Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 8 Nov, 2023

By Sean DeCoff

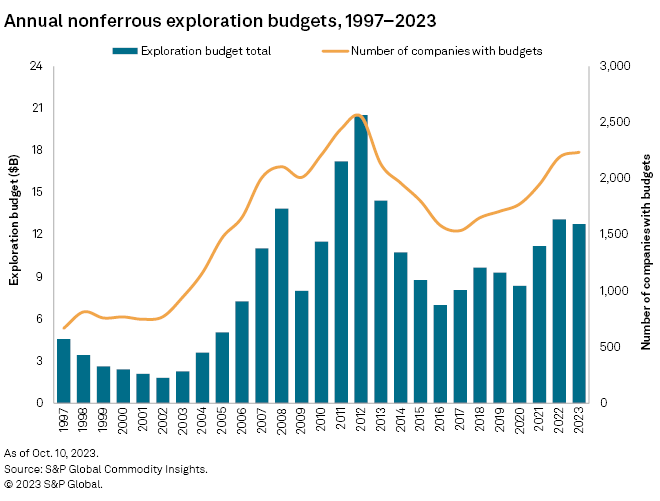

The recently released global exploration budget data for 2023 from S&P Global Commodity Insights' Corporate Exploration Strategies (CES) series shows that the macroeconomic headwinds and geopolitical tensions have taken a toll on exploration activity. While metal prices remain elevated compared to pre-pandemic levels, most have fallen considerably from their 2022 highs. Monetary tightening by central banks has restrained the flow of new capital, directly impacting junior explorers, which rely heavily on capital raisings to finance their exploration programs. Our survey of 3,100 public and private companies in 2023 revealed that the global aggregate nonferrous budget fell 3% year over year to $12.8 billion.

Tightening financial conditions and a pull-back in metal prices led to a modest 3.3% decrease in the aggregate nonferrous exploration budget in 2023. The global total registered at $12.8 billion.

As raising funds became more difficult, junior explorers were disproportionally affected and therefore accounted for the bulk of the decrease. For 2024, we forecast exploration budgets to hover around current levels; however, should the macro environment and financing conditions remain as is, we believe that a modest year-over-year decline (<5%) is the most likely scenario.

Accelerating energy transition initiatives as part of a global move to reduce carbon emissions boosted the mining industry's recovery from the COVID-19 pandemic. Rising demand drove many metals prices to all-time highs, which led to better market conditions and increased exploration financings during 2021. The positivity of 2021 resulted in a 34% increase in exploration budgets, a trend that continued into 2022, although some global macroeconomic uncertainties emerged. Despite concerns over rising inflation and geopolitical fallouts from Russia's invasion of Ukraine, several metal prices along with energy prices spiked, which exacerbated inflation rates globally. Nonetheless, positive momentum continued, and exploration budgets grew another 17% in 2022.

Moving into 2023, outlooks dramatically seesawed, with economic performance varying geographically. Many economies — most notably the US — had stronger-than-expected growth. While historically positive for commodities, low unemployment and stable GDP growth, coupled with rising energy prices, forced the US Federal Reserve to continue down the path of monetary tightening. As a result, interest rates rose much higher than anticipated, the dollar continued to strengthen and commodity prices retreated. Despite the uncertain environment and significant growth registered in the past two years, 2023 exploration budgets held up fairly well, decreasing a relatively modest 3%.

As 2023 draws to a close, we feel a similar story will likely emerge in 2024. Metals prices and financings have underperformed for most of 2023, which has directly impacted drilling activity. At the time of writing, September drill activity was the slowest in three years and funds raised by juniors and intermediates currently sit 14% lower year to date. Financings will likely remain depressed, given Fed statements indicating that rates are likely to remain elevated for longer. Countering the downside risks, however, are expanding country-level net-zero commitments, which continue to fuel exploration programs for base and battery metals. We forecast exploration budgets to hover around current levels for 2024; however, should the macro environment remain as is with financing conditions remaining difficult, we believe that a modest year-over-year decline of about 5% is the most likely scenario. The steepness of any decline, however, will depend on the next several months when the sector usually begins planning its next-year program and tapping the market for necessary funding.

