Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Nov, 2024

By Nathan Stovall and Zain Tariq

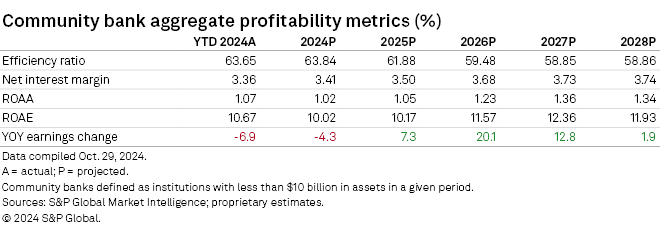

Community banks' net interest margins are expected expand and support earnings growth in 2025 even as the group faces higher loan losses.

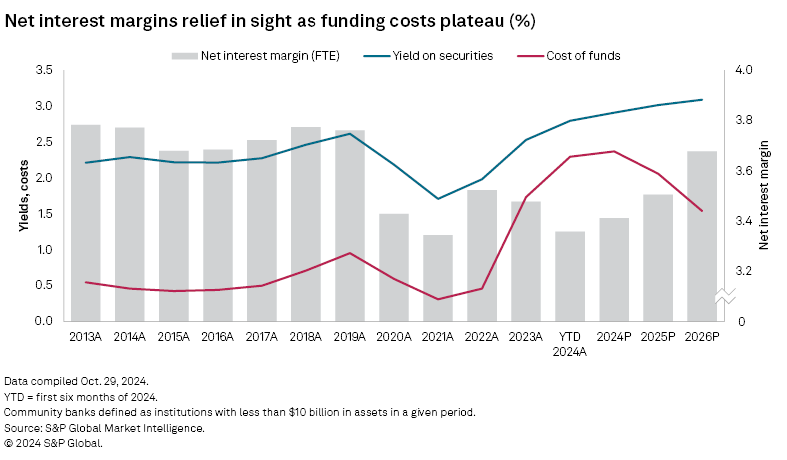

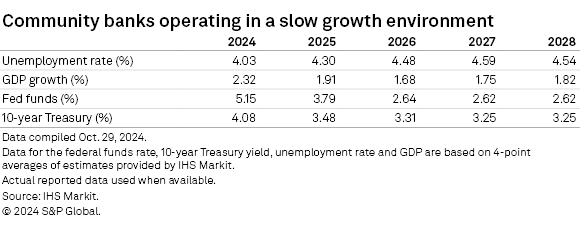

Community banks' funding costs likely peaked in the third quarter as the Federal Reserve shifted toward lower interest rates, but these banks will struggle to lower deposit costs quickly due to their increased reliance on certificates of deposits (CDs) for funding. Community bank margins should still expand as they benefit from newly originated loans carrying attractive yields, while fixed-rate assets reprice at higher yields. Given the sharp rate increases since the spring of 2022, certain assets may struggle to find refinancing options, particularly in commercial real estate, which could lead to loan losses. Community banks will experience challenges in their portfolios, but the overall impact of losses will not be as great as some fear. Capital also appears to be returning to the sector as valuations have recovered and have increased further since the US election, which could support some restructuring in connection with increased M&A activity.

Click here to access data exhibits and the US community bank projections template.

Community banks' deposit costs could stay sticky in the near term

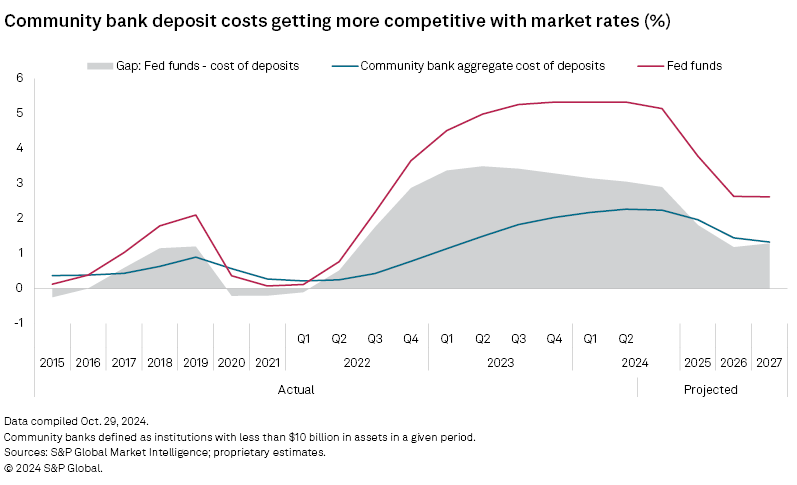

While deposits remain in focus for community banks, institutions are hoping to lower funding costs as the Fed pivots to lower interest rates. A number of community banks have ceased offering deposits with elevated rates, and the group broadly has become more competitive with rates available in the Treasury market, but substantial declines in funding costs might not occur for a few quarters as higher-cost CDs will take a while to mature.

Over the last few quarters, community banks have successfully grown deposits by raising interest rates on their offerings. By the second quarter of 2024, the gap between the average fed funds rate and the community bank aggregate's cost of deposits narrowed to 306 basis points. The gap has steadily declined since the peak of 349 basis points in the second quarter of 2023 and should contract further and support additional deposit growth.

