Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 12, 2025

By Anna Duquiatan

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

Access the databook.

See Commodity Insights' most recent market outlooks for aluminum, copper, gold, iron ore, lithium and cobalt, nickel and zinc.

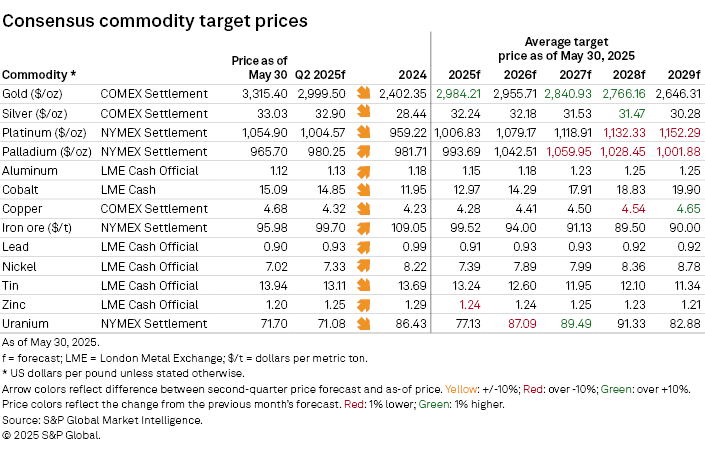

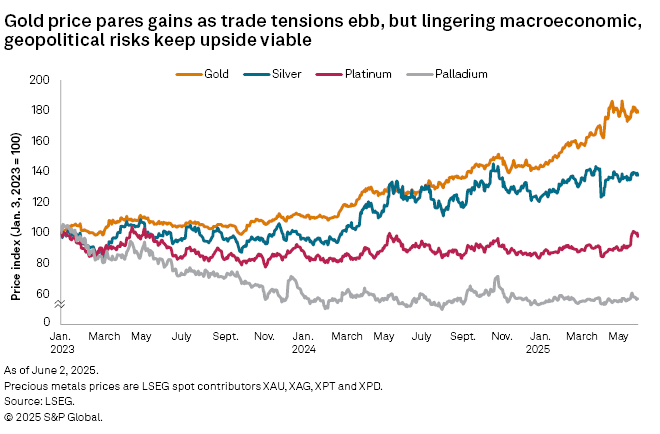

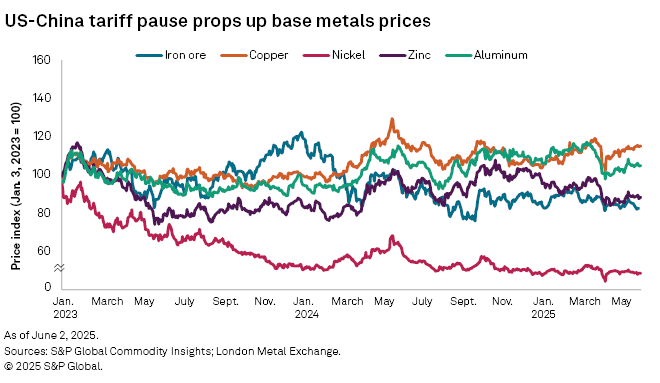

A temporary deferral of steep US-China trade tariffs renewed demand optimism across industrial metals markets in May, but the upside was limited by lingering concerns over the impacts of still-evolving trade dynamics on global economic growth prospects. Gold prices retreated from recent highs as trade risks thawed but remained elevated as macroeconomic and geopolitical uncertainties continued to drive investors' flight to safety. Appetite for safe-haven assets continued to bolster the consensus price outlook for gold in 2025–26, while tariff-induced demand worries and pockets of oversupply weighed on price expectations for industrial metals.

After months of escalation, trade tensions between the US and China partially eased as the world's two largest economies reached an agreement on May 12 to temporarily back down from aggressive "reciprocal" tariffs for a period of 90 days. The US slashed its import duties on Chinese goods from 145% to 30%, while China lowered its tariffs on US products from 125% to 10%. However, the reprieve may prove fragile after both the US and China alleged violations of the agreement just weeks after it entered into effect.

