Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 08, 2023

By Chris Rogers

The European Union Deforestation Regulation (EUDR) introduces wide-ranging supply chain reporting requirements for commodities and their downstream supply chains. The EUDR covers €40.9 billion of commodity imports to the EU and €85.0 billion of derived products.

Companies have three broad ways to deal with EUDR: improve sourcing visibility; raise prices; reorient supply chains. All three are risky and can be expensive.

€126 billion of visibility: New forestry products regulations

The European Union's Deforestation Regulation (EUDR), which came into force on June 29, brings significant new supply chain reporting requirements across the food, building materials, home/personal care, automotive, capital goods and furniture sectors.

EUDR is effectively an import regulation covering a specific range of products, which can be analyzed using international trade data.

In aggregate, EUDR covers €40.9 billion (US$44.2 billion) of materials imports in 2022, according to our data. It also covers as much as €85.0 billion of derived products, bringing the total value of trade which will be covered to about €126 billion — or roughly 4.2% of all EU imports.

Downstream supply chains: Not just about trees

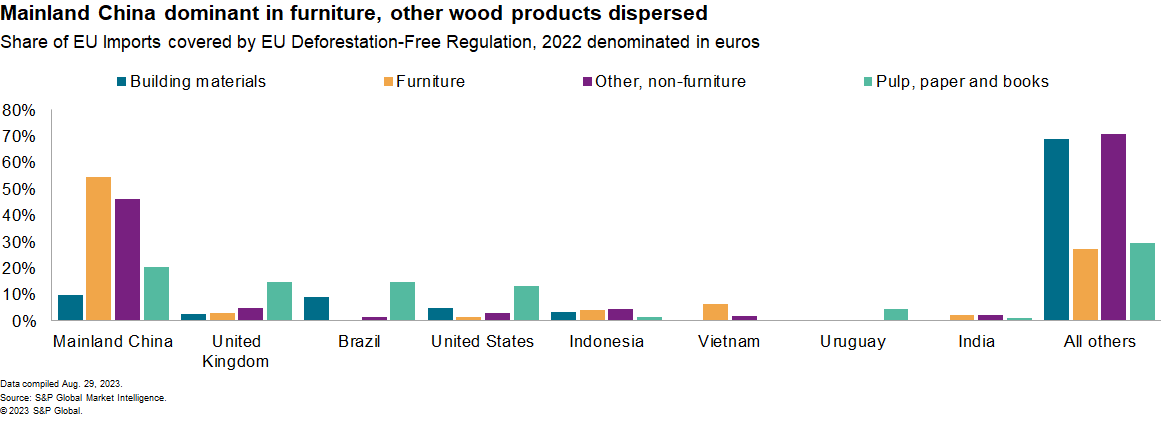

Since the EUDR covers derived products imports as well as raw materials, that widens the potential impact on sourcing beyond forestry countries to other major supplier nations including mainland China, the United Kingdom and the United States.

While wood products should be simple to trace, the commingling of resources and the mix of wood grades create complexity in tracing upstream supply chains. It is also the largest category by value, which represented €50.7 billion of imports in 2022.

Pulp and paper sourcing is widely diversified, with sourcing led by €4.6 billion of imports from mainland China, followed by the UK and Brazil with €3.4 billion each. It's worth noting that pulp and paper requirements are focused on softwoods, rather than the hardwoods more commonly harvested in tropical forests.

EU imports of furniture are led by supplies from mainland China. Supplies include a wide range of domestic and office furniture at a variety of price points delivered through specialist and generalist stores as well as online. Importers across those categories may be captured by EUDR.

Tracing, pricing and switching: Corporate responses to EUDR

Corporations, particularly direct importers, face a wide range of administrative burdens and risks resulting from EUDR. The stakes are high given non-compliance can lead to stiff fines.

There are at least three broad ways to deal with EUDR's requirements. The first, and arguably best, is to improve sourcing visibility. That's a far from simple process, with at least one coffee importer noting that traceability at the parcel level a huge challenge for that sector.

A second route is to increase prices for buyers and downstream customers. The industry bodies for the cocoa, coffee and meat sectors have reportedly indicated that prices will be increased to cover additional costs of compliance.

Prices are expected to rise further into late 2023 before falling thereafter. S&P Global Market Intelligence forecasts call for coffee and palm oil prices in fourth quarter 2024 to be lower respectively versus third quarter 2023, with soybeans set to fall by another 15%.

A third measure involves reorienting supply chains to minimize exposure to deforested countries altogether. The furniture industry illustrates the challenges of tracing back upstream from countries outside the EU.

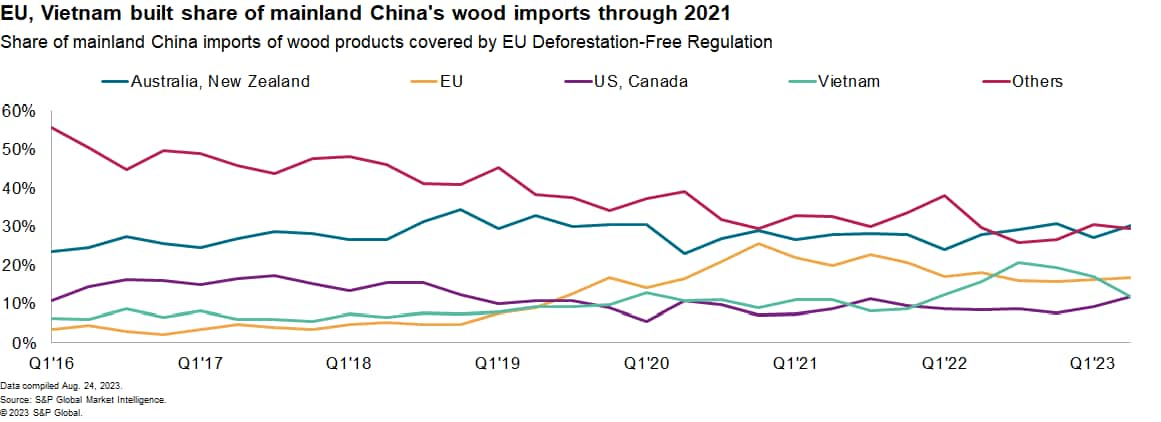

Mainland China is the leading supplier for furniture to the EU. Importers of wood in mainland China will therefore need to consider their sourcing.

There are signs of consolidation. In 2016, the top six sources for mainland China imports of wood materials covered by the EUDR accounted for 50% of shipments. As of 2022 that had increased to 70%. Of the six, only Vietnam includes deforested areas per the EUDR definition.

There was an increase in sourcing from the EU itself — that is, EU wood materials assembled into furniture in mainland China before being shipped back to the EU — which accounted for 17% of mainland China imports in 2022 from 3% in 2016.

There was also an increase in shipments from Vietnam, which accounted for 17% of shipments in 2022 from 6% in 2016.

More recently, there's been an increase in sourcing from the US and Canada. That may reflect the mix of products as consumer spending downshifts to cheaper items using the softwoods, which the US and Canada specialize in.

Subscribe to our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.