Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

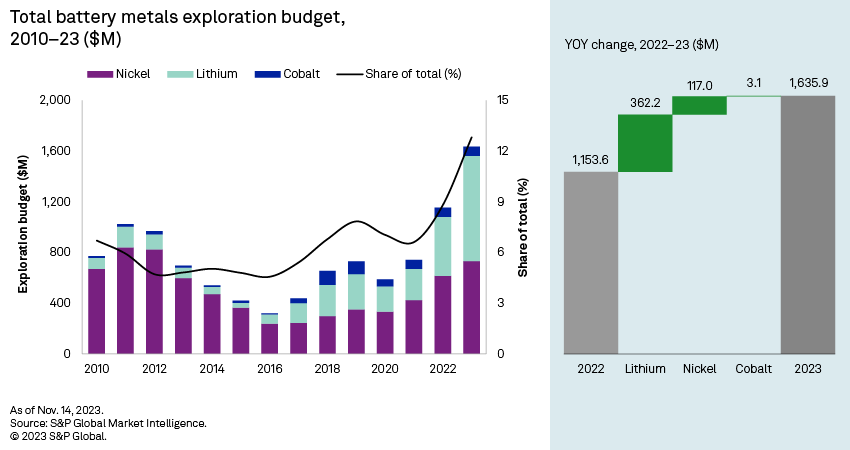

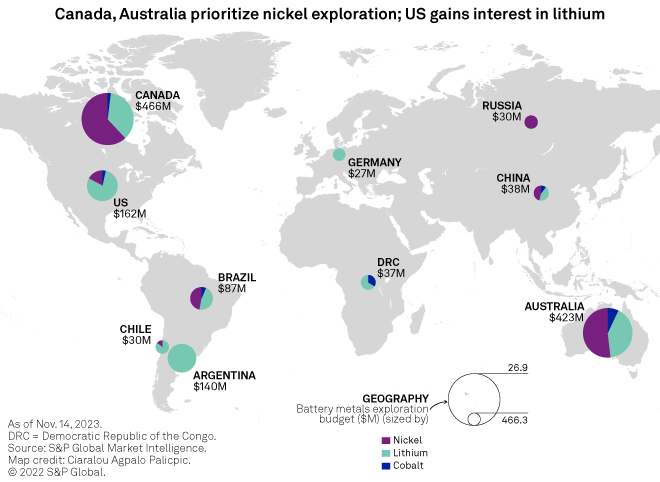

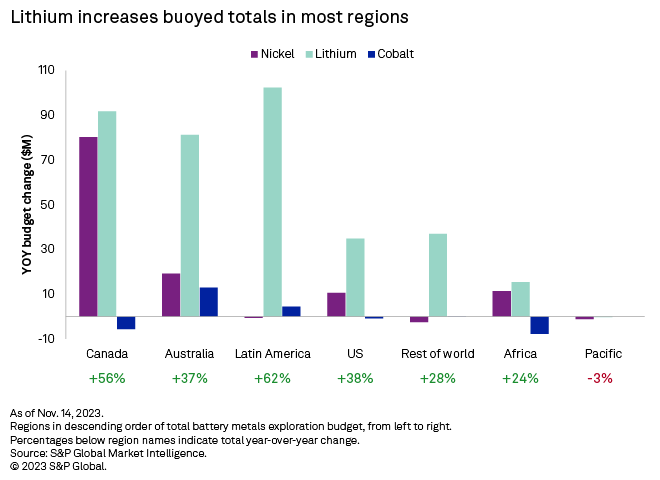

Exploration budgets for primary battery metals — nickel, lithium and cobalt — continued their upward trend to a new all-time high of $1.64 billion, a 42% increase from $1.15 billion in 2022. This marks the third consecutive year of strong increases, with the group's share of total exploration climbing 400 basis points to 13%.

➤ The increasing demand for metals necessary for decarbonization and electrification drove exploration budgets for battery metals lithium, nickel and cobalt to increase again in 2023. While the overall annual nonferrous exploration budgets fell 3% in 2023, total allocations to the battery metals were up 42% to a new high of $1.64 billion.

