Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 8 Apr, 2021

By Neil Barbour

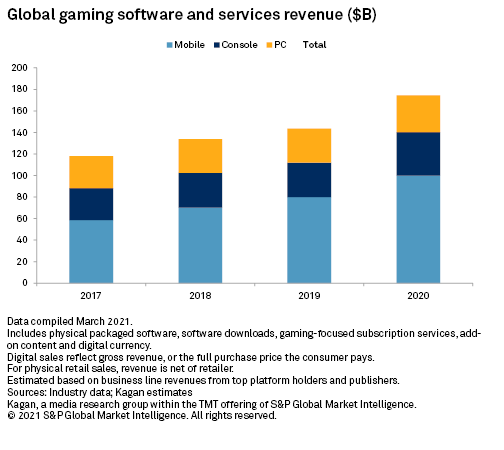

Global gaming software and services revenue grew 21.6% to an estimated $174.53 billion. Mobile led the way, with nearly $100 billion in annual revenue accounting for 57.2% of the market.

Console content was a distant second at $40.61 billion in annual revenue while PC trailed with $34.12 billion.

The pandemic was the primary growth driver in 2020 as consumers turned to games to pass the time, and the industry's bet on digital sales and free-to-play games in the preceding years set the stage to fully engage, and monetize, hardcore players with more time to spend and casual players looking for something new.

Kagan's gaming software and services analysis now includes PC gaming, which offers a more complete look at the global market. Our analysis of gaming content revenue is built on earnings reports from public companies. Estimates are derived from business line revenues where specific gaming segments are not broken out. Industrywide totals are estimated by establishing gross revenue trends across digital storefronts and physical retail sales among top publishers.

All three gaming segments in our analysis grew by double-digit percentages year over year in the fourth quarter of 2020, but PC and mobile started to lose steam compared to the third quarter of 2020. By contrast, console gaming pulled back in the third quarter of 2020 but was back in gear for the holiday gift-giving season that occurs during the fourth quarter in most Western markets.

These trends suggest that the pandemic-driven demand that coated all corners of the gaming market in mid-2020 was less of a factor at the end of the year, leaving the industry to revert to a model that relies on new releases to drive growth.