Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 20, 2024

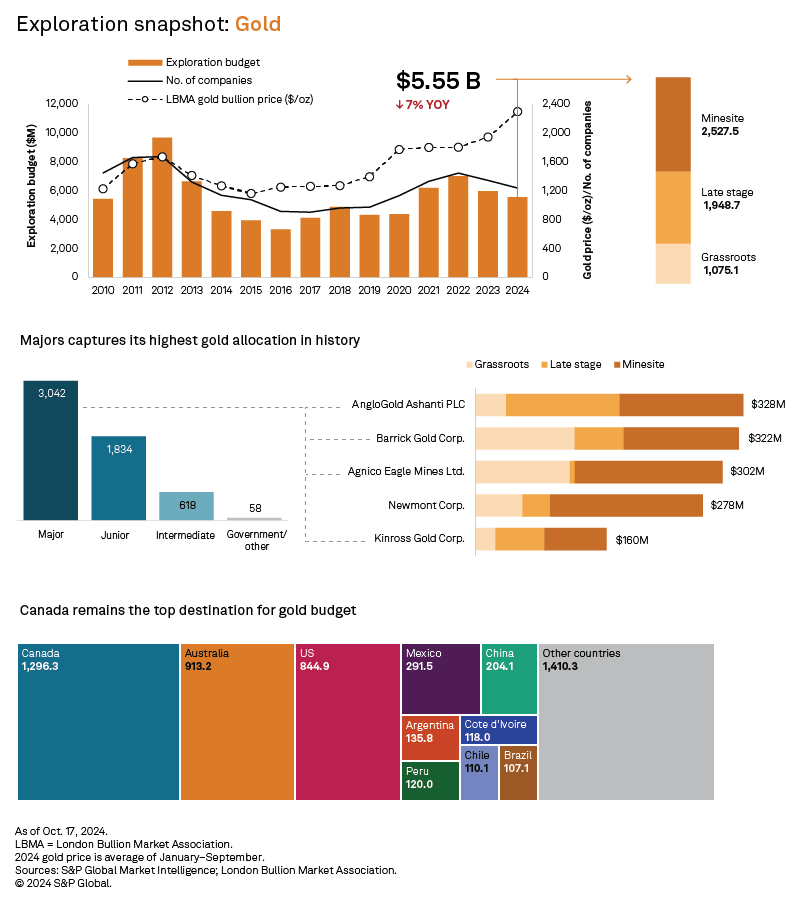

Gold exploration budgets declined 7% to $5.55 billion in 2024, despite high gold prices. The budgets accounted for 45% of global exploration but represented the lowest share for gold in the past decade. The number of gold explorers decreased 8% to 1,235 in 2024, influenced by consolidation among major companies and fewer junior explorers.

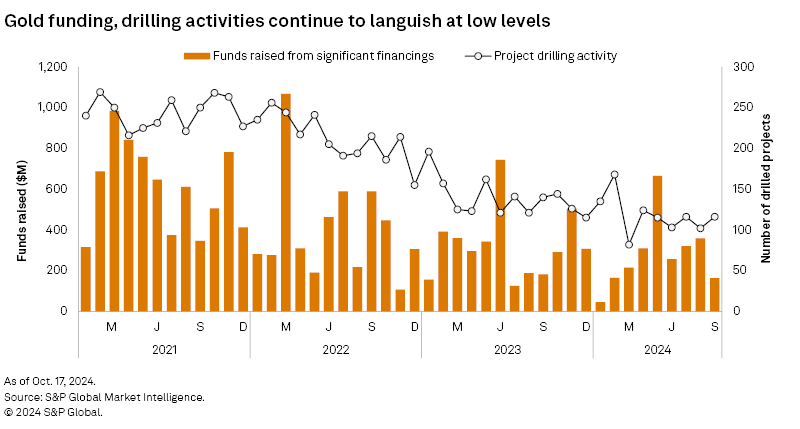

Exploration companies have increasingly prioritized cost efficiency over risky ventures, resulting in a 7% year-over-year decline in gold exploration budgets. This downturn has persisted despite gold prices reaching historical highs, accentuating a disconnect between market dynamics and exploration funding that has particularly affected the junior companies. Explorers seem likely to maintain their focus on stable investments, as seen in recent years. Allocations for grassroots projects have diminished, a trend that can only be reversed if capital markets become more receptive to risk. Amid this backdrop, rising gold prices may serve as a catalyst for higher exploration budgets in 2025, underscoring the importance of monitoring the financing of gold projects in the upcoming quarters to see if capital markets will buck the trend of the last two years and respond favorably.