➤ The bulk of the increase came from lithium exploration's 77% growth to an all-time high of $830 million, displacing nickel as the top battery metal in 2023 and making it the third most explored commodity overall, surpassing zinc-lead, nickel and silver. Nickel exploration increased 19% to $732 million. Cobalt exploration is in its third year of marginal increases, totaling $74 million.

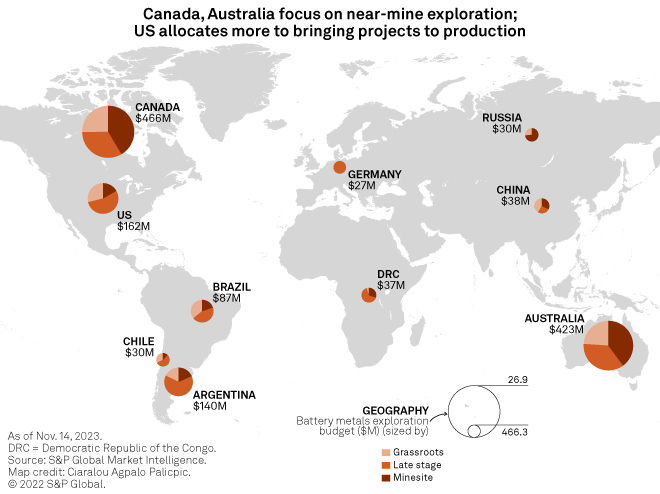

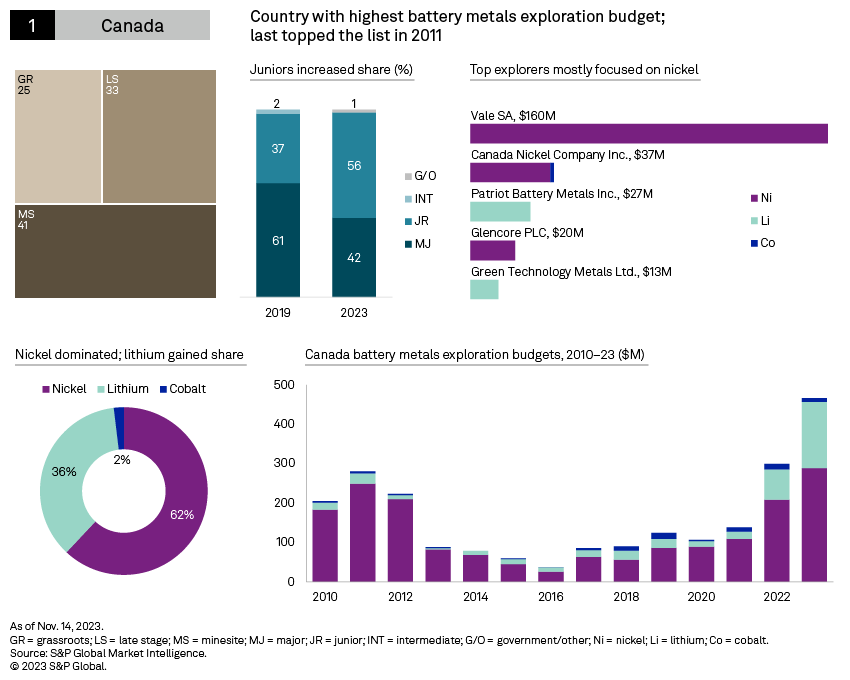

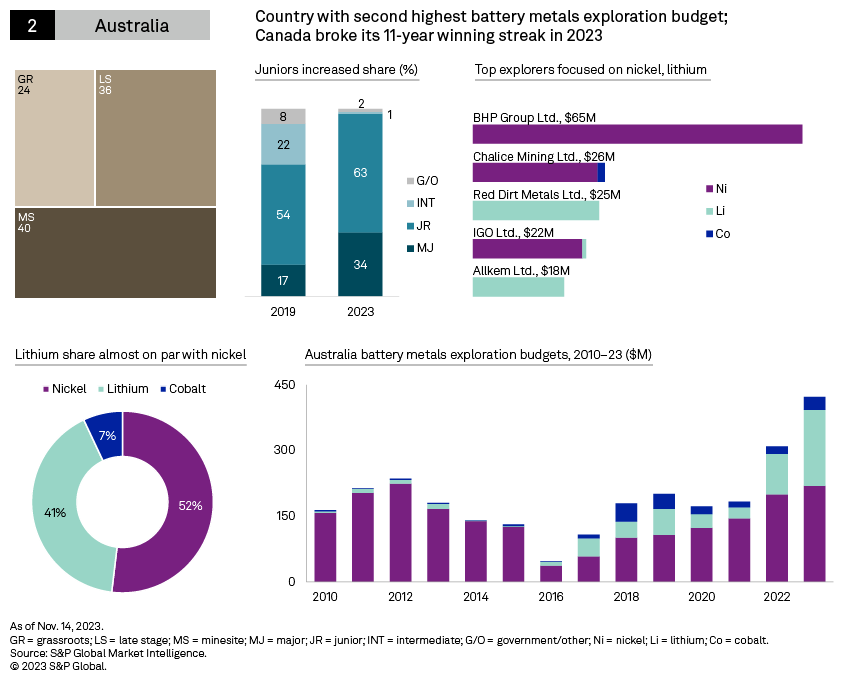

➤ The lithium story is largely shaped by junior explorers allocating more to mostly early- and late-stage assets, while nickel exploration is heavily influenced by major companies increasing activity at existing mines. Canada and Australia continue to be the top exploration hubs for these battery metals, which can be attributed to geology, the concentration of small explorers on the Toronto Stock Exchange and Australian Securities Exchange, and incentives to spend raised funds locally.

➤ The recent price corrections and estimated surpluses for all battery metals in the near term could weigh down momentum in exploration in the next few years. However, medium-term supply deficits should maintain interest and prevent any significant pullbacks.

