Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 20, 2023

By Ken Wattret

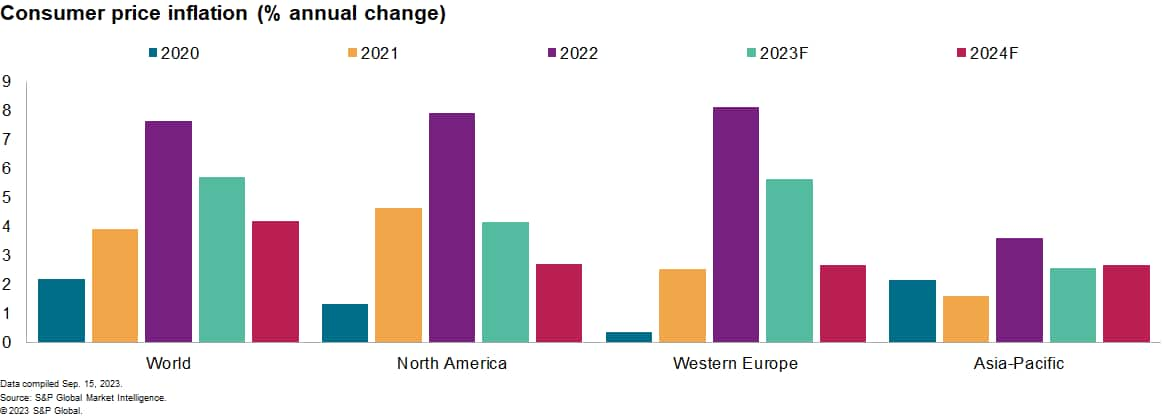

The near-term outlook for inflation has deteriorated. S&P Global Market Intelligence's September forecasts for global consumer price inflation have been revised higher in both 2023 and 2024. This partly reflects the impact of higher crude oil prices. The prices of some non-energy industrial commodities have also rebounded, although they remain well below the peaks of 2022. Sticky core inflation rates, particularly for services, are a prime concern given generally tight labor market conditions and elevated wage and unit labor cost growth.

Central bank rate cuts in advanced economies are some way off. The full effects of tighter financial conditions are yet to be felt, and most central banks maintain clear tightening biases. Policy rate cuts in advanced economies are unlikely until mid-2024, given the challenging inflationary environment. Futures markets are underestimating the potential for persistent underlying price pressures to delay monetary policy pivots.

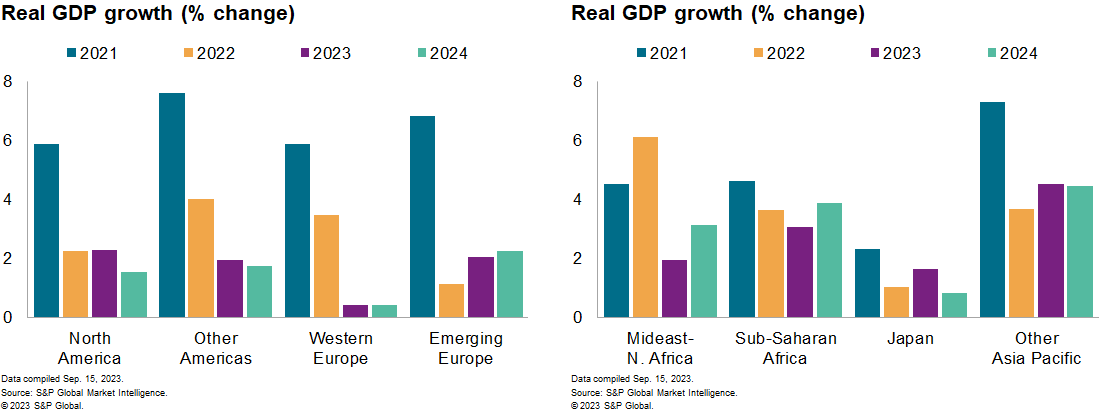

This year's global growth forecast has edged up — but the outlook is patchy. Our global real GDP growth forecast for 2023 ticked up to 2.6% in September, although near-term economic prospects vary markedly across, and in some cases within, regions. Strong momentum in the US remains the key driver of recent upward revisions to our global projections. We also revised up 2023 real GDP growth estimates for Japan, India and Brazil following stronger-than-expected second quarter data. Forecasts for the eurozone and mainland China have again been reduced with a recession now forecast in the former.

Global PMI data show alarming weakness. The JPMorgan Global Composite Purchasing Managers' Index™ (PMI™) compiled by S&P Global fell for the third successive month in August and, at 50.6, was barely in expansion territory. The global manufacturing output index was sub-50 for the third month straight, with the services equivalent down by over four points from its May peak. Forward-looking subcomponents signal further weakness ahead.

The 2024 global growth forecast has been lowered again. We reduced the September global real GDP growth forecast to 2.3%. A marked slowdown in quarter- over-quarter growth rates is forecast over the coming quarters compared with the first half of 2023. Downside risks include inflation persistence, tighter financial conditions and escalating geopolitical tensions.

A recession in western Europe is now our base case. Market Intelligence projects a mild "technical" recession in the eurozone during the second half of 2023, having forecast below-consensus growth outcomes since early in the year. Weakness in the most industry-sensitive economies, including the largest, Germany, remains a key part of the story. Momentum is also fading in the services-sensitive southern member states. While the UK's large real GDP contraction in July was exaggerated by special factors, we retain our long-standing recession call.

We revised up US annual growth yet still expect a marked slowdown. The September forecasts of US real GDP growth in 2023 and 2024 are marginally higher than in August, at 2.3% and 1.5%, respectively. This primarily reflects unexpectedly strong consumer spending through July, which also boosts the 2024 annual growth rate owing to carryover effects. Still, measured on the basis of fourth quarter over fourth quarter, US growth will likely end 2024 well below trend.

The outlook is mixed for Asia-Pacific. Multiple headwinds will hinder the economic expansion in mainland China, and recent monetary stimulus will not make a material difference. With recent "hard" activity data exhibiting broad-based weakness, we have again lowered real GDP growth forecasts for 2023 and 2024 to 5.0% and 4.6%, respectively. In contrast, much stronger-than-expected GDP data in Japan and India have prompted upward revisions to this year's growth forecasts.

US dollar strength is proving more persistent than expected. Interest rate differentials have remained supportive, with US economic growth outperforming many peers and the Fed's hiking cycle yet to conclude. Accordingly, we forecast the real, trade-weighted dollar to remain somewhat stronger for longer than previously projected. Gradual dollar depreciation is still expected given its current elevation and persistent US current-account deficits.

Learn more about our economic data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.