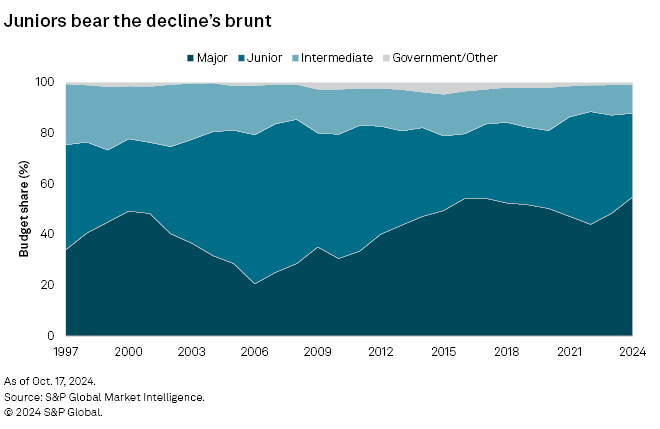

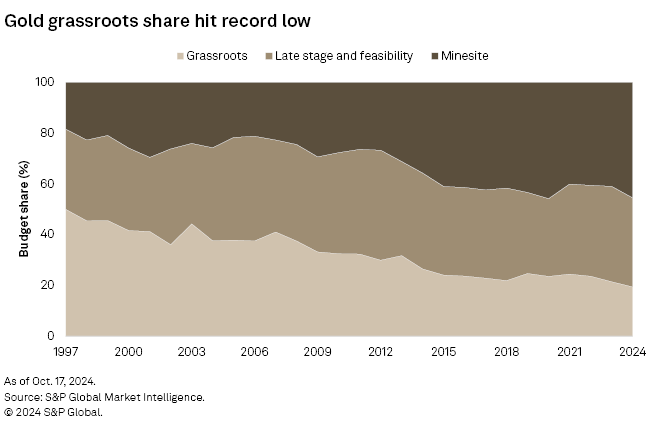

The cautious approach among investors has highlighted the disconnect between market prices and exploration funding, with ongoing financing difficulties in the junior sector significantly contributing to the downturn in gold mining budgets. Companies prioritized cost efficiency, often through mergers among major gold miners, over pursuing speculative exploration with the juniors. There has also been a notable shift toward more stable assets, resulting in 10 consecutive years of higher minesite allocations compared to earlier stages of exploration.

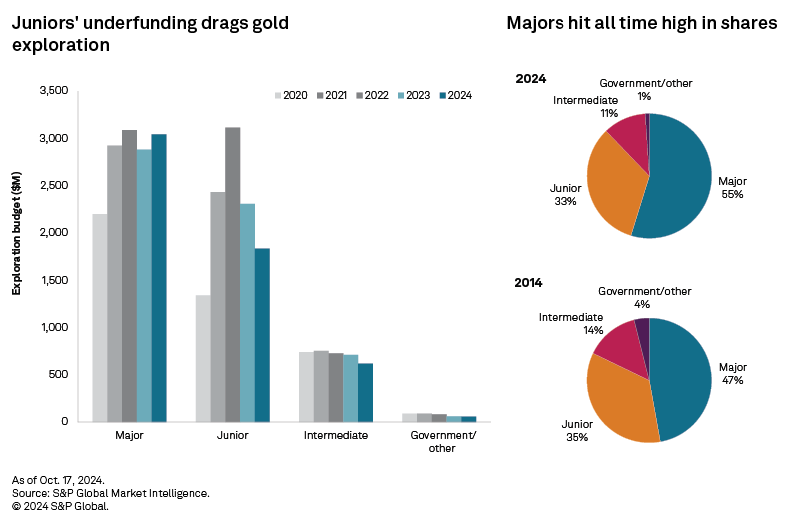

Majors surpass $3B amid funding challenges for juniors

Elevated post-pandemic interest rates have led market participants to favor investing in bonds over risking their capital in smaller companies. Junior miners faced significant funding challenges, leading to a 21% decline in their gold budgets, with their share falling to 33%, a four-year low. Intermediate companies — another sector that has relied on capital markets — experienced a 13% year-over-year decline in their gold budgets, barely maintaining their share of the global allocation above 11%.

