Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Dec 9, 2024

By Cesar Pastrana

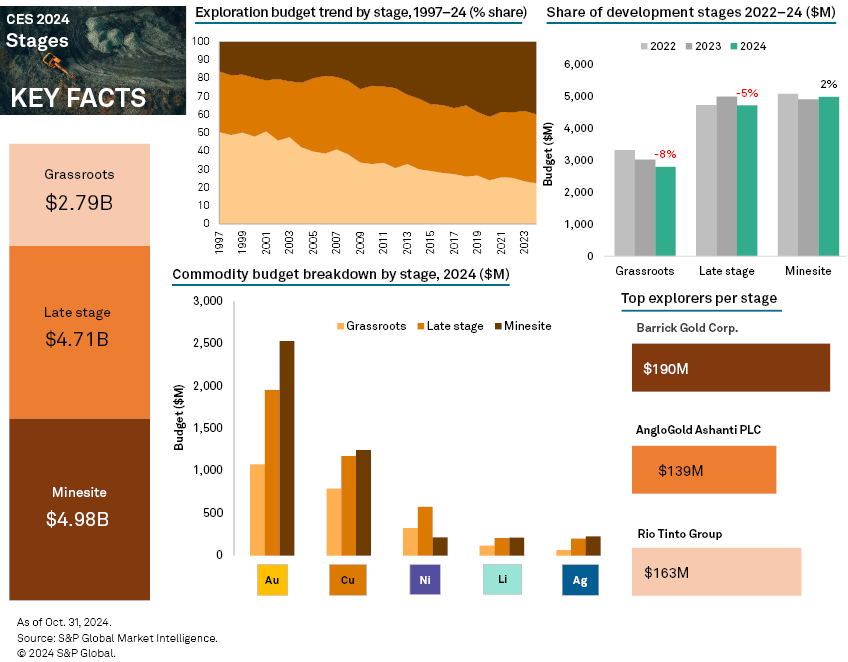

Global nonferrous exploration budgets declined again in 2024. Grassroots and late-stage exploration budgets decreased 8% and 5%, respectively, while minesite exploration increased a modest 2% year over year. Reductions to gold budgets negatively impacted both early- and late-stage allocations, while rising budgets for minesite copper, gold and lithium contributed to the growth in minesite exploration.

In 2024, grassroots exploration hit another record low in global share, following a previous decline in 2023. This trend indicates continued waning interest in generative projects as explorers opt to focus more on late-stage and minesite assets. While this shift is partly a natural progression as assets mature, the challenging investment climate has further compelled explorers to concentrate on extending resources at known deposits. Although this approach may be less rewarding, it is often perceived as less risky compared to venturing into uncharted territories.

Consequently, this trend has adversely affected the rate of new discoveries. With decarbonization and electrification on the horizon, the identification of new deposits is crucial to meet the increasing demand for minerals.

