Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Apr, 2023

By Tony Lenoir and Aude Marjolin

With the US dramatically ramping up energy storage to achieve its ambitious green energy goals, S&P Global Market Intelligence projects the country will grow its utility-scale battery capacity tenfold to 95 GW through 2035. Outsized dependence on imports for materials, components and the batteries themselves, however, present challenges.

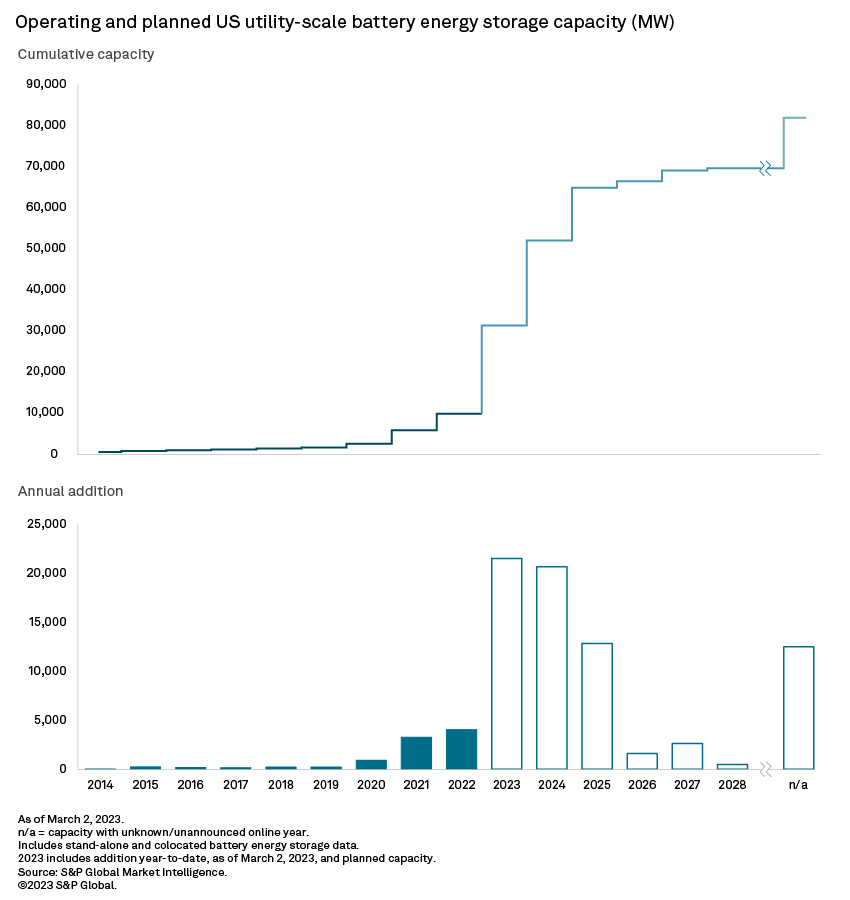

With only 10 GW in operation, battery energy storage, critical to reconciling renewable energy supply and demand, has not kept up with the renewable energy buildup in the US, potentially jeopardizing green energy transition milestones. But the segment is catching up fast, up nearly 300% in the past two years and looking down a pipeline of 72 GW of additional capacity, to be developed through the end of the 2020s.

Battery storage targets within state renewable portfolio standards are contributing to boosting the segment, and the S&P Global Market Intelligence Power Forecast projects the US will add 85 GW of battery energy storage capacity through 2035, with most battery energy storage projects in the country expected to be financially viable.

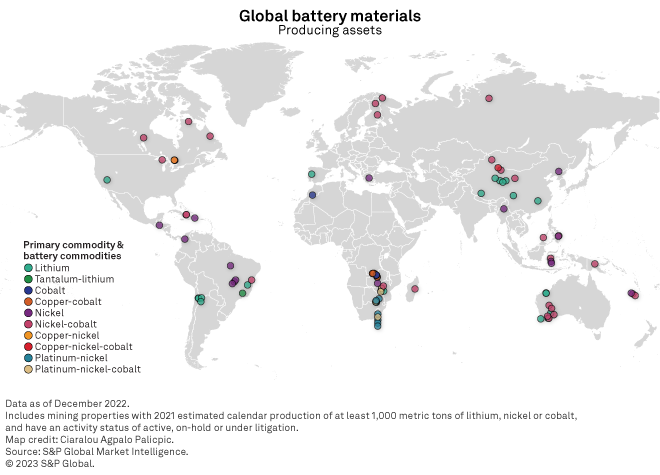

Overreliance on outside markets for materials, components and manufactured batteries — for which the power sector competes with electric vehicles — looms large over the US battery storage road map. That said, the US has some of the world's largest lithium reserves and resources, a competitive advantage that remains largely untapped.

