Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 15, 2024

By Ken Wattret

Learn more about our Global Economic Forecasting and Analysis

US monetary policy easing is set to begin later than previously forecast. Following a run of stronger-than-expected inflation prints, S&P Global Market Intelligence analysts now expect an initial rate cut by the Federal Reserve at December's meeting. Policy rate reductions will not occur until there is "greater confidence that inflation is moving sustainably toward 2%," according to the Federal Open Market Committee's statement in May. What this constitutes is uncertain. It will likely include lower wage growth and the Fed's target measure, core personal consumption expenditure (PCE) inflation, trending at about 2%. Consistent with these goals being achieved and in conjunction with weaker US growth, we forecast a series of US rate cuts in 2025-26. A return to the estimated neutral range for the Fed funds rate of 2.50%-2.75% is now expected in mid-2026.

Easing cycles in many other economies will start somewhat later as a result. Forecasts of initial policy rate reductions have been pushed back in countries operating currency pegs to the US dollar, such as Saudi Arabia, or where central banks are battling inflation pressures and are wary of currency depreciation given the slower pace of Fed easing, such as the UK. The Bank of Japan is a notable exception. Persistent yen weakness has led us to bring forward our forecast of the next policy rate hike to the fourth quarter of this year, albeit with the tightening cycle remaining rather gradual. We also continue to expect the European Central Bank to deliver an initial 25-basis-point rate cut at its next meeting on June 6. Well-behaved inflation data and the ECB's recent communications support our view. At the time of writing, the futures markets are factoring in an 80% chance of such an outcome.

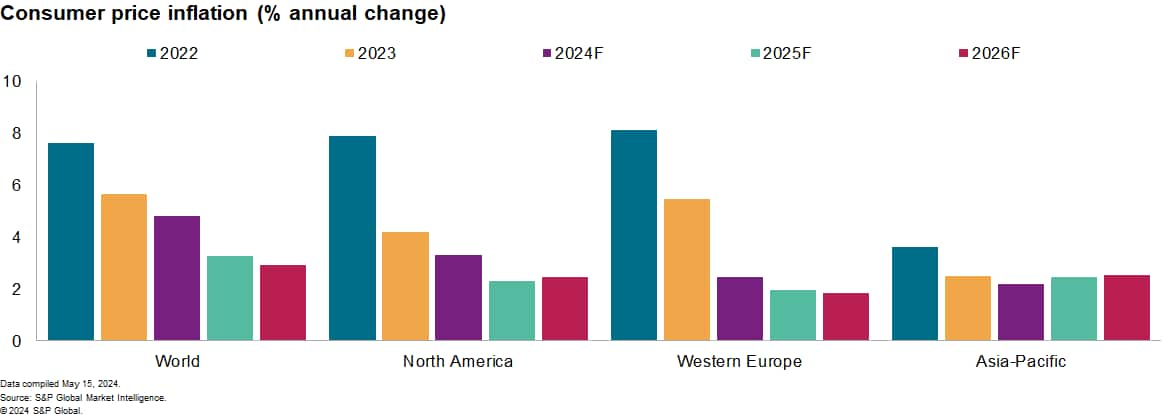

Sticky services inflation rates remain an impediment to swift policy easing. Global consumer price inflation edged down to 4.5% in March, according to our estimates, only slightly below the mid-2023 rate of 4.7%. While we forecast a gradual decline to about 3% by late 2025, it is taking longer than expected to get there.

Digging deeper into the components of core inflation helps to illustrate why. Consumer price inflation for core goods in the Group of Five economies dropped to just 0.3% in March, according to our estimates. That is 8 percentage points below the peak in early 2022. The equivalent inflation rate for services, which are generally more labor cost-sensitive, ticked up to 4.9% in March. Our projection for global consumer price inflation in 2024 was unchanged at 4.8% in our May update, with an upward revision to the US forecast broadly offset by lower forecasts in mainland China and Brazil.

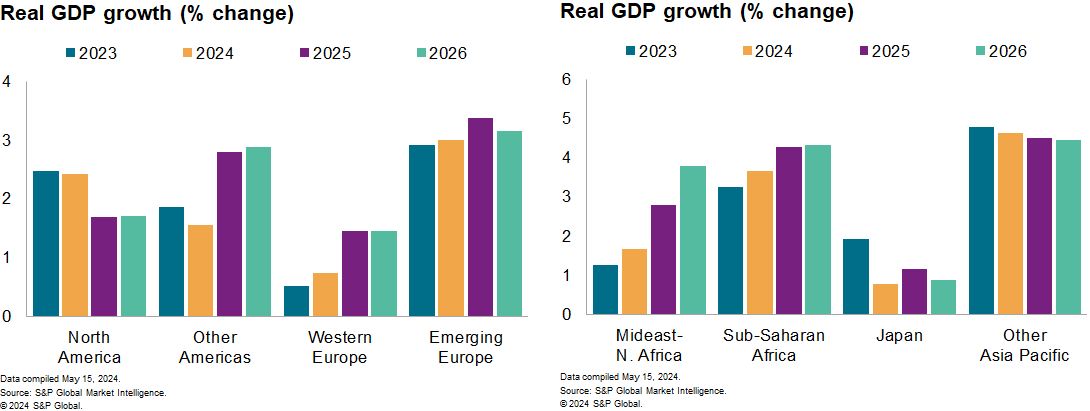

The real GDP growth forecasts for 2024 have been revised up in some major economies. These include the eurozone and the UK, where the initial estimates for first-quarter real GDP growth surprised to the upside. Relatively muted growth rates are forecast for the eurozone and the UK in 2024 at 0.7% and 0.5%, respectively. The growth forecasts for mainland China and Russia also edged higher in May's forecast round. As a result, our global real GDP growth forecast for this year was raised slightly to 2.7% from 2.6%. The revisions are consistent with the improvements in growth momentum flagged by our Purchasing Managers' IndexTM (PMI®) data. Still, various headwinds are expected to prevent global growth rates from matching the typical peaks during prior expansions, including financial conditions that will be somewhat less accommodative than expected and geopolitical uncertainties.

The pickup in global PMI data appears to be leveling off. While the composite global output index improved for the sixth month in a row in April, the increases in the past three months have been modest. At 52.4, April's level remained below its long-run average (53.2). The gap between the composite output indexes for emerging economies (53.6) and advanced economies (51.8) narrowed to a six-month low in April, helped by the pickup in Western Europe's economies. The global manufacturing output index was only just above the expansion level in April (50.3), although the export orders subindex continued its upward trend, again pointing to a pickup in global trade. Suppliers' delivery times continued to shorten, confirming limited effects from shipping disruptions.

Hear our global economist discuss our top 10 economic predictions for 2024

Learn more about our data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.