Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 04, 2022

By Todd C. Lee

The weaponization of the US dollar against Russia after its invasion of Ukraine has raised expectations that Beijing will accelerate its de-dollarization efforts, to protect against similar financial sanctions that Washington could deploy against China (mainland). While the Chinese renminbi (RMB) is unlikely to dethrone the US dollar in the global financial system soon, concerns remain that the dollar's weaponization against Russia has initiated an irreversible fracturing of the global financial system that will result in two international monetary systems, one led by the United States and one by China.

RMB internationalization and development as a reserve currency

The internationalization of the RMB and its potential emergence as a major reserve currency are related but not equivalent. The internationalization of the RMB is intended to increase its usage in international trade and financial transactions, while its possible ascension to a major global reserve currency entails RMB-denominated financial assets being widely and heavily held in central banks' foreign-exchange reserves.

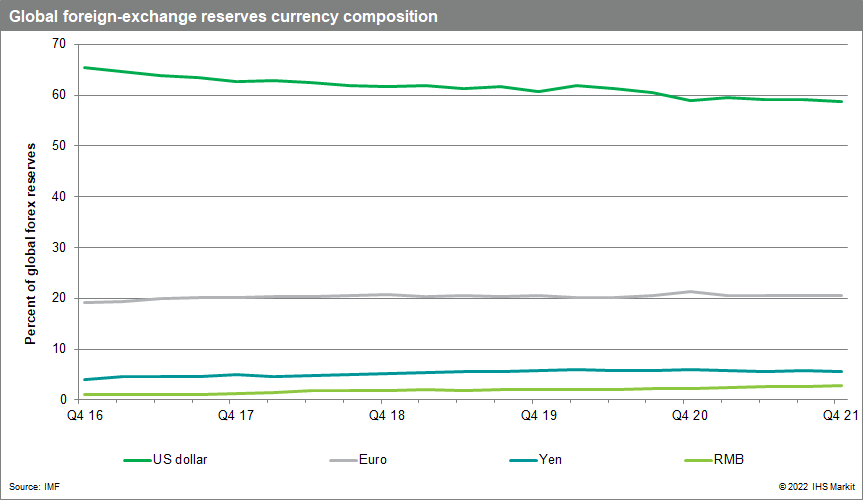

RMB's advancements in the two areas have been marginal, even with Beijing's greater push on both fronts since the early 2010s.

Prospects and impact of China's de-dollarization

Given the RMB remains far behind the US dollar in terms of international use and the role of the dominant global reserve currency, what countermeasures could Beijing deploy to protect China against US financial sanctions like those enacted against Russia?

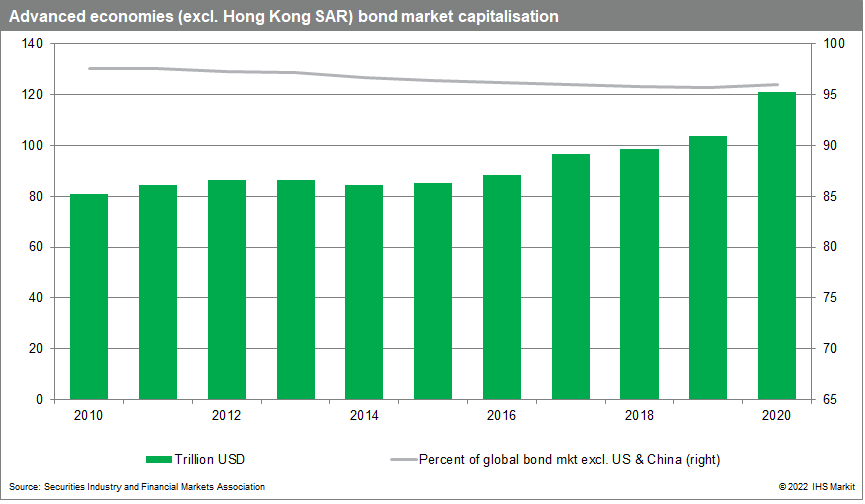

Option 1: Diversifying away from US dollar reserves

To protect against the US freezing China's foreign-exchange reserves, Beijing could aggressively diversify its reserve holdings away from US dollar-denominated assets. China reduced its holdings of US dollar reserves from 79% of its total foreign-exchange reserves in 1995 to 59% in 2016 (the latest data reported by China's State Administration of Foreign Exchange). This is far less than Russia's dollar-reserve diversification efforts, as the Russian central bank has reduced its holdings of dollar reserves to only 7% of its overall foreign-exchange reserves. However, because most of Russia's reserve diversifications went to financial assets of other advanced economies that are part of the US-led alliance against Moscow, more than half of Russia's foreign-exchange reserves were still frozen by the sanctions. Given the size and depth of advanced economies' financial markets, if Beijing were to diversify its reserve holdings away from dollar assets, it would have little choice but to reallocate its portfolio to the financial instruments of the other advanced economies. Indeed, advanced economies account for 96% of the global bond market excluding the US and China. (China cannot hold foreign-exchange reserves in RMB assets.)