All three commodities posted increases in 2023, but much of the boost in the group's budget came from lithium, which almost doubled and reached a new high in 2023. Nickel exploration is now only second to lithium exploration in total budget but remains below the high-watermark set in 2011 and 2012. Cobalt exploration struggles to regain levels it hit in 2018 and 2019, with relatively modest increases over the past several years.

Using data compiled as part of the Corporate Exploration Strategies (CES) series, S&P Global Market Intelligence identified 568 companies exploring the three battery metals in 2023 — another all-time high for the group — the bulk of which are lithium-focused.

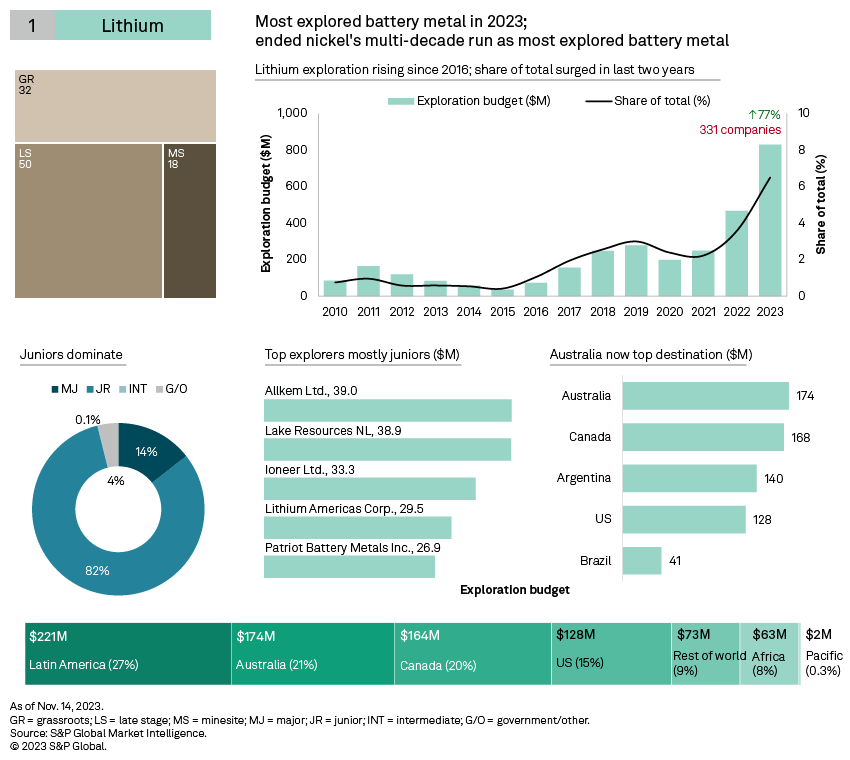

Lithium: record-breaking battery metal

Allocations to lithium exploration continued a streak of impressive increases, growing 77% to an all-time high of $830 billion in 2023 from $467 billion in 2022. Lithium now accounts for nearly 7% of total global budgets, surpassing zinc-lead, nickel and silver to become the third most explored commodity in 2023 behind gold and copper. This is an exceptional change from 2010 when lithium was not in the top 10 commodities for exploration.

