Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jan, 2016 | 07:00

By Tony Lenoir

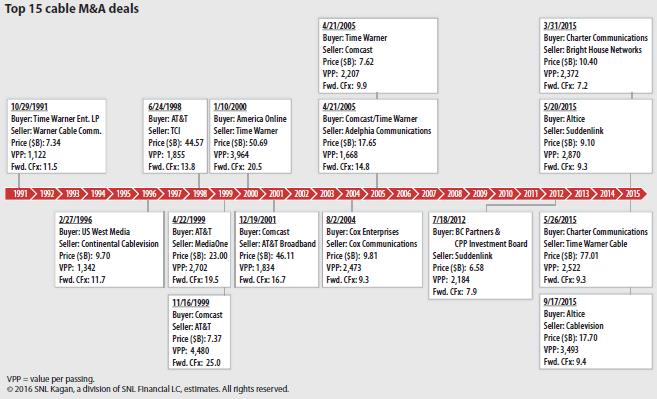

Large high-profile deals propelled cable M&A volume to unprecedented heights in 2015, with the metric clearing the $100 billion bar for the first time. Deals were few and far between, however, as the consolidation of the last few years led to a smaller pool of prized targets. And forward cash flow multiples, though at their highest level in years, remain far below the highs of the dot-com era.

Volume from deals announced in 2015 totaled $114.44 billion, or more than the previous 13 years combined. The weighted average forward cash flow multiple, meanwhile, rose from 7.6x in 2014 to 9.1x. Overall proposed M&A involved 43.3 million video passings, 16.8 million basic video subscribers and 18.8 million high-speed data subscribers for the 12 months ended Dec. 31, 2015.

With the number of mid-to-large acquisition targets now significantly lower, M&A activity and volume are likely to suffer in 2016. At the end of 2015, three of the six cable operators SNL Kagan had identified as logical high-profile M&A targets in an October 2014 report had agreed to be acquired. Of the three remaining on that list (Cable One, Cox Communications and Mediacom), Cox Communications appears to be the most highly prized. Additionally, more expensive debt financing, if the Federal Reserve sticks to its rate hike schedule), could weigh on the sector’s M&A.

That being said, smaller operators watching the ongoing consolidation, and the relatively steep rise in prices for cable assets in the last two years, could feel like the time is ripe to exit. This could be magnified by the uncertainties surrounding the video delivery business, which, aside from subscriber losses and compressing margins, include declining live linear TV ratings.