Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ARTICLES & REPORTS — Aug 10, 2023

By Jorge Pastor

With the highly anticipated recent NPR publication from the FDIC, OCC and FRB, the US catches up with regulators in Europe and the UK, issuing their proposed implementation for new capital rules that will follow the recommendations from BCBS in the so-called Basel III endgame (see "Basel III: Finalising post-crisis reforms").

US regulators have also included certain provisions in their proposed rulemaking that are applicable to smaller firms and that were motivated by the market turmoil from March this year when Silicon Valley Bank (SVB) became insolvent due to unrealised losses in their non-trading portfolios.

It is worth noting that the proposal is open to comments until 30th November 2023, so there is still room for some adjustments in the final rule.

The US timelines for the capital rules implementation will lag the EU and UK by about 6 months, and new capital requirements will also be deployed in a phased-in approach, beginning in July 2025 (as opposed to January 2025 in Europe), and being fully implemented by July 2028.

1. For the bigger organizations (Categories I and II), the previously used internal-models-based approaches for credit and operational risk are being replaced by the new "expanded risk-based approach"), in an attempt to standardize the way Risk Weighted Assets, or RWA, are calculated across firms.

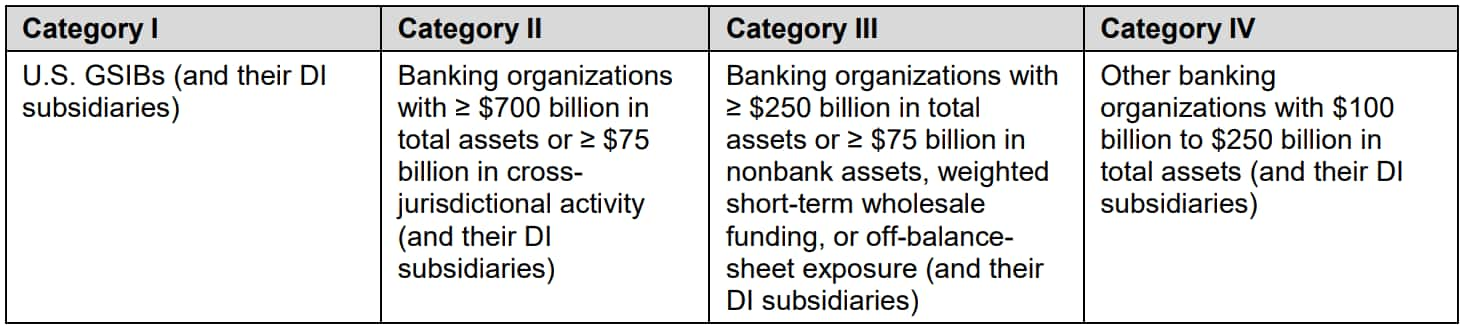

2. More importantly perhaps, the new "expanded risk-based approach" will apply now to all banking organizations with more than $100 billion in assets. These are banking organizations the Agencies classify as Categories I, II, III and IV, as depicted below.

3. Additionally, the regulators also leave the door open to apply these requirements to smaller organizations with less $100bn assets, if "its trading assets and trading liabilities are at least $5 billion or at least 10 percent of its total assets". The direction of travel is clear here and smaller banks and shadow banking could perhaps be required to comply with the capital requirements in the near future.

4. Internal-model approaches are still allowed for market risk RWA, due to the daily feedback on model performance that banking organizations need to maintain for market risk through back-testing and P&L attribution tests (see MAR32 - Internal models approach: backtesting and P&L attribution test requirements (bis.org)).

5. One of the changes motivated by the SVB collapse in March is the requirement, applicable to all banks with >$100bn assets (i.e., Cat I-IV), to include unrealized gains and losses from their AFS (Available-For-Sale) and HTM (Held-To-Maturity) portfolios in their regulatory capital. This was one of the drivers of the SVB collapse, when a deterioration in their HTM portfolio, due to the rising interest rates environment, sparked the panic across depositors about the solvency of the bank.

