Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Jun, 2023

By Neil Barbour

Highlights

Apple is bound to revitalize the AR/VR market, but it may take some time to find the right price-to-feature ratio that will catalyze mass-market adoption.

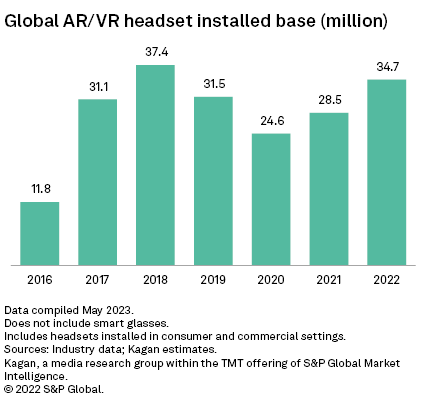

S&P Global Market Intelligence estimates the global installed base for AR/VR headsets reached 34.7 million as of the end of 2022.

While Apple may gain an advantage in the AR/VR market by leveraging its experience and market share in other device segments, it is hardly a first mover.

After years of winding up, Apple Inc. on June 5 finally announced that it would throw its hat into the AR/VR hardware market with the Apple Vision Pro. Apple's announcement was the clearest articulation yet of the idea that AR and VR are not just for gaming or niche commercial settings but can be used in daily life as one would use a laptop or a phone.

While other VR headset vendors have incorporated or have said they were working on similar features announced for the Apple Vision Pro, Apple has a far stronger sales pitch because its hardware already commands a strong presence in users' daily lives. Potential customers are far more likely to trust Apple in transitioning to a new computing platform as many users have already done just that over the past two decades.

The downside is that they will have to pay an Apple-size premium for the pleasure of being early adopters in that transition. The company said the device will start at $3,499 when it launches early next year. Apple is bound to revitalize the AR/VR market, but it may take some time to find the right price-to-feature ratio that will catalyze mass-market adoption.

Apple CEO Tim Cook described the headset as a way to "use your apps anywhere, any way you want" accompanied by a video that showed the headset incorporating many of the apps with which Apple users are already familiar, such as photos, Facetime, Safari, notes and messaging. The video also showed users in a virtual desktop setting, with access to a virtual keyboard and multiple app windows in the headset's field of view.

The Vision Pro is primarily a VR headset geared to presenting AR. External cameras provide low latency, high resolution view of the world outside, and then computer-generated imagery is imposed onto that view. A dial can be used to fade away the real world-view into an entirely computer-generated 3D environment. An OLED display on the front of the headset allows people externally to see a representation of the users' eyes to provide a degree of two-way engagement.

The unit does not include controllers and instead relies on gaze, hand gestures and voice inputs, but it is tethered to a battery pack via a cord. The headset employs Apple's M2 chip as well as a new custom R1 chipset to support the spatial computing solutions running in what the company is calling Vision OS. Its apps and data sync with other Apple devices and it can act as an additional display for a Mac laptop.

It's probably best to think of this launch as a developer- and tech-enthusiast-focused pilot project. Apple will iterate and refine its approach to AR/VR slowly and methodically, as it does with most of its products. As key use cases become more defined, it can tweak the hardware to play to those strengths. Other features that are ignored by early adopters can be cut or minimized in future models to save on costs.

We anticipate the steep price will limit sales to less than 500,000 units shipped in the first year of availability. It's likely that Apple will release more affordable models or, at the very least, it will continue to sharpen the value proposition to grow the installed base. We estimate the global installed base for AR/VR headsets reached 34.7 million as of the end of 2022.

A key content partnership was also revealed during the announcement. Bob Iger, the CEO of Walt Disney Co., announced that Disney would be making its Disney+ streaming service available to Vision Pro users, opening up a library of movies, documentaries and TV shows to the device's ecosystem. It also showed some potential application ideas, such as bringing a sports presentation out of the screen into the world around the user.

Still, we believe that Apple's real goal is selling smart glasses, not headsets. No matter how sexy and slim Apple can make a headset, that headset will still likely occlude eyesight, put extra weight on the skull or mess with people's hair. The mass market is already used to the look and feel of sunglasses and eyeglasses, making the form factor much more palatable.

