Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 24 Mar, 2023

By Andrea Caruso and Karl Sees

This blog is written and published by S&P Global Market Intelligence, a division independent of S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

In the past, only large financial institutions have ventured into deploying credit risk automation and workflow systems due to the volume of resources and investments required and the need to lock down processes. However, it is not uncommon today, to meet with a corporate credit risk officer who is looking to discuss the options, benefits, and risks of automating customer onboarding and credit risk management and monitoring processes.

Andrea Caruso, Head of Credit Analytics at S&P Global Market Intelligence, and Karl Sees, Head of CubeLogic Product Strategy at CubeLogic, discussed the risks and opportunities of Credit Risk Automation at the recent S&P Global Market Intelligence event Anticipate the Unknown - An Era of Change: Navigating Global Disruption and Credit Risk'. Here are the key take-aways from their session.

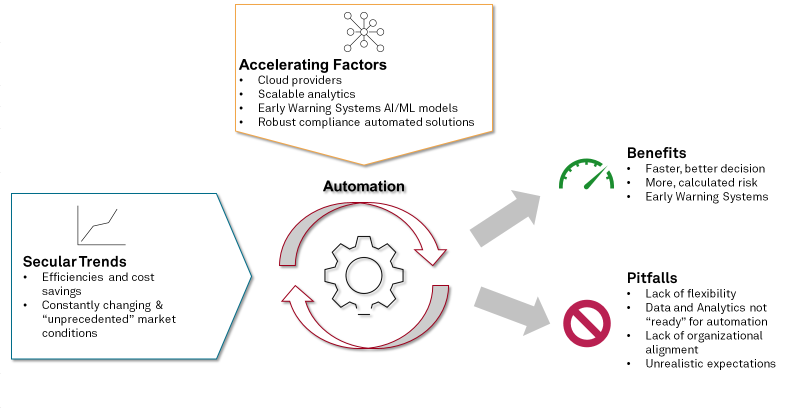

Drivers of Automation, Benefits, and Pitfalls

Source: S&P Global Market Intelligence, for illustrative purposes only.

We have seen secular trends toward Automation driven by the quest for efficiencies and cost savings. Additionally, since the financial crisis, we have experienced constantly changing and unprecedented market conditions that have increased awareness of the need to manage credit risk effectively. Corporations might have taken too much risk – and experienced more losses than their policies or too little risk – and missed opportunities, especially during benign credit cycles.

Figure 1. FED Delinquency Rates 1985 - 2022

So why are we now observing a spike in the interest in Automation? We have observed four major trends:

Corporations increasingly see credit risk management as a way to increase competitive advantage and accelerate business growth, not just as something to avoid and manage. Credit departments can partner more effectively with commercial and vendor teams by speeding up credit approval, taking more risk within the corporation's policy, identifying markets with deteriorating or improving credit conditions, focusing on the riskiest and largest customers, and generating early warnings for customers and suppliers.

Finally, the pandemic followed by Russia's invasion of Ukraine produced a level of volatility and market dislocation that was both unprecedented and shocking. There was a sudden appreciation of the need to improve the speed and quality of "early warning" processes.

Better, faster decisions and early warnings are all capabilities enabled by Automation.

Benefits

Better, faster decisions

IT infrastructure that scales with their business

Significant business process automation

Improved business intelligence

Less time spent gathering data and more time spent managing credit risks in the portfolio

A recent client case study typifies the challenges, motivations, and benefits experienced by firms embarking on a drive to automate their credit risk processes. The firm is one of the largest trading companies in the world, which, at the time, was trading 1.35 million trade legs a day with a team of credit managers overseeing a business with revenues over $115bn. Their challenges included consolidating vast data sets and timely risk reporting across multiple transaction systems, supporting complex business and credit processes, improving portfolio insights, and reducing operational risks and costs. To tackle this sizable initiative, the firm made phased changes to its overall strategic plan. Rapid and incremental improvements were executed as a result of a flexible business process and workflow solution that was able to quickly adapt to changes in the business as well as through learnings from the project itself. Significant cost savings and efficiencies were realized as a result of users being more self-reliant.

Pitfalls

Many of these pitfalls can be avoided through careful choice of technology. Workflows that can be easily configured and quickly adapted as the organizational processes evolve. Similarly, data availability and quality are never static: solutions that include a “Data Transformation” or EDM layer enable a Firm to improve its processes and analytics as its data improves continuously.

So much has been done to ensure we have "good data", but how can you manage that more efficiently/create future-looking processes?

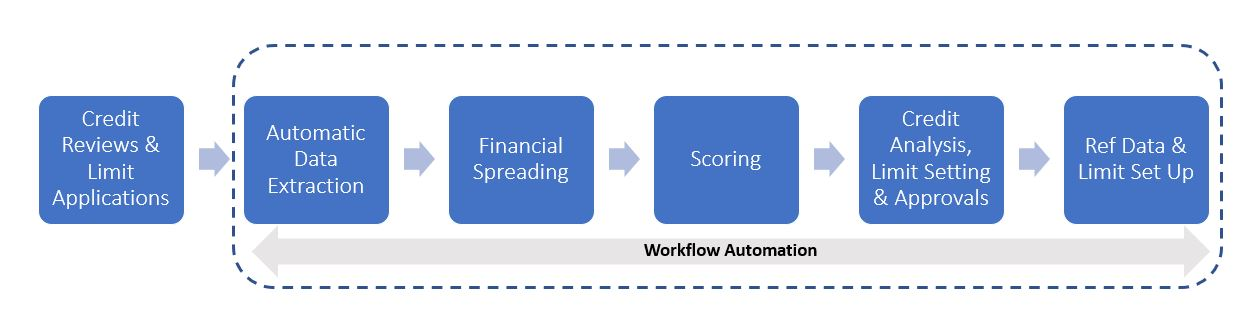

One example of a “future-looking” process is depicted in the Figure 2 below. It depicts a typical client onboarding and credit approval process. Rather than being performed via multiple IT systems, spreadsheets, word processing documents, etc., this workflow is executed within an end-to-end solution. An automated process like this can reduce the time it takes to onboard and approve a new client from weeks to hours/days. Not only does this reduce operating costs, but it also improves the competitiveness of the origination business by ensuring that the most attractive business does not go to faster competitors.

Figure 2. Automated Credit Risk Decisioning

Source: S&P Global Market Intelligence, for illustrative purposes only.

Early warning signals of deterioration or improvement are a big area where clients are increasingly focused. The challenge is that no single signal is sufficient for a portfolio. For a diverse multi-asset business covering public and private companies, you will need a range of signals:

Automation is not an either-or scenario. Corporations can roll out Automation in steps to maximize the benefits while solving the challenges that are hardest to tackle with a manual process.

For example, connecting the system of record with an Early Warning System/dashboard to analyze, stress, and monitor the exposure without implementing an end-to-end process.

Another approach to test Automation is to start with managed service – by outsourcing a workflow, such as onboarding while leveraging a vendor system, before "locking" the processes.

Today, credit departments can increase the competitiveness of their corporation by leveraging Automation without having to embark on large, long, and costly implementation while unlocking the value of the data collected through their customer and supplier interactions.

If you are interested in speaking with a credit specialist about Automation and Credit Risk, request a meeting here.

Theme

Products & Offerings