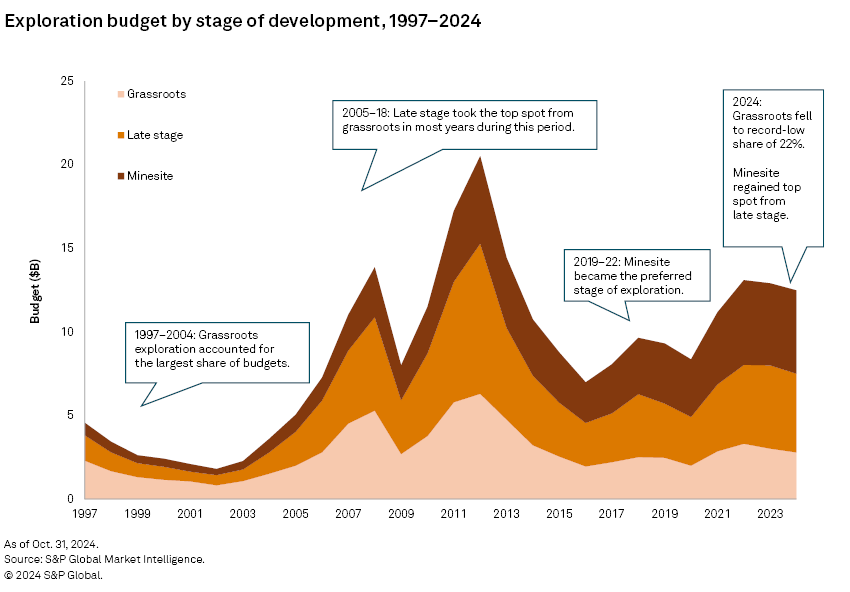

Based on our discovery series, we have consistently observed a downward trend in both the number of discoveries and the amount of contained metal over the years for both copper and gold exploration. Between 1997 and 2004, explorers concentrated on new discoveries, with grassroots exploration receiving nearly half of the annual global budgets. Since then, the share allocated to grassroots exploration has gradually diminished, however, as explorers shifted focus from generative, early-stage programs to late-stage and minesite exploration.

While this transition is partly natural, as assets are expected to mature over time, the decline in the investment climate following the drop in metal prices after peaking in 2012 has compelled explorers to adopt a more risk-averse stance and reprioritize their budget allocations. This shift has led to an increased emphasis on extending known deposits, which tends to boost company-held resources but limits opportunities for new discoveries. Although there has been an increase in reserves over the years, these gains predominantly come from older deposits or existing mines rather than new discoveries.

In tandem with explorers' decreasing allocation toward generative programs, both late-stage and near-mine exploration budgets have increased over the past decade compared to the late 1990s to early 2000s. Since 2017, these two stages have been in constant competition to be the largest allocation.

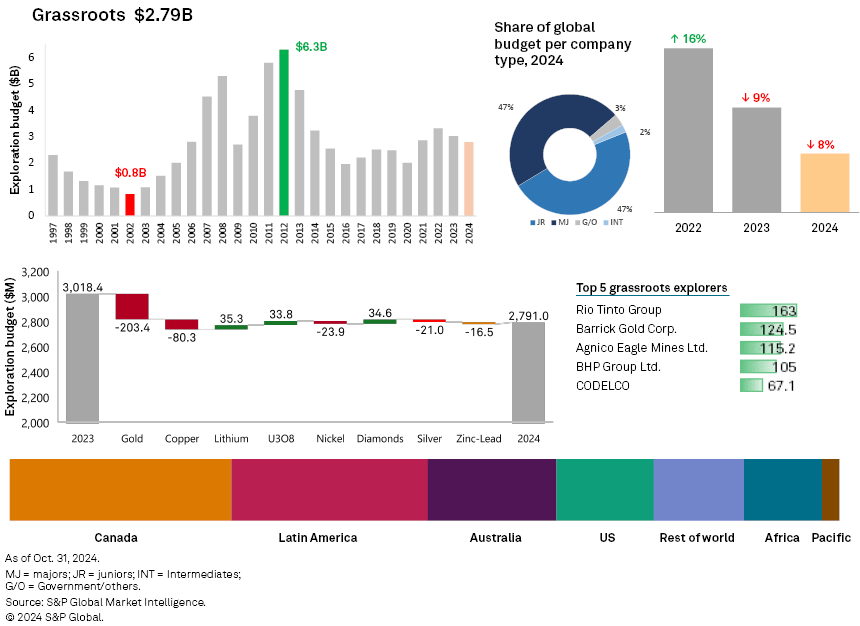

Grassroots hits new record low

Grassroots exploration's share of global budgets has consistently trended downward since its 2001 peak. In 2024, allocations fell 8% to $2.79 billion, pushing its share to a record low of 22%.

Australia recorded the most significant decline in grassroots budgets, with gold and copper allocations decreasing 32% and 25%, respectively. Several Latin American countries — including Ecuador, Mexico and Chile —cut their budgets by more than $20 million each.