Among junior companies, De Grey Mining Ltd. stood out with the highest budget, allocating over $60 million for activities at its gold assets in Western Australia, particularly focusing on late-stage work at Hemi. The company has enough cash to fully fund the initiative to enhance its resource estimate and integrate it into underground mining studies. This is not the case, however, for most juniors, as only 43 companies have budgets of at least $10 million in 2024 — down 10.4% year over year — while the total budgets of 2023's top 20 juniors dropped by an aggregate of about $50 million in 2024.

Major companies exceeded $3 billion in exploration budgets combined, capturing a 55% share of the total gold budget — the highest they have ever attained. The five major companies with the highest budgets in 2023 had increased budgets in 2024, effectively offsetting the decline in the overall number of majors with gold exploration budgets, which decreased to 73 from 78.

For the first time in 12 years, three major companies have surpassed $300 million in gold exploration budgets. AngloGold Ashanti PLC secured the leading position in gold exploration in 2024 with a total budget of $328 million. Over a third of this allocation is dedicated to its operations in Nevada, where a key priority is completing the prefeasibility study for the Silicon project by 2025. Close behind is Barrick Gold Corp., which boosted its gold budget 37% to $322 million. Like AngloGold, Barrick Gold has been exploring at various stages in Nevada, dedicating nearly $140 million to the state, a significant portion of which is allocated for the prefeasibility study at Nevada Operations. Agnico Eagle Mines Ltd., 2023's top company, marginally increased its budget to $302 million, which led to it losing its top position. The company remains focused on its interest in Canadian Malartic, where it recently completed almost 30,000 meters of drilling as part of the exploration program at Odyssey.

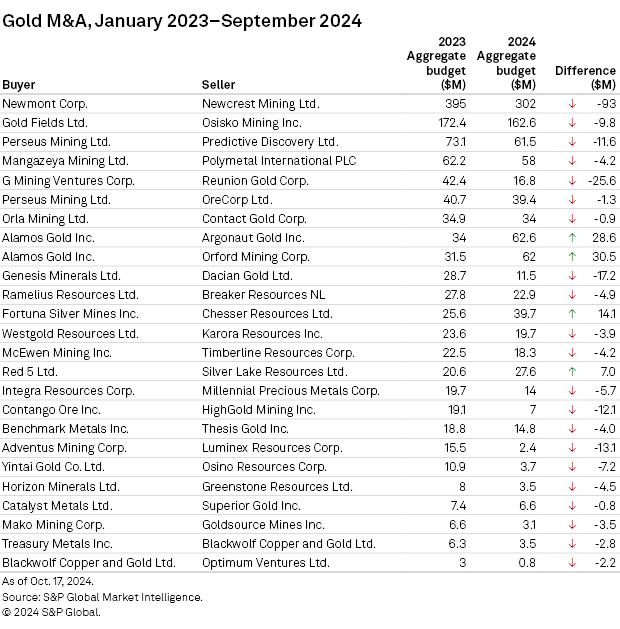

M&A amplifies gold budget cuts

M&A activities have been the strategy to achieve value and mitigate risks, often resulting in lower combined exploration budgets. Examining company-level consolidations in the mining sector, nearly all gold-focused companies that completed M&A activities from January 2023 through September 2024 reported year-over-year declines in their gold exploration budgets. Newmont Corp., which acquired Newcrest Mining Ltd., experienced a $93 million reduction year over year in its aggregate budget for 2024. While Newmont's budget slightly increased, Newcrest's estimated budget plummeted to just $24 million from $123 million for the period prior to Newmont assuming control of operations.

A notable exception to the trend of budget reductions following acquisitions is Alamos Gold Inc., which nearly doubled its budget after acquiring Argonaut Gold Inc. and Orford Mining Corp. This increase reflects broader budget expansions across its key assets, driven by exploration success in 2023. The Island and Mulatos projects together accounted for approximately 60% of the total budget. The acquired companies had a combined budget of only $6 million for gold in 2023 — a relatively minimal amount that had little impact.

Shift to existing gold assets continues

The industry has become more prudent in its exploration strategies, opting for safer investments in minesite work, rather than pursuing riskier assets that are still in the early stages. Allocations to grassroots-stage projects decreased 16% to $1.08 billion, with its total share down to a record low of 19%. As the industry shifts toward more stable assets, the total share of near-mine exploration increased to 45% in 2024, while the share of late-stage exploration decreased to 35%.

Two major companies — Barrick Gold and Agnico — had an over $100 million budget each for early-stage work, but this planned expenditure did not offset the significant decline in the number of companies pursuing grassroots projects, which decreased by over a hundred to a total of 711.

