Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Mar 01, 2024

By Matt Chessum

On February 14th 2024, Cummins Inc (CMI) announced it would commence an exchange offer to split off its remaining interest in Atmus Filtration Technologies Inc (ATMU). In May 2023, 19.5% of Atmus shares were sold via an initial public offering, with Cummins Inc retaining 80.5% of Atmus' common stock.

According to the Cummins investor website[1], "the exchange offer is expected to permit Cummins shareholders to exchange all or a portion of their shares of Cummins common stock for shares of Atmus common stock at a 7% discount".

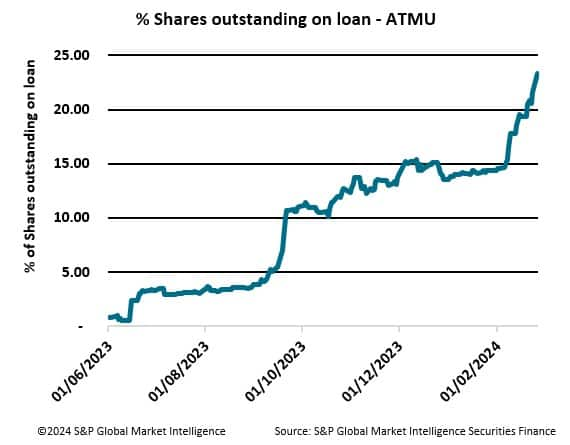

Since this announcement, borrowing activity has increased significantly in ATMU stock, reaching 23% of outstanding shares. The discount permitted by the exchange offer produces an arbitrage opportunity for investors.

investors ability to participate in this opportunity.

For more information on how to access this data set, please contact the sales team at:

h-ihsm-global-equitysalesspecialists@spglobal.com

[1] Cummins Launches Exchange Offer for Separation of Atmus Filtration Technologies Inc. :: Cummins Inc. (CMI)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.