Option 2: Full push for the RMB to achieve major global reserve currency status

Beijing could launch a forceful push to promote the RMB as a major global reserve currency. The key obstacle to this option is not the US dollar's entrenched dominance in international trade and finance that the RMB has struggled to chip away. Rather, the essential barrier to the RMB becoming a major global reserve currency is the Chinese government's inability to fully liberalize China's capital account, owing to its underdeveloped and insufficiently robust financial system. China's financial system is dominated by banks, which are mostly under state command. Given this, bank lending is not always based on commercial criteria and generally favors state-owned enterprises or politically connected private firms. China's bond market lacks transparency because China's subpar domestic credit rating industry has consistently provided inflated ratings for Chinese bonds. China's stock markets are highly volatile owing to poor corporate governance, inadequate accounting practices, low auditing standards, and speculative investments by retail investors. If Beijing fully liberalizes China's capital account, allowing unfettered capital flows across the country's borders, its less than fully healthy financial markets could induce debilitating capital flight during periods of economic stress.

Option 3: Expedite the development of China's central bank digital currency

Another potential option for China's de-dollarization is to fast-track the development of its central bank digital currency (CBDC). CBDC is fiat money issued by the central bank in digital format, which is widely available to the public. There are two types of CBDC: wholesale CBDC used by financial institutions, and retail CBDC used by households and businesses. Wholesale CBDC is already in use, as they are financial institutions' deposits at the central bank (that is, reserves). As a result, launching CBDC effectively means rolling out retail CBDC. The PBoC began developing China's CBDC - known as e-CNY - in 2017. Regardless of China's progress in e-CNY's development, requirements for the RMB to become a major global reserve currency remain the same. Specifically, China still needs to clear the hurdle of capital account liberalization. Furthermore, privacy will be a major concern for the internationalization of e-CNY despite the PBoC's assurance of e-CNY's "controllable anonymity," given that the institutional limits on governmental executive power in China are much more blurred than in advanced economies.

Prospects and impact of "shock and awe" financial sanctions against China

There are two major components of the US-led financial sanctions against Russia: removing Russian banks from SWIFT, and freezing the Russian central bank's foreign-exchange reserves.

It would be nearly impossible to completely cut off China's banks from SWIFT. Even the sanctions against Russia only imposed a partial exclusion of Russian banks from the system, the reason being Europe's heavy dependence on oil and natural gas imports from Russia. The international payment system and international supply chains are two sides of the same coin: goods sold and bought through the international supply chain are paid and paid for through the international payment system. Given that Europe is reluctant to completely cut off oil and natural gas imports from Russia, it cannot completely cut off Russian banks from the payment system.

China's entrenchment in the international supply chain dwarfs that of Russia. China is the world's largest goods trader and is deeply entrenched across a wide stretch of the global supply chain, while Russia is mainly a commodities exporter. Thus, completely cutting off China from the international payment system would send catastrophic shockwaves through the global economy, as it would effectively entail a hard decoupling with China. As a result, only the most extreme geopolitical conflict between China and the US could put this option on the table.

Freezing China's foreign-exchange reserves would be less catastrophic than completely removing China from the international payment system, although the resulting shocks to the global economy would still be extreme given the country's immense size. Freezing China's foreign-exchange holdings would severely impair the PBoC's ability to stabilize the RMB's exchange rate and fend off a currency crisis. An RMB crash would inevitably ensue, leading to an import collapse. The Chinese authorities would be likely to impose strict capital controls to stabilize the RMB. Foreign portfolio investment in China would be trapped, and multinational enterprises operating in China would be unable to repatriate their earnings.

Final word

Beijing's efforts toward RMB internationalization and reserve currency promotion have been unable to shake the US dollar's dominance in international finance and its role as the pre-eminent global reserve currency. China's under-developed and insufficiently robust financial system is the key technical obstacle to the RMB becoming a major reserve currency. China's blurry institutional limitations on governmental executive authority also pose a major impediment to the RMB's ascension to a major reserve currency. Ironically, the removal of these major barriers would imply a convergence of China's economic and political system with that of the advanced economies, which would greatly reduce the risk of the US-led shock-and-awe financial sanctions against China that Beijing is seeking to avoid.

Posted 04 May 2022 by Todd C. Lee, Chief China Economist, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.