S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 21, 2024

Business activity in the euro area came close to stabilising in March, as provisional PMI® survey data registered only a marginal decline in output of goods and services. A modest recovery of service sector output gained momentum, accompanied by a softening in the rate of manufacturing output decline. However, ongoing falls in output in France and Germany offset a gathering upturn in the rest of the eurozone to point to an uneven economic picture.

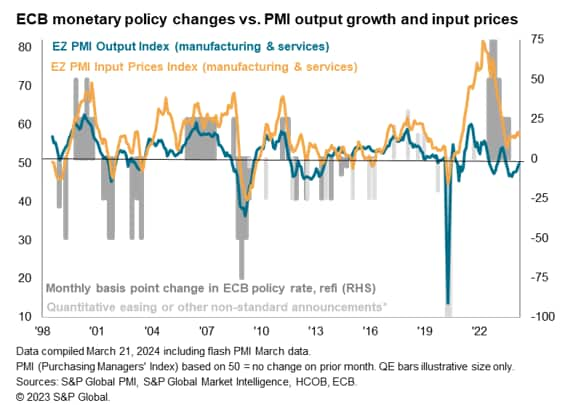

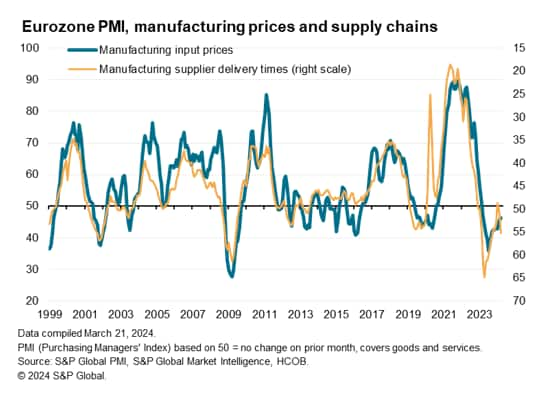

Encouragingly, order books fell at a reduced rate and business confidence about the year ahead improved to a 13-month high. Supplier delivery times at goods producers also continued to improve after the initial Red Sea related delays seen at the start of the year, facilitating a further fall in manufacturing input prices. Service sector input cost and selling price inflation rates meanwhile remained elevated by historical standards due to higher wage costs, though a cooling in the pace of increase in cost burdens was recorded to take some pressure off overall selling price inflation.

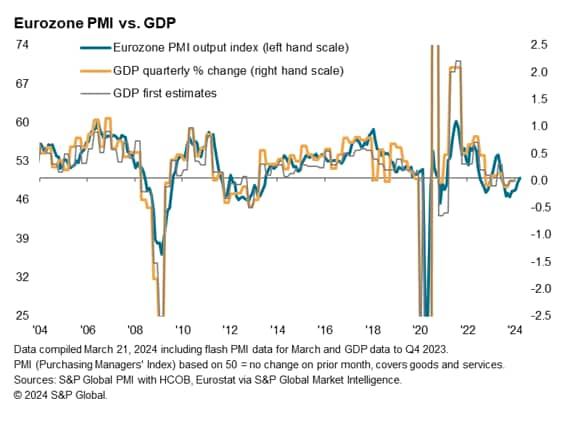

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, rose from 49.2 in February to 49.9 in March. Although signalling a tenth consecutive month of falling output, March's decline was only marginal and the smallest since last June, indicating a near-stabilisation of activity. New orders fell at the slowest rate for ten months and backlogs of work were depleted at the weakest rate for nine months.

A simple model based on historical comparisons of the composite PMI and quarterly changes in gross domestic product (GDP) indicates that the March reading of the PMI is consistent with flat GDP, with a 0.1% quarterly decline signalled for the first quarter as a whole.