Since 2005, major companies have focused the majority of their budgets on existing gold assets, and this year they have hit a record high of $1.9 billion — over 70% of the minesite budget.

The decline in grassroots projects had a ripple effect on the broader mining industry, considering the stage's vital role in discovering new resources. A recent report on gold discoveries highlights how the trend of reduced budgets may constrain future supply, noting that none of the discoveries made in the last decade have ranked among the largest 30 gold discoveries. Recent discoveries have been scarce and smaller, averaging 3.5 million ounces, compared to the 5.5-Moz average from 2010 to 2019.

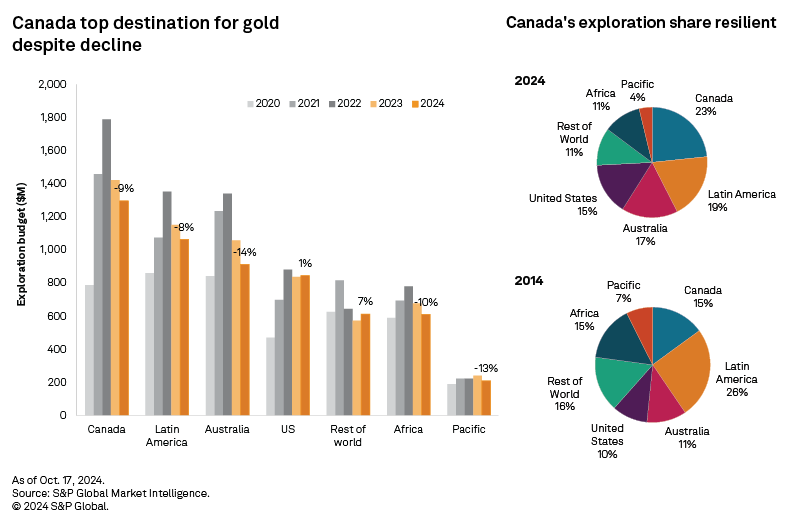

Gold budgets down in leading regions

Canada remained the leading destination, with a $1.30 billion budget, despite a 9% decline. Most campaigns in the region focused on late-stage exploration, which received $581 million. Although this is the highest amount allocated, it still represents a 17% year-over-year decline. Agnico Eagle increased its budget 5% to $233 million, 18% of Canada's total gold exploration budget. Among the 10 companies with the highest budgets in 2023, only Agnico and Eldorado Gold Corp. recorded increases.

For the third consecutive year, Latin America received a gold exploration budget exceeding $1 billion, despite an 8% year-over-year decline attributed to reduced allocations for the region's traditional leaders — Mexico, Argentina, Chile and Brazil. Each of these countries still received budgets exceeding $100 million, however. Fresnillo PLC now holds the largest budget for gold exploration in the region, with nearly 90% of its drill program in the first half of 2024 targeting brownfield sites, while also conducting work to resume operations at its Lucerito and Candamena projects in Mexico. AngloGold Ashanti's gold exploration budget in Argentina increased 61%, but the budget for its operations in Brazil and Colombia decreased $31 million.

Australia ended a three-year streak of receiving an over $1 billion gold budget following a 14% budget cut in 2024, bringing the total down to $913 million. Among the 10 companies with the highest budgets for Australia's gold exploration, seven increased their budgets, but the significant decline in the juniors' planned spending — to $351 million from $467 million — was too substantial to maintain overall budget levels. For the past two years, the juniors had been the most active in Australia's gold exploration, but they are now outpaced by the majors, which recorded only a nominal increase of $7 million, bringing their total to $369 million. Among these majors, Northern Star Resources Ltd. allocated the largest budget for gold exploration, dedicating $87 million to support ongoing activities, including the expansion of mineral resources within the current mining footprint at KCGM.

Gold price could rally exploration

Rather than a liquidity influx for exploration, companies increasingly focused on risk-averse strategies that enhance their bottom lines. As of the end of the third quarter of 2024, year-to-date funds raised for junior and intermediate companies are down 11% year over year, according to September data from the Industry Monitor report. Aside from lower funds raised, the total number of financings was also lower year to date compared to the same period in 2023. Drilling activity has shown a modest recovery, with 116 gold projects reporting drill results, but the total number of drillings year to date is still 17% lower year over year.

A positive response from the capital market regarding gold prices — which surpassed $2,700 per ounce in the fourth quarter, with further upside anticipated — will serve as the key catalyst to turn things around for gold exploration. Should gold prices remain elevated, support for gold exploration may strengthen in 2025, especially in a period of easing interest rates.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.