S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 21, 2024

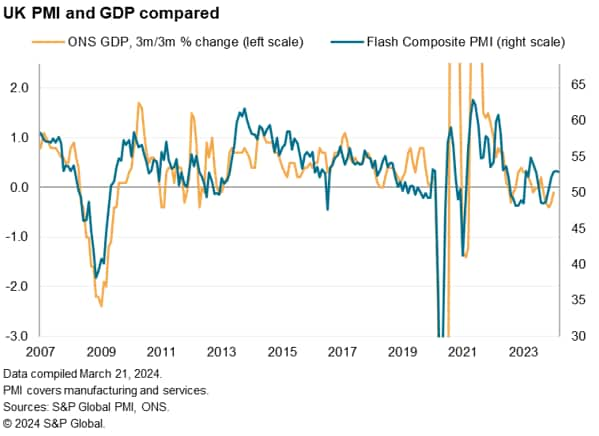

Further signs of the UK economy having pulled out of last year's brief recession are provided by the provisional PMI data for March. A further robust expansion of business activity ended the economy's best quarter since the second quarter of last year. The survey data are indicative of first quarter GDP rising 0.25% to thereby signal a reassuringly solid rebound from the technical recession seen in the second half of 2023.

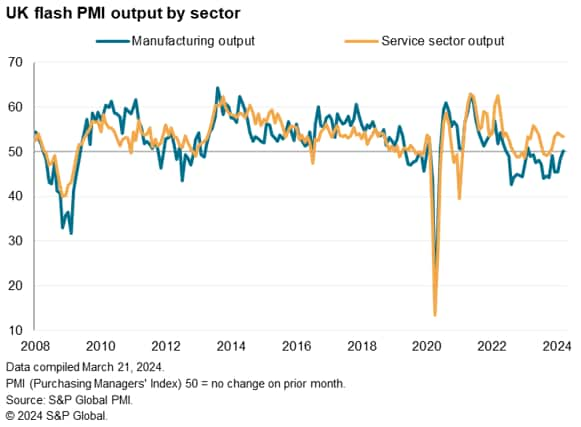

It is also encouraging to see a more broad-based expansion, with a sustained increase in service sector activity accompanied in March by signs of a tentative return to growth for manufacturing output. Business expectations for the year ahead also remain reassuringly lofty by recent standards.

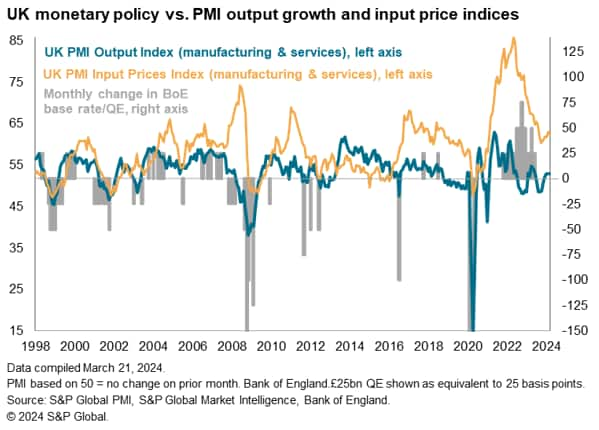

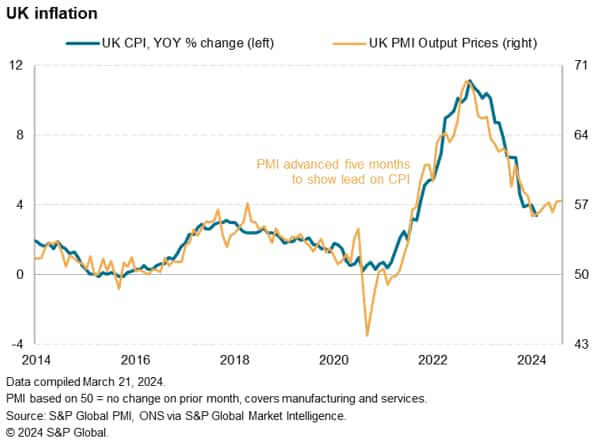

However, while recession worries have abated, inflation remains a concern. Stubbornly sticky service sector inflation has persisted into March, exacerbated by renewed inflation in the manufacturing sector. While the headline rate of inflation looks likely to cool in the months ahead, March's PMI warns of elevated underlying price pressures which will likely add to calls for restraint in any pivot to lower interest rates until there are firm signs of lower wage growth.