Since mid-September, a number of banks have ceased offering CDs with elevated rates. As of June 28, 958 banks offered one-year CDs with annual percentage yield exceeding 4%. That number held fairly steady through early September, inching lower to 908 banks offering CDs above 4% as of Sept. 4. The Fed cut rates Sept. 18, and the number of banks in the group fell to 788 institutions by Sept. 27 and 600 banks by Nov. 1.

While fewer banks were marketing CDs with elevated rates, the products had grown to 27.3% of deposits by the end of the second quarter from 26.7% in the first quarter and 23.3% a year earlier. Many of those products carry one-year terms, meaning institutions might not feel pricing relief for some time. At the end of the second quarter, the bulk of CDs held by community banks were set to mature in the next year, with 29.6% of all CDs maturing or repricing in the next three months, while 84.1% of CDs were set to mature in the next 12 months.

Further rate cuts by the Fed will eventually relieve community banks' funding costs, but more substantial reductions anticipated in 2025 will be necessary to significantly lower deposit costs. Funding costs are expected to decline in 2025 with projected betas reaching 19.9%, a notable decrease from 2023.

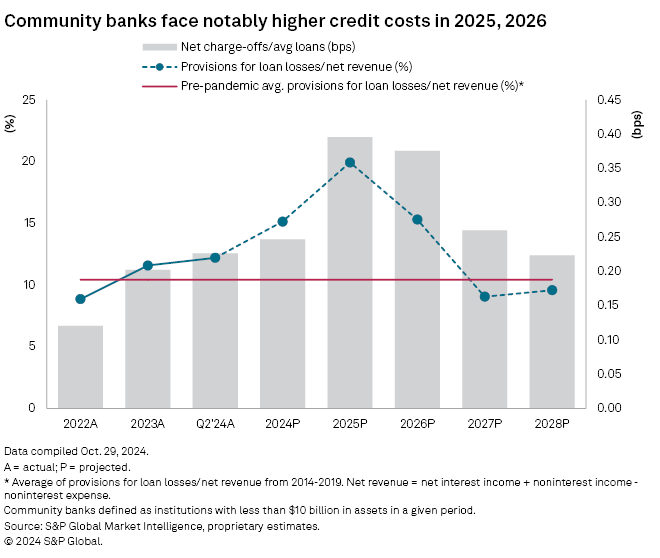

Community banks face higher credit costs but have earnings to absorb the hit

The investors and regulators continue to heavily scrutinize many community banks since they have outsized commercial real estate (CRE) concentrations and the asset quality of loans tied to the market has continued to slip. Despite concerns, community banks have reported only modest deterioration in their borrowing bases. While lower rates could offer some relief, we expect stress to continue to build over the next few quarters, leading to higher credit losses.

CRE exposures remain in the spotlight due to post-pandemic behavior shifts impacting the cash flows of many commercial properties as companies have adopted hybrid work models. Higher interest rates have also significantly increased borrowers' loan debt-servicing costs. While further Fed rate cuts could give borrowers some relief, intermediate rates have spiked off the lows in mid-September as investors weighed the possibility of higher deficits and prolonged inflation. The heightened focus from regulators and investors has come as CRE delinquencies at community banks have risen off historically low bases, increasing for seven straight quarters.

Against that backdrop, regulators have emphasized the importance of strong risk management for banks' CRE portfolios, particularly for institutions with elevated CRE concentrations. In certain cases, regulators have encouraged banks with a greater share of CRE in their portfolios to raise capital, particularly when seeking acquisitions. At a minimum, the regulatory focus seems to have constrained the growth of CRE loans, while some banks have incrementally pruned their CRE portfolios.

For instance, Atlantic Union Bankshares Corp. announced plans to sell as much as $2 billion of Sandy Spring Bancorp Inc.'s CRE loans as part of its plans to acquire the company. Valley National Bancorp said during its third-quarter earnings conference call that it planned to sell $800 million in performing CRE loans at a 1% discount in the fourth quarter. The bank subsequently raised capital to further reduce its CRE concentration and took advantage of the sharp increase in bank stocks after the US election to facilitate the transaction. This rally in the sector could support similar moves and encourage more M&A activity, including deals where buyers aim to divest portions of the target's loan portfolio.

Community banks will face challenges in their commercial real estate books, particularly as borrowers digest the impact of higher interest rates, less credit availability and lower occupancy rates since the pandemic. The real test will arise when many CRE credits mature and some borrowers struggle to refinance loans at significantly higher rates. In some cases, banks have offered extensions to those maturities.

We expect community banks to see higher charge-offs, with losses jumping in 2025 and holding near the same levels in 2026 due to extended loan terms. However, even with net charge-offs in 2024 expected to jump 30.6% from 2023 levels, losses and the reserves required to fund them should prove a modest hit to earnings as opposed to the more severe headwind that would occur during a significant economic downturn.

Provisions for loan losses are projected to rise to 15.1% of net revenue in 2024, up from 12.2% in the first half of 2024 and 11.6% in full year 2023, and may increase to 19.9% in 2025.

Scope and methodology

The outlook discussed in this article is based on a proprietary S&P Global Market Intelligence model that utilizes the actual results of nearly 10,000 active and historical commercial and savings banks and savings and loan associations. The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.