Charging up on battery energy storage 101, US market outlook

Battery energy storage systems (BESSs) are critical to a successful energy transition, given the intermittent nature of solar and wind power. Those systems accumulate, hold and dispatch energy, frequently sourced from renewables, in opportune sequences, reconciling peak production and consumption cycles. As such, battery energy storage is the keystone bridging the gap between renewable energy production and consumption, without which the green energy edifice cannot stand.

Without an adequate keystone, useful renewable energy that could have been produced will instead be lost. This is known as curtailment, or the willful reduction of renewable energy generation. High curtailment rates make the goal of decarbonizing the US power sector harder to reach.

Set to accelerate the green energy transition in the US, the Inflation Reduction Act of 2022 shines a spotlight on the need for storage solutions. A growing number of states are incorporating, or increasing, BESS capacity targets in their renewable portfolio standards (RPSs). Billions of dollars are being poured into battery research and development to optimize efficiency, reduce costs and boost duration capabilities.

BESSs may operate on a stand-alone basis or be paired — colocated — with a generator, often a renewable project, most commonly solar. A more cost-effective solution given the potential for economies of scale in the construction phase (when planned upstream), colocated systems are edging out their stand-alone counterparts. The massive pipeline of US solar projects — about 230 GW currently — can only magnify this trend.

The image below is a video presentation; please click on the image to access controls to play, pause or navigate to specific video frames. To view the video in full screen, please click the square at the bottom right of the video player; to exit full-screen view, please click "x" or press the "Esc" key.

Revenue generation

BESSs make most of their money through three broad revenue streams: arbitrage; resource adequacy; and, to a lesser extent, ancillary services.

Arbitrage revenue is generated by charging during periods of low wholesale electricity demand and dispatching at peak hours — buying low and selling high. In the case of renewable production, particularly solar, this implies accumulating energy during the day, when insolation is at its highest, to discharge in late afternoon, early evening. With winds often blowing in the late hours of the day, BESSs generally save surplus wind energy production at night to dispatch it in the morning when energy demand increases.

Independent System Operators (ISOs) with a resource adequacy market offer capacity revenue opportunities for BESSs. Resource adequacy mandates minimum levels of generation capacity to balance out anticipated energy supply and demand in a region. ISOs ensure resource adequacy by securing the capacity of energy resources in exchange for a recurring fee — generally monthly and expressed in dollars per unit of capacity (e.g., $/MW or $/kW) — via multiyear contracts. In essence, capacity revenue is the equivalent of the subscription model prevalent across services, providing steady cash flows.

Ancillary services contribute to grid reliability. Including fast-response services — mostly frequency regulation, "black-start" and contingency reserves — ancillary services characterize the need for resource adequacy. Frequency regulation smooths out small, short-term imbalances between supply and demand. Black-starts help restore parts of the grid in the event of an outage. Contingency reserves fill in for other generation resources when they fail.

To learn more about our energy data and analysis, request a demo.

The current US market

The US was slow to develop the utility-scale battery storage infrastructure necessary to ensure grid reliability amid its renewable buildup, but the pace has noticeably accelerated. At the end of 2020, the country had about 2.5 GW of combined stand-alone and colocated utility-scale battery storage capacity; it built an additional 3.3 GW in 2021 and 4 GW in 2022, bringing the nationwide total close to 10 GW.

Colocation accounts for the bulk of total BESS capacity in the US, currently at 58%, up from 52% in 2020. In 2019, colocated systems contributed 33% of the annual addition of large-scale energy storage capacity. This metric rose to 48% in 2020 and jumped to 74% in 2021, before coming back down to 48% in 2022. Now, about 77% of colocated utility-scale BESSs in the US are paired with solar projects, according to Market Intelligence data.