Business activity grew at a solid pace again in March, the PMI surveys signaling a fifth consecutive monthly expansion. The headline economic growth indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK Composite Output Index, registered 52.9 in March, down only marginally from 53.0 in February and rounding off the best quarter of growth since the second quarter of last year.

The sustained robust pace of expansion is indicative of GDP growing 0.25% in the first quarter, which would mark an end to the brief technical recession seen in the second half of last year.

The upturn was again driven by the service sector, where output rose for a fifth month in a row. Although the pace of expansion slowed to the weakest for three months, the rate of increase remained robust and only modestly below the pre-pandemic ten-year average.

Beside the strong-growing tech/IT service sector, especially robust output gains were seen in the financial services sector, with more muted - but sustained - growth seen for business services. Besides a lift in activity at hotels and restaurants, broader demand for consumer services continued to fall, as did demand for travel and transport.

March also brought encouraging news of a marginal return to growth of manufacturing output, which had contracted over the prior 12 months, amid improved demand conditions. New orders placed at factories rose for the first time since last March. Although only marginal, the rise in demand signaled was the largest for 22 months, albeit with export orders continuing to decline.

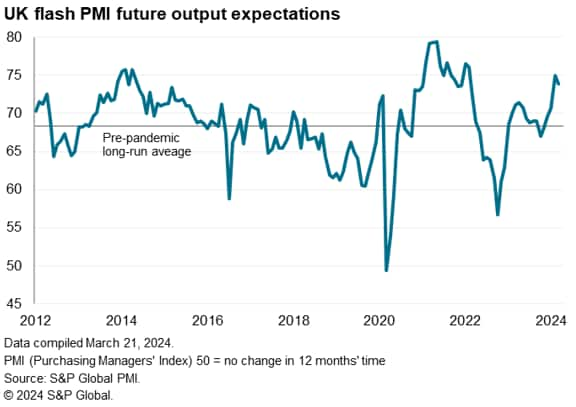

The sustained business growth in March was accompanied by continued optimism about the 12-month outlook. Business expectations about the year ahead dipped slightly from February's two-year high but remained well above the survey's long-run average.

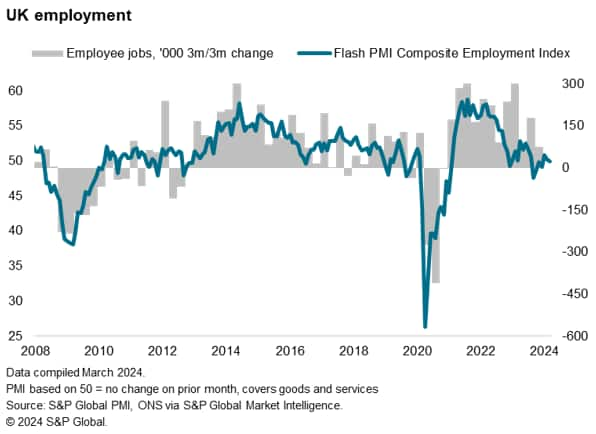

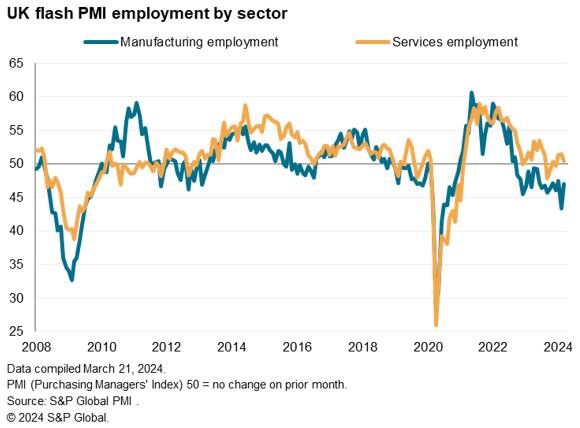

These elevated output expectations failed to drive net job creation in March, however, with the survey's overall flash employment index dropping to the 50.0 neutral level. Further manufacturing job losses (albeit at a reduced rate compared to February) were accompanied by a near-stalling of service sector employment.

