust service sector gains were seen in the eurozone, UK and Japan with a more modest gain seen in the US, the latter nonetheless being significant in representing the first such improvement since last June.

It should be noted, however, that at least some of the improved service sector PMI readings can be traced to cases of warmer than usual weather, which boosted outdoor services activities, whether that was outdoor dining, recreational activities or services relating to other outdoor-oriented sectors such as construction, for example.

Manufacturing meanwhile continued to lag, with output falling for an eighth successive month. The rate of contraction cooled, however, to the weakest seen over these past eight months, as both the eurozone and UK reported modest expansions in production and the US decline eased to the slowest seen over the past four months. In contrast, Japan' s manufacturing sector bucked the trend, with output declining at an accelerating rate, driven in part by slumping exports in a reflecting of subdued global trade flows.

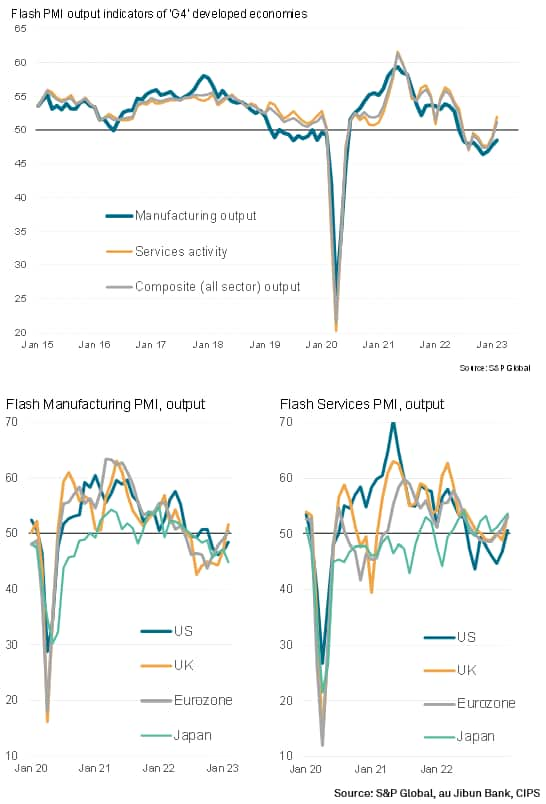

Output by sector across the G4

Part of the easing in the rate of decline of manufacturing output across the G4, and in particular the rising output seen in Europe, was fueled by improved supplier delivery times. Across the four economies, supplier delivery times shortened to the greatest extent since 2009. The faster deliveries reflecting an alleviation of pandemic-related shortages as well as reduced demand for inputs by manufacturers around the world, the latter in turn driven by an ongoing trend towards inventory reduction.

A further upside of these faster deliveries was a cooling of associated price pressures: Whereas the pandemic saw longer delivery times being associated with shortages and hence stronger pricing power, the situation is now reversing. Hence the cost of materials being supplied into factories rose across the G4 at the slowest rate for 27 months in February, the rate of inflation having now cooled in nine of the past ten months.

G4 flash PMI factory input costs and supply chains

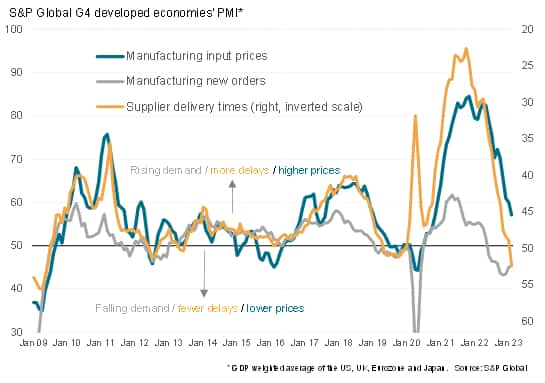

The reduced upward pressure on raw material prices helped drive a slower rate of inflation for goods leaving the factory gate on average across the G4, with manufacturing output prices rising at the slowest rate for two years.

