Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 23 Aug, 2021

By Ewa Skornas

European VC and Growth Investment Set for a Record Year

European[1] VC and growth capital investment hit an all-time high in the first six months of 2021. A staggering €41.8bn was raised by European companies in the first half of the year, surpassing the record €32.6bn invested in 2020 and up from €13.3bn amassed over the same period last year (Fig 1). That’s despite the total number of closed deals being just 20% higher than in the first half of last year.

Source: S&P Global Market Intelligence. For illustrative purposes only.

Later stage funding rounds recorded the fastest growth in terms of both deal count and volume compared with 2020. The total number of later-stage rounds completed so far in 2021 was almost at par with 2020’s complete tally, while aggregate value increased twofold, from €8bn to €15.5bn. Almost 16% of this year’s capital went to just eight start-ups, each raising more than €500m. To put this figure into perspective, there were only six such rounds last year and just five in 2019. The largest financing round in 2021 was completed by the Swedish battery start-up Northvolt AB, which raised €2.25bn.[2] Other mega rounds this year included €990m raised by Sitecore Corporation A/S, based in Copenhagen and San Francisco,[3] as well as €821m secured by Celonis GmbH, an execution management software provider headquartered in Munich.[4] Amsterdam-based Mollie B.V closed a €665m funding round at the end of June,[5] while another German company, Trade Republic Bank GmbH, raised €613m in its Series C round.[6]

From a geographical perspective, U.K. gained the largest share of capital deployed to Europe throughout the first half of the year. Almost €11bn was invested into U.K.- based targets, accounting for 26% of new money funnelled into the continent, and this figure excludes a recent €680m investment into Revolut, which closed mid-July.[7] Germany and France came in second and third, representing 17% and 11% of capital, respectively. In fourth place is Sweden, which recorded its largest VC deal ever, increasing the amount of capital deployed into its VC-backed companies to €4.6bn so far this year, compared with €2.5bn total in 2020. The Netherlands rounds out the top five most-invested countries. Remarkably, Denmark, Turkey and Spain can also be counted among the regional winners of this year’s record level investment spree; each exceeded the €1bn mark in capital received through June 30, 2021.

On a sectoral basis, IT took the lion’s share of capital invested in the first six months of 2021, accounting for 33% of aggregate deal value and 42% of all completed deals. Healthcare was the second most targeted sector, representing 16.5% of aggregate capital, followed by Financials at 12%. Yet, when it comes to the total number of investments, Healthcare recorded four times as many deals as Financials, making the latter the sector with the highest average deal value across all industries in 2021. This highlights the quality and attractiveness of European fintech companies, showing that investors are happy to write large checks for the right opportunities. Perhaps not surprisingly, every other deal in the Healthcare sector involved either a healthtech or a biotech company.

U.S. VC funds flocking to Europe

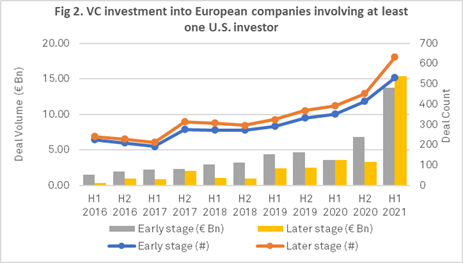

The ever-growing base of deep-pocketed U.S. VC firms investing in European start-ups fuelled the funding bonanza in the first half of 2021. The total number of VC and growth capital deals involving U.S. investors stood at 652 in the first six month of 2021, a 63% increase year-over-year and only 24% less than 2020’s tally of 866 deals (Fig 2). Even more impressive, the aggregate deal value of those deals reached almost €30bn and accounted for 72% of total capital invested into European companies, which is a whopping 313% increase year-over-year. Increasingly, U.S. investors seem to deploy capital into promising start-ups at late-stage rounds, but early-stage funding also attracted strong interest from across the pond. The total number of late-stage deals, with participation of at least one American investor, grew by 530% between H1 2016 and H1 2021, while early-stage investment more than doubled over the same period. What’s driving this interest? It could be the combination of several factors: more attractive valuation of European start-ups relative to their U.S. peers, a well-established VC landscape and an increasing number of success stories.

Source: S&P Global Market Intelligence. For illustrative purposes only.

Europe’s unicorn list expands at an accelerated rate

Following record levels of capital deployment in the first half of 2021, the number of European companies newly crowned as unicorns[8] more than tripled 2020’s total of 10. The 33 European start-ups that joined the unicorn list in the first half of 2021 amassed €6.9bn in fresh capital over the period, or 16% of all funding for start-ups in Europe and collectively are currently valued at $65bn.

The first firm to join Europe’s unicorn list was the German SaaS fintech firm, Mambu GmbH,[9] who raised $134m in the latest round in early January 2021, bringing the company’s post-money valuation to over $2bn.