Rio Tinto Group, the leading grassroots explorer, decreased its allocation for the region by a significant 57%, highlighting a major shift in investment strategy. Additionally, Vale SA reported a 42% decrease in its grassroots budget, primarily affecting its copper assets. These reductions reflect broader trends in the mining industry, with companies reassessing their exploration investments in response to fluctuating market conditions and economic uncertainties.

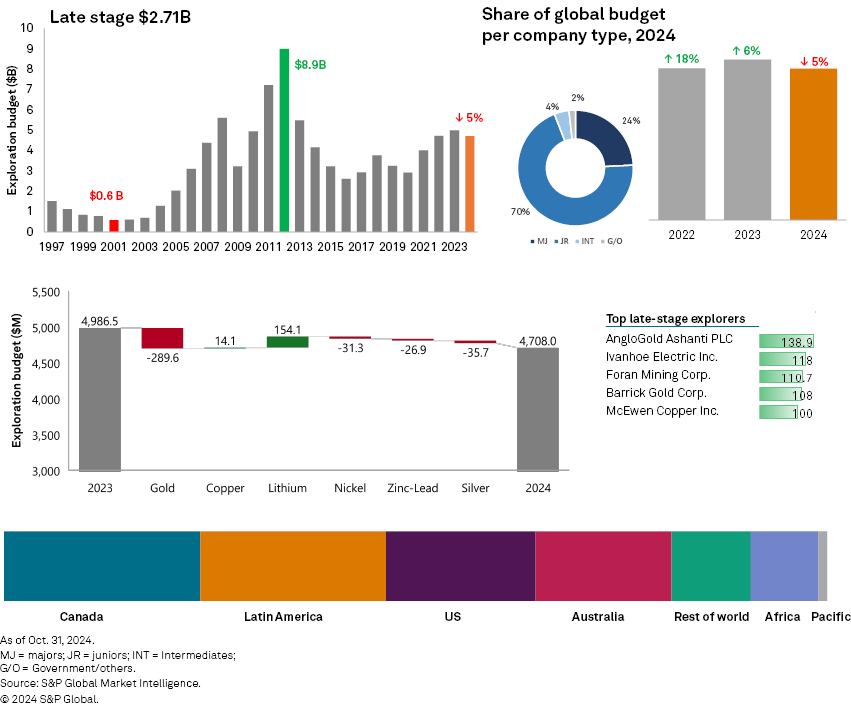

Late stage declined the most

Late-stage exploration recorded the largest decrease among all stages of development in 2024 to $4.71 billion, breaking a three-year trend of growing budgets. This resulted in a slight decline in its share of the global budget to 38% and caused it to fall to second place among all stages. The decrease in late-stage allocations was mainly driven by contributions from the Australia and Latin America regions, primarily due to reduced funding for gold and, in Australia's case, copper, too.

