Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 09, 2024

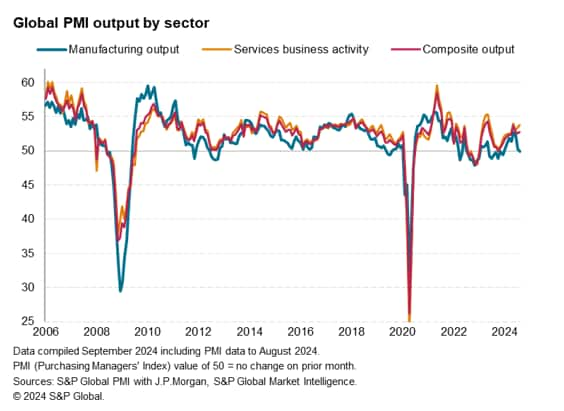

A renewed fall in manufacturing output signaled by the August global manufacturing PMI raises worries about spillover effects to the service sector, which is now the main driver of global economic growth.

Although only accounting for around one-tenth of GDP in most developed economies, the manufacturing sector's health carries overweight importance because of its leading indicator properties: the historical data from the PMI indicates that a deteriorating manufacturing performance tends to be followed by a noticeable weakening of the service sector within the next six months.

A broader economic slowdown is by no means certain: the manufacturing downturn may prove to be a short-lived blip as anticipated interest rate cuts help drive a revival of demand, investment, and business activity. Could this time also be different, as economies grow less reliant on manufacturing? Business trends over the summer months can also be volatile. Hence September's PMI data will be crucial in determining the near-term global growth trajectory, and especially in monitoring this interplay between goods and services.

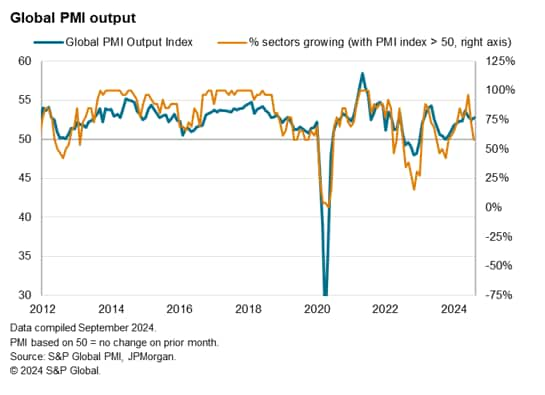

The headline global PMI, tracking monthly output changes across all major developed and emerging markets, remained in expansion territory in August, signaling a tenth successive month of growth and slight upturn in the pace of expansion to one of the strongest seen over the past year.

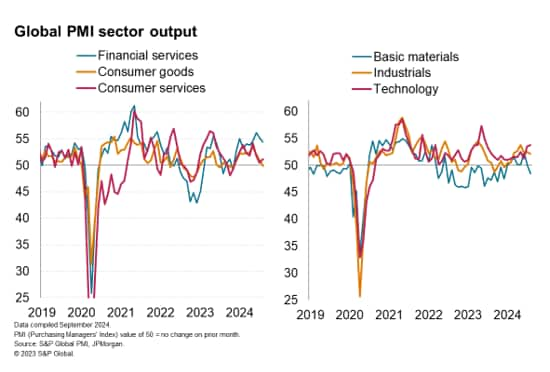

The upturn has become worryingly skewed in recent months, however, reliant on rising service sector activity as manufacturing output slipped into decline in August.

In fact, of the 25 sub-sectors covered by the PMI, 11 reported lower output in August, representing the highest proportion of declining sectors since last November.