This increase in budgets follows price spikes in 2022: Global average lithium prices shot up to more than $55,000 per metric ton at the end of the first quarter and peaked at $68,000/t in December due to the tight lithium market. Prices have since cooled down as economic growth slowed, but a general upward trend in lithium demand and prices since 2016 has supported the growth of exploration budgets to their current level.

Unlike gold and copper exploration, which usually centers on advanced or producing properties, lithium exploration is still focused on grassroots and late-stage programs, with only 18% dedicated to existing mines. Although budgets for lithium exploration increased across all stages of development, minesite exploration only posted a modest 12% growth to $150 million. On the other hand, grassroots exploration almost tripled in 2023 to $262 million, and late-stage exploration almost doubled to $418 million, accounting for half of the lithium budgets. This is a direct result of lithium being a relatively young industry, with few mines in production compared to other commodities.

Much of the grassroots and late-stage growth is driven by junior companies, which have accounted for the majority of lithium budgets since 2011. In 2023, allocations by juniors more than doubled to $677 million, from $326 million in 2022. Although the majors have also significantly increased their lithium budgets by 79%, their $120 million allocation is still far below that of the juniors. Consequently, the juniors now account for more than 80% of lithium budgets, up from 70% in 2022. As for the rest of the company types, the intermediate companies group was the only group to post a decline, slashing their budgets to just over $1 million from $44 million in 2022, while government-controlled and other companies slightly increased their budgets by over $1 million to $31 million.

In terms of locations of lithium exploration, 2023 marks the first year that any country had an allocation exceeding $100 million — and, in fact, four countries breached this threshold. Australia leads the list as the top exploration hub for lithium, a position it last held in 2017. It overtook the US after almost doubling budgets to $174 million. The biggest increase, however, was in Canada, with its budgets more than doubling to $168 million, putting it in a close second to Australia. Argentina, which was the top exploration destination for lithium in 2021 and dropped to the fourth spot in 2022, is now in third place after almost doubling budgets to $140 million. The US fell to the fourth spot after a more tempered 37% increase to $128 million. These top four countries alone — Australia, Canada, Argentina and the US — account for almost 75% of lithium exploration globally.

Given the size of allocations to Australia and Canada and their significance to the exploration scene, we categorize them along with the US as individual regions. But even with major increases in these two countries, Latin America still emerged as the top explored region for lithium. This is a spot the region has held since we started recording lithium budgets in 2010, with the exception of 2020 when the US as a region overtook the top spot. Latin America's dominance is unsurprising, as the region encompasses lithium-rich countries such as Argentina, Brazil and Chile. In fact, 96% of the budget increase in the region was allocated to Argentina and Brazil, with only a minimal $1.1 million increase in Chile.

The largest allocation for lithium exploration in 2023 came from Queensland-based major producer Allkem Ltd. with $39 million, up more than 70% from its $23 million budget in 2022. Allkem increased its budgets across its assets in Australia, Canada and Argentina, with most of the increase directed to Mt Cattlin mine in Western Australia. During fiscal year 2023, Allkem updated and expanded the mineral reserves and resources (R&R) in the mine. In 2022, Mt Cattlin was the fifth largest lithium-producing mine in Australia.

The largest increase, however, came from New South Wales-based junior company Lake Resources NL, which quadrupled its budget to almost $40 million from $10 million in 2022. This increase was directed to its Kachi late-stage brine asset in Argentina, which is currently undergoing a feasibility study.

