Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 22, 2024

Learn more about our data and insights

Production of lithium, cobalt, copper, nickel, zinc, and aluminum (among other nonferrous metals) is estimated to account for more than $4 trillion in 2035. Batteries and accumulators are estimated to surpass the $1 trillion mark by the next decade.

The automotive industry is transitioning from internal combustion engines (ICE) to battery electric vehicles (EVs), driving demand for lithium over the next decade. The electronic components and boards sector, which includes semiconductors, and the communication equipment sector, which includes cell phones, are key end markets spurring future demand for batteries.

As battery output increases, the use of lithium and other nonferrous metals such as nickel and cobalt will also increase in similar ratios. However, technological advances play a significant role and research into lithium recovery could extend battery lifespan. Technological developments in car batteries may reduce lithium dependency over time.

The construction sector also remains another powerful driver in the demand for nonferrous metals. We estimate that new construction projects will translate into an additional spending of $4 trillion over the next 10 years in the global economy. This represents about $15 billion per year in purchases of aluminum, copper, lithium, cobalt, zinc and nickel at the global level.

Looking at longer-term growth patterns by segment, residential construction spending is projected to increase at a slower pace compared with other construction segments. Nonresidential structures spending is expected to expand over 2022-27, driven mainly by the strong institutional segment outlook. Infrastructure spending will likely moderate during 2027-32 as major infrastructure packages subside.

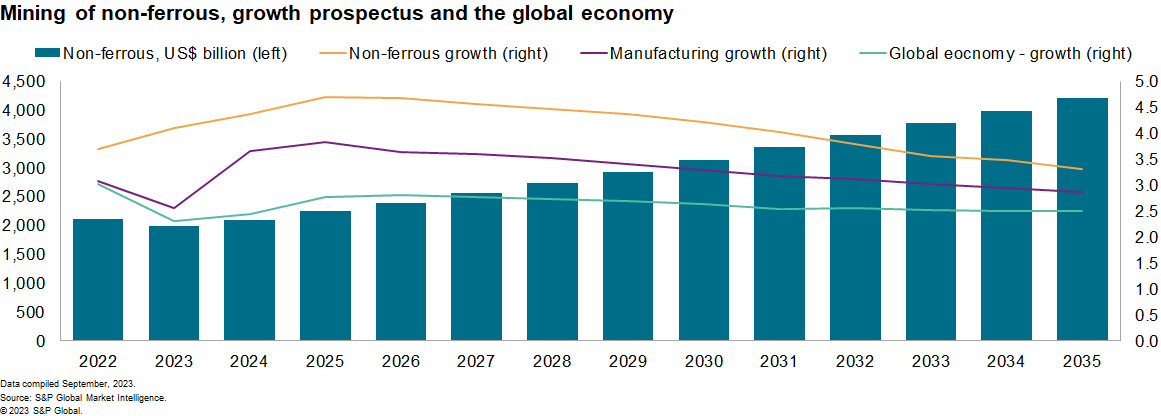

Mining of lithium, cobalt, aluminum and other nonferrous metals will outpace global manufacturing and the global GDP growth rate over the next decade. Given the current industry demand drivers and global macroeconomic conditions, we estimate mining of lithium, nickel, cobalt, aluminum, zinc, copper, and other nonferrous metals will double by the middle of the next decade.

Restrictions on critical minerals: Impacts on supply chains

Indonesia banned the export of nickel ore in 2014 and then again in 2019 to encourage local refining. It is also considering extending its ban to other materials. Supply chains affected include corrosion-resistant steel, aerospace and electric vehicle batteries.

Indonesia's sales of nickel mattes and sinters grew to $6.72 billion in 2022 from $784 million in 2019. This experience may not be replicable in Latin America or Africa, however. Indonesia accounts for half of global nickel production so was a "must deal with" partner. Bans may not even be necessary, with firms outside of mainland China setting up processing in economies including Tanzania (nickel) and Mauritius (graphite) to secure long-term offtake of minerals.

In Chile, which classes lithium as a "strategic mineral" and where concessions are not granted, the government is developing a new state-focused lithium strategy. Private-sector involvement would be allowed in partnership with state-owned companies and as a minority owner in strategic projects.

The Mexican government has also classified lithium as "strategic" and is unlikely to grant new concessions; this raises the risk of revisions of existing permits. Mainland China is a dominant buyer of battery materials and the leading producer of EVs and batteries for export, providing little room for smaller players to negotiate.

Mainland China's imports from Chile have provided growth capital, with Chile's total production rising by 38% in 2022 versus Argentina's 4%. While lithium is hard to replace on a 10-year horizon, it is not rare geologically, providing plenty of options (e.g., the US and Australia) for those looking to avoid resource nationalism in Latin America or Africa. There is a risk that these alternative resources and planning uncertainty could lead to reduced inward investment.

The DRC's state mining company may review its contracts with private mining firms as well as forming a "cobalt OPEC" to preserve its share of cobalt earnings. - The DRC's output of cobalt has been expanding although its share of global cobalt production is falling, having dropped to 70.0% in 2022 from 72.1% in 2021 - Indonesia's global s are rose to % from 1.6% according to U.S. Geological Survey data.

The DRC's elevated operating risks and concerns regarding labor standards have already led buyers of cobalt to consider alternatives sources. Higher costs and interruption risk may accelerate the shift to alternative battery technologies that remove or reduce cobalt in their batteries.

Learn more about our Comparative Industry Service

Key operational risks and trends to watch

We see varying approaches to lithium development in Latin America. Bolivia, Mexico and Chile all classify lithium as a strategic mineral, although Argentina does not. In Bolivia, private companies can only get involved in partnership with the state, and there is no legal clarity of the existing framework.

In Mexico, no new concessions are permitted and the intention is to bring lithium fully under state control. The private sector will likely be able to participate in parts of the value chain. The country's free trade agreement (FTA) with the US means it can benefit from the Inflation Reduction Act (IRA).

No concessions are permitted in Chile, although private companies can partner with the state. President Gabriel Boric advocates majority state ownership in strategic projects. Like Mexico, Chile has an FTA with US and can benefit from the IRA. Mainland China's presence has increased in the lithium mining sector.

In Argentina, concessions are allowed and regulations vary by province. The country does not have an FTA with US and is likely sidelined by the IRA, although it is negotiating exceptions. The government will probably seek to develop the sector, but lingering capital and currency controls will remain an obstacle for investment.

In sub-Saharan Africa, governments are trying to ensure future domestic beneficiation of lithium before exports. New policy and regulation in Zimbabwe are likely to develop arrangements on taxation and royalties. Namibia's government, owing to the country's sizable lithium deposits, is pressuring mining companies to invest in local processing and refining capacity.

In South Africa, financial and security failures in state-owned transport enterprise Transnet increases the likelihood of exports being delayed for weeks. Intermittent export bans on critical minerals toward Durban port are likely throughout 2023 and 2024.

—With contributions from Obakeng Makapane

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.