Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 23 Dec, 2022

By Erik Keith

5G service deployments will be driven and enabled by leveraging multiple technology and network evolution options, according to Kagan's annual survey of 82 global mobile network decision-makers. Survey respondents confirmed the variety of pathways to 5G for mobile network operators, or MNOs, including key factors such as plans for frequency spectra utilization, 4G to 5G technology migration options, and the implementation of open radio access network, or open RAN, solutions.

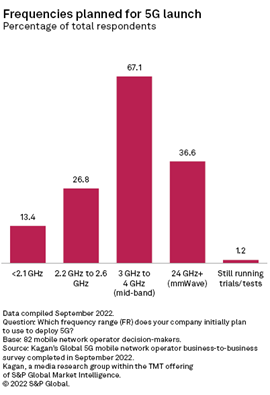

For the second year in a row, more than two-thirds of the global 5G survey respondents chose the mid-band — specifically, the 3 GHz to 4 GHz bands — as the frequency spectrum range most preferred, with 67% of the MNOs planning to leverage this frequency range to deliver initial 5G services. This represents a small drop from the 69% of operators surveyed in 2021.

The more striking (and important) change year over year is in the second most popular frequency band chosen by 5G survey respondents. In the 2021 survey, there was a tie for second place between the 2.2 GHz to 2.9 GHz range, and millimeter wave, or mmWave, spectra (i.e., above 24 GHz), with 26 of the 83 respondents (31.3%) selecting these two bands as the second most popular spectrum choice.

For 2022, however, 37% of survey respondents indicated plans to leverage mmWave for 5G service implementations. To be fair, interest in mmWave technology has waxed and waned in our survey results over the years but it now appears to be solidifying as the second most-chosen frequency band overall. Meanwhile, 2022 respondents revealed a lower preference for the 2.2 GHz to 2.9 GHz band, with only 27% claiming this spectrum range as their primary choice for 5G.

Low band (sub 2.1 GHz, e.g., the 600 MHz band used by T-Mobile USA) remains the least popular frequency range for mobile network operators in deploying 5G service, with 13% of respondents indicating they plan to use low band spectra (comparable to the 12% of respondents in the 2021 survey).

5G migration options

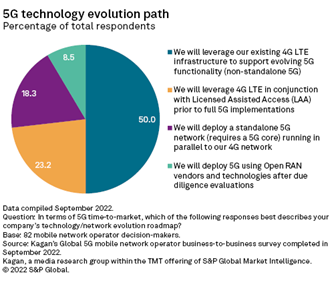

The most popular of the four discrete 4G to 5G network migration technologies, indicated by 50% of survey respondents (up from 48% in 2021), is one which leverages existing 4G LTE spectrum and infrastructure. This is known as non-stand-alone 5G and enables operators to deploy 5G services both more quickly and cost-effectively than the other technology options.

The second most popular choice for 5G service deployment (23% of respondents, compared to 25% in 2021) was utilizing 4G LTE networks in conjunction with licensed assisted access, or LAA, technology. LAA, like non-stand-alone 5G, enables faster time-to-market, but lower overall performance due to its dependence on 4G network elements (and its lack of a 5G core).

The third most popular option — implemented or planned by 18% of respondents, down from 21% in 2021 — for MNOs is to build a stand-alone 5G network, which runs parallel to existing 4G networks and services. This is more expensive as it requires investment in, and deployment of, a 5G core.

A stand-alone 5G network is sometimes referred to as "true 5G" as it does not utilize any 4G network elements and is therefore capable of delivering both higher throughput speeds and lower latency, with the related benefit of lower operational costs.

The least popular option for 4G to 5G network migration, despite the marketing hype and corresponding industry attention, was the exclusive use of open RAN technology, which was selected by only 8.5% of respondents in 2022 (up from 6% in 2021). Open RAN leverages cloud- and software-based solutions to enable 5G service, as opposed to the more traditional hardware-centric approach. Nevertheless, open RAN is expected to be utilized extensively as 5G networks become more pervasive, which is explored in the next article in this series.

Data presented in this article is from Kagan's September 2022 business-to-business global 5G survey. A total of 82 carrier decision-makers that are well versed in 5G deployment plans were queried online or by phone. Of the respondents, 10 operators were from North America, 28 were from Europe, 11 were from the Middle East/Africa, 14 were from Latin America, and 19 were from Asia-Pacific.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research