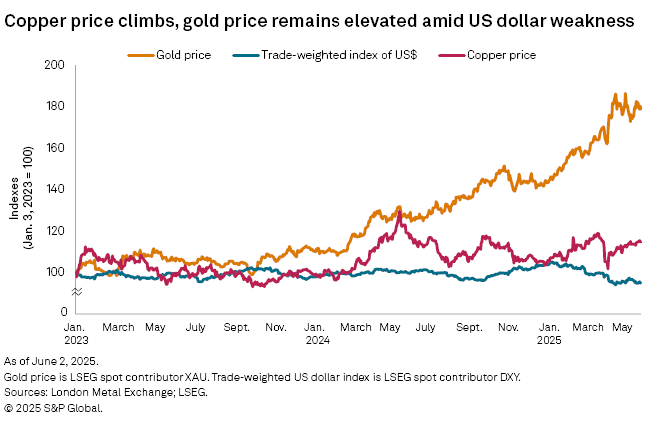

The trade-weighted index of the US dollar found temporary support from the US-China tariff pause but ended the month 10.1% weaker year-to-date. Despite the recent winding down of US-China import levies, the ongoing volatility in the global trade landscape continues to fuel concerns over supply chains, consumption levels and global economic growth prospects. The US Federal Reserve in its May 6–7 meeting said it downgraded US GDP growth expectations for 2025 and 2026, as tariffs stoke rising risks of inflation and unemployment. Global GDP growth outlooks from S&P Global Ratings have also been lowered amid trade uncertainty. Purchasing managers' indexes in the US and China were in contractionary territory in May, signaling a slowdown in economic activity.

China has expanded efforts to stimulate its domestic economy amid mounting trade challenges. The People's Bank of China announced May 6 that it would cut the reserve requirement ratio for banks for the first time since September 2024 and reduce housing loan rates. However, evolving trade dynamics and a sluggish recovery in the domestic property sector continue to drive downside risks for China's economic growth outlook.

After rising above the $3,400 per ounce threshold in late April, the London Bullion Market Association gold price pulled back in May to average $3,277.99/oz. As a temporary pause in US-China bilateral tariffs signaled cooling trade tensions, COMEX-based hedging slowed, and net long positions on COMEX gold declined in May. Yet, with the trade landscape remaining volatile, worries persist over potential inflationary pressures and slower global economic growth. Macroeconomic risks combined with geopolitical turmoil to bolster safe-haven demand for gold. Physically backed exchange-traded fund inflows reached a record high in April amid a surge of inflows into Asian funds, while central bank gold purchases remained robust in March. Consensus target prices for gold have been upgraded 1.5% on average for the 2025–28 period and downgraded 0.1% for 2029.

Bullish fundamentals and US dollar weakness kept the silver price supported on either side of $33/oz in May. Industrial applications in clean energy technologies and electronics fuel demand optimism for silver, while supply levels are expected to remain in deficit for the fifth consecutive year in 2025. A reprieve in trade tensions contributed to upside momentum for the silver price, but gloomy global economic growth prospects limit support. Silver consensus price forecasts have been adjusted 0.6% higher on average across 2025–28 and 0.3% lower for 2029.

The platinum price reached a two-year high of $1,094.60/oz on May 23, supported by expectations for a persistent structural deficit. In its latest quarterly report, the World Platinum Investment Council noted a shortfall of 816,000 oz in the platinum market during the March quarter, the largest single quarterly deficit in six years. Robust investment demand amid tariff-induced uncertainties offset reduced consumption in the automotive and industrial sectors during the quarter. Although overall demand is expected to decline for full-year 2025, supply will remain constrained, keeping the market deficit intact for a third consecutive year. Market tightness is limiting the downside for the platinum consensus price estimates, which have been lowered 0.5% on average for the 2025–29 period. Meanwhile, the palladium price largely moved below $1,000/oz in May, and consensus price targets have been downgraded 1.1% on average over the five-year forecast horizon.

The London Metal Exchange three-month (LME 3M) copper price recovered to reach a monthly peak of $9,610.00 per metric ton on May 23 as relaxed US-China trade barriers signaled renewed opportunities for copper trade. However, slowing manufacturing activity in the US and China amid lingering concerns over potential tariff impacts, a sluggish China property market and elevated refined supply, particularly in the US, limited price support. As anticipation of potential tariffs on US imports of copper encouraged front-loading, shipments jumped 55.5% month over month in March. On May 22, COMEX stocks exceeded levels held at the LME for the first time since March 2022, subsequently narrowing the COMEX-LME cash price arbitrage. Meanwhile, China copper cathode imports fell 8% year over year January–April, as domestic refined copper output rose 5.6%. Refined supply is largely expected to remain in a surplus through the end of the decade, while a concentrate deficit is projected to widen through to 2035. A concentrate supply squeeze prevails now, with spot treatment charges (TCs) continuing to tread record low levels. Consensus price forecasts for copper have been downgraded 0.3% on average for 2025–28 and adjusted 3.0% higher for 2029.

