Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 16, 2025

By Steve Piper

The US Northeast, including New York and the six states that make up New England, features support for the key revenue streams that underpin solar-plus-storage investment, including organized capacity markets, renewable energy credit markets and procurement goals for battery storage specifically. While these factors drive a forecast of stable revenues at reasonable confidence, they do not by themselves ensure successful investments under forecast market conditions. Capacity revenues to battery storage facilities are subject to some uncertainty, and the presence of competitive hydroelectric generation in the region, including pumped storage, constrains growth in arbitrage revenues evident in other markets. In comparing the power markets of the New York ISO and ISO New England, increasing arbitrage and capacity revenues from storage offset declining solar wholesale revenues and the expiration of production tax credits.

While the Northeast power markets of NYISO and ISO-NE have discoverable revenue streams to support hybrid solar projects, the markets are sufficiently competitive that strong merchant returns cannot be taken for granted. NYISO maintains a legacy base of hydro and nuclear assets that keep energy and capacity prices low, as expanding green energy pushes wholesale prices and resulting revenues lower still. A growing fleet of solar farms is forecast to improve intra-day arbitrage, gradually offsetting the impact of falling power prices. While there are similar dynamics in ISO-NE, a more supportive set of capacity and renewable energy credit (REC) markets offer improved prospects.

Download Commodity Insights' interactive US solar-plus-storage investment outlook and its Excel companion.

Market overview — New York hybrid solar

Under the broad mandate of the Climate Leadership and Community Protection Act (CLCPA), several state agencies are involved in ramping up investment in renewable generation. The New York State Energy Research and Development Authority (NYSERDA) has the greatest early involvement in contracting efforts for solar, onshore wind, and offshore wind. While investment in onshore wind and solar has been significant, new wholesale projects have lagged somewhat, given the scope of the CLCPA. The New York Power Authority (NYPA) was cleared in mid-2024 to develop onshore renewables. Transmission infrastructure investment has also moved forward to ease the movement of power from upstate New York to the metropolitan load centers, including the Champlain Hudson Power Express and Clean Path New York. Regarding storage, NYSERDA aims to deploy 3,000 MW of grid-scale energy storage by 2030 and an additional 3,000 MW of distributed storage.

As each of these initiatives expands, we forecast rapid growth of renewables in NYISO, much of which is concentrated in upstate zones A–E. By 2035, solar generation is forecast to grow from 3.2% of NYISO's generating mix to 25.2%, while deployment of offshore wind drives wind generation from 11.6% to 34.1%. This generation share growth is offset by declining shares of nuclear and hydroelectric generation, as these sources grow at a slower rate than load and face displacement risk from growing solar generation. Overall, NYISO is forecast to nearly reach a net-zero grid by 2035, growing from 58.1% in-state carbon-free generation to 91.0%. Committed purchases of zero-carbon generation from Canada bring the net-zero generation goal closer still. This aggressive trajectory sets up multiple trends in the revenue streams underpinning solar-plus-storage assets:

– High solar penetration and risk of curtailment will increasingly impair the revenue stream from solar assets if targeted levels are achieved.

– New York's compliance REC market creates a stable revenue stream to supplement power market revenues. We forecast that NY Tier I REC prices will grow as demand for green energy to fulfill CLCPA remains strong.

– The Production Tax Credit (PTC) provides an important additional revenue stream for the first several years of projects recently completed. Although there may be some energy communities in the state, access to "step-up" tax credits is likely to be limited.

– Although the battery portion of solar-plus-storage will qualify for revenues under NYISO's season-ahead capacity markets, comparatively low peak credits limit the revenue for which batteries can qualify.

Upstate New York hosts a high level of competitive legacy generation including nuclear and hydroelectric plants in addition to the forecast of rapidly expanding solar. This tends to limit the spread between midday maximum solar hours and the maximum priced evening hours. Available arbitrage revenues are therefore low. Low midday power prices attributable to expanding solar generation are not forecast to appear until after 2030, and evening peak prices show little overall growth. We forecast that in 2030, NYISO's fleet of storage will primarily charge overnight, discharging during the evening peak period. Hybrid solar and storage facilities are more constrained to charge by day and less able to low overnight power prices.