It should nonetheless be noted that, despite the rate of increase falling sharply over the past ten months, the average rate of inflation for goods prices in the G4 remains elevated by historical standards, running higher than anything seen in the decade for which comparable data are available prior to the pandemic.

A similar elevated rate of inflation is evident for service sector charges, where the rate of inflation has fallen sharply since last year's peaks but ticked higher again in February across the G4 on average, likewise running far above anything seen in the history survey prior to the pandemic.

These elevated selling price inflation rates in part reflect the pass-through of prior increases in costs for raw materials and energy (notably in Europe, where rates of selling price inflation remain especially high), but also reflect reports of increased wage pressures in recent months. As companies indicate, while raw material shortages may have eased in 2023 so far, labour shortages have worsened, pushing the inflationary forces away from goods towards services.

Selling prices

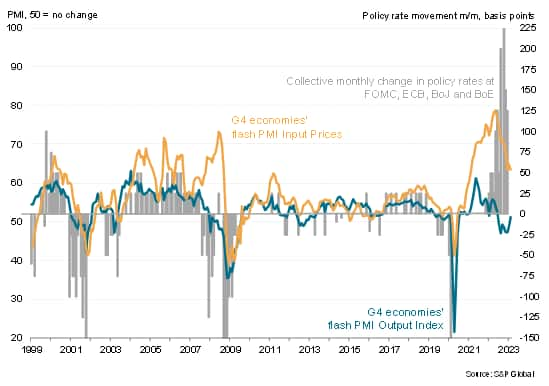

The February flash PMI data therefore point to cooling yet still elevated price pressures, combined with some surprising resilience of economic activity in the main developed economies in the face of recent monetary policy tightening. As such, the data suggest that policymakers in the US and in Europe cannot rely on recessions to do the work of higher interest rates in the months ahead. Hence the markets have begun to price-in higher terminal policy rates in the wake of the flash PMI numbers.

PMI data vs. central bank policymaking

Outlook

A key question, therefore, is whether the return to growth in February represents a turning point, at least in terms of the US and Europe being able to avoid recessions. Temporary factors no doubt buoyed the level of activity in February, notably in the service sector amid warmer than usual weather. In manufacturing, some of the output improvement was linked to easing supply chains, which may merely provide a short-term boost unless demand picks up. It is worth bearing in mind that in both sectors output indices ran ahead of new orders gauges, adding weight to the argument that underlying demand is not strong enough to sustain the recent uptick in output that has been aided by temporary factors. Also, do not forget that the PMI surveys exclude retail, which has been hard hit by the inflationary surge.

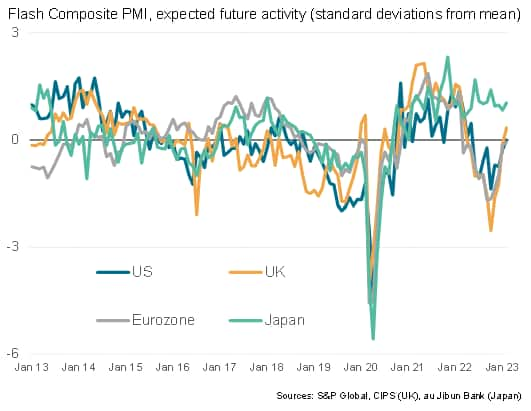

More encouragingly, the survey gauges of future output expectations improved across all four the major developed economies in February, either running above or drawing near to long run averages. This suggests that companies are preparing for better times ahead; something which was corroborated by the surveys also showing employment to have risen at a slightly increased rate in February. However, some of this optimism is predicated on central banks easing off their policy tightening amid signs of inflation peaking. If more rate hikes begin to get penciled-in as the economic picture brightens, one might expect confidence to take another knock, in which case the risk of recession is merely pushed down the road to later in the year.

Access the press releases for US, UK, Eurozone and Japan.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.