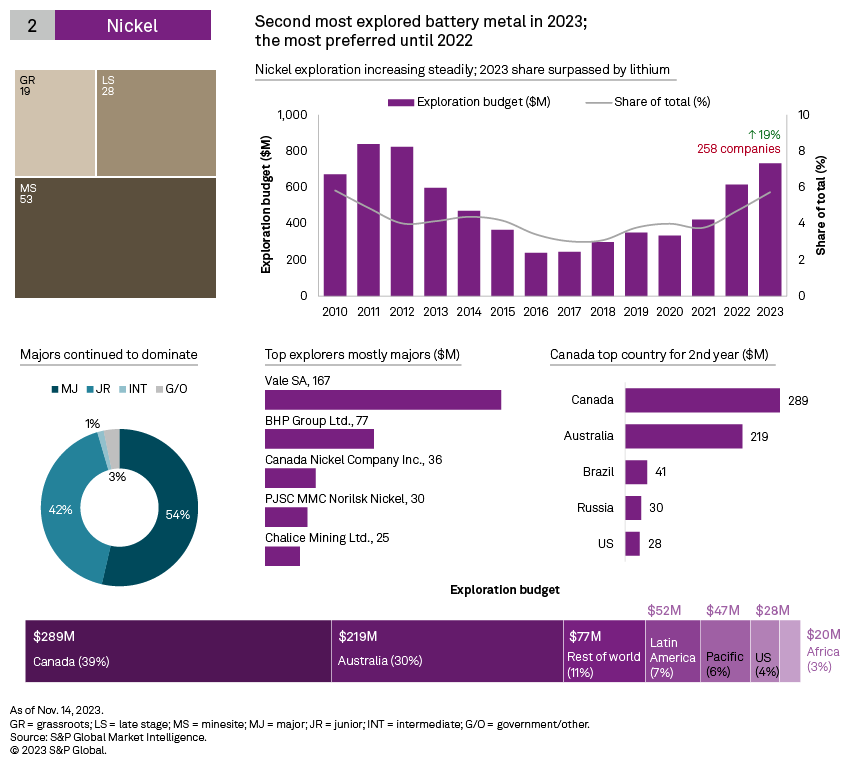

Nickel: a minesite, majors story

With a much more moderate budget increase than lithium, nickel is no longer the most explored battery metal. Its 2023 total of $732 million was up 19% year over year. Nickel accounted for almost 6% of total exploration budgets for all commodities in 2023.

While lithium exploration mostly centers on late-stage assets, nickel exploration is more often carried out at existing mines; only 19% of the 2023 budgets were dedicated to grassroots efforts. This preference for near-mine works has been a persisting trend since 2017. In 2023, only minesite exploration for nickel recorded an increase, shooting up 76% to an all-time high of $387 million, further solidifying the trend away from earlier stages of exploration. Conversely, nickel explorers cut grassroots exploration 25% to $141 million, and late-stage decreased 2% to $204 million. With these lower allocations, minesite exploration's share of the nickel budgets' total expanded to 53% from 36% in 2022.

Nickel exploration has always been a "majors story," with that company group responsible for 88% of the increased allocations to minesite nickel exploration in 2023. The major producers had the largest budget increase for nickel, up $88 million to an 11-year high of $393 million. Much of this increase was dedicated to assets in Canada and Australia. Meanwhile, the junior sector had a more tempered increase this year after driving the budget growth in 2022. Juniors' allocations grew 12% to $306 million, their highest since 2008. Junior companies are largely dependent on fundraising, and the group's more moderate increase compared to 2022 is due to lower financings for nickel in that year, which were down 22%. Still, the juniors are in a close second to the majors in terms of share of total. Intermediate companies dropped 60% to $10 million, the lowest since 2001.

Whereas Australia leads in lithium exploration, Canada is the top destination for nickel explorers for the second year running. Canada topped the list with an all-time high of $289 million, 39% more year over year. Canada also had the highest increase among all countries, mostly from the majors. Australia continues in the second spot with $219 million, up 10%. The juniors account for more than half of the nickel exploration in Australia, but companies in the sector marginally decreased their budgets to the country in 2023, countered by the significant increase from the majors. Canada has significantly grown its nickel R&R over the past 10 years. In 2014, Canada ranked fifth globally in nickel R&R with 23 million metric tons (MMt) of contained nickel. In a span of just 10 years, Canada grew its nickel R&R to 44.1 MMt, ranking second to leader Indonesia. Australia is in a close third place with 41.6 MMt.

Looking at regions, Canada and Australia still lead, followed by the Rest of world group, despite allocations to the last of these regions declining 3% to $77 million. The bulk of the decrease came from Russia and China.

