Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 26, 2023

The much anticipated "new normal" finally arrived at US freight docks in 2023, and its defining characteristic was lower freight demand.

Lower consumer demand for imports and domestic goods reshaped international and US freight markets last year. Although the US economy expanded, with unemployment at historic lows, the economy defined by the shipment of goods began to contract in late 2022 and is still in recession today.

There are few signs of a catalyst in 2024 that would sharpen consumer appetite for the goods that typically fill ocean containers, airplane bellies, railcars and intermodal containers or trucks. US manufacturing remains sluggish, too, vacillating between expansion and contraction.

Sequential improvements in imports, solid if not spectacular growth in holiday sales, and ongoing inventory destocking has led some analysts to argue that freight demand will pick up in the first half of the year, possibly after the Lunar New Year holiday in February. But other experts believe demand will only increase gradually over the course of this year, with greater growth starting closer to mid-2024 or even 2025, barring unforeseen events.

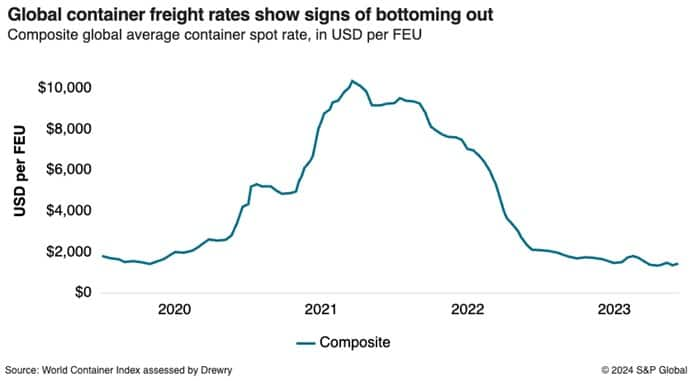

As the season for annual contract negotiations begins, shippers are enjoying a dramatic transportation price correction, as ocean, air and landside transportation spot rates all spiral down from the heights of 2021 and 2022 to bottoms close to 2018 or 2019 pricing levels.

Transportation pricing is still stuck in those troughs, and without an appreciable increase in demand it may take most of 2024, if not longer, for rates to get much higher. Overcapacity in several transportation modes is keeping a lid on pricing — and overcapacity is proving stubborn.

That indicates US shippers will have a longer runway to recover from the supply chain disruption and rocketing costs of 2020-2022, as pricing power in most modes remains in their hands.

There may not be a catalyst for faster growth on the horizon, but there are signs that US freight demand is resetting — or "normalizing" — at new, albeit lower, levels. That means markets from ocean shipping and air freight to trucking, intermodal rail and parcel and package delivery are rebalancing, rather than rebounding.

"We're going through freight market moderation, just as we're seeing moderation in the US economy," said Jason Miller, associate professor of logistics at Michigan State University.

"That takes people by surprise because it's been a wild ride since 2017," said Miller, who is also a Journal of Commerce contributor. "They're waiting for the next shoe to drop, and they expect more volatility."

They will likely be disappointed, he said. Without a housing or commodity boom, or a surge in consumer spending, "I don't see a scenario with a very robust demand curve taking place," said Miller.

Within the US, "the whole freight pie has shrunk back to 2018, 2019 levels," said Dean Croke, principal analyst at DAT Freight & Analytics. "It's a massive realignment that everybody is struggling with. It's really hard to read the tea leaves because there are so many mixed signals."

The market did see some incredible spikes in 2022 followed by big drops in 2023, especially in ocean volume.

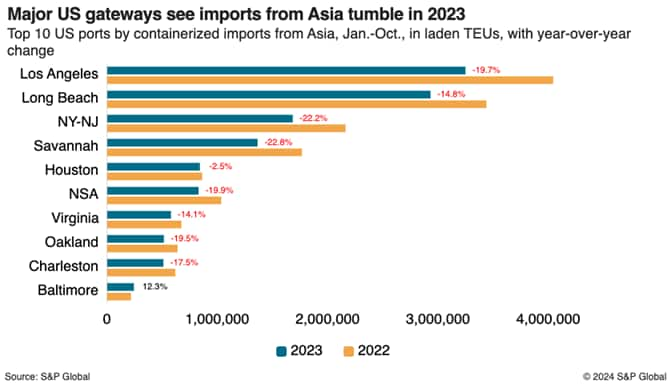

Total US containerized trade dropped 27.4% from September 2022 through last February, according to data from PIERS, a sister product of the Journal of Commerce within S&P Global. That decline was a reaction to the big wave of advance imports in early 2022 as cargo owners sought to avoid port labor disruptions and stockouts.