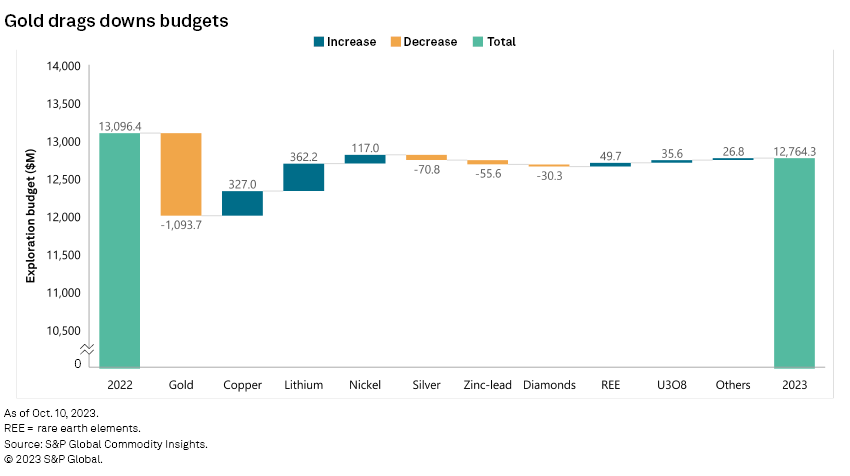

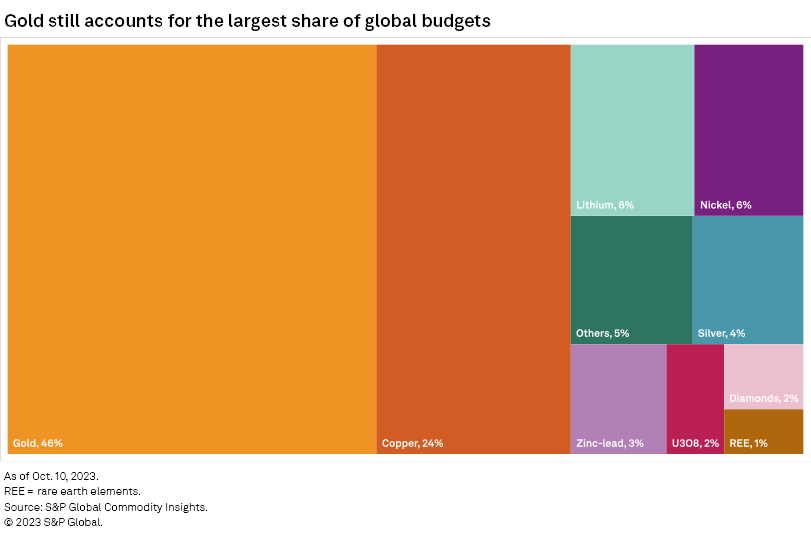

Gold wipes out base/battery metal gains

Gold budgets slipped 16% in 2023, enough to cancel out all gains registered by base and battery metals, given that gold typically accounts for half of the global exploration budget. On a dollar basis, the gold budget dropped $1.09 billion to $5.92 billion — the largest year-over-year drop in a decade — dissipating all gains from 2022. Because junior companies typically account for half of gold exploration, their exploration programs were the first to be impacted when financial conditions began tightening.

Green metals — specifically copper, nickel and lithium — again posted strong budget growth. The copper budget came in at $3.12 billion, up 12%, the highest year-over-year increase since 2014 and the third consecutive year of double-digit percentage growth. The increase came mostly from major miners' budget increases, particularly BHP Group Ltd., Vale SA, Barrick Gold Corp. and Rio Tinto Group, despite some large budgets among juniors such as Ivanhoe Electric Inc.

Lithium budgets were the most noteworthy, becoming 2023's third-most explored metal from sixth place in 2022. Budget for the battery metal rose 77% year over year to $829.6 million. Since the focus on lithium mining is relatively new, most explorers are still classified as junior companies, but they appeared impervious to the tightening financial environment in 2023. Among them, most of the year-over-year gains came from Ioneer Ltd., Ganfeng Lithium Group Co. Ltd. and Allkem Ltd.

