Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 10, 2018

By Stuart Nield

Despite being introduced over six years ago, there is still no market consensus on how to calculate the Funding Valuation Adjustment or FVA. One bone of contention is whether to use the same funding curve for borrowing and lending (symmetric funding) or to use different curves to reflect the real bid/offer that banks incur in the market (asymmetric funding). In this article, we'll review the difference between the two approaches, discuss the technical challenges involved and give some compelling evidence as to why banks should make the switch to asymmetric funding sooner rather than later.

FVA Calculation

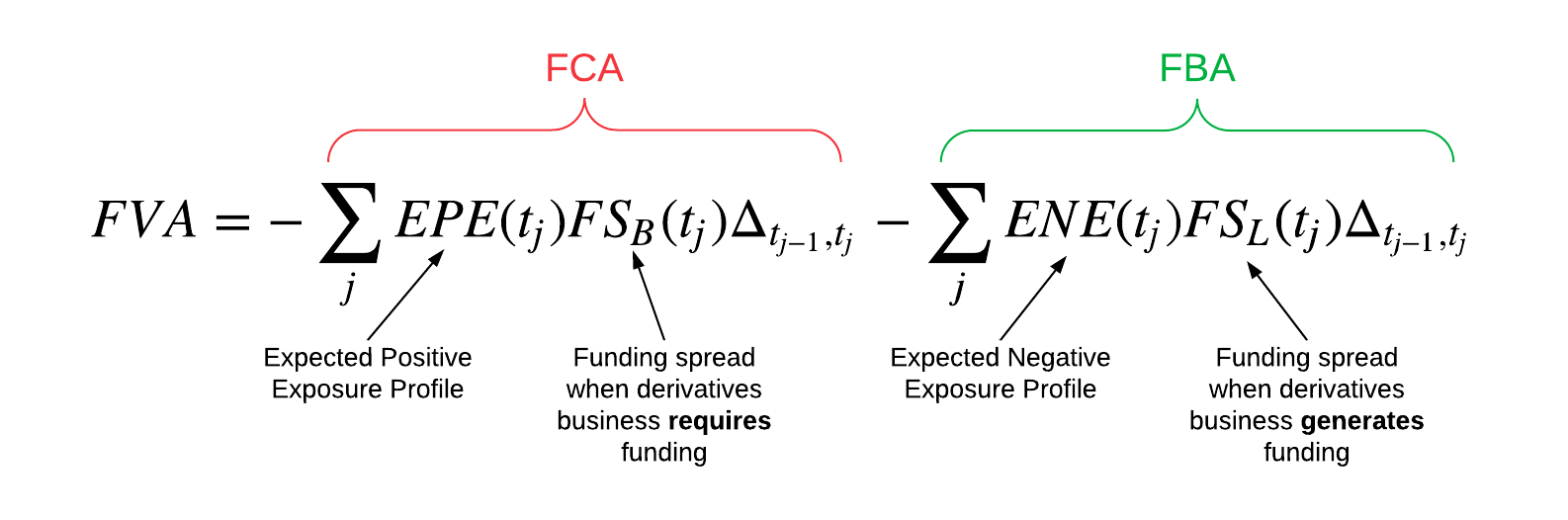

FVA can be broken down into two components: the funding cost adjustment (FCA), arising when the derivatives business requires funding, and the funding benefit adjustment (FBA), arising when the derivatives business generates funding. These two components use banks' lending and borrowing spreads respectively as shown in the formula below (where the survival probability has been omitted for simplicity):

One key property of this formula is that it is performed across the entire derivative portfolio - cash received for derivatives funding can be rehypothecated across all trades. The two funding spreads used for calculating FCA and FBA are typically set by the bank's internal treasury.

