Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 13 May, 2021

By Deana Myers

The Technology, Media and Telecom sectors are emerging from a global pandemic that brought into focus the demise of legacy services and accelerated the transition to digital entertainment and communication habits. It also brought into sharp focus the power of technology providers and antitrust scrutiny over the companies that play such a central role in how we operate daily.

What are the main themes expected to influence the TMT Industry for H2 2021 and beyond?

1: Online video

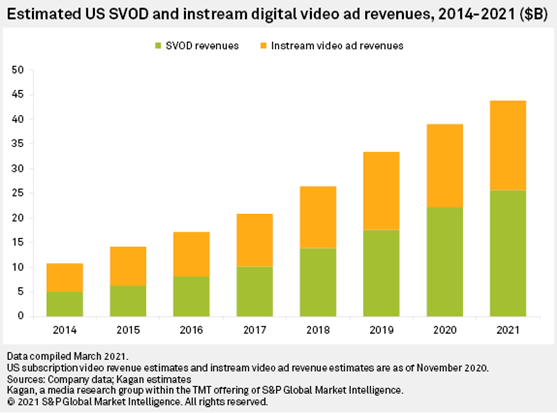

Firstly, evolving consumer behaviors, new video entrants and the stay-at-home orders helped push streaming subscriptions and digital viewership to record levels in 2020. Free ad-supported services also recorded strong growth with both having an impact on pay TV cord cutting.

As restrictions ease, free video competition rises and consumers look to cut their video bills, we expect subscription growth will slow while advertising services may continue to improve. Further consolidation could be ahead as some subscription offerings fail to reach scale and profitability.

2: Broadband

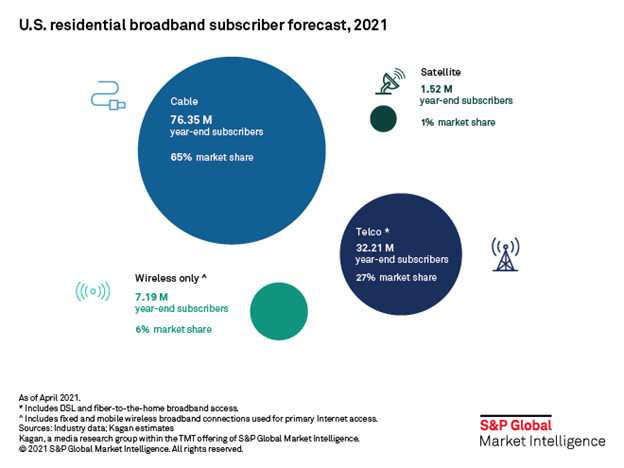

Secondly, Broadband was a pandemic success, but the surge has heightened concerns of a lull in 2021. The emphasis on working from home and uncertainty in the return to school are expected to lift penetrations to 90% of U.S. households.

The premium placed on speed and capacity have delayed broadband cord cutting, but fixed 5G strategies are coming into focus. We expect broadband subs to swell from 113 million in 2020 to more than 130 million in 2025.

3: Mergers and Acquisitions

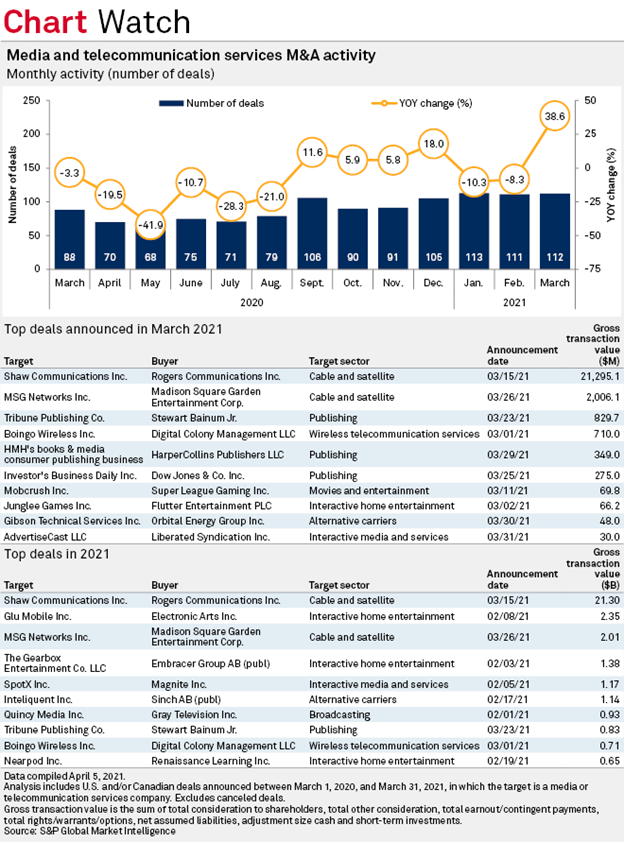

Thirdly, M&A in the media and telecom space is a tale of two conflicting trends. On one hand, we are in the middle of a buying bonanza. This deal activity has largely been driven by TMT SPACs, or special purpose acquisition companies. On the other hand, there have been more activities pushing for regulations, especially on the antitrust front.

Overall, the pandemic accelerated our digital habits with streaming and broadband subscriber growth likely to result in a slowdown during 2021. However, the changes in how we work, learn, and consume entertainment leapt forward in a way that promises to endure.

After a brief slowdown at the beginning of the pandemic, M&A activities in the TMT space proliferated throughout much of 2020. In 2021, deal activities, especially those involving major TMT players, will face greater regulatory scrutiny.