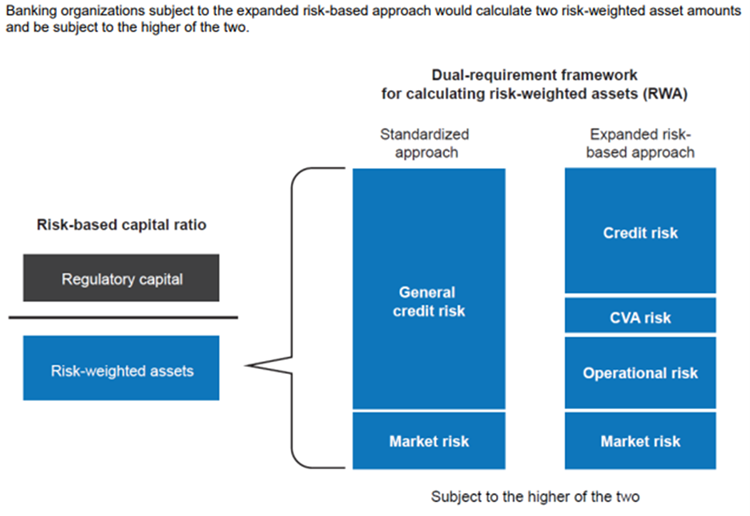

6. The proposal will continue to require larger banks to calculate RWA under the standardized approach and the new expanded risk-based approach and use the higher of the two resulting RWAs. The aim of this is to subject larger banking organizations to, at-least, the same or higher standards than smaller organizations.

Source "Fact Sheet: Proposed Rules to Strengthen Capital Requirements for Large Banks", fdic.gov

Overall, the proposal is largely as expected, and presents the anticipated challenges and required decision-making in banking organizations.

At S&P Global Market Intelligence, we've been part of the industry discussions for many years and this proposed rulemaking finds us well prepared to help our clients fulfil the new regulations.

Our Fundamental Review of the Trading Book (FRTB) risk solutions offer scalable and manageable approaches for all the different aspects of the new rules, and we can help firms understand if the standardized approaches or the expanded risk-based approaches are more suitable them.

Within Market Risk:

- FRTB Modellability: With our turnkey solution, we are helping organizations determine whether risk factors fall under the modellable umbrella, or whether they need to be treated as non-modellable risk factors (NMRFs) that would incur higher capital charges. The FRTB modellability service leverages 100+ million RPOs across all asset classes (IR, FX, FI, CR, EQ, CO) that curates, normalizes and enriches real price observations (RPO) with reference data to make them easy to use.

- FRTB Scenario & Proxying Service: Helping proxy NMRFs using S&P Global's extensive historical pricing market data and configuring proxy rules to generate scenarios to feed into the IMA calculation

- FRTB SA Solution: Lightweight, intraday aggregation and analytics tool that provides immediate access to all components of the SA capital charge: Sensitivity Based Method (SBM), Residual Risk Add-on (RRAO) and Default Risk Charge (DRC).

- FRTB IMA Solution: Calculate market risk RWA using the power of our Traded Market Risk system, capable of calculating out of the box all the capital calculations and needs for IMA compliance: Expected Shortfall, P&L attribution (PLA), backtesting, what-if capabilities, allocation, etc.

Within Credit Risk:

- BA-CVA: Using our cutting-edge xVA engine capabilities to calculate and aggregate CVA RWA requirements under the basic approach.

- SA-CVA: The number of CVA sensitivities required under the standardized risk-based approach (SA-CVA) pushes many systems to the breaking point, but our solution is capable of producing these and the final aggregated SA-CVA figures rapidly, without needing to invest in expensive grid computing solutions on premises.

- Deal-time incremental CVA: Our solution can generate what-if SA-CVA calculations intraday in less than a minute to calculate the impact to the capital number in real-time.

"These additional measures are aimed at increasing the robustness of risk and capital framework in the US. We know our customers rely on leveraging our solutions with one of the fastest and widest coverage pricing libraries in the market along with unrivalled depth of best-in-class market data coverage. This, combined with our cutting-edge cloud based technology enables us to offer unsurpassed scalability and flexibility in our solutions to meet these emerging requirements today.''

Mark Findlay, Managing Director and Head of Financial Risk Analytics, S&P Global Market Intelligence.

- Fully scalable: Banks that will now be subject to the Basel capital requirements may be unsure about their computing needs and associated costs, especially if considering on-premises hardware. Our cloud-native solutions are fully scalable to clients' needs and accommodate fluctuating computing demands, as well as varying firm sizes and trading portfolios.

- Quick to onboard: Integrating the banks' Front Office or Risk systems with new systems to produce the capital requirements can be cumbersome. Our solutions, harnessing S&P Global's market data and a standardized and flexible trade representation format, are quick to onboard and/or migrate from other systems.

- Secure and private: Data storage can become a headache for organizations under the new FRTB regulations. Our solutions offer the flexibility and scalability needed to handle this in a cost-efficient manner and in secure and private environments in which the clients control their data and in which their data is ring-fenced and protected.

- Performant and efficient: Using High-Performance computing, we are able to perform calculations that many market participants struggle with, like deal-time incremental CVA calculations.

Learn more about the FRTB solutions from S&P Global Market Intelligence.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location