Augmented World Expo

While Apple may gain an advantage in the AR/VR market by leveraging its experience and market share in other device segments, it is hardly a first mover.

One glance around the show floor at the Santa Clara Convention Center on May 31 through June 2 would bear out that fact. In the days before the Apple announcement, the Augmented World Expo was something of a last rites ceremony for the previous wave of stand-alone AR/VR headsets.

Many demos were moving away from using Meta Platforms Inc.'s Quest 2 and HTC Corp.'s Vive Focus and instead favored the lighter weight and higher fidelity of the Quest Pro and HTC Vive XR Elite headsets.

Meta announced that it would bring most of the boundary-pushing tech it featured in the Quest Pro to its next consumer-facing headset, the Quest 3, later this year for $499, half the going rate for a Quest Pro.

Like Apple, Meta is trying to transition AR/VR hardware from being peripherals focused on gamers and tinkerers to an everyday computing platform. As we said earlier, headsets will always be a hard sell, but there are three key components that the Quest 3 is incorporating to address concerns around comfort and usability.

– Pancake lenses. VR headsets have traditionally employed Fresnel lenses that require a large amount of space between the lens and the actual display. Pancake lenses rely on waveguided images across a more compact lens array, allowing manufacturers to reduce the overall size of the unit.

– Full-color pass-through cameras. Stand-alone VR headsets have long used monochromatic front-facing cameras to track the position of the user and their peripherals. Recent headsets have significantly upgraded those cameras and can incorporate that resulting video feed into the user's field of view. This opens the door to AR-like applications where computer-generated imagery can be overlaid onto the real world

– Adjustable halo straps. Sony Group Corp.'s PlayStation VR was widely considered one of the most comfortable VR headsets upon release in 2016. The key comfort feature was a plastic ring that extended around the user's head, which could be adjusted with a dial at the back of the unit. Vendors experimented with alternatives, but most have now settled on something approximating Sony's solution.

It also appears that Apple is using some version of these components in its forthcoming headset, though the company characteristically steered clear of using insider tech terminology that it didn't create.

Note that Meta and HTC incorporated these features in enterprise-focused headsets over the past year, with Quest Pro, released in November 2022, and the Vive XR Elite, unveiled in January 2023.

This would be the first time they will be available in a headset priced under $999. Of course, there will also likely be improvements in resolution, frame rate and field of view, but Meta has yet to dig into the details.

The end of the line for XR2?

QUALCOMM Inc. was showing off its vision for AR-enabled applications at the show via its Snapdragon Spaces initiative. Spaces is a spatial computing developer toolkit designed to leverage synergies between Snapdragon-powered smartphones and Snapdragon XR-powered smart glasses. The platform is compatible with the OpenXR specification and has plugins available for Epic Games Inc.'s Unreal and Unity Software Inc.'s Unity development platforms.

One Spaces demo was a cooking aid that allowed the user to call up a recipe inside the smart glasses and post multiple timers around the kitchen. All the interactions could be performed with gestures or gazes, meaning the user don't have to pause to wash their hands as they might while doing similar actions with a phone.

The concept is a compelling use case for the average consumer in AR, but there was a sense that aging hardware was holding the demo back. The controls were unreliable, and the imagery was simplistic and washed out. Perhaps these issues were a function of the demo being in an early, unpolished state.

But it's worth noting that Qualcomm's XR2 chipset powering the experience has been on the market since 2019 and has been tasked with addressing a wide range of devices and use cases that may not have been a priority during its initial development. Although the XR2 has been modified multiple times since its initial launch, it may be due for a more radical overhaul to deliver on the spatial computing promises that were made on the floor.

Such an overhaul may be on the way with Quest 3, which is set to feature a "next-generation" Snapdragon chipset with "twice the graphical performance of the previous generation GPU in the Quest 2." Representatives for Qualcomm at the show declined to confirm or deny that this would be the Snapdragon XR 3.

Technology is a regular feature from Kagan, a part of S&P Global Market Intelligence.

Research

Research