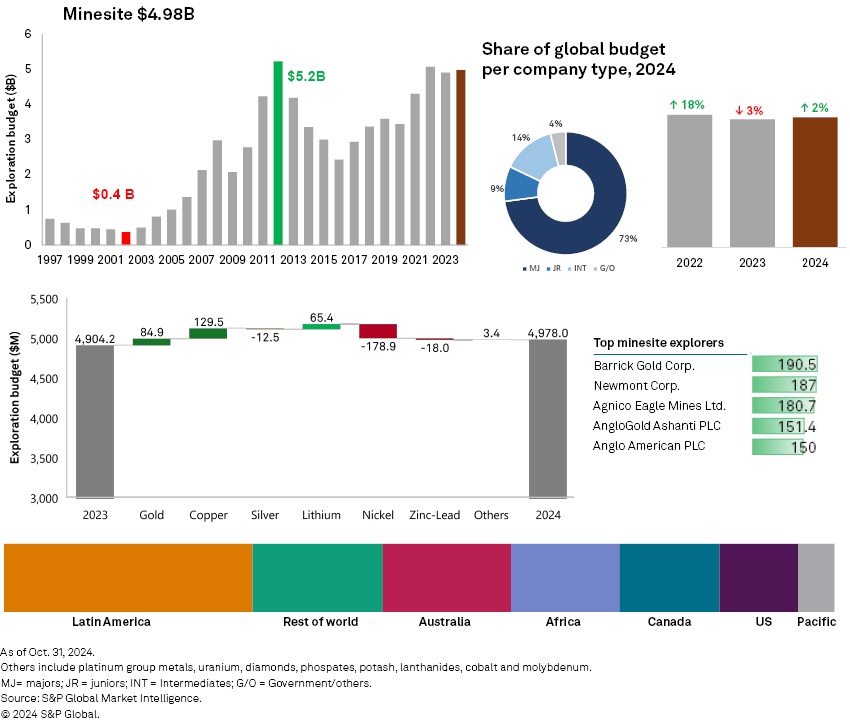

Minesite remained resilient amid a tight capital environment

There is a different narrative for minesite exploration than for the other stages of development, as it was the only one that increased year over year. Although the growth is modest at 2%, it is sufficient to position minesite as the preferred stage in 2024, with gold and copper being the primary drivers.

Elevated interest rates have adversely affected both equity and debt markets, limiting juniors' access to funding for exploration and operational activities. In contrast, major companies depend less on capital markets to finance their exploration efforts. These majors typically own the majority of active and producing mine assets, which provides them with a steady cash flow to support their operations. This financial stability allows them to navigate the current economic landscape more effectively than their junior counterparts.

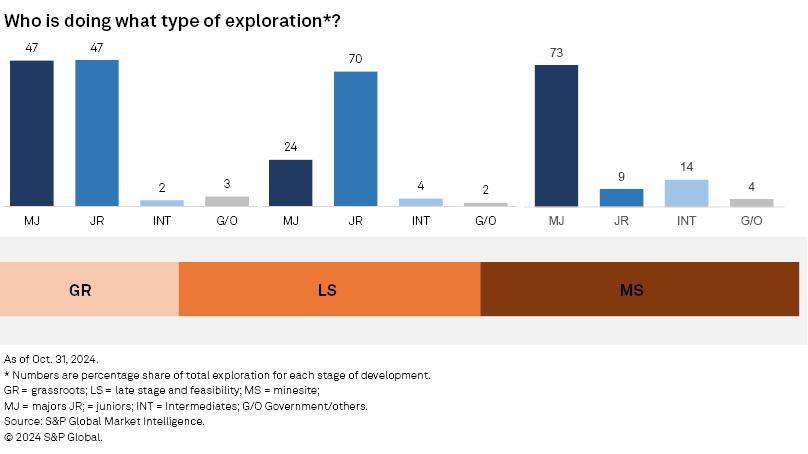

Who is doing what type of exploration?

Juniors continue to lead in grassroots exploration, but a challenging financing environment has limited their allocations, allowing majors to gain ground. Late-stage exploration budgets have significantly decreased for most explorers, while majors maintain a strong presence in minesite exploration, accounting for nearly one-third of the total budget.

Underinvestment in generative exploration threatens new supply pipeline

The exploration sector reflects a complex landscape marked by a decline in grassroots and late-stage exploration, juxtaposed with modest growth in minesite budgets. This shift underscores the industry's cautious approach, heavily influenced by volatile metal prices and a challenging financing environment.

The trend toward prioritizing known deposits over new discoveries raises concerns about the long-term sustainability of resource availability. As the exploration landscape evolves, the balance between risk and reward will be crucial for explorers aiming to revitalize discovery rates while navigating financial constraints. Without renewed investment in generative projects, the potential for significant discoveries may continue to wane, posing challenges for the future of the nonferrous sector.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.