The brief respite from US-China trade tensions likewise drove the LME 3M zinc price to a monthly peak of $2,765.00/t May 14, but still-evolving trade dynamics could jeopardize demand prospects. Front-loading efforts triggered by worries over impending tariffs drove US refined zinc imports 28% higher month over month in March. Yet, the cost implications of increased import duties have weighed on US and China manufacturing activity, as well as US consumer confidence. Net investor positions on LME zinc entered negative territory for the first time since March 2024 amid heightened expectations of slowing global economic growth. Regarding supply, support from a steady decline in LME and Shanghai Futures Exchange inventories was offset by an ongoing loosening of the concentrate market as China spot TCs for zinc extended gains in May. Consensus price outlooks for zinc were lowered 0.2% on average for the five-year forecast horizon.

A stubborn supply glut prevailed over short-lived support from easing US-China trade friction at the LME nickel market, where the 3M price averaged at $15,540.40/t in May. Amid a backdrop of a persistently oversupplied global primary nickel market, investor funds remained net short on LME nickel in May. Nickel stocks at the LME held near a four-year high of 200,000 metric tons during the month. LME inventories are expected to remain robust even as the anticipation of potential tariff hikes could encourage metal flow into the US. Meanwhile, exacerbating demand-side pressure from a tenuous tariff pause, the US Congress is deliberating a proposal to revoke incentives introduced by former President Joe Biden for the purchase of electric vehicles. Slowing EV uptake would adversely impact demand for nickel and other battery metals. Consensus price expectations for nickel have been downgraded 0.2% on average for 2025–29.

The LME 3M aluminum price rebounded to $2,528.50/t on May 14 on the heels of the US-China tariff pause, before slipping to $2,444.00/t on May 30 amid lackluster fundamentals. Inventories at the COMEX and SHFE have fallen 54.1% and 24.3%, respectively, in the year-to-date period through May 30. Meanwhile, LME stock levels improved as canceled warrants — representing metal that could be withdrawn from warehouses — shrank significantly. On the demand side, China exports of semimanufactured products declined 6% year over year in January–April amid reduced operating rates and profit margins among downstream processors, while North American light-vehicle output projections have been lowered due to the impact of tariffs. Slowing global economic growth as increased tariffs materialize would further stifle demand and widen an already anticipated market surplus. Consensus price forecasts for aluminum have been downgraded 0.2% on average for 2025–27.

The Platts IODEX 62% Fe iron ore price was caught between a narrow range of $96-$101 per dry metric ton in May, with a brief rally to the monthly peak of $102.80/dmt on May 14 on the heels of the US-China bilateral tariff cut agreement. Platts is part of S&P Global Commodity Insights. US sector-specific tariffs on imports of steel, aluminum and automotives continue to drag on market sentiments, alongside a persistent steel oversupply in China. Steelmakers in China face increasing pressure to curtail production amid challenging market conditions, which include a sluggish recovery in the domestic property market and rising trade protectionism. Reduced China steel production would pressure iron ore demand, which is already reflected in January–April iron ore imports dropping 23.5 million metric tons year over year. The expected global seaborne iron ore trade surplus should be less severe over the next few years, as transportation infrastructure build-out challenges in Guinea slow the supply ramp-up from the Simandou greenfield project. As a result, consensus price outlooks for iron ore have been upgraded 0.4% for 2025 but downgraded 0.3% on average for 2026–29.

The Platts-assessed European cobalt metal price held at $16.00 per pound throughout much of May, buoyed by the depreciating US dollar as the market awaits clarity surrounding the export ban implemented by the Democratic Republic of Congo. The DRC government has yet to announce next steps after the export ban that took effect Feb. 22 reached its three-month review timeline in late May, with some observers speculating on a transition to a quota mechanism. Aimed at addressing abundant supplies, the export ban has yet to significantly impact production levels; major producers such as CMOC Group Ltd. and Glencore PLC anticipate steady output. However, DRC cobalt exports to China were lower year over year during the March quarter. Concerns have been raised about the possibility of stockpiled material flooding the market should the ban be lifted. Although EV uptake across key markets was strong in April, longer-term demand prospects are at risk amid accumulating trade barriers, such as US auto tariffs and imminent import duties on critical minerals. The cobalt consensus price target is 0.2% lower for 2025 and unchanged for 2026–29.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.