Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Dec, 2016 | 09:00

By Kellsy Panno

Highlights

The largest U.S. banks are taking aim at PayPal Holdings Inc.'s dominance in the person-to-person payment market, according to an S&P Global Market Intelligence analysis.

By fortifying their payments business, banks are hoping to prevent further disruption to their business model.

The largest U.S. banks are taking aim at PayPal Holdings Inc.'s dominance in the person-to-person payment market.

As personal finances become increasingly digitized, the way people pay one another is transitioning from cash and checks to payment apps. Financial technology company PayPal has led the nascent mobile person-to-person payment market, but big banks are going after PayPal to defend their current base by debuting faster services and partnerships aimed at improving the convenience and reliability of their person-to-person services.

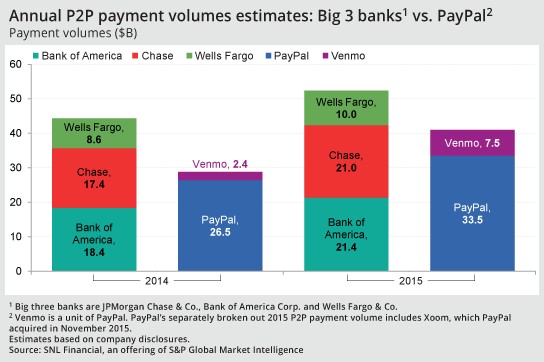

The mobile person-to-person market is maturing; transaction volumes are growing and payments are becoming safer and faster. While data is not readily available and payment service providers only sporadically disclose transaction volumes, we estimate that market leader PayPal, along with the big three banks — JPMorgan Chase & Co., Bank of America Corp., and Wells Fargo & Co. — processed about $93 billion in person-to-person transactions in 2015, up 28% from 2014.

PayPal is the single largest provider of mobile person-to-person payment services in the U.S., and its focus on the service has grown since the firm spun off from eBay in mid-2015. In 2015, PayPal processed $41 billion in mobile person-to-person payments, up 42% from 2014, according to company disclosures. PayPal executives have attributed much of its growth to the mass popularity of Venmo, a social media-augmented person-to-person payment service most popular with millennials. PayPal acquired Venmo as part of the $800 million acquisition of payment processing startup Braintree in late 2013.

PayPal disclosures show that Venmo grew person-to-person payments by 213% in 2015, totaling $7.5 billion, and comprising 18% of PayPal's total person-to-person payment volume. Quarterly person-to-person volumes and growth rates disclosed by the company in 2015 were used to extrapolate Venmo's total 2014 person-to-person volume of $2.4 billion. For context, Venmo processed $2.5 billion in person-to-person volume in the fourth quarter of 2015 alone, and volumes have continued to expand through each quarter in 2016, according to company filings.

Venmo generated $12 billion in person-to-person payment volume through the first three quarters of 2016, with $4.9 billion in the third quarter alone. Assuming a fourth-quarter run rate of $4.9 billion puts Venmo on pace to end 2016 with $16.9 billion in annual person-to-person volume, up 125% year-over-year.

In the second quarter of 2016, each of the big three banks disclosed person-to-person payment volume details for the first time, enabling estimates of each bank's respective person-to-person volume for 2014 and 2015.

JPMorgan and Wells Fargo reported 2015 person-to-person volumes of about $21 billion and $10 billion, respectively, while Bank of America disclosed second-quarter and year-to-date 2016 person-to-person volumes and related year-over-year growth rates. These disclosures allowed us to estimate person-to-person volumes for the first and second quarters of 2015. Anchoring calculations around these figures enabled estimates of Bank of America's full-year 2015 person-to-person volume.

Growth rates provided by Bank of America guided estimates for the other banks' 2014 person-to-person volumes. In addition, estimates featured the following assumptions:

According to our estimates, the big three banks combined outweigh PayPal in total annual person-to-person volume by a narrow margin. PayPal does about twice the estimated payment volume of each bank individually, but the big banks are coming for PayPal's market share. And they’re doing it together.

Banks have offered mobile person-to-person services within their respective apps for the last several years, but these solutions could take days to process and require multiple steps for receivers to take delivery of payment.

To fix this, a network of the country's largest banks, including JPMorgan, Bank of America and Wells Fargo, came together to form clearXchange. What began as a consortium of six member banks has grown to include 24 banks and fintech companies.

Working together, these banks can process and clear person-to-person money transfers in near real-time, something PayPal has yet to achieve. While PayPal transfers are instant with respect to PayPal accounts, transferring money to a connected bank account still takes a business day to complete.

In an effort to brand and market this service to both bank customers and potential third-party users, clearXchange debuted Zelle in October. The Zelle platform will eventually allow customers of all member banks to perform real-time person-to-person transfers. Currently, the real-time capability is only turned on for certain banks, but Zelle claims it will enable real-time payments across all member banks in 2017.

Person-to-person payment services are offered fee-free from PayPal and Zelle, so their importance cannot be quantified in terms of revenue. The real value of person-to-person payments to these companies is the connection it helps them maintain with customers.

For banks to cede the person-to-person payments market to a nonbank entity like PayPal is to cede a significant piece of their customers' finances to a competitor. Zelle is the banks' answer to Venmo and PayPal, and it could help them stave off competition in other aspects of their business.

Executives in the banking and consumer credit industry worry that fintech companies like PayPal that have become embedded in the financial lives of so many customers may move in on other areas of the banking and financial management industry, particularly areas like personal financial management and personal loans. By fortifying their payments business, banks are hoping to prevent further disruption to their business model.

The impending holiday season will no doubt offer valuable insights into the competitive dynamic between PayPal and the big banks. PayPal says it expects to process more than 17 million person-to-person transactions in the month of December and predicts Venmo's gift box emoji will be used 350,000 times in the months of November and December as people gift money.