The stalled job picture combined with resilient current output growth and elevated future output expectations at least in part reflected job creation being restricted by labour supply problems. The tightness of the labour market, and the associated need to offer higher wages amid the recent rise in inflation, was in turn commonly cited as a key driver of higher costs at companies.

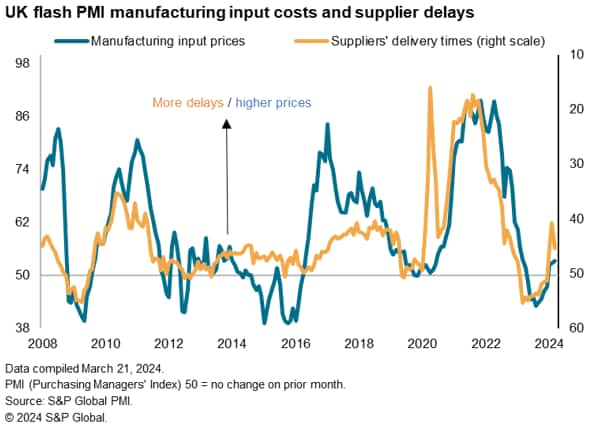

In manufacturing, an additional cost driver was renewed raw material supply shortages. March saw average supplier delivery times lengthen for a third successive month, with delays commonly linked to Red Sea-related shipping disruptions. Longer lead-times tend to be associated with higher prices as a reflection of demand exceeding near-term supply, though the need to re-route ships around Africa has also directly raised shipping costs so far this year.

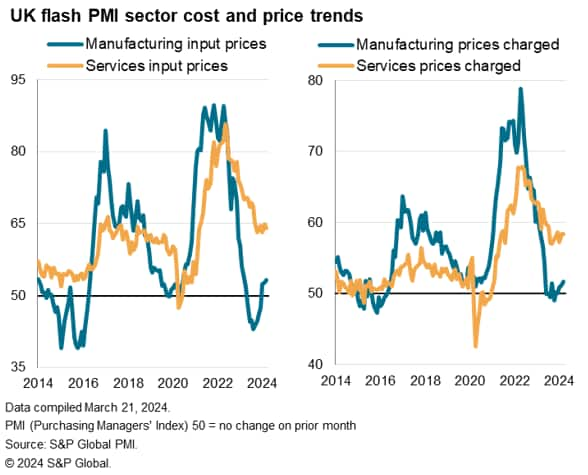

The combination of wage inflation and higher raw material prices, the latter also linked to increased fuel prices during the month, caused overall input cost inflation across manufacturing and services to remain elevated in March. Although the rate of increase eased slightly, it continued to run well above the average seen in the decade preceding the pandemic.

While service sector input cost inflation cooled slightly, it remained well above its pre-pandemic average, and manufacturing input costs rose for a third straight month, the rate of inflation lifting to its highest for a year.

Higher costs were again passed on to customers in the form of increased selling prices, which rose at an elevated pace in services and showed renewed growth in manufacturing, though still at a low level. The resulting combined increase in selling prices for goods and services edged up to its highest since last July.

The PMI surveys indicate that the rate of selling price inflation bottomed-out last August, and has since remained somewhat range-bound at an elevated level indicative of consumer price inflation running at an annual rate of approximately 4%, the rate nudging slightly higher in March. While favourable base effects and lower energy prices in particular mean the Bank of England's 2% target for headline inflation may well be reached in the coming months, the survey data warn that underlying price pressures, especially in the service sector, will create problems in sustaining such low inflation.

It is hoped that lower headline inflation will lead to lower negotiated wage growth, helping reduce domestically generated services inflation. The PMI's services price gauges will therefore be especially important inflation barometers to assess in the months ahead.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location