Technical Challenges

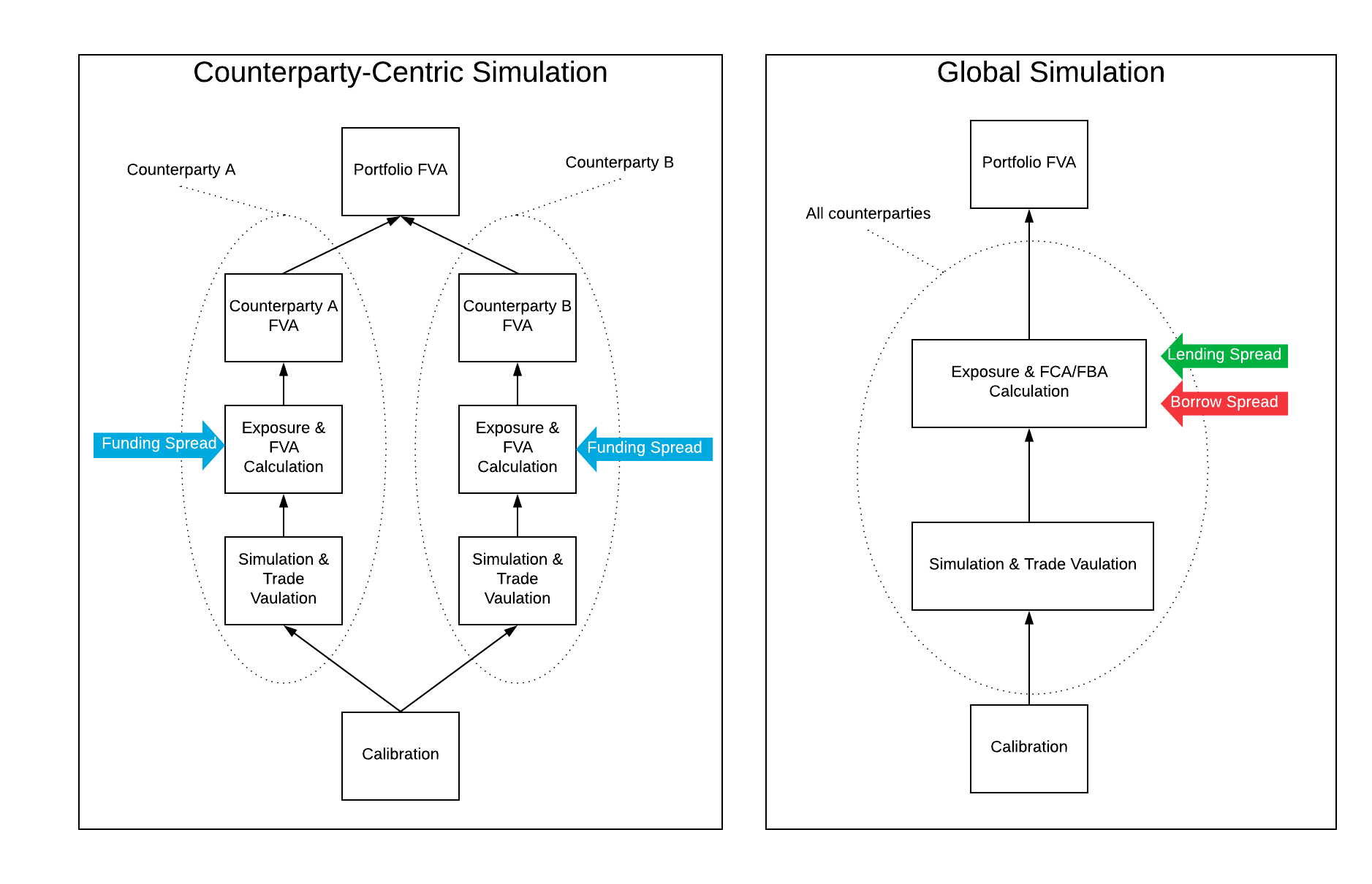

Determining the EPE and ENE across the entire derivative portfolio calls for a global simulation of all the trades in a bank's portfolio. This can prove difficult for legacy systems that were designed at the beginning of the xVA journey as the early VAs (CVA, DVA) were built on counterparty centric simulation workflow. The difference between the global simulation approach (required for asymmetric FVA) and the counterparty centric simulation approach is illustrated below.

In counterparty centric simulation, each counterparty is treated separately - only those risk factors in each counterparty's portfolio are simulated. This technique keeps the simulated data relatively small as only the relevant assets are simulated reducing the memory requirements. However, this simplicity comes at a cost: the random numbers used across counterparties will be different giving inconsistent scenarios across the entire portfolio. This means that trade valuations on a per path basis cannot be added across all derivatives - something that is required to calculate asymmetric FVA.

In contrast, a global simulation simulates all risk factors in the derivative portfolio simultaneously giving scenario consistency across all trades. Trade MTM matrices can be aggregated across the entire derivative portfolio allowing EPE and ENE to be calculated at the total portfolio level. Different curves can then be used to calculate FBA and FCA as per the equation above.

Institutions using counterparty centric simulation are forced to use only symmetric funding in calculating their FVA as the counterparty level EPEs and ENEs cannot be added up to the portfolio level due to scenario inconsistency. Asymmetric FVA is beyond their reach.

Case Study

To understand the impact of switching to asymmetric funding we configured an example portfolio using our Front Office xVA Solution [1]. This xVA system is built using big data technologies [2] and can therefore perform a global simulation allowing users to calculate both symmetric and asymmetric FVA at the total portfolio level. The example portfolio contained:

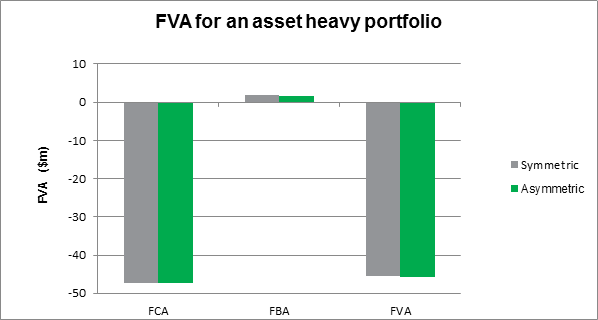

Banks typically have asset heavy portfolios (trades are deep in the money) because long dated rate receiver and inflation swaps initiated in the early 2000s increased in value as rates dropped following the 2008 credit crisis. Our example portfolio has been configured to reflect a typical bank and so it is asset heavy.

