Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Sep, 2023

By Neil Barbour

Blockchain service operators rolled out a wave of new announcements in August aiming to simplify the onboarding process for developers and players as the blockchain gaming market struggles to remain relevant after losing its momentum to the cryptocurrency crash in 2022.

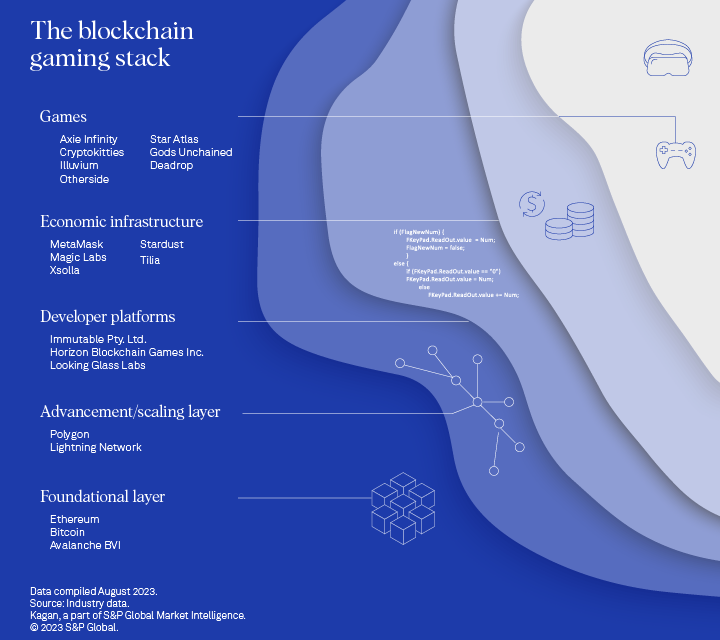

Blockchain gaming, sometimes known as crypto gaming or Web3 gaming, refers to interactive entertainment that leverages smart contracts tracked and stored on a decentralized ledger. The primary function for this model is the minting and trading of non-fungible tokens tied to in-game assets.

Blockchain game developers had big plans for 2023, but as the year wears on, it becomes increasingly clear that many of the announced games will remain in development longer than anticipated.

This is bad news for other companies in the blockchain stack that profit from supporting transactions, trades and other activity on the blockchain. They are desperate for new material to work with and so are eager to improve the pipeline to entice new gamers and developers.

In S&P Global's recent consumer metaverse survey, more than half of respondents who said they used a metaverse app or service said they had purchased or received an NFT inside of a metaverse hub, video game or 3D virtual experience. The survey polled 4,000 adults in 42 countries during spring and early summer 2023.

These results suggest blockchain gaming has already cultivated a consumer market, even if it has had a hard time harvesting revenue growth.

A key roadblock is NFT gaming's reputation for being difficult to navigate. Making a purchase often requires users to link a crypto wallet in a fragile, multistep process filled with jargon, handoffs between different apps and multiple authentication measures. Substantive charges can also be associated with completing transactions on the blockchain. Some amount of cost and complexity will need to be stripped away before blockchain gaming can maintain a mass market.

That is where advancements made in the infrastructure stack come into play. The goal is to make the most attractive platform to draw the most developers and players, which increases their chances of having the most hit games. Developer platforms, advancement layers, scaling layers and financial service players all make money from volume on their networks.

For consumers, the goal is to make a transaction with as few clicks as possible and using payment processes with which they are comfortable.

For developers, the goal is to have simple modules that can be plugged into their existing projects or be built around seamlessly with new projects instead of having to re-invent the crypto wheel every time they have a new game idea.

In all cases, security is a priority. In March 2022, a hack on SKY Mavis PTE. Ltd.'s Axie Inifty servers drained $600 million out of the game's economy, a key event in the collapse of crypto gaming.

Kagan forecast that in-game NFTs will drive $15.46 billion in revenue by 2027, less than 10% of our forecast for the total gaming market by that time.

However, our forecast had anticipated some level of success driven by new games before the end of 2023, something we have yet to observe. Projects like Animoca Brands Corp. Ltd.'s Otherside, ATMTA Inc.'s Star Atlas, Illuvium Pty. Ltd.'s Illuvium, and Midnight Society Inc.'s Deaddrop have entered beta phases, but wide public releases still seem a long way off.

Technology is a regular feature from Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.