The three leading countries producing unicorns in Europe this year were Germany, with eight firms, the U.K., with seven firms and France, with six firms, with an aggregate post-money valuation at $15bn, $14bn and over $12bn, respectively (Fig. 3). However, there are also a few newcomers that attracted investor attention. Before the pandemic, online retail and delivery was a convenience for few, but in 2020, it quickly became a necessity, which might explain the success behind some of the unicorns. Velcka Pecka,[10] based in Czechia, raised $118m in series C from its returning investors, bringing its post-money valuation to over $1bn. Ireland’s LetsGetChecked,[11] an at-home health testing kit provider of PCR COVID tests, among others, raised $150m in its Series D funding round, putting it on the list of companies valued at more than $1bn. Turkey’s grocery delivery service Getir[12] received $555m in its latest funding round in June, bringing the total funding received to date to over $1bn and its current post-money valuation to $7.5bn, making it the highest valued unicorn of H1 2021. German fintech company Trade Republic Bank[13] and London-based Blockchain Access,[14] each with a total post-money valuation of over $5bn, follow next (see Table 4).

Source: S&P Global Market Intelligence. For illustrative purposes only.

Of the 2021 European unicorns, Gorillas Technologies GmbH,[15] which offers on-demand grocery delivery services – and was only founded in 2020 – was the fastest to reach unicorn status. The firm received $288m, their largest investment to date, from both domestic and non-domestic investors, in their Series B funding round, pushing their value to $1bn. Turkish mobile gaming company Dream Games[16] was the next fastest to reach the unicorn list. For the rest of 2021’s unicorns, it took an average of 7.8 years to make the list.

Table 4: Top 10 most-valued European companies that secured unicorn status in H1 2021

According to S&P Global Market Intelligence data, the most active domestic VC investor in Europe’s new unicorns was Index Ventures SA[17] from Switzerland, which invested in six out of 33 unicorns, including Swedish healthcare app KRY,[18] valued at $2bn, and French digital health insurer Alan SA,[19] valued at over $1.6bn. The second notable domestic investor with the highest number of recently created unicorns in its portfolio is the French PE/VC firm Eurazeo SA[20]. Five of their current portfolio companies have become unicorns in 2021.

The growing number of American VC players investing in European companies has been a significant factor in the increase of European unicorns. Almost 34% of the investors in the H1 2021’ Unicorns were from the U.S. and this trend is likely to accelerate. One of the most successful U.S. investors in terms of spotting future European unicorns was Accel Partners.[21] The company invested in five of 2021’s unicorns and holds first place in terms of total number of investments in Europe’s unicorns.

After a remarkable first half, VC and growth investment into European companies is set for a record year. With elevated levels of funding, bolstered by U.S. investors, it is likely that Europe’s unicorn cohort might get bigger at a faster rate, and even more startups from countries not currently dominating the list are likely to become unicorns. For instance, Croatian electric vehicle startup Rimac Automibili[22] is showing a lot or promise, with current valuation standing at $922.5m following the latest funding round in March of 2021, which was led by Porsche Ventures GmbH.[23] Spanish second-hand clothes retailer Wallapop[24] is another potential unicorn. Since its inception in 2013, the company has raised more than $214m in total funding and its current post-money valuation stands at $837m.

[1] For this article, the term includes Europe and Turkey.

[2] Northvolt AB, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#offering/capitalOfferingProfile?id=3017842

[3]Sitecore Corporation A/S, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#offering/capitalOfferingProfile?id=2281428

[4] Celonis GmbH, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#offering/capitalOfferingProfile?id=3012692

[5] Mollie B.V., S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#offering/capitalOfferingProfile?id=3026086

[6] Trade Republic Bank GmbH, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#offering/capitalOfferingProfile?id=3001150

[7]Revolut Limited, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#offering/capitalOfferingProfile?id=3042823

[8] Unicorns are defined as companies valued at $1bn or more.

[9]Mambu GmbH, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=5214628

[10]Velka Pecka s.r.o., S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=5307807

[11]PrivaPath Diagnostics Limited, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=5308191

[12]Getir Perakende Lojistik A.Ş, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=13706772

[13]Trade Republic Bank GmbH, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=10879397

[14]Blockchain Access UK Ltd., S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=5271400

[15]Gorillas Technologies GmbH, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=23930666

[16]DREAM OYUN YAZILIM VE PAZARLAMA ANONİM ŞİRKETİ., S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=19489732

[17]Index Ventures SA, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=4240844

[18]KRY International AB, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.com/CIQDotNet/company.aspx?companyId=380863829

[19]Alan SA, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=7702933

[20] Eurazeo SE, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=4145136

[21]Accel Partners, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=4182982

[22]Rimac Automobili d.o.o., S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=7644519

[23] Porsche Ventures GmbH, S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=13761291

[24] Secondhanding Networks S.L., S&P Capital IQ Pro. (As of August 11, 2021). Retrieved from: https://www.capitaliq.spglobal.com/web/client?#company/profile?id=5270877