The pace of deployment has picked up, but state-level data shows development is concentrated in a handful of markets. California and Texas account for nearly 72% of operating battery energy storage capacity. Third-ranked Florida operates only 546 MW — a mere 25% of Texas' tally and 11% of California's. Overall, 41 US states have utility-scale battery storage in operation, but the bottom 31 operate 700 MW in aggregate, accounting for only 7% of overall capacity.

US outlook

As of writing, the US had more than 72 GW of combined stand-alone and colocated battery energy storage in the works, with all 50 states and the District of Columbia planning to deploy large-scale battery energy storage capacity. Texas leads the pack with more than 29 GW in planning, or 40% of the US pipeline. Driven, in part, by ambitious RPSs, the Western US states of California and Nevada round out the top three, with an aggregate 25 GW. Combined, Texas, California and Nevada account for three-quarters of the planned US total.

Planned colocated capacity accounts for more than 57% of the overall pipeline. Nearly 38 GW of planned colocated BESS capacity, or 92% of the planned colocated total, is to be paired with solar projects. For perspective, the metric stands at 3% for colocation with wind. Combined with current operating capacity, the pipeline pushes the percentage of utility-scale solar capacity paired with battery energy storage to 14%, up from 6% today.

The development of utility-scale BESS capacity is picking up, in part driven by RPS targets in some of the most populous states in the US, but the current pipeline is not enough to accommodate the country's renewable energy transition. Ten US states, to date, target specific amounts of large-scale battery energy storage capacity: California, Connecticut, Illinois, Maine, Massachusetts, Nevada, New Jersey, New York, Oregon and Virginia. In addition, states such as Maryland, New Hampshire and Tennessee promote the deployment of BESSs through tax credits.

The S&P Global Market Intelligence Power Forecast projects the US will add over 85 GW of utility-scale battery energy storage capacity by 2035. Power Forecast expects high arbitrage opportunities in the Electric Reliability Council of Texas territory, particularly in western ERCOT, due to the region's high renewable energy penetration levels. Generally, the West, which includes the California Independent System Operator territory, offers relatively similar prospects. In the northeastern US, where overall conditions have kept renewable penetration somewhat in check, the logic is reversed; even so, projections for BESS economics are relatively healthy, thanks to solid resource adequacy opportunities.

Potential challenges

These ambitious battery energy storage goals could be kept in check by the US' reliance on outside markets for supply, with this exposure ranging from materials to the batteries themselves. Even if the US were to onshore manufacturing for all its battery needs, it would still depend on imports for most of the materials and components that go into battery production.

However, domestic production of batteries is being boosted by government incentives, such as tax credits outlined in the Inflation Reduction Act. The 2022 law is accelerating investment along the entire supply chain, from battery production to mining. On the latter side, it is evidenced in exploration budgets targeting lithium for the US nearly doubling in 2022 to the highest country amount of $93.5 million. Mined supply is not expected to meet domestic demand, however, mostly due to administrative challenges in the form of lengthy permitting processes through state and local governments, compounded by environmental concerns.

While the US holds a significant amount of the world's lithium reserves and resources, the country only produced 0.6% of the 2022 global lithium output from its single operating mine, Albemarle Corp.'s Silver Peak operation in Nevada.

Further action is expected in a long-standing, controversial permitting process for what could become the largest planned lithium mine in the US. Lithium Americas Corp.'s plans for its feasibility-stage open pit Lithium Nevada mine, most commonly known as Thacker Pass, are contingent on the outcome of a federal ruling regarding whether environmental laws were followed. Moreover, members of the Fort McDermitt Pauite, Shoshone and Bannock tribes are protesting the use of sacred ancestral land for the project and the potential harm to Indigenous people from an influx of workers into the area.

Many of the hurdles of the green energy transition — in the US as well as elsewhere, and for lithium and other energy metals alike — are embodied in this issue. Complicated permitting processes, extended time frames from exploration to mine commissioning, and environmental and sometimes sustainability concerns surrounding the location of the deposits and the toll a mine would take on local inhabitants and ecosystems are weighing against increasing demand and a need for local supply chains.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Rameez Ali, Chris Allen Villanueva, Adam Wilson, Steve Piper, Eric Hanselman, Ciaralou Palicpic and James Mantooth contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.