Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 2 Nov, 2021

By Aline Soares

Mined copper supply growth will relieve concentrate tightness in the market over 2022-25. With a shortage of projects, supply will lag demand in the long term, pushing prices to unchartered territories.

The Take

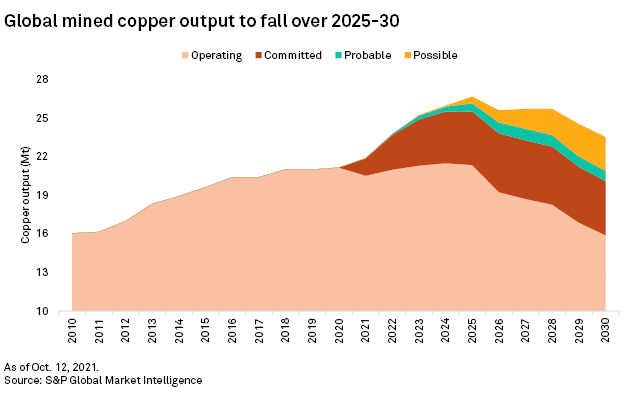

Based on our supply-side research, S&P Global Market Intelligence expects mined copper production to rise to 21.87 million tonnes and 26.14 Mt in 2021 and 2025, respectively, from 21.16 Mt in 2020, bolstered by brownfield mine expansions and some large greenfield projects. Although we identified 14 probable and 26 possible projects in the copper pipeline, it remains unlikely that all will come to fruition. Despite our expectation of an easing of the copper concentrate market balance through to 2025, our base case forecast for 2026-2030 sees the copper industry unable to meet growing demand for concentrate, even when including uncommitted development-stage projects that could potentially move forward and start up during this period.

* Based on our supply-side research, we expect mined copper production to rise to 21.87 Mt and 26.14 Mt in 2021 and 2025, respectively, from 21.16 Mt in 2020.

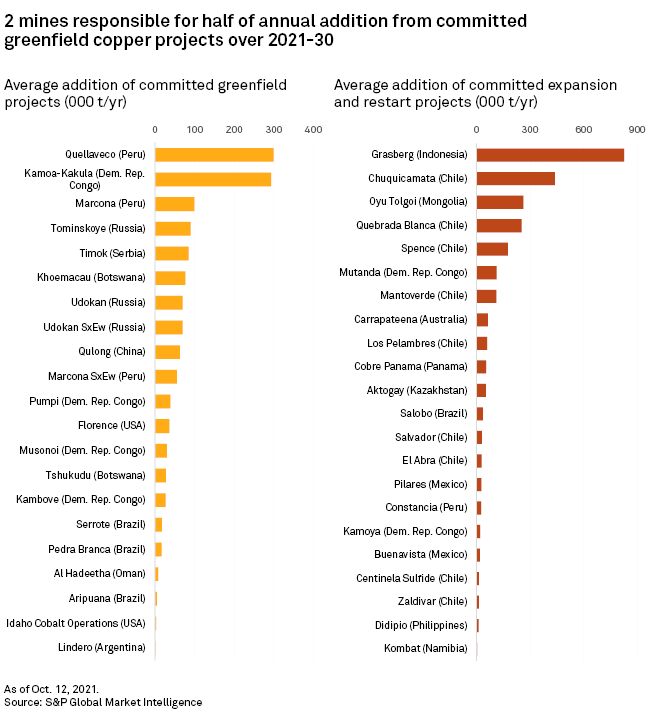

* Supply growth will be bolstered by brownfield mine expansions, led by Freeport-McMoRan Inc.'s Grasberg Block Cave ramp-up in Indonesia, Codelco's Chuquicamata underground mine in Chile and Rio Tinto Group's Oyu Tolgoi project in Mongolia. Two large greenfield projects, Anglo American PLC's Quellaveco mine in Peru and Zijin Mining Group Co. Ltd.'s Kamoa-Kakula project in Democratic Republic of the Congo, or DRC, will add a combined 722,000 tonnes of mined copper supply by 2025.

* It remains unlikely, however, that all the probable and possible projects identified in our copper supply pipeline will come to fruition. We expect 43 committed assets, which include projects under construction and those with budget or permit approvals in advanced stages, will be responsible for 4.39 Mt of additional supply on average annually from 2025 to 2030. Probable and possible projects, however, could increase supply by 628,000 tonnes and 515,000 tonnes, respectively, in 2025 and 781,000 tonnes and 2.43 Mt in 2030.

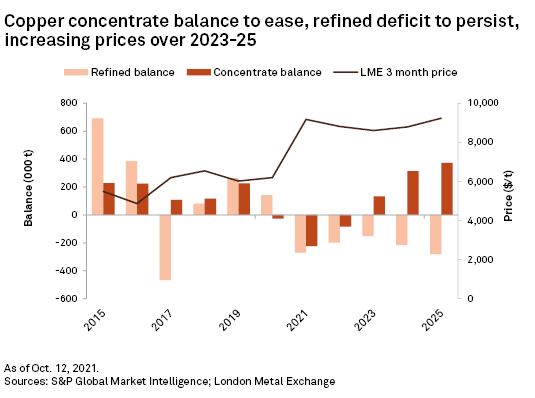

* Despite our expectation of an easing in the copper concentrate market balance through to 2025, we forecast that the refined copper market will move into a 279,000-tonne deficit by 2025 from a 142,000-tonne surplus in 2020.

