Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 8 Jun, 2022

By John Abbott

Some M&A deals court controversy. When Broadcom announced it had reached an agreement to acquire VMware at the end of May, we noted a lack of any obvious and immediate synergies between the two companies from the technical and product points of view, but also from a cultural standpoint. With Broadcom acting as a financially oriented legacy software rollup specialist, what would the future be for VMware – one of the key architects of cloud computing? We argued that it could slow innovation at VMware just at a point when emerging cloud-native software stacks were in danger of making its traditional virtualization platform less compelling than it once was.

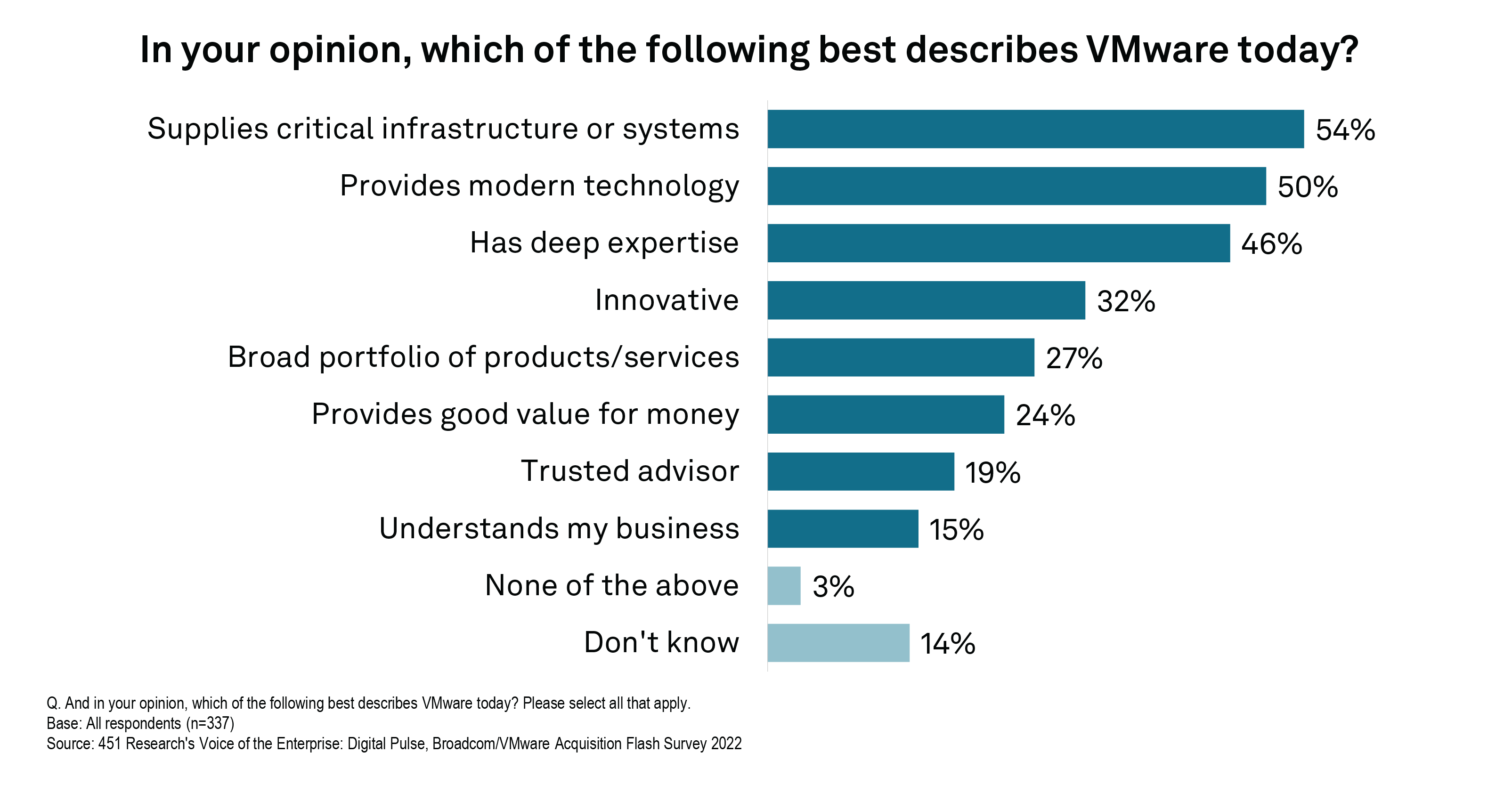

Checking in with our 451 Alliance, surveying several hundred enterprise leaders to get their sentiments on the deal – just as we did with Dell-EMC in 2015 and IBM-Red Hat in 2018 – we get a strong sense of just how important VMware is to its users. The majority of survey respondents don't view the company's software in legacy terms, but rather view it as supporting their critical IT systems and requiring deep expertise and continuing innovation to secure its long-term future. The most frequently expressed sentiment that emerges from the survey, addressed to the acquirer, is "don't break VMware."

The reactions to the deal captured by our survey were primarily neutral (44%) or negative (40%) impressions and were strongest among organizations that identify themselves as existing customers of both Broadcom and VMware (56% negative, with 27% citing "very negative" impressions). This could be due to negative experience of past Broadcom software acquisitions (such as CA and Symantec), fueling fears concerning the handling of VMware tools that are considered important to their businesses.