Nickel ranked as the fourth-most explored metal with a budget of $732.2 million, up 19% year over year. The gain primarily came from Vale and BHP on the back of renewed focus on their existing assets in Canada and Australia, respectively.

Silver budgets decreased for the second year in a row, this time falling 11% to $556 million. Silver exploration has the fifth-largest budget, down from third-largest in 2022. Budgets were trimmed across several companies, most notably Pan American Silver Corp. and Hochschild Mining PLC. Zinc exploration also dropped, decreasing 12% to $412 million. Given the market has plenty of mine supply with constrained smelter capacity, majors and juniors pulled back on exploration spending.

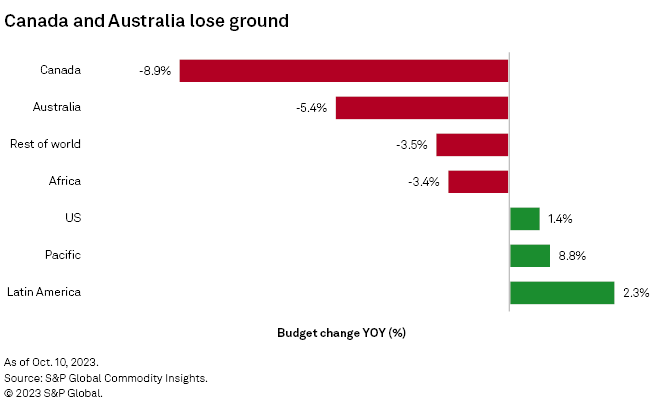

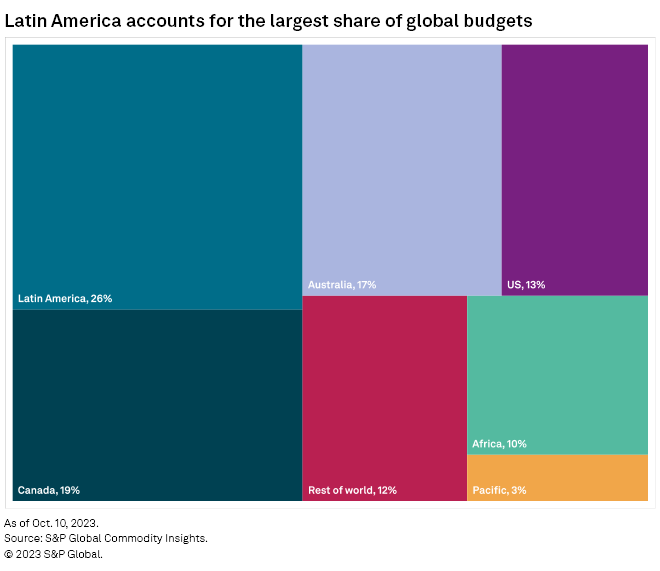

Canada, Australia declines overshadow Latin America strength

The only regions to post gains in 2023 were Latin America, the US and Asia-Pacific. Latin America continues to attract the largest share of the global exploration budget, as it has done since our CES study began. The region's budget was up 2.3% year over year to $3.38 billion. Chile, Argentina and Guyana contributed the most to the region's performance, although the gain was limited by declines in Peru, Ecuador and Nicaragua.

Exploration budgets for the US increased 1.4% in 2023 to $1.62 billion. Base metal and lithium gains were able to offset the decline in precious metal exploration. While typical majors — such as Freeport-McMoRan Inc., BHP and Antofagasta PLC — reduced planned spending in the country, Kinross Gold Corp., AngloGold Ashanti PLC and Ivanhoe Electric were significant in making up the difference.

Asia-Pacific, the smallest region by allocation, registered a budget of $370 million, up 8.8% — the largest percentage increase in all regions. The increase mainly came from nickel and copper exploration in Indonesia and gold exploration in Fiji.