The 2022 import surge not only swamped warehouses and wrecked inventory plans, but it also skewed the trade picture in 2023, with year-over-year declines continuing even as ocean imports rose on a monthly sequential basis beginning in April, according to PIERS.

The year-over-year scale swung in the fall, as TEU imports in September drew even with a year ago, and then rose year over year in October and November, according to the National Retail Federation/Hackett Associates Global Port Tracker (GPT).

The GPT expects TEU imports in December to total 1.93 million TEUs, up 11.5% year over year. For the full year 2023, it forecasts TEU imports will drop 12.6%, the second year of decline.

US containerized exports also rose gradually last summer on a sequential monthly basis, turning positive year over year in September, according to PIERS. Still, those exports were below pre-pandemic September 2019 levels.

At 3.09 million TEUs, total US containerized trade was up 18% in September from its nadir in March 2023, although still 14.4% below its previous high of 3.61 million TEUs in May 2022, the PIERS data showed.

In another sign that containerized trade was rebalancing or normalizing heading into 2024, the GPT expects monthly year-over-year volume growth to continue in early 2024, with January forecast at 1.93 million TEUs, up 6.6% from a year ago.

Containerized imports in February — typically the slowest month because of Lunar New Year factory shutdowns in Asia — are forecast at 1.77 million TEUs, a 14.5% year-over-year increase. March is forecast at 1.75 million TEUs, up 7.7% year over year, and April at 1.8 million TEUs, a 1% gain.

At first glance, that forecast seems to reflect swelling demand. But these annualized increases follow the deep declines of the prior year, after the imports were pulled forward in late 2021 and early 2022. That suggests the increases represent rebalancing.

But rebalancing does not mean a return to higher freight rates. Pricing remains depressed across transportation modes, and except for the US LTL trucking market, does not appear poised for growth.

Ocean container spot rates from North Asia to the US West Coast hit $9,500 per TEU in early 2021 but were down to about $1,600 per TEU in November, according to Platts, a sister company of the Journal of Commerce within S&P Global.

The Drewry World Container Shipping Index, based on several route-specific indices, plunged 78% from a peak average rate of $10,375 per TEU in September 2021 to $2,120 per TEU by the end of 2022. The index continued to fall, albeit more gradually, last year, dropping 39.5% year over year by Nov. 27 to an average rate of $1,382 per TEU. That is lower than the Drewry index's pandemic nadir of $1,486 per TEU on March 2, 2020.

Ocean carriers see continuing weak demand and overcapacity on the horizon. Drewry has estimated that combined ocean spot and contract rates will fall 33% in 2024 after a 60% drop in 2023.

"Container demand is expected to be under downward pressure with no encouraging sign of restoring desire for consumption," South Korean carrier HMM noted in its third-quarter results.

Business is not better in the air. As of Nov. 20, the global air cargo rates measured by the Baltic Air Freight Indices were down 54.7% from their pandemic high point in December 2021, and down 17% year over year.

The global air cargo index, which reflects air cargo rates from London, Frankfurt, Hong Kong, Chicago, Shanghai and Singapore to 17 destinations, was up 27.5% from its Aug. 28 nadir. That increase was not based on demand, but constrained capacity due to temporary weather disruptions.

Air freight demand remains down 8% from pre-pandemic levels and is only predicted to grow by 1% to 2% in 2024, according to ocean and air freight rate benchmarking platform Xeneta. At the same time, Xeneta expects air cargo capacity to increase 2% to 4% in 2024.

On the ground, US truckload rates have been in a year-long slump, with the long-distance US truckload producer price index (PPI) dropping 30% from May 2022 through August 2023. The PPI, which measures "selling prices," including base rates and any other charges paid by shippers, rose 4.4% through October.

Rising fuel prices likely accounted for most of that increase. Truckload spot rates ended November lower than October, according to a Journal of Commerce analysis of data from Cargo Chief, DAT Freight & Analytics and digital broker Loadsmart, as well as a survey of logistics providers.