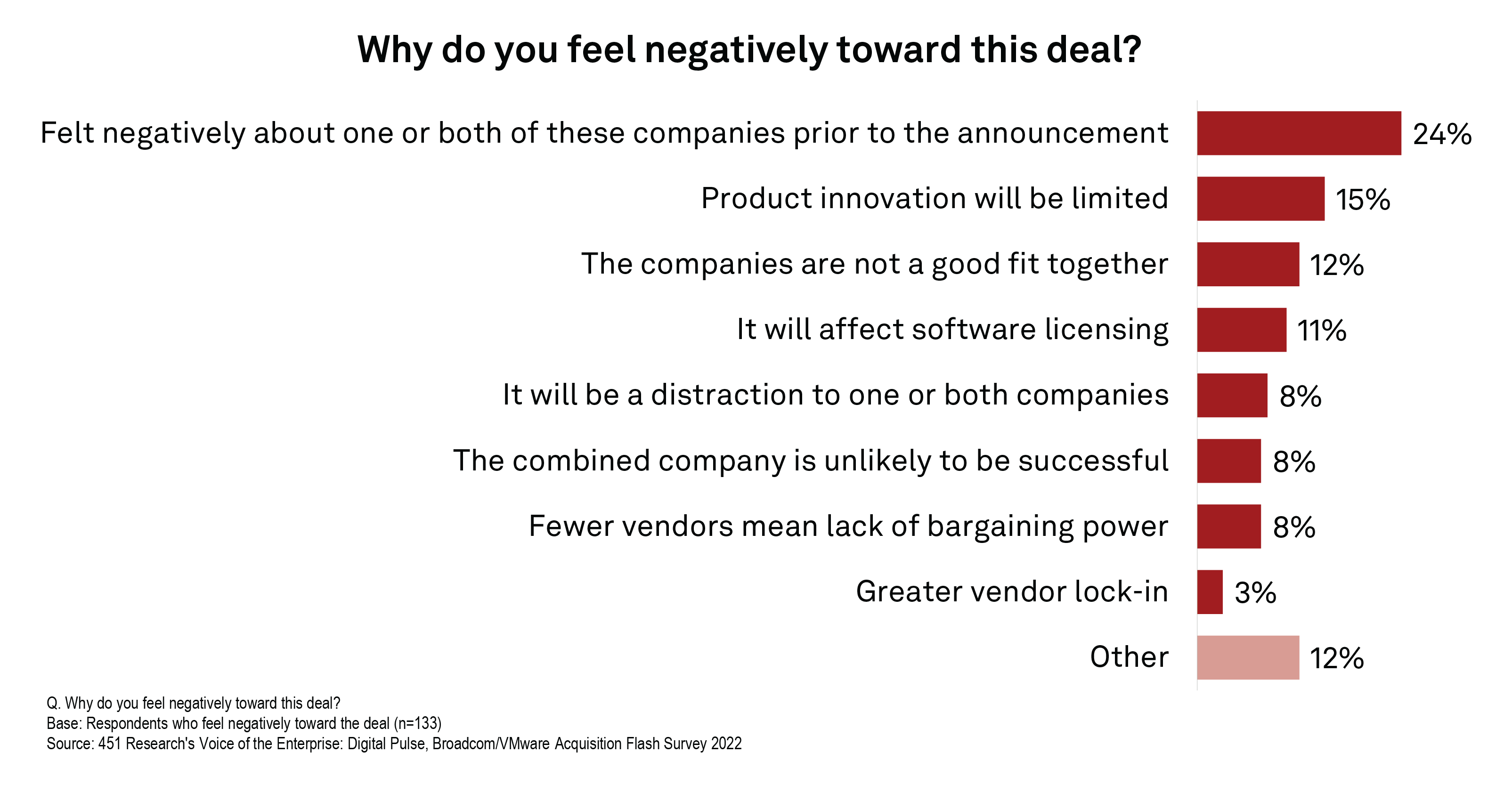

After a general existing negative feeling about one or both vendors prior to the deal, the three main worries on the list are that the pace of innovation will be stifled, the general lack of obvious synergies between the two companies, and the potential impact on software licensing terms and conditions. Given the experience of CA and Symantec users over the past few years, such fears seem to have some grounding in reality. However, since the deal was made public, both Broadcom and VMware executives have been actively reassuring customers that this deal will be different.