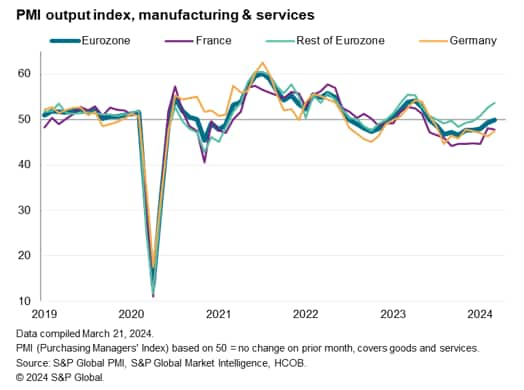

However, business conditions once again varied considerably across the eurozone, both by sector and country.

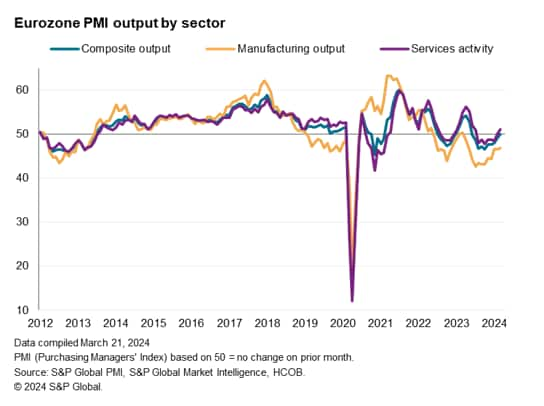

Manufacturing output fell across the eurozone for a twelfth successive month in March, with the rate of decline easing only slightly to register another month of steep contraction. New orders for goods likewise fell sharply by historical standards, though the fall was the slowest recorded over the past year after the rate of decline moderated for a fifth straight month.

In contrast, service sector business activity rose for a second month in March after six months of decline, with the pace of expansion building on the fractional rise seen in February to register the largest gain since last June. The overall pace of services expansion nevertheless remained well below the pace seen this time last year thanks to only a marginal rise in new business during the month. The rise in new work was, however, notable in being the first recorded since last June.

By country, output again fell sharply in Germany, dropping for a ninth successive month, albeit at a reduced rate as services activity came close to stabilising and the manufacturing sector's steep decline moderated slightly.

Output also contracted sharply in France, the rate of decline picking up compared to February but still showing the second-weakest fall since France's current period of contraction began in June of last year. Although services output fell at a faster rate, the pace of decrease remained weaker than seen at the start of the year, and manufacturing production fell at the slowest rate for 14 months.

The rest of the eurozone meanwhile collectively reported growth of output for a third successive month, with the rate of expansion reaching an 11-month high. A second month of marginal manufacturing output gains was accompanied by the fastest service sector growth since last May.

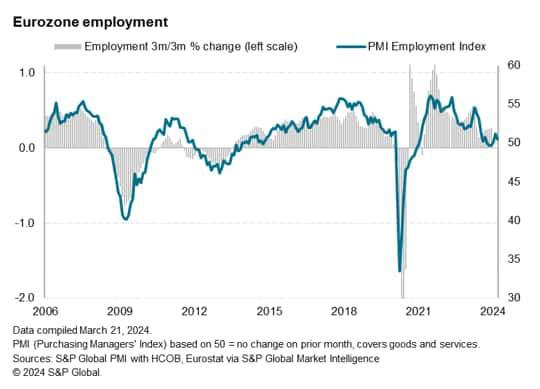

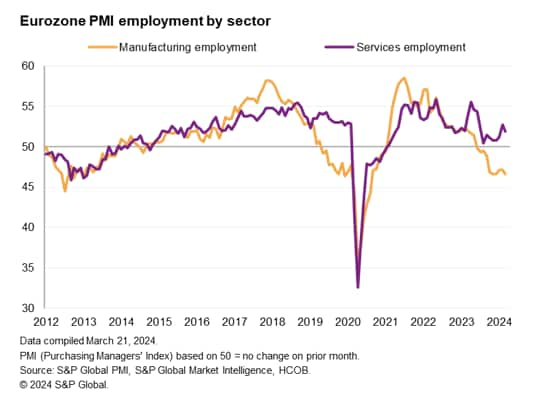

Employment increased for a third month running in March after two months of marginal declines at the end of 2023, though the rate of growth slowed to only a very modest pace.

