Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 09, 2025

The nation's electric, gas and water utilities are channeling substantial investments into infrastructure enhancements aimed at modernizing mature generation, transmission and distribution networks, and meeting new demand. These initiatives include the construction of new natural gas, solar and wind power generation facilities, alongside the integration of advanced technologies such as smart meters, smart grid systems, cybersecurity protocols, electric vehicles and battery storage solutions. This significant capital outlay is poised to underpin robust profit growth within the utility sector for the foreseeable future.

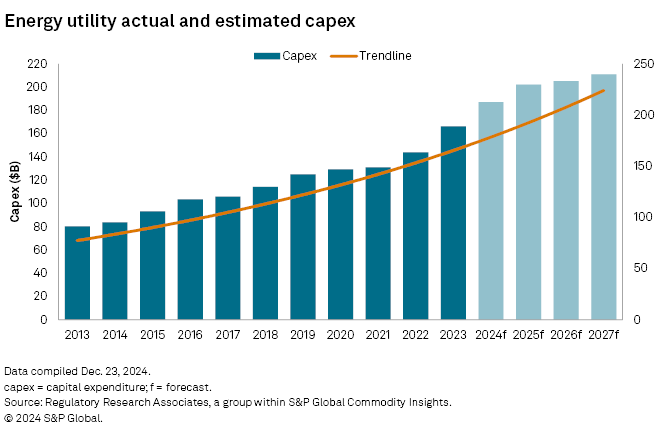

➤ Projected capital expenditures for 2024 among the 45 energy utilities in Regulatory Research Associates' representative sample of publicly traded, US-based utilities are forecast to reach nearly $187 billion. This represents a 12% increase from the $166 billion spent in 2023, and a nearly 30% rise compared to the $144 billion invested in 2022.

➤ Aggregate energy utility investments are projected to hit new highs of $202 billion in 2025, $206 billion in 2026 and $211 billion in 2027. These increases are largely driven by federal legislation passed in 2021 and 2022 that supports infrastructure investment, state-level energy transition plans and incentives, and a strong surge in demand from datacenters amid the continuing expansion of AI and cloud computing technologies.

➤ Within the smaller investor-owned water utility sector, total capex is projected to grow approximately 14% in 2024 to $5.5 billion, from $4.8 billion in 2023. This follows growth rates of 13.6% in 2023 and 18% in 2022.

➤ While the aggregate energy capex forecast for 2028 is $172 billion, the level is likely to be revised significantly upward as utility companies solidify their future project plans in early 2025 disclosures.

Several factors are anticipated to drive an increase in utility capex over the coming years. The pressing need to replace aging infrastructure is already catalyzing considerable investment. Concurrently, state-level renewable portfolio standards are escalating, necessitating substantial expansions in low-carbon energy generation capabilities. Further bolstering these dynamics are federal infrastructure investment initiatives, notably the Inflation Reduction Act of 2022, which aims to transition the US power generation landscape predominantly to zero-carbon sources by 2035.

Energy utilities are ramping up investment levels in 2025, 2026 and 2027

Despite potential uncertainties stemming from a new US administration regarding investments supported by the IRA, the financial frameworks underpinning these initiatives are generally expected to withstand administrative changes. Many of the subsidies are structured as tax credits, effectively functioning as tax reductions, thereby providing significant insulation from shifts in congressional or executive control.

|

Planned infrastructure investment strategies for US electric and gas utilities encompass the modernization of aging transmission and distribution systems, the development of new natural gas, solar, and wind power generation capacities, and the adoption of cutting-edge technologies such as smart meters, smart grid systems, cybersecurity measures and battery storage. These substantial investments are anticipated to form the foundation for sustained profit growth within the sector for the foreseeable future.

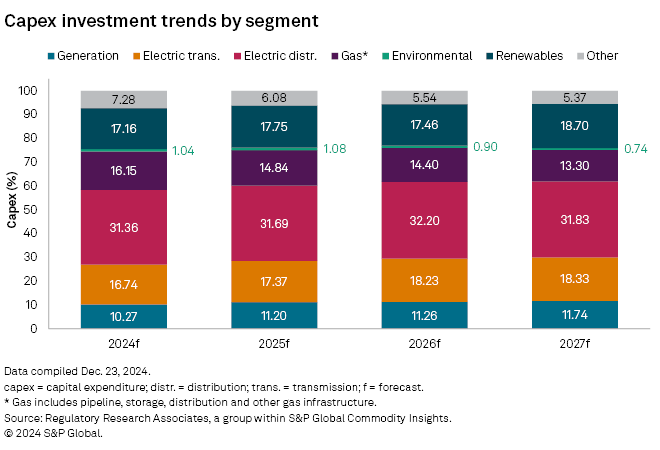

Investment in renewables within the RRA's coverage area is projected to exceed $26 billion in 2024, according to utilities that provided a breakdown of their capex spending totals by segment. Some utilities only provided a consolidated total.

Expansion of renewable generation resources

Renewable energy investment is anticipated to continue on a growth trajectory in subsequent years, with annual investments expected to surpass $30 billion in both 2025 and 2026, reaching over $33 billion by 2027. Several factors will drive ongoing development in electric utility renewable energy, including declining technology costs, state policies and renewable portfolio standards, consumer and corporate demand, and environmental, social and governance considerations, all within a broader trend toward decarbonization in the utility sector.

|

The expansion of renewable generation resources, often located far from demand centers, will necessitate new transmission line projects. Furthermore, despite challenges to the rate of return levels authorized by the Federal Energy Regulatory Commission — such as from periodic changes in return on equity calculation methodologies and underlying models — the average return on equity permitted for transmission investments remains higher than the average equity returns sanctioned by state commissions in traditional general base rate case proceedings.

Natural gas continues to dovetail in energy transition

Natural gas capex will continue to be driven by the need to replace mature gas distribution infrastructure over the long term, in line with state and federal safety mandates. Despite challenges in various regions, natural gas is expected to remain a vital energy source for the foreseeable future, particularly to bridge capacity gaps created by rising datacenter demand that cannot presently be entirely met by renewables due to intermittency coupled with insufficient availability of energy storage.

Furthermore, midstream pipelines and downstream distribution networks are poised to play a pivotal role in efforts by many midstream and utility companies to extend the lifespan of their infrastructure through LNG exports and through domestic transportation of renewable natural gas and hydrogen blends.

For additional insight into infrastructure investments over the next several years within the US utility industry, refer to the capex databook as of Dec. 23, 2024, also available via the Research Library. The data incorporate intelligence distilled from the aggregation of multiple individual company forecasts. To access the most recent previous capex report, refer to Energy utility capex plans on track to all-time highs from 2025 to 2027.

Note: This report is designed to identify capital expenditure trends in the US utility sector, drawing data from a range of sources, including corporate investor presentations, annual reports and other sources. While S&P Global Market Intelligence strives to ensure the accuracy of the included underlying data, the sources vary in terms of depth, quality and timeliness. Actual company-specific capital expenditure information should be acquired from filings with the US Securities and Exchange Commission.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a complete, searchable listing of RRA's in-depth research and analysis, visit the S&P Capital IQ Pro Energy Research Library.

Theme

Location