Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 8 Feb, 2022

By Keith Nissen

Introduction

Bowing to ongoing industry trends, some U.S. cable news networks are launching new online subscription video services to offset declining traditional multichannel TV audiences. Fox Corp.'s Fox Nation and the forthcoming CNN+ from Warner Media LLC — to be launched in early 2022 — are examples. However, survey data of current Fox Nation viewers suggests the audiences for online cable news subscription video-on-demand services, at least initially, bear little resemblance to traditional cable news audiences.

* Traditional cable news viewers tend to be older adults, while subscribers to the Fox Nation SVOD service are primarily millennials.

* The vast majority of Fox Nation viewers subscribe to a pay TV subscription and will add new SVOD services regardless of price.

* Fox Nation viewers tend to be college-educated, urban/suburban men, which mirrors traditional Fox News demographics.

Over the past five years, Kagan Consumer Insights survey results have documented the drop of traditional multichannel TV households — from 79% in 2017 to 65% in 2021 — while the percentage of internet households subscribing to an online video service has grown from 65% to 83% over the same period. As a result, online versions of many cable TV networks have been launched in recent years, including such familiar brands as Discovery+, AMC+, Disney+ and ESPN+.

Fox Nation, the online subscription video service operated by Fox News, was launched in late 2018. Results from the Kagan third-quarter 2021 U.S. Consumer Insights survey show that approximately 5% of internet households are currently using Fox Nation. In addition to news, Fox Nation offers a wide variety of daily TV programming, documentaries and movies. While many details of the CNN+ service have yet to be announced, numerous high-profile names from the news industry and Hollywood have already signed on to host shows.

Back in 2018, Kagan conducted a survey to determine how Americans received their news. The survey found that, at the time, one-third (33%) of U.S. internet adults said they viewed cable news, of which 41% reported viewing Fox News and 29% viewed CNN. Viewership of both cable news networks skewed heavily toward older adults. Over half (53%) of Fox News viewers were baby boomers or seniors, aged 53 and above, and nearly four out of 10 (38%) CNN viewers fell into the same generational age category. Since 2018, viewership of cable news has declined, but the overall age distribution has probably not changed that much.

But the Kagan third quarter 2021 U.S. Consumer Insights survey, paints a very different picture of Fox Nation viewers. For example, the survey data shows that Fox Nation viewers are predominantly young adults, with over half (52%) being millennials, ages 25-40. Only 19% of current Fox Nation viewers are baby boomers or seniors, 56 years of age and older.

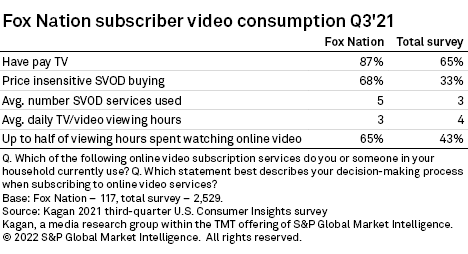

Rather than attracting new viewers, the survey found that nearly nine in 10 (87%) Fox Nation viewers also subscribe to a pay TV service and presumably watch the Fox News cable channel. Over two-thirds (68%) of Fox Nation viewers are price-insensitive SVOD buyers that will subscribe to whatever services they want to watch regardless of the price. As a result, Fox Nation viewers use an average of five SVOD services compared to a national average of three SVOD services. Like most younger adults, Fox Nation viewers tend to spend less time per day watching TV/video but spend more time watching online TV/video content than the average internet adult.

While some behaviors/demographics differed, the survey found that Fox Nation viewers are similar to the historic Fox News audience in terms of gender, education, income and population center size. For example, over two-thirds of Fox Nation viewers are college-educated men, predominantly living in urban or suburban metro areas. The income distribution for Fox Nation viewers tends to be fairly evenly distributed, with one-third (32%) high-income earners. And while historic CNN viewership also tends to be skewed toward urban, college-educated individuals, with a fairly even gender split, there is a higher percentage of low-income households among CNN users than for Fox News or Fox Nation.

The major takeaways from the survey data are that, at least initially, we can expect CNN+ to attract young adult subscribers from its existing base of cable news viewers who are willing to add new SVOD services without regard to price. This first wave of subscribers will most likely mirror the demographics of existing CNN cable news viewers, other than age. The challenge for both Fox Nation and CNN+ will be how, in the future, to attract subscribers who do not subscribe to a pay TV service, as well as older adults who are more budget-conscious when adding new SVOD subscriptions.

Data presented in this article was collected from Kagan's third-quarter 2021 U.S. Consumer Insights survey conducted in September 2021, as well as the third-quarter 2018 U.S. Consumer Insights survey. The surveys totaled approximately 2,500 internet adults with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded up to the nearest whole number. Gen Z are adults ages 18-23; millennials are 24-40; Gen X are 41-55; boomers/seniors are 56+.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.