A steepening rate of job losses in the manufacturing sector occurred alongside a softer pace of job creation in the service sector. The fall in manufacturing jobs was notable in being the joint-largest since August 2020.

By country, renewed marginal falls in headcounts were seen in both Germany and France but the rest of the region saw further services-led net job creation, albeit at a reduced rate, in part linked to labour shortages.

The ongoing plight in the manufacturing sector was further highlighted by a continued steep reduction in input buying by factories, which in turn led to the sharpest fall in inventories of inputs since December (and the second-steepest decrease since November 2012). An upside to the lower levels of input buying was less pressure on supply chains. Having lengthened in January for the first time in a year amid Red Sea related shipping disruptions, supplier delivery times shortened for a second successive month in March to indicate a further alleviation of supply chain issues.

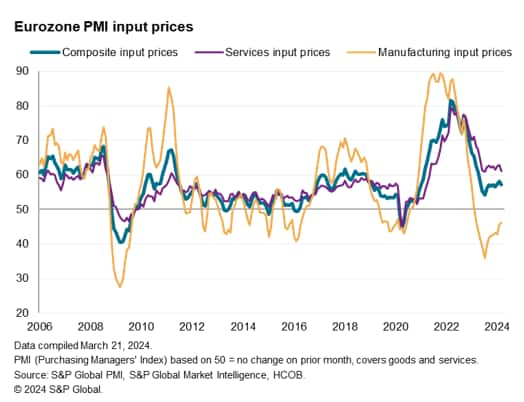

Price pressures eased during March, but remained elevated by pre-pandemic standards.

Growth of average input costs across the goods and services sectors slowed in March after having accelerated in the prior two months, with the pace of overall cost inflation down to a three-month low. Rates cooled in Germany, France and collectively across the rest of the region. Services sector costs rose at the softest pace for eight months, while factory input prices fell at the weakest rate for a year. While the continued fall in manufacturing costs helped pull overall input cost inflation closer to its pre-pandemic ten-year average, service sector inflation remained well above its pre-pandemic average despite the further easing in March, often linked to higher staffing costs.

Selling price inflation moderated in March, cooling for the first time in five months after having hit a nine-month high in February. Rates of selling price inflation slowed in France, Germany and the rest of the region combined. While manufacturers' average selling prices fell for an eleventh successive month, charges for services continued to climb at a strong pace by historical standards, albeit the rate of increase losing some momentum to show the slowest rise for four months.

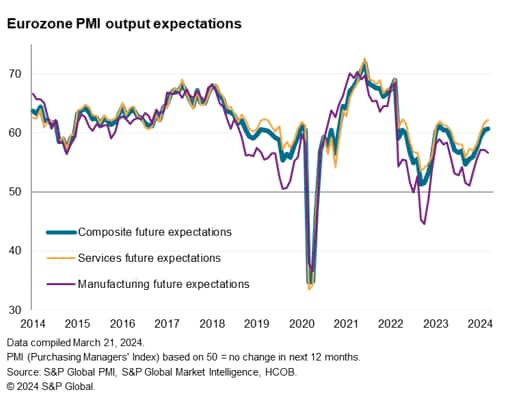

Looking ahead, business expectations about the coming 12 months improved for a sixth straight month in March, signalling the highest degree of optimism since February of last year. Confidence hit a 23-month high in the service sector, reviving further from a low-point seen last September, but slipped lower in manufacturing (albeit running higher than seen at the end of 2023). Improved sentiment in France and Germany contrasted with a pull-back in confidence in the rest of the region, though the latter continued to run relatively higher.

Recent months have seen business confidence improve largely thanks to the expectation of lower interest rates and a moderating cost of living squeeze. However, worries persist regarding elevated levels of economic uncertainty amid global geopolitical concerns and still high price levels.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location