Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 12, 2025

By Dan Lowrey

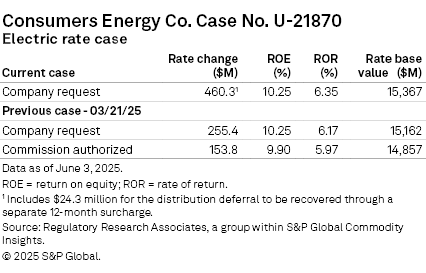

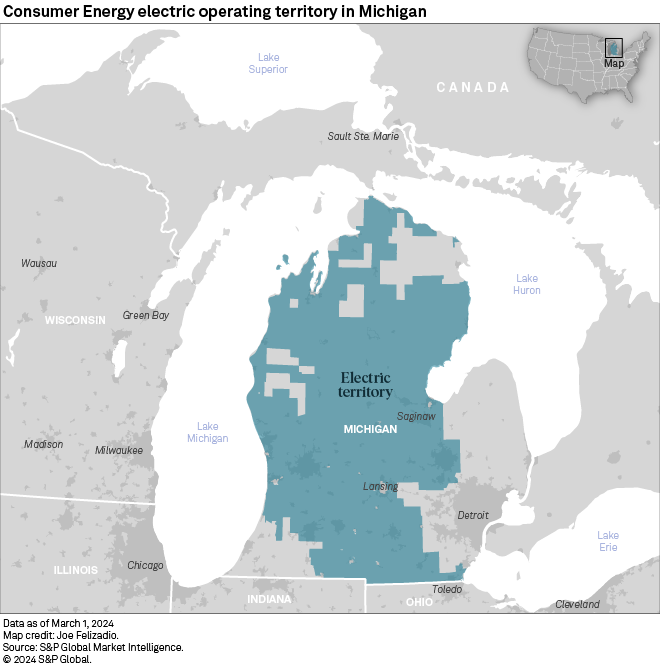

Consumers Energy Co. on June 2 filed a formal rate case application with the Michigan Public Service Commission seeking an increase in electric rates of $460.2 million, which includes $24.3 million that will be collected on a distribution deferral through a separate 12-month surcharge. The company's request is based upon a 10.25% return on equity (ROE), which exceeds national averages and is 35 basis points above its currently authorized ROE.

A procedural schedule has not been established in the proceeding. The company is requesting that the effective date of new rates is the later of the May 1, 2026, start of the projected test year or the date of the commission’s order in this case.

➤ Consumers Energy Co. (CE) is requesting an increase in authorized electric rates of $460.2 million for the test year ending April 30, 2027. A key driver of the request is continued investments in CE's Reliability Roadmap, which is a major overhaul of the company's distribution network to help it withstand extreme weather and repair deteriorating elements.

➤ The company is requesting an ROE of 10.25%, which is consistent with CE's previous requests in past rate cases, but exceeds national averages tracked by Regulatory Research Associates. The request is also above the company's currently authorized ROE of 9.90%, which it has consistently been authorized since 2020.

➤ RRA views the regulatory climate in Michigan as somewhat constructive from an investor perspective. In recently decided rate cases, the PSC has adopted ROEs exceeding prevailing industry averages. However, on July 31, 2024, RRA reduced its ranking of Michigan regulation to Average/1 from Above Average/3 following some contentious rate case decisions for the state's utilities.

The company is requesting (in Case U-21870) a $435.9 million increase in electric base rates, which includes $77.5 million for a return on a regulatory asset attributed to the J.H. Campbell plant over the projected 12-month period ending April 30, 2027. The commission has previously approved a 9% return on equity for the remaining net book value of the plant after the retirement of the coal-burning units in May 2025. The rate request also includes an additional $24.3 million for the distribution deferral to be recovered through a separate 12-month surcharge.

The increase is premised upon a 10.25% return on equity (42.94% of regulatory capital structure) and a 6.35% return on an average rate base valued at $15.368 billion for a test year ending April 30, 2027.

The requested 10.25% ROE is above the 9.72% average of returns accorded to electric utilities in all case decisions observed by RRA through the first quarter of 2025, as well as the 9.74% ROE average for the full year 2024.

In rate case decisions for vertically integrated utilities such as CE, the average for the first three months of 2025 was 9.83%, while the average for the full year 2024 was 9.84%. For further information regarding ROE trends, refer to RRA's latest "Major Rate Case Decisions Quarterly Update." CE is currently authorized a 9.90% ROE. About $77 million of the overall revenue request is associated with changes in cost of capital.

The application emphasizes the importance of funding CE's Reliability Roadmap, which outlines necessary investments in infrastructure to enhance reliability amid severe weather challenges highlighted in a third-party audit. The Reliability Roadmap presents a strategy for improving reliability through four key categories of work: forestry line clearing; hardening the system to address infrastructure in poor health and at risk from severe weather impact; inspections to identify and fix failures; and digital automation that includes technological solutions to increase the efficiency of distribution planning, service restoration and line clearing. CE is also proposing a ramp-up in line clearing to achieve a five-year clearing cycle on the low-voltage distribution system as compared to the company’s previous goal of a seven-year cycle. The ramp-up to a five-year cycle is planned to occur through 2031.

The company projected higher operations and maintenance expenses required to support long-term investments and ensure service reliability, along with increased financing costs to attract capital for these necessary investments.