After outperforming all regions in 2022, Canada underperformed globally in 2023 with its budget coming in 8.9% lower year over year at $2.44 billion. After two years of above-average growth, Canada still holds the top country spot and second place in our regional ranking. Given the country's large junior population and the difficulty juniors faced in raising funds, budgets were due to decrease in 2023. The decline was mitigated, however, by a strong year-over-year budget growth among the majors, which posted a 9% increase.

Australia, the third-most desired exploration region, posted a budget of $2.2 billion, down 5.4%. While all company types reduced budgets, most of the decline came from juniors. Target exploration in Australia remained similar to Canada and the global trend, with gold exploration declining 21%, copper increasing 1.3%, nickel jumping 10% and lithium increasing 88%.

Rest of world and Africa regions came in at $1.49 billion and $1.27 billion for 2023, down 3.5% and 3.4%, respectively, in line with the global average. Kinross and Boliden AB (publ) led the declines in Europe, while Africa's losses were more broad-based.

Given their size and importance to the industry, Canada, Australia and the US are treated as regions for the purpose of continental-scale comparisons.

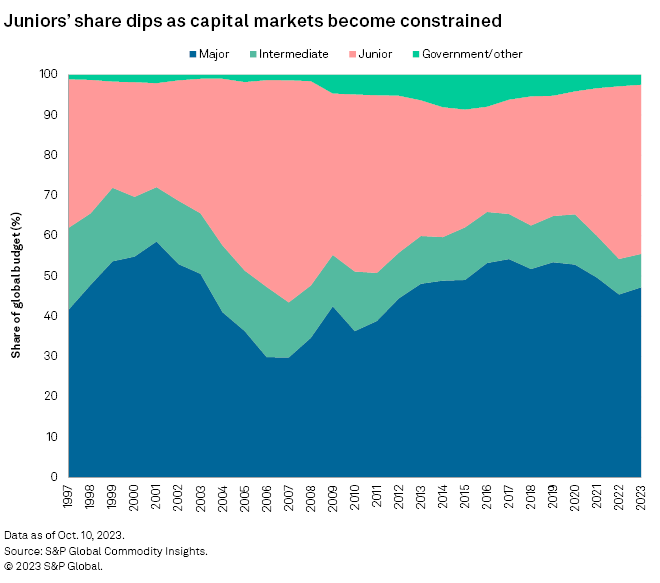

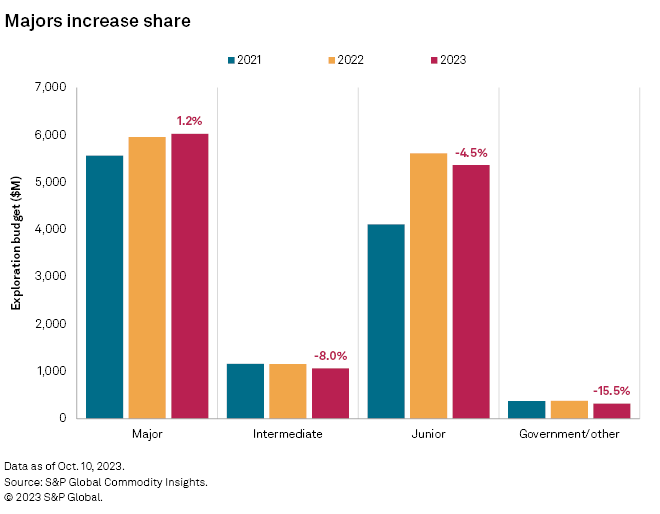

Junior allocations suffer; majors limit damage

Junior explorers — companies with less than $50 million in revenue — the driving force in the post-pandemic exploration recovery, lost steam in 2023 as budgets for the group fell 4.5% year over year to $5.36 billion. As expected, the weakening financing conditions impacted the juniors to a much greater extent. However, the impact varied depending on which metals the exploration programs focused on. Funding dried up for juniors with gold-focused exploration programs, while those that focused on metals associated with the green energy transition gained steady funding and even ended up with expanded exploration budgets.