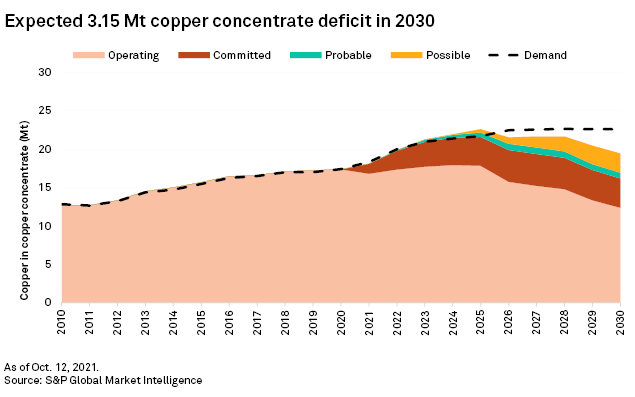

* Our base case forecast from 2026 to 2030 sees the copper industry unable to meet growing demand for concentrate, even when including uncommitted development-stage projects that could potentially move forward and start up during this period.

Near-term mine output growth not enough to prevent deficit in refined market

Mined copper output increased at a CAGR of 1.5% in 2015-20, compared with 4.1% in 2010-2015, as low copper prices in 2014 did little to incentivize investments in new projects. A copper price resurgence in 2020-21, amid huge economic incentives to help countries recover from the COVID-19 pandemic, combined with a strong demand outlook expected from growth in renewable power and electric vehicle markets have led to more projects being advanced. Market Intelligence analysis shows that companies have focused their exploration budgets on expanding known deposits and existing mines, which has hindered the discovery of new major greenfield deposits. Exploration typically requires higher capital expenditure and a longer period to startup and is fraught with the difficulties associated with the discovery of new, large-scale copper deposits.

Capacity additions from new large-scale projects, assuming development progresses on time, are expected to relieve the tightness in the concentrate market, whose balance is forecast to move to a 373,000-tonne surplus in 2025 from a 223,000-tonne deficit in 2021. Despite this expected easing in the concentrate balance, we forecast that the refined copper market will move into a 279,000-tonne deficit by 2025 from a 142,000-tonne surplus in 2020.

Output from existing operations to fall from 2025 onward on declining ore grades

Production from existing copper mines, including concentrate and solvent extraction-electrowinning, or Sx-Ew, mines, is expected to increase at a CAGR of 1.0% in 2021-25 but fall at a CAGR of 4.7% in 2026-30, driven by declining ore grades and mine closures, including Glencore PLC's 33.75%-owned Antamina (BHP Group 33.75%, Teck Resources Ltd. 22.5%, Mitsubishi Corp. 10%), Codelco's Radomiro Tomic and Teck's Highland Valley. As a result, production from existing operating mines — not considering those assets that are starting up, project expansions or mine restarts — is projected to fall to 15.90 Mt in 2030 from 20.53 Mt in 2021.

This supply projection does not consider unannounced mine life extensions, tailings processing or reserve and resource updates, which would soften the projected fall. Exploring at and around their existing mine sites is the most common strategy adopted by miners, as it is less capex-intensive than developing greenfield projects. Our data shows a positive trend in the copper exploration budget since 2016, although the COVID-19 pandemic led to investments and worker mobility being scaled back. From 2016 to 2020, minesite represented 28% of the copper exploration budget, 10 percentage points higher than in 2006-2010, while grassroots' share remained stable and late-stage and feasibility fell 12 percentage points to 35%.

A key downside risk to supply is that our production forecasts for operating mines do not account for any ESG-related disruptions — an important factor that has affected mines, mainly those in Chile, where a water shortage has constrained output at some operations. As a result, several companies such as Antofagasta PLC are developing desalination infrastructure to use seawater at the mine site. Phase one of Antofagasta's Los Pelambres project, which includes an 800-liter-per-second capacity desalination plant, is expected to be finished in 2022. In addition to the increased spending with the desalination plant, the energy needed to desalinate and pump the water from the coast to high-altitude areas weighs on costs, but investments to mitigate water shortages will be key for both existing mines and future projects.

Diminishing supply from currently operating mines combined with the projected increase in demand for copper concentrate over 2021-2030 would result in a 3.85-Mt production shortfall in 2025. This shortage will not be observed, however, as known late-stage copper projects will contribute to narrow the deficit.

Not enough late-stage projects to meet demand in medium term

We have classified late-stage copper projects into "committed," "probable" and "possible" categories. The combined output from these operations, which include Sx-Ew mines, would increase global mined copper output to 26.67 Mt and 23.52 Mt in 2025 and 2030, respectively, from 21.87 Mt in 2021. In our most recent Copper Commodity Briefing Service, however, we forecast mined copper supply to rise to 26.14 Mt by 2025, as it is unlikely that all probable and possible projects will come to fruition.

