Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 08, 2023

By Jingyi Pan

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

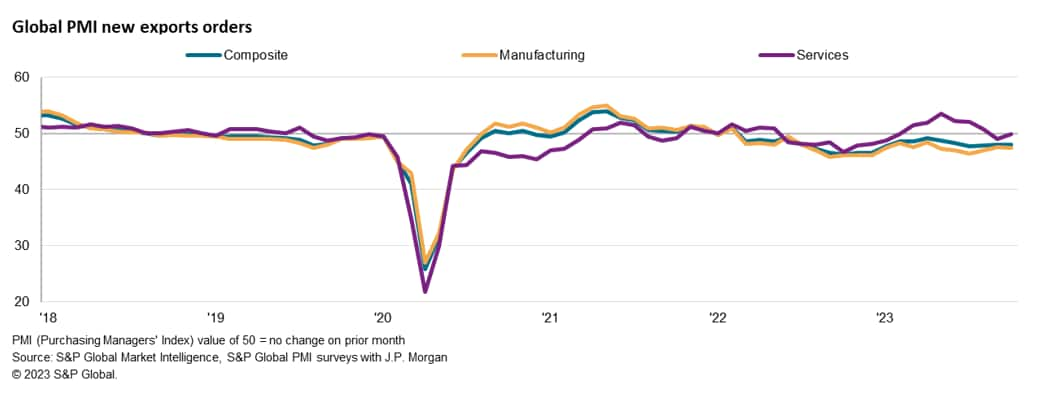

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a twentieth successive monthly deterioration in global trade in October, thereby signalling sustained weakness in global trade conditions going into the final quarter of the year. The seasonally adjusted PMI New Export Orders Index was unchanged at 48.0, which corresponded to a moderate decline in trade conditions.

An unchanged composite PMI New Export Orders Index masked variations by sector in October. While manufacturing goods trade contracted at a slightly sharper rate at the start of the fourth quarter, the downturn in services exchange eased to only a marginal pace. Consequently, the gap in performance between goods and services exports widened again after having narrowed in the prior two months.

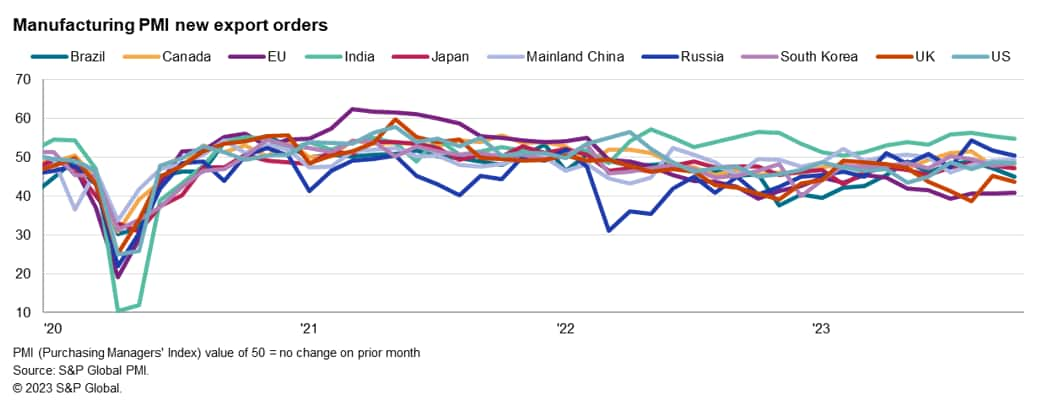

Manufacturing new export orders shrank at a slightly quicker rate in October companies reported weak underlying demand, softening economic conditions and destocking, coupled with pressures from tight financial conditions, which continued to limit spendings on goods. This extended the sequence of shrinking export orders that commenced in March 2022. Overall, the rate of contraction was stable and close to the rolling 12-month average in October, but remained marked by historical standards. By broad sectors, the downturn in export demand picked up speed across both consumer and investment goods while the intermediate goods segment saw export orders decline at a slower ,and only moderate, pace.

More detailed sub-sector data further outlined the broad-based nature of the latest downturn in goods trade. The steepest decline in goods exports was recorded for general industries while paper & timber products and construction materials followed closely behind. Exports of chemicals and food products notably saw renewed contractions after growing marginally over September.

Turning to services, the October PMI data pointed to a second monthly deterioration in trade conditions, albeit with the rate of decline easing to a marginal one. This is in line with the broader trend for global services demand, which fell fractionally for a second consecutive month. The latest data continued to outline the fizzling out of service sector growth after a strong start to the year. The tightening of financial conditions has, as expectedly, broadened its reach into the service sector, thus leading to the latest indications of slowing services exchanges.

By region, both developed and emerging markets recorded lower trade activity in October but to varying degrees. The rate at which trade deteriorated in developed markets was little changed from September and thus remained sharp overall. The downturn was driven by a sharper fall in manufacturing exports as developed world services exchanges fell at a slower rate. Meanwhile the slowdown in trade was muted among emerging economies, where manufacturing exports declined only marginally and services new export business rose at a quicker pace in October.

Measured across both goods and services, trade across the majority of the top 10 economies monitored remained in doldrums at the start of the fourth quarter. The downturn was again led by the EU, where export orders fell at one of the fastest rates on record, barring the pandemic period. This was despite the pace of decline easing slightly from September. France and Germany notably posted especially steep drops in export orders, though both rates similarly slowed from the previous month. By sector across Europe, the sharpest fall in new orders from abroad was observed in the auto sector amidst an acceleration in the downturn of the broader consumer goods industry.

The UK followed closely behind the EU, with new export orders continuing to shrink at a rate well above its 12-month rolling average. This was, however, driven primarily by falling manufacturing new export orders as new export business stabilised among service providers in the UK.

The US and Japan meanwhile saw diverging trends with the fall in export orders slowing to a marginal rate in the US but accelerating to a four-month high in Japan. Renewed improvements of foreign interest in US services helped to offset some of the gloom in the manufacturing sector. In contrast, Japan's service sector recorded the first decline in new export business since August 2022, joining its manufacturing sector in downturn.

Among the major emerging markets, India remained the best performer with exports sustaining a strong expansion in October. The rate of growth eased to the weakest since June but remained well above the rolling 12-month average to signal solid improvements. Faster services new export business expansion contrasted with slower Indian manufacturing export orders growth. Both rates of improvement nevertheless remained historically elevated and far outperformed the majority of markets tracked.

Russia also saw growth in new export orders across both manufacturing and services in October, with strong growth of services export paired with muted improvements in goods trade. Anecdotal evidence suggested that expansions into new export markets partly supported the rise in service sector new export business.

Finally, mainland China and Brazil continued to see new export business contract in October. The trends varied here, however, with the decline in mainland China being the shallowest in the current four-month sequence while Brazil's downturn in trade was the most pronounced since March. Conditions improved across both manufacturing and service sectors in mainland China as the fall in goods trade slowed while services exports grew faster. Whereas for Brazil, conditions in manufacturing and service sectors both worsened amidst difficulty in securing new work from abroad, according to surveyed companies.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location