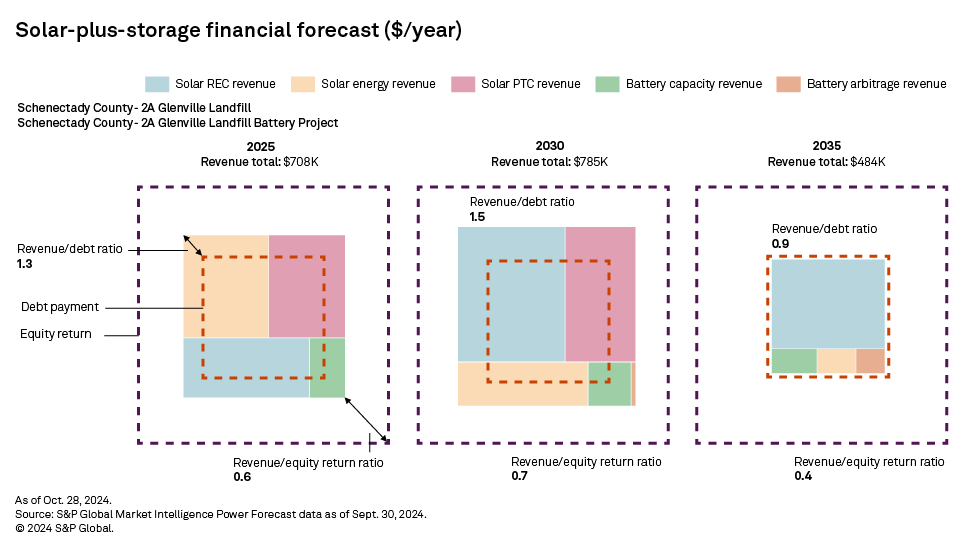

The merchant economics of an indicative 7.5 MW solar and storage system in NYISO Zone F illustrate these dynamics. Initially, the PTC and energy revenues contribute most of the project value, but regional growth in solar undercuts solar revenues, with the decline offset by correspondingly reduced battery charging costs and forecast growth in NY Tier I REC revenues to deliver average annual revenues of $600,000 annually until the tax credit expires after 2031. Capacity revenues are forecast to contribute $100,000 annually through 2031.

Overall, merchant revenue streams are forecast to come in below the full annualized revenue requirements, suggesting equity investors would earn less than a 12% return on this investment, trending lower still in the post-PTC period. The forecast revenue shortfall is attributable to low wholesale prices and the resulting small contribution from arbitrage despite a forecast of high solar penetration. In the near term, hybrid projects would need fixed-price contracts to reduce the merchant risk of these projects.

Market overview — New England hybrid solar

Most New England states have ambitious Renewable Portfolio Standards that collectively are forecast to drive significant build-out of onshore solar and offshore wind, mirroring the activity in New York. Battery storage development in the region is growing, including an estimated 730 MW of operating capacity across 135 projects, and 6,700 MW announced for development. Massachusetts has significant goals for energy storage. The state established a target of 1,000 MWh of energy storage by 2025, for both distributed and grid-scale storage. The Massachusetts Department of Energy Resources (DOER) is actively promoting energy storage through programs and incentives to encourage investment. Rhode Island similarly has a battery-storage procurement target of 600 MW.

We forecast the generation share of wind and solar to expand significantly in ISO-NE by 2035, driven mainly by the development of offshore wind. We expect wind generation share will grow from 9.2% in 2025 to 51.3% by 2035, while solar generation share will grow from 8.1% to 12.6% over the same period. As with New York, the region will approach net-zero carbon generation over this period, with generation from natural gas falling from 28.6% in 2025 to just 6.0% in 2035. Imports of hydroelectric generation from Canada will put ISO-NE very close to net-zero during the peak summer months, with exports of green energy to Canada more likely in winter.