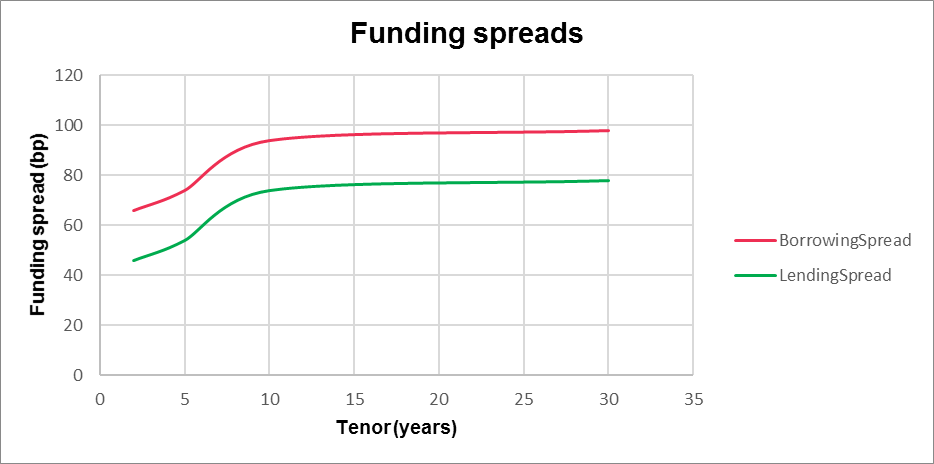

A key input to the FVA calculation is the level of the funding curve, which is not directly observable in the market. However, we were able to infer a typical funding level from contributions to our Totem xVA service [3]. This curve is shown as the borrowing spread in the chart below:

To generate a lending spread curve, we assumed a 20bp spread to the borrowing spread as shown in the chart above.

Running the FVA calculation yields the following results for the total derivative portfolio. For symmetric funding, we have used the same curve (the borrow curve) to compute FVA, but for asymmetric funding, we used the two curves.

As you can see above, there is only a ~1% difference between symmetric and asymmetric funding for our asset heavy portfolio. This result stems from the fact that the FCA (which uses the borrow spread) dominates over the FBA (which uses the lending spread) meaning that their sum (the FVA) is mostly FCA.

But what happens as our portfolio becomes more balanced? This is an important question as banks have recently been making their derivative portfolios more balanced by trying to terminate, novate or restructure long-dated, deep in-the-money trades to reduce capital usage. There are several examples of dealers setting up non-core units to wind down capital intensive trades [4]. In addition, recent increases in interest rates have made receiver swaps less in-the-money for banks.

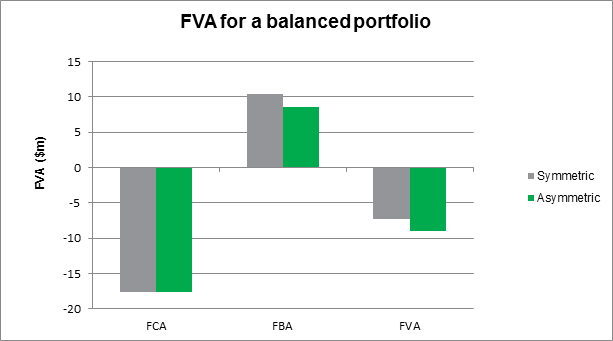

To answer this question, we rebalanced our example portfolio by re-striking long-dated in-the-money interest rate swaps. Recalculating the FVA gives a different picture:

The FBA term is no longer insignificant compared to the FCA term so the difference in FBA arising from symmetric/asymmetric funding is pronounced and translates into a ~20% difference in FVA.

With the industry likely to adopt asymmetric FVA in the future, banks are faced with a dilemma: do they switch now while they're asset heavy and take a small write-down or wait until industry adoption is clear but face a large write-down on a more balanced portfolio?

Parallels could be drawn to the usage of credit spread in the calculation of CVA - whether to use historical or market implied. In this case, the banks who were at the back of the pack took painful losses [5]. It will be interesting to see whether history repeats itself for FVA.

[1] https://ihsmarkit.com/products/front-office-xva-solution.html

[3] https://ihsmarkit.com/products/totem.html

[4] https://www.ft.com/content/61480b4e-e285-11e3-89fd-00144feabdc0

[5] https://www.risk.net/derivatives/2450880/traders-shocked-712m-cva-loss-stanchart

Posted 10 September 2018 by Stuart Nield, Global Head of Product, Financial Risk Analytics, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.