Major companies have the largest allocation to nickel exploration. Interestingly, only 19 of the 258 companies budgeting for nickel are majors; 215 are juniors. Six out of those 19 major companies are in the top 10 for nickel exploration budgets. Vale SA sustained its nine-year run at the top, with 62% growth in budgets to $167 million, its highest allocation to the metal in our records. The budget is dedicated to its nickel mines in Manitoba, Ontario, and Newfoundland and Labrador. In second is BHP Group Ltd., with a $77 million budget that is almost double 2022's and dedicated to its mines in South and Western Australia.

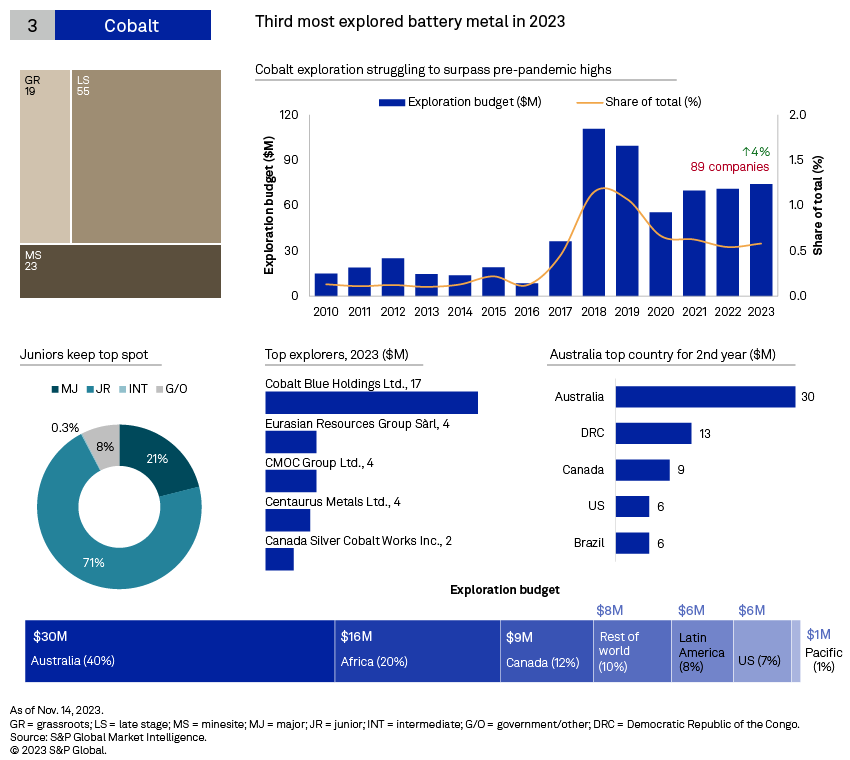

Cobalt: Consistent but tempered growth post-pandemic

After recording a $111 million total in 2018, allocations to cobalt declined through 2020, when they hit a low of $56 million. Since 2020, cobalt budgets have been slowly but steadily recovering. In 2023, budgets totaled $74 million, marginally up from $71 million in 2022.

Since 2020, cobalt exploration has mostly been done on minesite assets, usually coinciding with nickel exploration. However, 2023 marked a shift to late-stage exploration as the top-budgeted stage. This is mostly influenced by junior company Cobalt Blue Holdings Ltd., which increased its budget fourfold as its wholly owned BHCP project in New South Wales is currently undergoing definitive feasibility studies. This made late-stage the only stage to post an increase, almost doubling to $41 million from $21 million. Grassroots and minesite exploration posted declines of more than 30% to $16 million and $17 million, respectively.

Cobalt exploration has always been dominated by junior companies, which were the only group to post an increase in 2023, up 30% to $53 million. Out of the 89 companies budgeted for cobalt, 70 are juniors.

The significant influence of the junior sector on cobalt exploration and the major presence of juniors in Australia contributed to the country becoming the top destination for cobalt exploration. This is the second year Australia has held this spot, with the Democratic Republic of the Congo ranking number one in 2021. Allocations to Australia increased $13 million or 78% to $30 million. Another notable increase was recorded in Brazil, up $5 million to $6 million, pushing the country to the fourth spot from 10th in 2022. Regionally, Australia has ended Africa's three-year streak as the top region after Africa posted declines, mostly coming from the Democratic Republic of Congo, Zambia and Morocco.

