Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 24 Aug, 2021

By Scott Robson

Highlights

Total distribution revenues reported by U.S. cable network owners grew 9.3% in the second quarter on a year-over-year basis.

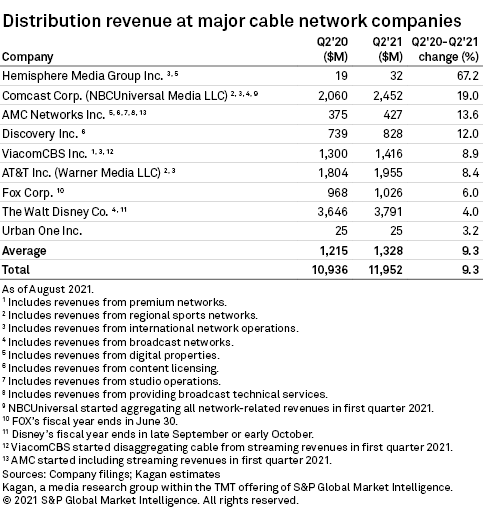

Combined distribution revenues at the nine major publicly traded cable network companies in the U.S. grew 9.3% year over year in the second quarter of 2021 as digital subscription fees and contractual rate hikes boosted distribution revenues. All nine companies reported year-over-year growth, led by a 67.2% gain at Spanish-language network owner Hemisphere Media Group Inc.

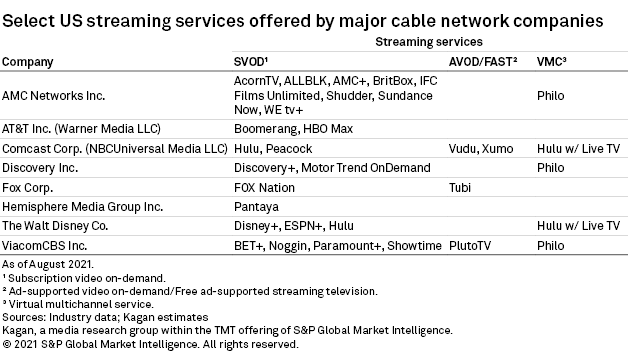

Historically, fluctuations in distribution revenue at cable networks were caused by changes in license fees and subscribers. Distribution revenues, however, are increasingly being manipulated by new streaming businesses. All four of the companies, which were able to grow distribution revenue by double digits in the second quarter, have supplemented traditional carriage fees at linear networks with subscription revenues from on-demand services.

Hemisphere Media Group became the sole owner of Pantaya LLC on March 31, 2021, and subscription revenue generated by the subscription streaming service is now recognized in the company's reported distribution revenues. The Pantaya service is nearing 1 million subscribers, with a goal of reaching about 2.5 million by 2025.

On the company's earnings call, CEO Alan Sokol announced an agreement with Alphabet Inc.'s YouTube TV to carry Cine Latino, WAPA América and Pasiones, with launches expected before year-end. Sokol is optimistic that the YouTube launch will lead to additional launches on other major virtual multichannel video programming distributors.

Comcast Corp.'s NBCUniversal Media LLC segment grew reported distribution revenues by 19.0% year over year to $2.45 billion in the second quarter. The company's Peacock streaming service generated $122 million in revenue during the quarter.

Distribution revenue at NBCUniversal's regional sports networks was negatively impacted in the second quarter of 2020 by credits paid to consumers for fewer live sporting events, which resulted in a favorable year-over-year comparison. The company also forged new carriage agreements with higher rates at the end of 2020, which contributed to the year-over-year growth in revenue.

AMC Networks Inc. grew reported distribution and other revenue by 13.6% to $426.7 million in the quarter. AMC includes revenue from content licensing deals with distribution revenue. Content licensing revenues fell 10% in the quarter due to production delays from COVID-19 shutdowns. The company noted a 21% increase in streaming revenues in the quarter. AMC began including revenue from its suite of subscription streaming services in its reported domestic operations in 2021.

Discovery Inc. was the fourth company to grow reported distribution revenues by double digits, recording a 12.0% year-over-year increase in the second quarter. Speaking on the company's earnings call , CFO Gunnar Wiedenfels noted that distribution revenue growth was primarily driven by a growing Discovery+ subscriber base. Discovery sold Great American Country in the quarter, which had a negative impact on revenues.

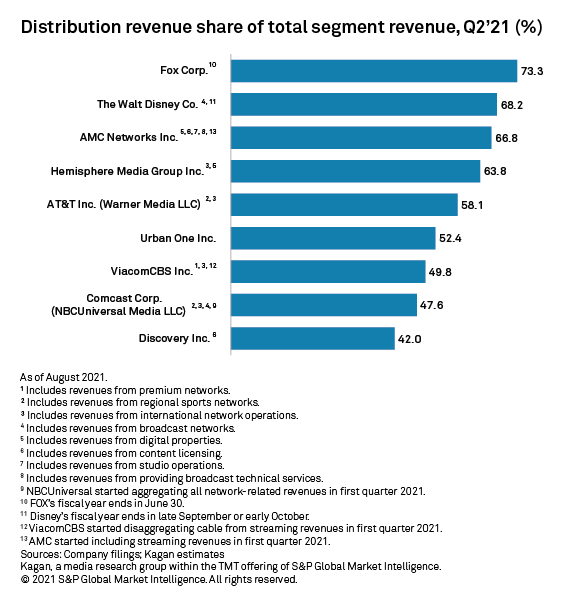

The Discovery U.S. Networks business segment derives only 42.0% of its total revenue from distribution, which is the smallest portion of any group in our database.

U.S. basic cable networks owned by Fox Corp. generated the highest concentration of total segment revenue from distribution revenue in the quarter, with its $1.03 billion equating to 73.3% of the total. On the company's earnings call, management cited double-digit pricing growth at FOX News Channel as being a key driver to the overall strength. Future distribution revenue growth at FOX is expected to slow in the next few quarters, as the company will catch up with year-over-year comps from a previously favorable renewal cycle.

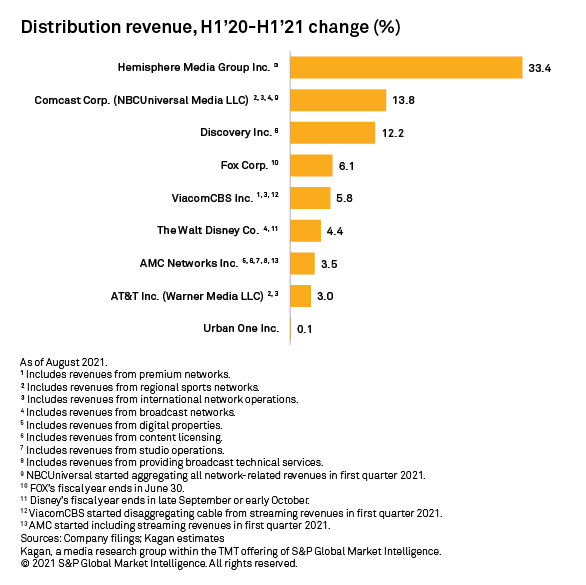

Looking at the first half of the year, all nine U.S. cable network groups were able to grow distribution revenue at a combined rate of 6.8%.

Already a client?

Already a client?