Major companies — companies with more than $500 million in revenue and the ability to internally fund their own exploration programs via large, secured lines of credit or directly from revenue — did not pull back on exploration and posted a collective budget of $6.02 billion, a 1.2% rise. Similar to the overall trend, gold budgets were down 6.6%, while copper increased 12.8%, nickel jumped 29% and lithium increased 78.7%. Major's share of global budgets had eroded since 2020 due to juniors' strong post-pandemic growth, but that trend halted in 2023.

Intermediate explorers — companies with $50 million to $500 million in revenue — and government-linked entities posted larger-than-expected declines. For intermediates, seven companies cut exploration by more than $10 million, while declines were small and spread out for the government/other category, but mainly across China-based entities.

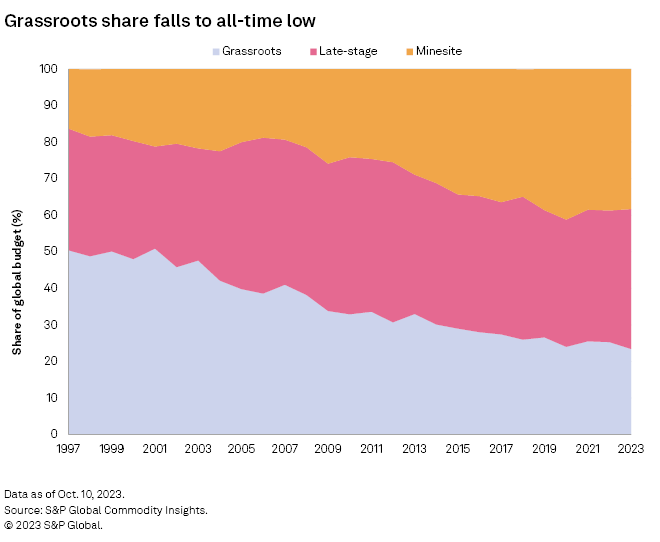

Grassroots exploration share dips to record low

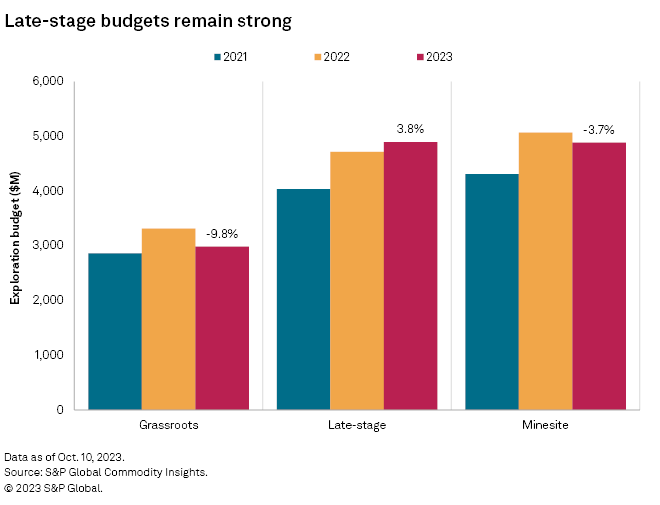

Grassroots budgets' downward trend resumed in 2023, declining 9.8% to $2.99 billion — the largest drop among stages in percentage and dollar terms. The larger-than-average decline pulled down the early-stage share of overall budgets to 23.4%, the lowest share on record. At the beginning of our study, grassroots exploration typically garnered about 50% of all exploration budgets, but it began losing share in 2004 and has not recovered since.

Budgets for late-stage exploration and feasibility work posted the only year-over-year increase in 2023. Allocations came in at $4.89 billion, and the 3.8% increase was enough for the stage to narrowly rank first both in dollar terms and by share of the global budget (38.34%), for the first time since 2018.

Minesite exploration came in at $4.88 billion, down 3.7% year over year, causing the group to lose out on the top spot; minesite exploration accounts for 38.27% of overall budgets, however. The group has been steadily gaining share since 2008. This reflects a general shift in the industry toward safer but potentially lower-reward late-stage and minesite programs and away from riskier early-stage exploration that offers higher potential rewards in terms of new discoveries.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.