With its ongoing feasibility study in Australia, Cobalt Blue Holdings tops the list of cobalt explorers this year. Major producers Eurasian Resources Group SARL and CMOC Group Ltd. tied for a distant second with $4 million.

Where is battery exploration happening?

The US Inflation Reduction Act of 2022 paved the way for an accelerated US energy transition, increasing demand for critical metals such as lithium, nickel and cobalt. This has accelerated the production of these metals in the US and its free trade partners, which include both Canada and Australia. These countries could remain the leaders in lithium exploration, as they move to secure enough supply to meet US demand post-legislation.

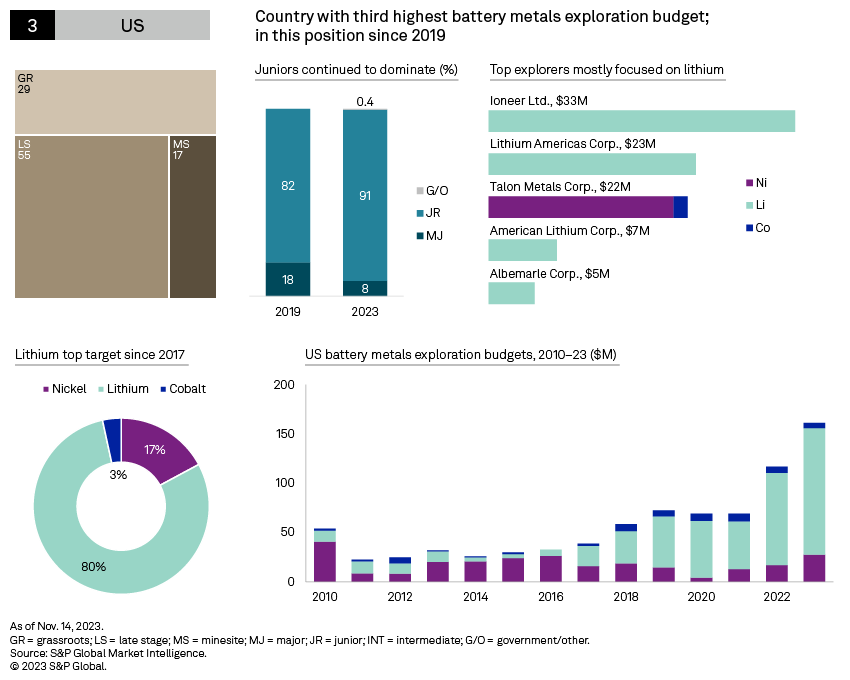

In 2023, Canada, Australia and the US rank as the top destinations for collective allocations for the three battery metals. Australia has topped the list since 2012, but Canada ended Australia's streak after strong increases in the former's lithium and nickel exploration. The US is still in third place, a spot it has held since 2019.

Near-term surpluses, falling prices could temper increases to battery metal exploration

Our most recent Commodity Briefing Service releases for nickel, lithium and cobalt forecast surplus for all three battery metals in the next two to four years. Nickel's London Metal Exchange year-to-date average prices are currently down 14% to around $22,000/t, compared to the same period last year, as bearish sentiment toward the nickel market continues amid the gloomy macroeconomic outlook. Prices are expected to further dip to as low as $18,500/t in 2024 on the back of a widening surplus, and although the nickel balance is expected to gradually tighten after that, it is still anticipated to be in surplus until 2027, and prices are not expected to breach $20,000 by that time. As nickel exploration is largely coming from majors budgeting for their nickel mines, this price trend could deter additional allocations as revenues shrink. Additionally, junior and intermediate companies' nickel financings year to date are down 33% from 2022, which does not bode well for junior budgets.

Likewise, lithium supply is expected to have an increasing surplus from 2023 to 2024, potentially putting negative pressure on prices. The surplus is expected to last until 2026, after which the lithium supply is anticipated to see a deficit. Unlike nickel, lithium financings year to date are now almost double the same period in 2022 and have even surpassed the total in 2021. Given that lithium exploration is largely influenced by the juniors, this could likely insulate lithium from the potential declines in 2024 budgets, possibly resulting in flat budgets or decelerated growth year over year.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.