S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 13 May, 2021

What are the key themes to shape the healthcare sector in the second half of 2021 and beyond?

1: The ongoing pandemic

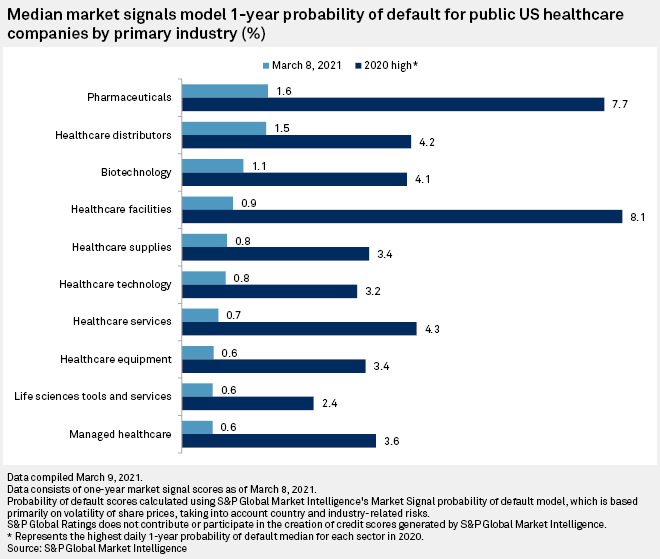

The healthcare industry was both deeply impacted by COVID-19 and tasked with mounting an effective response to it. As a consequence, probability of default scores fell for all segments of healthcare in Q1 2021 compared with their highs in 2020.

Hospitals and other providers have seen patient and elective procedure volumes rebound to as much as 95% of pre-pandemic levels following the cancellation of elective services early in the outbreak. Investors will keep a close eye on these metrics as they watch COVID case numbers and vaccination rates.

Pharmaceutical and biotech companies have developed COVID-19 therapies and vaccines with unprecedented speed. Some companies are expected to bring in billions in revenue for products that combat the coronavirus. Others are engendering goodwill by pledging to make no profits on such products and by offering their services and expertise to fight the pandemic.

2: The rise of digital health and Big Tech disruption

The use of telehealth services skyrocketed during the pandemic, with publicly traded telehealth companies Teladoc and Amwell reporting that total visits more than doubled in 2020.

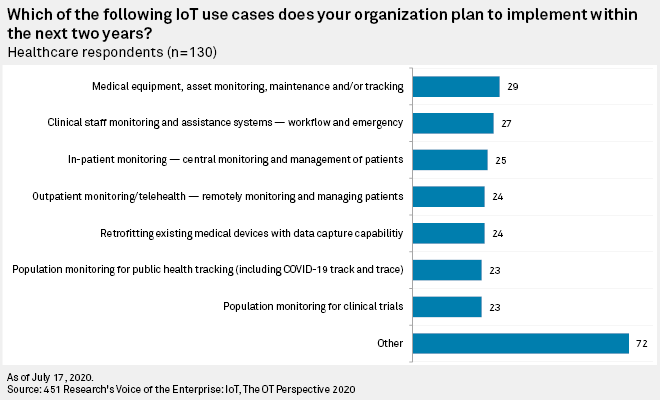

Robust usage and stable reimbursement may drive more investment and acquisitions in the broader digital health space. According to a survey by 451 Research, part of S&P Global Market Intelligence, healthcare professionals plan to invest in technologies that enable patient monitoring and telehealth.

U.S. President Joe Biden has proposed a $100 billion investment in high-speed broadband, which, if approved, may have implications for telehealth.

Big Tech also sees opportunities in healthcare. Apple, Amazon, and Alphabet’s Google have each made moves into the wearables market, and Microsoft recently announced the acquisition of Nuance Communications, which provides voice recognition software to healthcare facilities.

3: Drug pricing and access

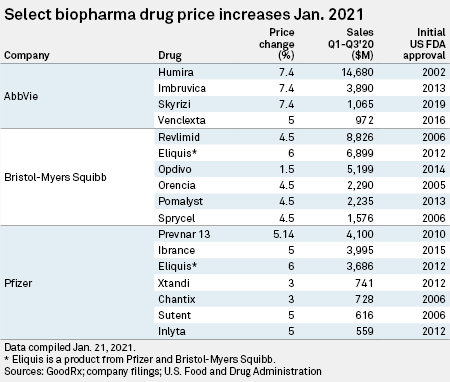

This is a familiar one for pharma and biotech companies. Pharmaceutical companies applied price increases to more generic and brand name drugs in the first few weeks of 2021 than in each of the previous two years, according to data from GoodRx. However, the average increase was lower across the board, showing the industry’s awareness of headline risk around large price hikes.

The U.S. Federal Trade Commission is rallying fellow antitrust regulators to include pricing and access in their reviews of pharmaceutical mergers and acquisitions. That could further slow the pace of M&A after 2020 saw the lowest number of healthcare deals since 2017 and the lowest aggregate transaction value since at least 2015.

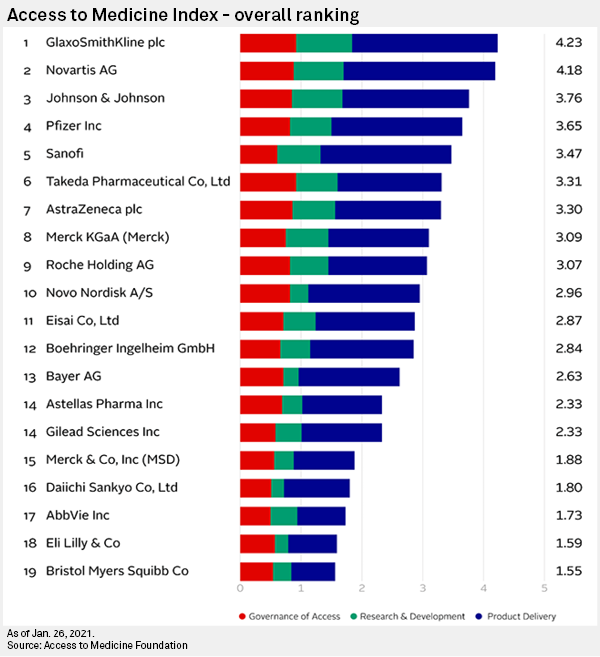

The pandemic exposed inequities in access to life-saving treatments, with lower-income nations waiting longer than higher-income countries, according to the Access to Medicine Foundation. Investors are taking more of an interest in companies’ plans to ensure more equitable access to new products, building on the goodwill the sector has attained during the pandemic.

In conclusion, 2021 will reveal the lingering effects of COVID-19 on the healthcare industry and test its resilience in the face of Big Tech disruption and greater scrutiny of its pricing practices. Stay connected with us at S&P Global Market Intelligence to see how the rest of the year will unfold.