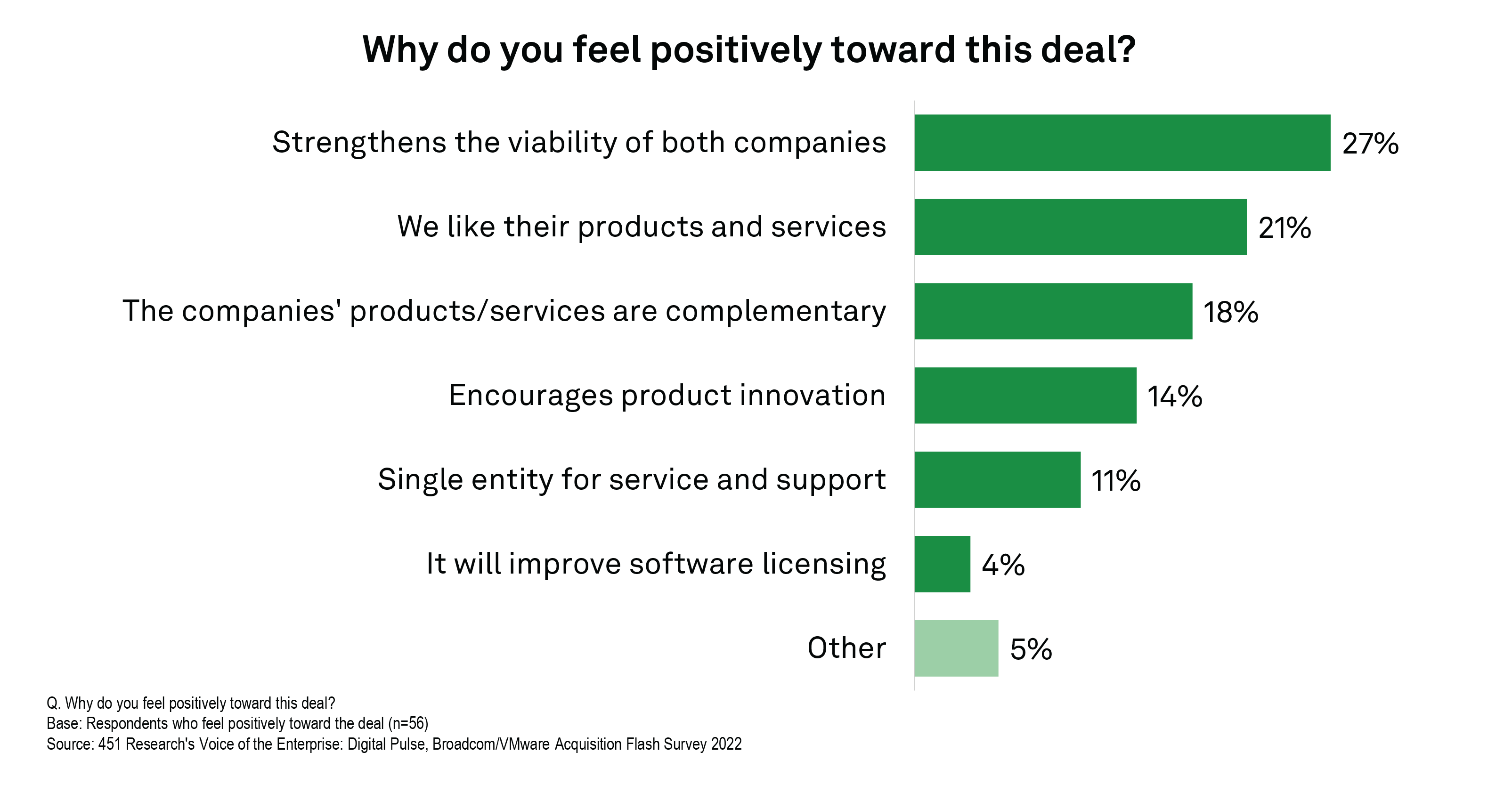

Those who view the acquisition as positive primarily see it as a means of strengthening the viability of both companies, although there is a degree of support for the view that both have some strong products that could be complementary, and therefore stimulate further product innovation. In this respect, Broadcom's decision to position VMware as its flagship software brand and maintain its identity goes in its favor. The CA and Symantec brands have lost significant visibility since their acquisitions, largely because the portfolios were fragmented.

VMware is highly prevalent across the enterprise IT sector, and its brand is much more valuable. There is also a much broader ecosystem of value-added partners that help sustain and grow the business. Broadcom has already indicated that it intends to pay more attention to such partners than it has with some previous acquisitions.

A number of our survey respondents did feel there were some synergies that could be exploited, with several highlighting networking and the edge as potential areas. "Getting into distributed platforms is actually very interesting, and I think they are going to be a pretty major force around edge computing," said one respondent.

Which of the Following Best Describes VMware Today?

There is a marked contrast in how the two discrete companies are perceived. Nearly 54% of our survey respondents say they regard VMware as a supplier of "critical infrastructure or systems" (compared with 20.3% for Broadcom), while 44% say it "provides modern technology" (vs. 22.1% for Broadcom) and 46% agree that it "has deep expertise" (vs. just 11.9% for Broadcom). Meanwhile, some 37.7% say the companies are not well aligned, with 46.9% neutral and just 12.4% believing them to be well aligned.

One VMware customer in the healthcare sector pointed out that VMware could not have been bought by any of the usual suspects without raising neutrality concerns. "With a Broadcom, or somebody else not already in the market, picking them up, then business goes on as usual." Another commented, "As long as they keep it separate, I’m fine."

Methodology: This online survey of 338 respondents was conducted from May 27 through June 3, 2022, by 451 Research, the enterprise technology research unit of S&P Global Market Intelligence.