There are 43 committed projects starting up production between 2021 and 2030. Expansions or restarts of existing operations are expected to contribute 66%, or 3.0 Mt, of the 4.57 Mt additional committed production in 2026, when output is forecast to peak. While most committed expansions are in Chile, greenfield projects are mainly located in Peru, DRC and Russia. The two largest greenfield projects are Kamoa-Kakula in the DRC, which started in June 2021, and Anglo American PLC's Quellaveco mine in Peru, which is expected to ramp up in mid-2022. Including both concentrate and Sx-Ew output, Minsur SA's Marcona and AO Holding Company Metalloinvest's Udokan are two other projects with average annual production above 100,000 tonnes. In terms of brownfield projects, the output of the three largest — Grasberg, Chuquicamata and Oyu Tolgoi — will be equivalent to more than 60% of total additional production in 2026. These projects will use block caving to mine the large deposits.

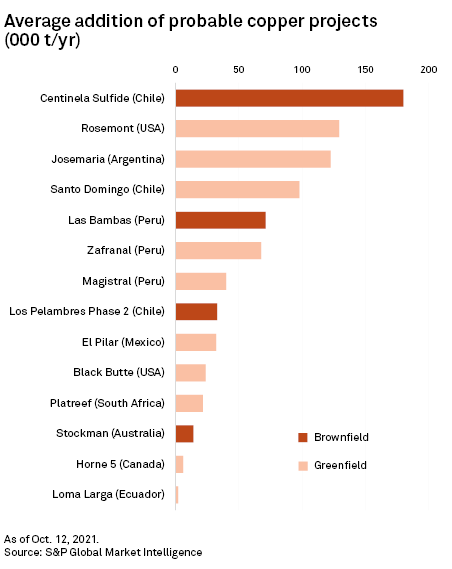

In the "probable" category, we have mapped 14 projects, with a potential peak combined output of around 880,000 tonnes per year in 2027. There are 10 projects defined as greenfield, with a typical timeline from feasibility to commercial production between five and seven years, according to our research, although some of them have been delayed due to difficulty in obtaining all the permits to start construction. The largest probable greenfield project, Hudbay Minerals Inc.'s Rosemont operation in the U.S., has seen construction suspended by the U.S. District Court for the District of Arizona since August 2019; the federal permit appeals decision is expected to be released in the second half of 2021. The other two probable greenfield projects expected to produce more than 100,000 t/y are Capstone Mining Corp.'s Santo Domingo in Chile and Josemaria in Argentina, owned by Josemaria Resources Inc., a Lundin Group Company. Capstone has obtained the key permits for construction and is expected to release a feasibility study of a cobalt project at Santo Domingo in the second half of 2022, while feasibility has been finalized at Josemaria and an Environmental Social Impact Assessment is to be completed in first-half 2022. The largest brownfield project is Antofagasta's Centinela Sulfide in Chile, which is expected to have an average production of 180,000 t/y when a second concentrator and tailings deposit will be completed, presumably in 2023, pending company Board approval in 2022.

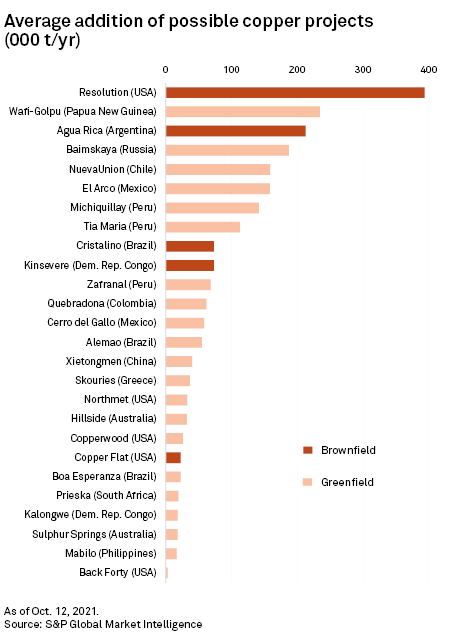

There are 26 assets in our "possible" project list, forecast to hit their production peak only in 2030 when their combined output could reach 2.43 Mt. Eight of these assets have an estimated annual output of at least 100,000 tonnes, with Rio Tinto’s brownfield Resolution project in the U.S. being the largest.

Tightness in mined copper market could push prices to unchartered territories

From 2026 to 2030, the copper industry will not be able to meet concentrate copper demand, barring unannounced expansions but considering all development-stage projects, including uncommitted ones that will likely be delayed or remain undeveloped. Our average three-month copper price forecast of $8,859/t in 2022-25 may open up opportunities for miners to gain funding for project development, as the average base case copper price for most projects is quite below our forecast.

As environmental, social and governance concerns strengthen, however, copper prices will be just one of the factors impacting project viability. Project acceptance by local communities and governments has become a significant hurdle for miners, with the potential to deepen the lack of supply. Action from the mining industry is imperative on these pressing issues in order to enable the much-needed projects to move forward in face of increasing demand from the electrification and the renewable energy revolution.

Products & Offerings