Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 23, 2025

By Conner Forrest and McKayla Wooldridge

There have been several developments in the financial technology sector in the past few years that have reshaped how employees leverage their personal and corporate finances. Earned wage access allows workers to draw against wages they have already earned in a pay cycle, while updates to corporate card programs and spending management have helped operationalize finances in new ways that affect procurement, contracting and more. The impact of these changes has been swift and strong, but we believe there are opportunities for the vendors in these areas to continue innovating.

Innovations in financial tools and technologies are impacting the employee experience for wages, with software for earned wage access (EWA), and outgoing capital, with updates across corporate cards and spending management. However, the initial effects of these changes are just a signpost for continuing evolution in the market. We see EWA providers setting the stage for partnership with — or acquisition by — larger payroll specialists, or evolving into broader financial wellness platforms or frontline worker tools.

At the same time, data from disconnected spending tools is leading to the genesis of all-in-one spending management systems that could upend financial planning and corporate performance management, while digital corporate card initiatives enhance the security and usability of those cards while adding visibility for managers with real-time reconciliation. Financial software and fintech enhancements are creating a unique inflection point at which employee experience meets business value.

Context

Finance has always played a role in both HR and the employee experience — people have to get paid for their work. Recently, the role that finance plays has gone beyond simply releasing payroll twice a month. Changes in wage access, total rewards and even spending management technology have more closely tied finance to the employee experience.

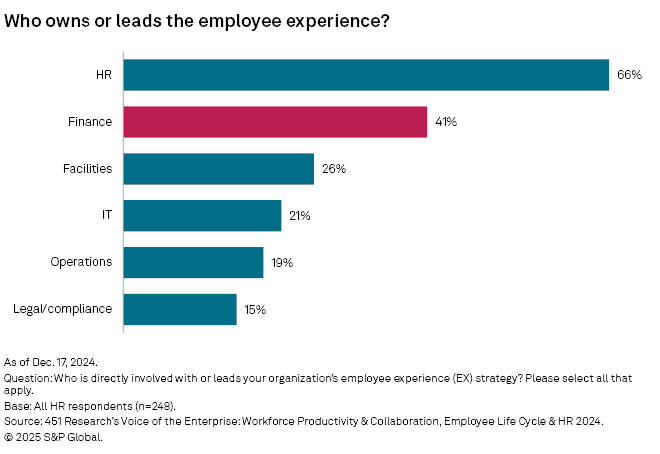

When asked who is directly involved with or leads their organization's employee experience strategy, HR respondents to S&P Global Market Intelligence 451 Research's Voice of the Enterprise: Workforce Productivity & Collaboration, Employee Life Cycle & HR 2024 survey cited finance as second only to HR, and far ahead of other departments.

Beyond this, finance is the second-highest collaborator with human resources (27%), sitting just under facilities (29%), according to that same data. As these advances continue to proliferate, finance's role in the employee experience of money will expand.

Where EWA can go from here

For the uninitiated, EWA is a salary or wage advance system that lets employees who are paid on a traditional monthly or bimonthly batch payroll cycle access the wages they have earned ahead of time. The employee often puts in a request and is paid within a few days for free, or they can pay a fee for instant transfer of the funds. With EWA, there is typically no cost to the employer, either, and the vendor (with a banking partner) funds the advance and backpays themselves after payroll has processed, so the organization's payroll does not have to give up the structure and planning benefits of its monthly or bimonthly cycle.

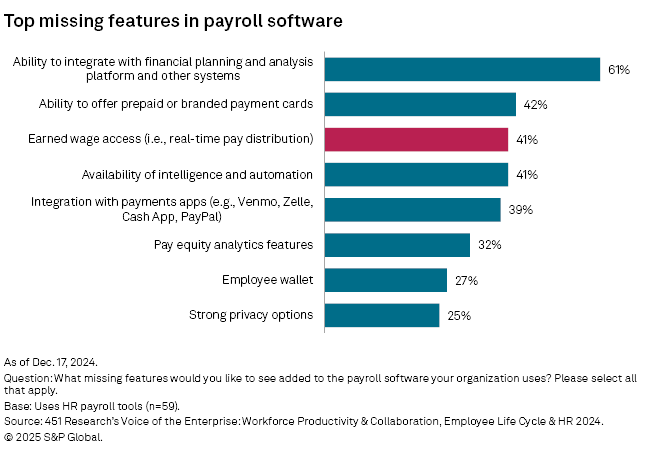

EWA providers typically earn revenue on the instant access fees. Faster access to earned wages serves as an alternative to payday loans, which are short-term loans that can yield high rates and fees. According to the survey cited above, EWA has emerged as a missing feature that many HR buyers want to see in their payroll software.

Numerous specialists have emerged to facilitate earned wage access for employers and employees, including DailyPay Inc., Clair Inc., Tapcheck Inc., Instant Financial Inc., Rain Technologies Inc., PayActiv Inc., ZayZoon Inc., Chime Financial Inc., Branch Messenger Inc. and OrbisPay. Larger incumbent payroll players are getting into the EWA market as well and could become a threat to the startups in the space — or a possible acquirer. For example, Automatic Data Processing, Inc.'s purchase of Global Cash Card Inc. laid the foundation for its Wisely Pay product, which includes both EWA options and a payment card.