Compliance with federal orders, such as the US Department of Energy's May 23 directive to continue operating the Campbell Plant beyond May 31, 2025, adds to the financial considerations in the rate case. CE indicated it is coordinating with Midcontinent Independent System Operator and complying with the DOE order. The costs presented in this electric rate case have not been adjusted to reflect the impacts of the DOE order. CE plans to request recovery of the costs associated with the order through a Federal Energy Regulatory Commission process.

The application also addresses future retirement of units at the D.E. Karn coal plant, whereby the company is seeking to recover costs incurred for maintaining these facilities, as well as for their eventual decommissioning and environmental responsibilities associated with the facility.

|

The application also provides funding for approved transportation electrification programs, which are centered on optimizing the charging load from electric vehicles to the benefit of all customers, and investments, incentives, programs and expenditures that are reasonably expected to increase transportation electrification in the company’s electric service territory. These programs include PowerMIDrive Residential, PowerMIDrive Public Charging and PowerMIFleet.

CE is proposing continuation of its Investment Recovery Mechanism (IRM) that will cover a two-year period beginning May 1, 2026, consistent with the start of the test year in this case. About $22 million of the overall revenue requirement increase request is associated with IRM distribution investments.

CE is currently negotiating the sale of its river hydro generation fleet, which includes 13 hydroelectric dams. Should the sale fail to materialize or receive regulatory approval, the company may need to reconsider decommissioning or relicensing these assets. In its application, CE is seeking to extend deferred regulatory accounting treatment of the assets through the test year.

With respect to rate design, CE is proposing to update the Residential Advanced Metering Infrastructure Opt-Out fees; update the production capacity charge, include a facilities allowance, and include a Power Factor adjustment for Rate LEDR; update new service connection fees, including a new overhead service connection fee and adjustment to the underground service connection fee; and increase the eligibility for the Shut Off Protection Plan from 200% to 400% of the federal poverty line.

CE is a CMS Energy Corp. subsidiary.

Previous rate case

Including the most recent, CE has filed six electric rate cases since 2020 at annual intervals.

The most recent concluded March 21, when the PSC issued a final order in rate case Case U-21585, authorizing the utility a $153.8 million increase in base rates, or roughly 60% of CE's most recent request. The authorized rate increase was premised upon a 9.90% return on equity (41.73% of regulatory capital structure) and a 5.97% overall return on rate base valued at $14.86 billion and test year ending Feb. 28, 2026. New electric rates were implemented April 4.

The commission also approved CE's recovery of $22 million through a separate 12-month surcharge for distribution deferral.

The order included approval for significant investments aimed at improving grid reliability. Notably, the order helps fully fund $125.1 million allocated for tree trimming and vegetation management and $86.3 million for strategic low-voltage line distribution investments.

The commission order adopted enhancements to CE's transportation electrification program for EVs. Among the enhancements are utilization of the North American Charging Standard and expansion of EV-charging rebate options for income-qualified residential customers. The enhancements applied to CE's PowerMIDrive Residential, PowerMIDrive Public and PowerMIFleet programs, as approved for continuation in this case and in previous rate cases, to support EV adoption.

The commission also directed CE to explore, along with other regulated electric and natural gas utilities, changes to summertime extreme weather policies, such as prohibitions on shut-offs during periods of extreme heat. Potential changes will be explored comprehensively in Case No. U-20140.

RRA view of Michigan energy regulation

Regulatory Research Associates views the regulatory climate in Michigan as somewhat constructive from an investor perspective. Even so, in July 2024, RRA reduced the ranking of Michigan regulation to Average/1 from Above Average/3. RRA concluded that while the jurisdiction remains more constructive than average from an investor viewpoint, the outcomes of certain recent rate proceedings could indicate a tightening in the regulatory climate.

RRA had placed the state on watch following a 2022 rate case decision in which the PSC authorized DTE Electric Co. (DTE-E) an increase in rates that was less than 10% of that requested but did not lower the ranking at that time. At the time, RRA viewed the decisions to be an anomaly, as a large part of the revenue requirement difference stemmed from reliance on a higher post-COVID-19 sales forecast than the utility had used in its revenue requirement calculations.

DTE-E has had two rate cases decided since then, and while generally more constructive, the company requested rehearing of two issues with respect to its latest case decided Jan. 23, 2025. The commission denied the request for rehearing. DTE-E is not the only company that has faced challenges in recent rate proceedings before the PSC. In a July 2, 2024, electric rate decision for Indiana Michigan Power Co. (IMP), the commission authorized the company a rate increase that was about half of what the company requested and kept its authorized ROE unchanged despite recent increases in interest rates. While the approved ROEs for both DTE-E and IMP remain above prevailing industry averages, they compare less favorably to those averages, which have risen, albeit modestly, in recent periods.

Nevertheless, the commission has several constructive practices in place: a streamlined rate case process, a framework for utilizing forecast test years to reduce regulatory lag and a framework that permits a cash return on certain construction work in progress, thereby reducing the uncertainty of cost recovery. Retail competition for electric generation is in place but is limited, and attempts to raise this limit have not been successful.

For additional information concerning the regulatory climate in Michigan, refer to the Michigan Commission Profile.

For additional detail concerning RRA's regulatory rankings, refer to the most recent State Regulatory Evaluations Quarterly report.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme

Location

Products & Offerings

Segment