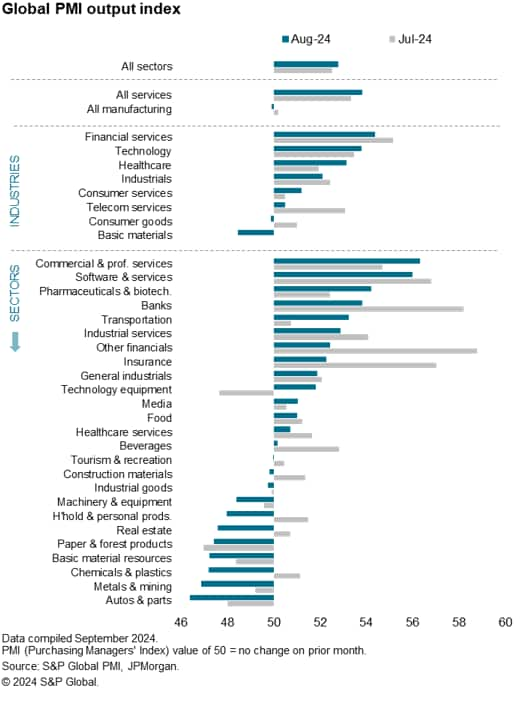

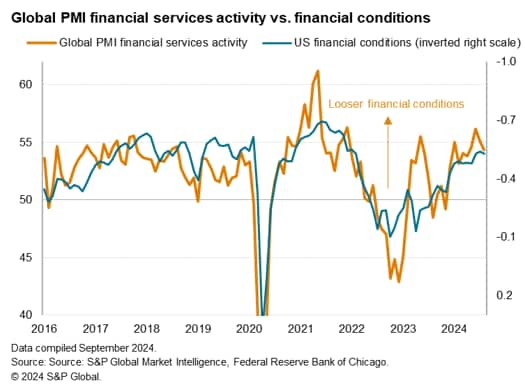

Financial services was the fastest growing broad industry again in August, with companies citing looser financial conditions as having driven demand, notably for banking services.

However, the fastest growing sub-sectors were those offering business services, including commercial, professional and software services.

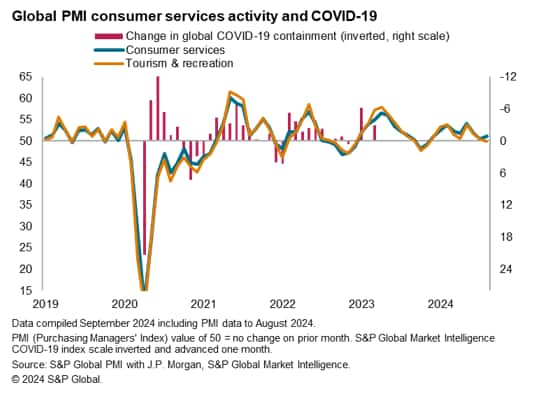

In contrast to the strong business-to-business services growth, consumer services activity rose only very modestly in August, in part reflecting stalled tourism & recreation activity.

At the other end of the scale, basic materials was the fastest-declining broad industry, with companies citing reduced demand for raw materials amid concerns about inventory levels and the economic outlook. Note that the August PMI surveys reported the steepest drop in input buying by factories seen so far this year.

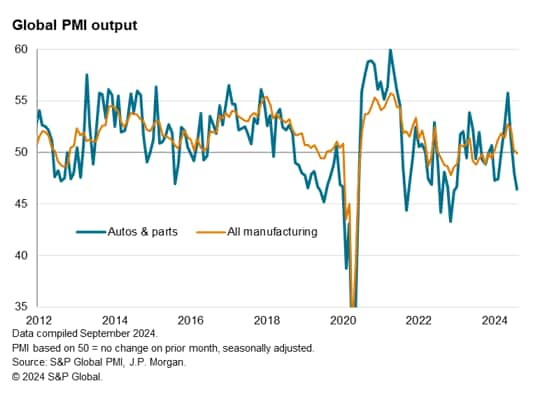

Looking at the detailed sub-sectors, the worst performer was in fact autos & parts, where the rate of contraction hit a 20-month high -representing some pay-back after a brief growth spurt in the second quarter.

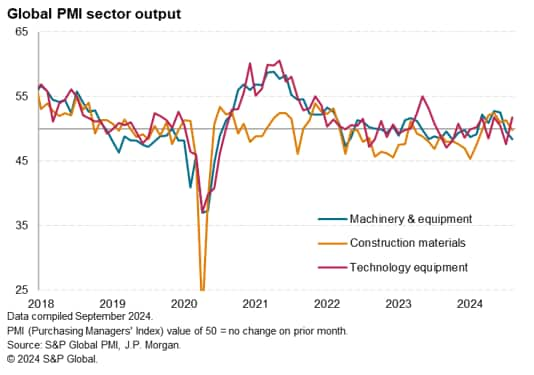

The capex-oriented machinery & equipment and construction materials sectors also both notably declined, hinting at reduced global investment spending, though tech equipment output picked up.

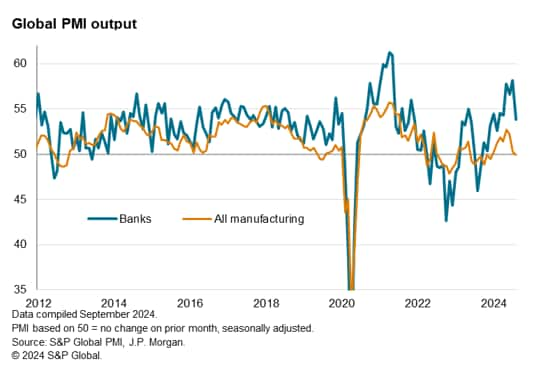

A key question for the outlook is whether lower interest rates can stimulate the manufacturing sector via higher consumer spending and capex. Encouragingly, while downturns in manufacturing have historically tended to lead to a worsening performance in the broader services economy, the banking sector often leads manufacturing.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.