While the novelty of EWA is far from wearing off, its eventual direction of travel could see it end up as a table-stakes feature of payroll, not a stand-alone product. Of course, this is good news for startups looking to be acquired, or to form a partnership — payroll specialist Gusto Inc. has already inked a deal to offer Clair as an embedded feature of its Gusto Wallet offering — but not all vendors will have the same outcome. The question then becomes, where can EWA go from here?

One option is to build an ecosystem of financial wellness insights. DailyPay has begun moving in this direction with its new gamified savings features, financial wellness data and credit health tools for consumers. Tapcheck also offers financial tools and wellness programs for users. This sets up EWA providers to position themselves as acquisition targets for employee experience platforms as well, which often have a wellness component.

A second option for EWA is to offer a workforce hub for frontline workers. The technology is especially popular among frontline workers with the promise of daily — or more frequent — pay for the hours worked. And being that these employees often don't have a corporate email, an EWA application could be a good option for reaching employees in a channel they like to interact with frequently.

Branch, for example, allows employees deploying its EWA tool to pick up shifts more easily when needed. DailyPay also integrates with a host of time and attendance vendors and could build a partnership that supports a mobile workforce communications hub centered on an EWA application. In the future, mobile recruiting vendors such as Harri (US) LLC and TalentReef Inc., as well as learning specialists such as Arist Holdings Inc. or frontline digital adoption providers such as Skyllful Inc., could integrate specifically to make a core suite of HR tools for frontline workers.

The biggest opportunity for earned wage access, in our opinion, is usage data being plugged into benefits and total reward systems to inform an organization's strategy. In many cases, EWA vendors already collect data on what employees are spending their advanced wages on — gas for their car, to pay a cell phone bill, or otherwise. This data could be employed to optimize employee benefits.

For example, if 75% of employees are advancing their wages to pay their cell phone bill, perhaps the organization should consider subsidizing cell phone plans if possible. Workday Inc.'s new Wellness product features AI-powered analysis of the most in-demand benefits to help employers better tailor their programs, and could possibly leverage data from an EWA provider to understand what voluntary benefits would be most impactful.

Why spending management matters

When many people consider spend management, their first thought is expense reports. And while that is a core element of spending, the technology is composed of a wider swath of processes that include bill pay, accounts payable, procurement and corporate cards. Essentially, nearly anything that involves employees spending money is managed here.

The challenge is that business spending (e.g., payroll, travel and expenses, accounts payable) lives in different systems, is often managed by different teams and is subject to different operational processes. Integrating data from a variety of sources (42%) is the number one challenge that businesses face with their commercial payments data, according to a 2024 commercial payments survey from 451 Research and Discover Global Network.

And just as HR is taking a deeper interest in how employees acquire money through wages, they are also more closely working with how employees spend corporate dollars. Vendors are taking note of this, as we saw when human capital management specialist Paylocity Holding Corp. acquired spend management software Airbase Inc. in September for $325 million.

Overall, spend management is becoming more integrated, with providers that once focused on expense management delving into adjacent areas such as accounts payable, procurement and even payroll to create an "all in one" spend management platform. This is driving M&A activity as companies look to purchase vendors to build a one-stop procure-to-pay offering, which we discussed in a previous report.

A more integrated spend management platform can help businesses gain greater insight into their overall spending, make payments and reimbursements more quickly and efficiently, and enhance cash flow. This has implications for how organizations' financial planning and analysis, budget design, and scenario modeling are addressed as they will be able to more effectively understand the impact that each minute change has on spending.

We could see these new all-in-one spend management vendors begin to build out templated reports for spend management data with the ability to model the impact of changes at each step in the process. This, of course, could also make them an attractive acquisition target for larger financial planning and analysis and corporate performance management providers.

How corporate card data might impact professional spending

Employees are becoming more digitally demanding, expecting the same convenient purchasing options that they are accustomed to in their personal lives. A mobile application (40%), 24/7 support (39%), tap-to-pay functionality (34%) and the ability to load a card into a digital wallet (32%) are the top corporate card features that consumers who use a corporate card say is important to them, according to our VoCUL: Connected Customer, Quantifying the Customer Experience 2024 report.

Offering digital corporate card capabilities extends beyond just providing a convenient experience for employees — it can directly impact visibility into corporate expenses and prevent overspending. Giving employees more visibility and control over approved spend categories, streamlining receipt uploads, automating expense reports, and simplifying reimbursements are a few ways that companies can leverage spend management software and technology such as AI to better manage their spending.

Our research indicates that roughly one-third of employees surveyed say they are never, rarely or only sometimes on time submitting their expense reports, according to the VoCUL survey cited above. This can affect cash flow and mask visibility into expenses. We envision a future where expense reports will be replaced entirely with real-time reconciliation, and the industry is already moving in this direction.

Further, providers are beginning to offer push-to-wallet to enable employees to use virtual cards via a digital wallet. Visa Inc., for example, announced its push-to-wallet capability for virtual cards in October 2024. Not only does this satisfy employee demand for digital wallet compatibility, it also enables businesses to monitor transactions more closely and set spending limits. Because virtual cards can be instantly provisioned for a particular expense, and their credentials expire after the purchase is complete, they are more secure than physical cards and give businesses greater control over spending.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

Location

Products & Offerings

Segment