This rapid buildup of green generation in ISO-NE sets up several related trends in the revenue streams underpinning hybrid solar assets:

– The rapid expansion of wind generation moderates the appearance of the solar "duck curve" seen in other regions with greater solar resources and more rapid solar growth. This results in forecast solar energy revenues holding stable over the next 10 years and more modest curtailment risk.

– New England's compliance REC markets are supportive and fungible across the region, making these revenues stable and relatively accessible.

– As in New York, the PTC provides an important additional revenue stream for the first several years of projects recently completed. Although there may be some energy communities in New England states, access to "step-up" tax credits is likely to be limited here as well.

– The battery portion of solar-plus-storage will qualify for revenues under ISO-NE's FCM capacity market. While the structure of the capacity market is currently under review, we forecast relatively robust resource adequacy prices moving forward.

Growth of offshore wind and competitive hydro and pumped storage in the region tends to limit arbitrage between midday and evening peak during the summer months, undermining this source of revenue and margin. While somewhat more price arbitrage exists during the winter months, it is offset by diminishing solar generation to again limit arbitrage opportunities.

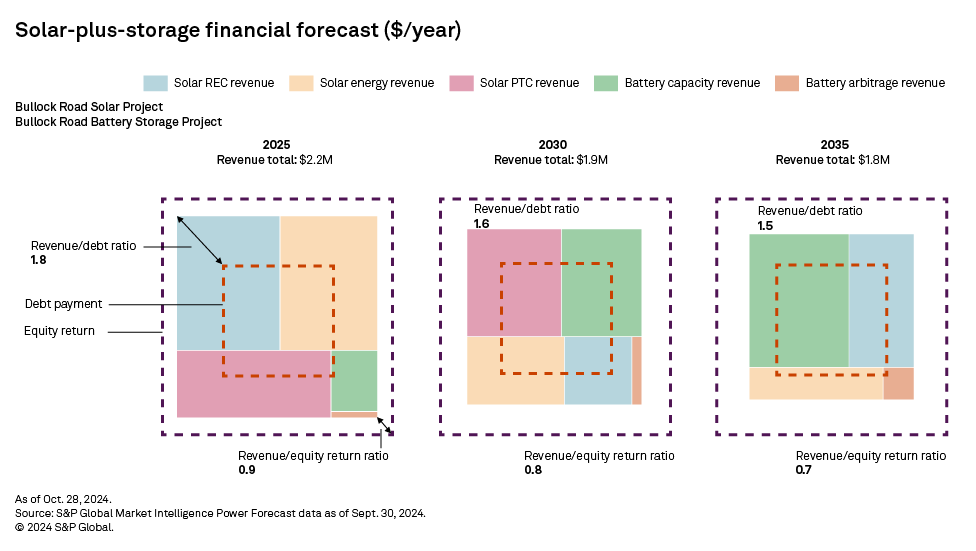

Compared to upstate New York, the merchant economics of an indicative 17-MW solar and storage system in Massachusetts are forecast to be more supportive. Initially, PTC, energy revenues and RECs contribute a balance of forecast revenues to the facility with solar energy revenue gradually undercut by increased green energy penetration. The expiration of the PTC in 2031 is offset by growing capacity and REC revenue to deliver stable operating margins forecast at $1.8 million annually through 2035. Capacity revenues are projected to become an important part of the revenue profile from 2030.

Merchant revenue streams are forecast to match up well with the full annualized revenue requirements and plant operating expenses, suggesting equity investors can expect the assumed 12% return on this investment, even after the PTC expires. Low forecast energy and arbitrage revenues are offset by stronger forecast REC and capacity pricing, delivering stable revenues to the project.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a complete, searchable listing of RRA's in-depth research and analysis, visit the S&P Capital IQ Pro Energy Research Library.

Theme

Location