The Journal of Commerce shipper-paid rates have fluctuated within a 5-cent range since July 4.

DAT's national average dry-van contract rate was down 15.7% year over year in December, at $1.99 per mile, excluding fuel surcharges, and were nearly 20% higher than the comparable average spot rate. DAT's Croke said the truckload market in November 2023 looked more like that of 2019.

"Tender acceptance rates remain very high, so that's why we're seeing lower spot market volume," he said. Croke expected truckload spot rates to rise in December, but to still end 2023 lower year over year.

As truckload rates stabilized and turned upward, ever so slightly, last summer, so did intermodal rail pricing. Spot intermodal rates rose to $1.75 per mile on average nationally in September from $1.71 in June. Contract intermodal rates increased to $1.64 per mile from $1.55 over the same period.

Without more inbound freight, however, there is little impetus for a bigger jump in pricing, on the rail or highway.

The glaring exception last year was the LTL market. Following the collapse of Yellow, formerly the third-largest US LTL provider, in July, LTL pricing shot upward as shippers shifted freight from the failed company to new carriers. The US LTL PPI rose 5.9% from July through October.

The increase was partly due to rate increases as lower-priced freight migrated to higher-priced carriers, and partly to fuel surcharges. But the shift was a market rebalancing, rather than a real rebound.

LTL rates are likely to rise by single-digit percentages in early 2024, but once the market has reset at its new post-Yellow level, there is little new freight entering that would keep up pressure.

Although cargo growth forecasts have been cautious, ongoing US inventory reductions are generating optimism in some quarters for more solid demand in the second half or even first half of 2024.

"Next year could be a really good year. I'm super bullish," Weston LaBar, head of strategy at Cargomatic, which offers drayage, intermodal and less-than-truckload solutions, told the Journal of Commerce.

"Everyone we have spoken to has finally gotten their excess inventory down, so potentially there could be a surge of imports," said David Bennett, chief commercial officer at Farrow, a Canadian freight forwarder and customs broker recently acquired by Kuehne+Nagel Group.

However, such optimism depends on US consumers opening their wallets wider and buying more goods. "Inventories are being right-sized, (but) that doesn't mean we're going back to ordering," Miller said.

Retailers such as Gap and Target cited double-digit year-over-year reductions in inventories in the third quarter and said they had improved inventory discipline. Goods are flowing faster through distribution channels — a sign of inventory reduction, but also reduced demand.

"We're benefiting from a more than two-week reduction of import lead times compared with last year and a nearly 10 percentage point improvement in purchase order fill rates," John Mulligan, executive vice president and COO at Target, said in mid-November.

But destocking in 2023 was not uniform across multiple retail, wholesale and manufacturing sectors, MSU's Miller said. For furniture wholesalers, inventory-to-sales ratios are back to normal, but for apparel wholesalers, inventories are still elevated, he said, noting, "It's way too early to say we're all good, everything is back to normal."

The key, as always, is the US consumer. Americans are still spending, but not like in 2021 or 2022. Inflation has taken its toll as COVID-relief stimulus dries up, student loan payments restart, credit card debt mounts and concerns about layoffs rise even in a tight labor market.

The delinquency rate on credit card loans rose to 2.98% in the 2023 third quarter, compared with 2.08% in the same period in 2022 and 1.55% in the 2021 third quarter.

Stronger consumer confidence and a return to purchasing goods such as apparel and appliances would help tip the freight market toward a rebound, but a consumer-driven recovery in demand still seems unlikely in the near term. An important factor will be how the Federal Reserve handles interest rates in 2024, Miller said.

A decrease in interest rates would lead to an uptick in single-family home construction, boosting freight volumes domestically and generating increased demand for containerized imports, Miller said. Without lower interest rates, he expects demand to stay soft in the first half.

Higher interest rates also dampen enthusiasm for inventory replenishment, Croke said. Businesses are more cautious about building inventory when interest rates are high because purchases are often made on credit, which is tied to the prime rate, the interest rate commercial banks charge creditworthy customers.

"We've got a lot of inventory sitting in warehouses and shippers reluctant to aggressively order more because of high interest rates," Croke said. "Lower interest rates are the key to consumers feeling better about buying stuff, for shippers to stock up on inventory and manufacturing investments to return."

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?